Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

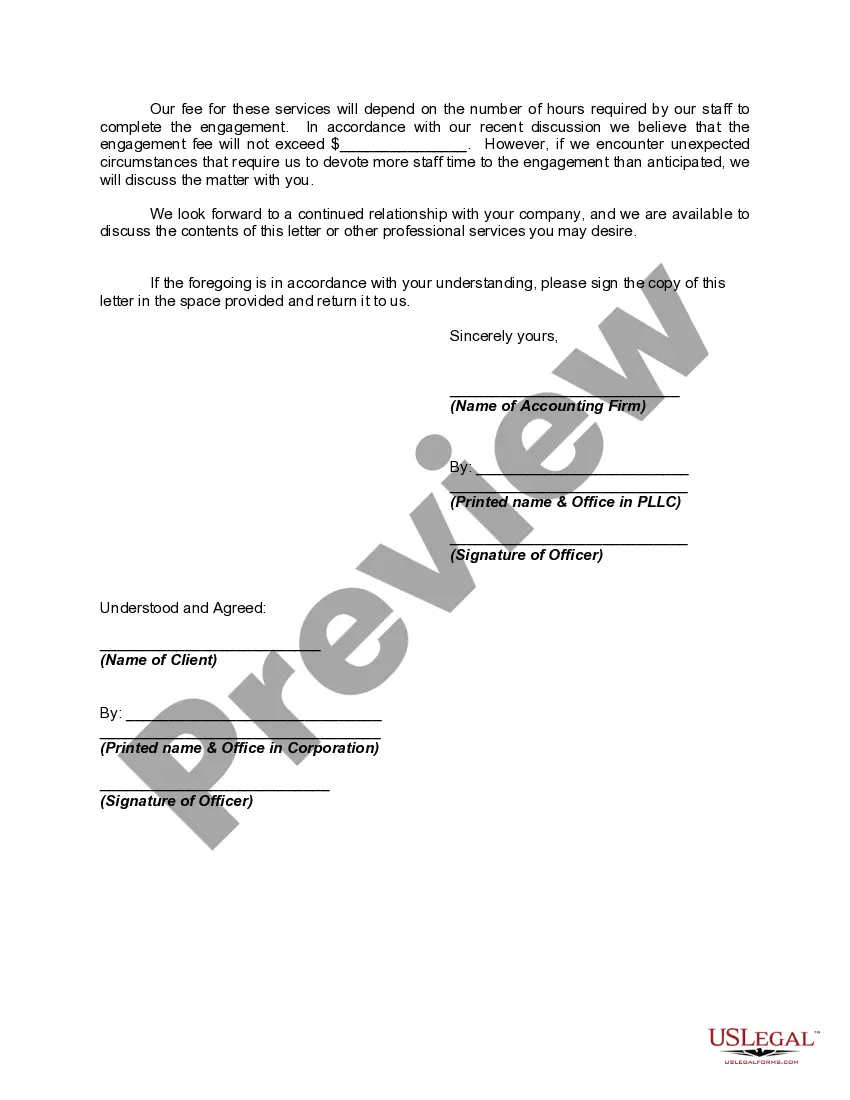

Title: Understanding the Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm Introduction: In the world of accounting, an engagement letter serves as a crucial document that outlines the terms and conditions of the professional services to be performed by an accounting firm. This article aims to provide a detailed description of the Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm. Additionally, we will explore any possible variations or types of engagement letters in the Montana context. Keyword: Montana engagement letter for review of financial statements and compilation by accounting firm I. Overview of the Montana Engagement Letter: The Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legally binding agreement between an accounting firm and its client, serving as a foundation for the accountant-client professional relationship. This particular engagement letter pertains specifically to the review of financial statements and compilation services. Keyword: review of financial statements and compilation II. Key Elements of the Montana Engagement Letter: 1. Introduction: The engagement letter should start with a clear identification of the accounting firm, the client, and a brief overview of the services to be rendered. Keyword: Montana engagement letter introduction 2. Scope of Services: This section outlines the specific work to be performed by the accounting firm, including the review of financial statements and compilation services. Keyword: Montana engagement letter scope of services 3. Responsibilities of the Accounting Firm: This part lays out the obligations and duties of the accounting firm in conducting the review and compilation procedures accurately and in accordance with Generally Accepted Accounting Principles (GAAP) or other relevant reporting frameworks. Keyword: Montana engagement letter accounting firm responsibilities 4. Responsibilities of the Client: The engagement letter states the role and responsibilities of the client in providing accurate and complete financial records, granting the necessary access, and cooperating in the engagement process. Keyword: Montana engagement letter client responsibilities 5. Reporting: This section highlights the expected format and nature of the final report to be delivered to the client, including any limitations on the accountant's responsibility. Keyword: Montana engagement letter reporting requirements III. Types/variations of Montana Engagement Letters for Review of Financial Statements and Compilation: While the primary Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm covers the standard services, there might be specific variations or additional types of engagement letters depending on the specific circumstances: 1. Limited Review Engagement Letter: This engagement letter defines a review service with a narrower scope than a full review, tailored to meet specific engagement requirements. 2. Agreed-Upon Procedures (AUP) Engagement Letter: An AUP engagement letter outlines the agreed-upon procedures that the accounting firm will perform on specific financial information, rather than conducting a full review or compilation. 3. Special-Purpose Financial Statements Engagement Letter: This engagement letter relates to cases where the accounting firm is engaged to review or compile financial statements for a special purpose, such as governmental or nonprofit organizations. Keyword: Montana engagement letter types or variations Conclusion: The Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm plays a crucial role in establishing the terms, responsibilities, and scope of services between the accounting firm and its client. By understanding the elements and potential variations of these engagement letters, both parties can ensure a clear and mutually beneficial working relationship.Title: Understanding the Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm Introduction: In the world of accounting, an engagement letter serves as a crucial document that outlines the terms and conditions of the professional services to be performed by an accounting firm. This article aims to provide a detailed description of the Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm. Additionally, we will explore any possible variations or types of engagement letters in the Montana context. Keyword: Montana engagement letter for review of financial statements and compilation by accounting firm I. Overview of the Montana Engagement Letter: The Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legally binding agreement between an accounting firm and its client, serving as a foundation for the accountant-client professional relationship. This particular engagement letter pertains specifically to the review of financial statements and compilation services. Keyword: review of financial statements and compilation II. Key Elements of the Montana Engagement Letter: 1. Introduction: The engagement letter should start with a clear identification of the accounting firm, the client, and a brief overview of the services to be rendered. Keyword: Montana engagement letter introduction 2. Scope of Services: This section outlines the specific work to be performed by the accounting firm, including the review of financial statements and compilation services. Keyword: Montana engagement letter scope of services 3. Responsibilities of the Accounting Firm: This part lays out the obligations and duties of the accounting firm in conducting the review and compilation procedures accurately and in accordance with Generally Accepted Accounting Principles (GAAP) or other relevant reporting frameworks. Keyword: Montana engagement letter accounting firm responsibilities 4. Responsibilities of the Client: The engagement letter states the role and responsibilities of the client in providing accurate and complete financial records, granting the necessary access, and cooperating in the engagement process. Keyword: Montana engagement letter client responsibilities 5. Reporting: This section highlights the expected format and nature of the final report to be delivered to the client, including any limitations on the accountant's responsibility. Keyword: Montana engagement letter reporting requirements III. Types/variations of Montana Engagement Letters for Review of Financial Statements and Compilation: While the primary Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm covers the standard services, there might be specific variations or additional types of engagement letters depending on the specific circumstances: 1. Limited Review Engagement Letter: This engagement letter defines a review service with a narrower scope than a full review, tailored to meet specific engagement requirements. 2. Agreed-Upon Procedures (AUP) Engagement Letter: An AUP engagement letter outlines the agreed-upon procedures that the accounting firm will perform on specific financial information, rather than conducting a full review or compilation. 3. Special-Purpose Financial Statements Engagement Letter: This engagement letter relates to cases where the accounting firm is engaged to review or compile financial statements for a special purpose, such as governmental or nonprofit organizations. Keyword: Montana engagement letter types or variations Conclusion: The Montana Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm plays a crucial role in establishing the terms, responsibilities, and scope of services between the accounting firm and its client. By understanding the elements and potential variations of these engagement letters, both parties can ensure a clear and mutually beneficial working relationship.