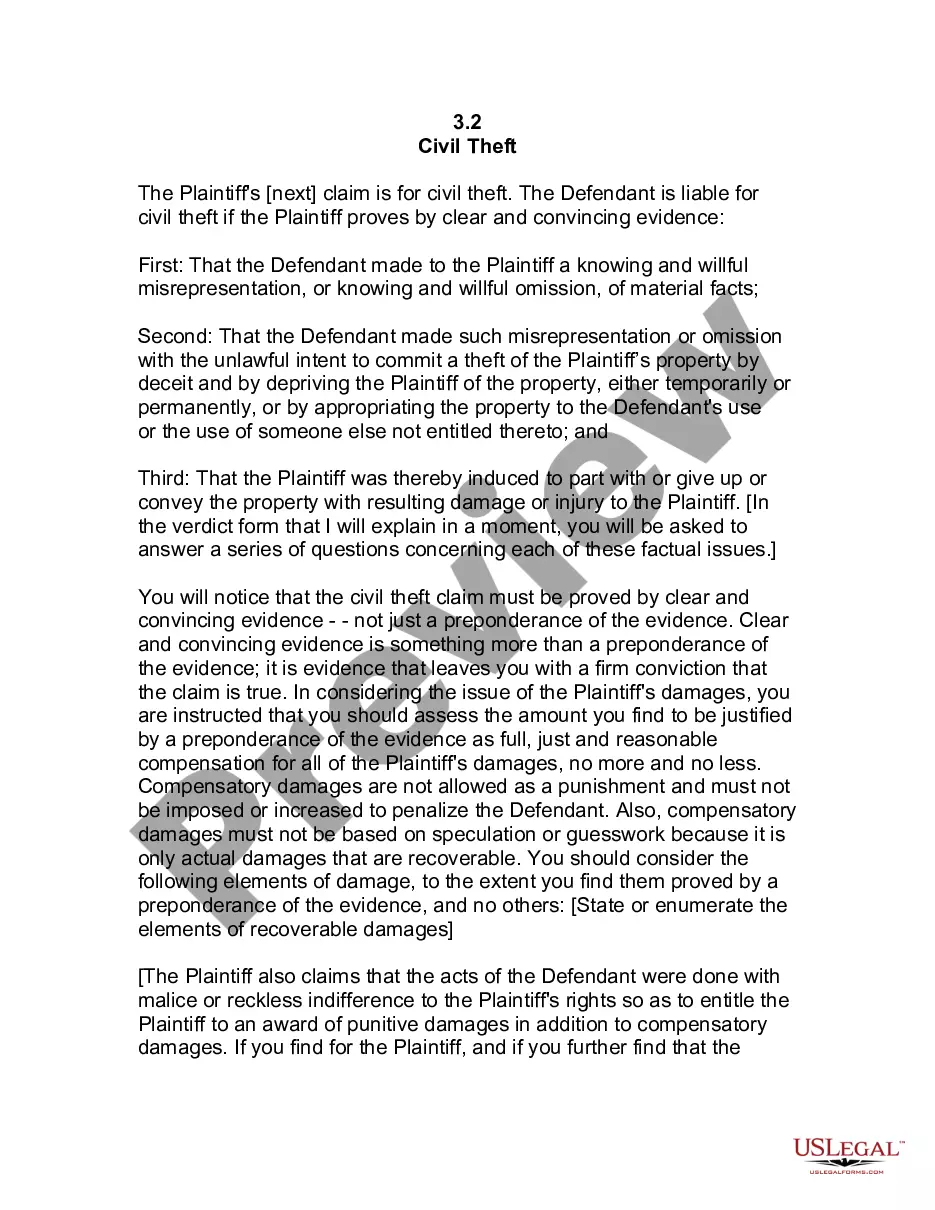

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

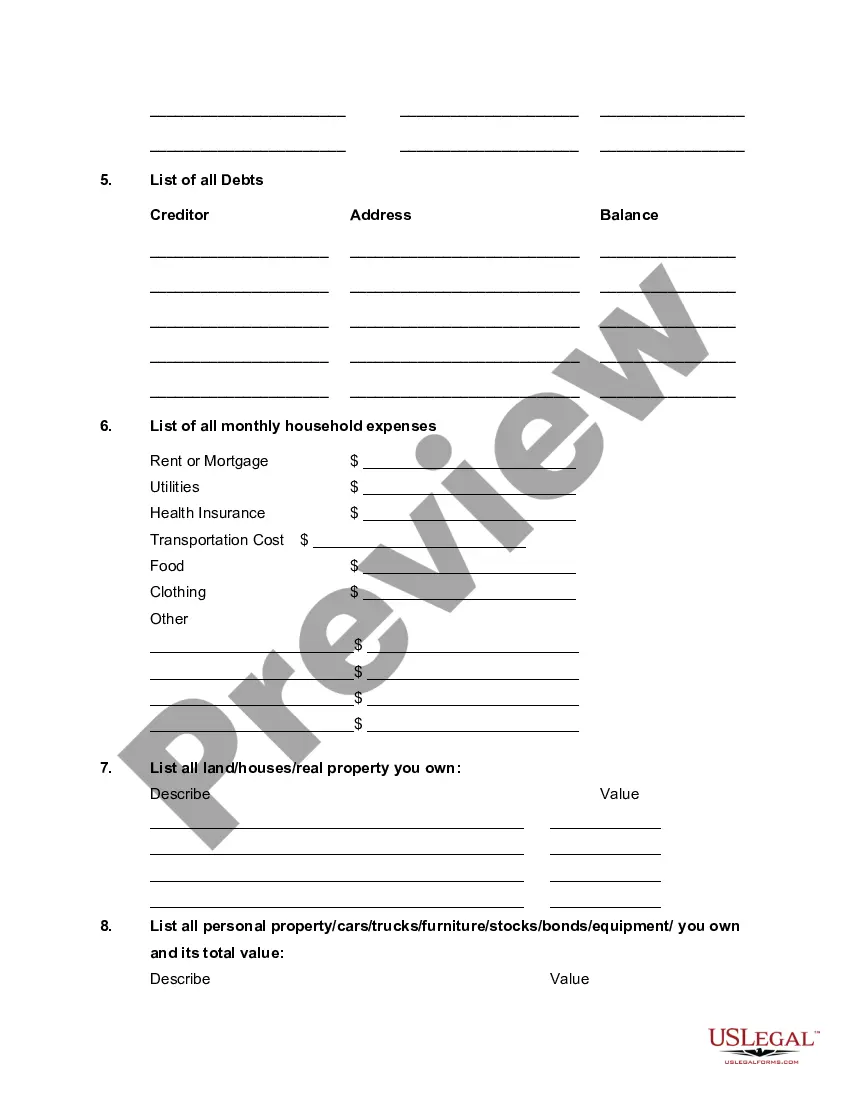

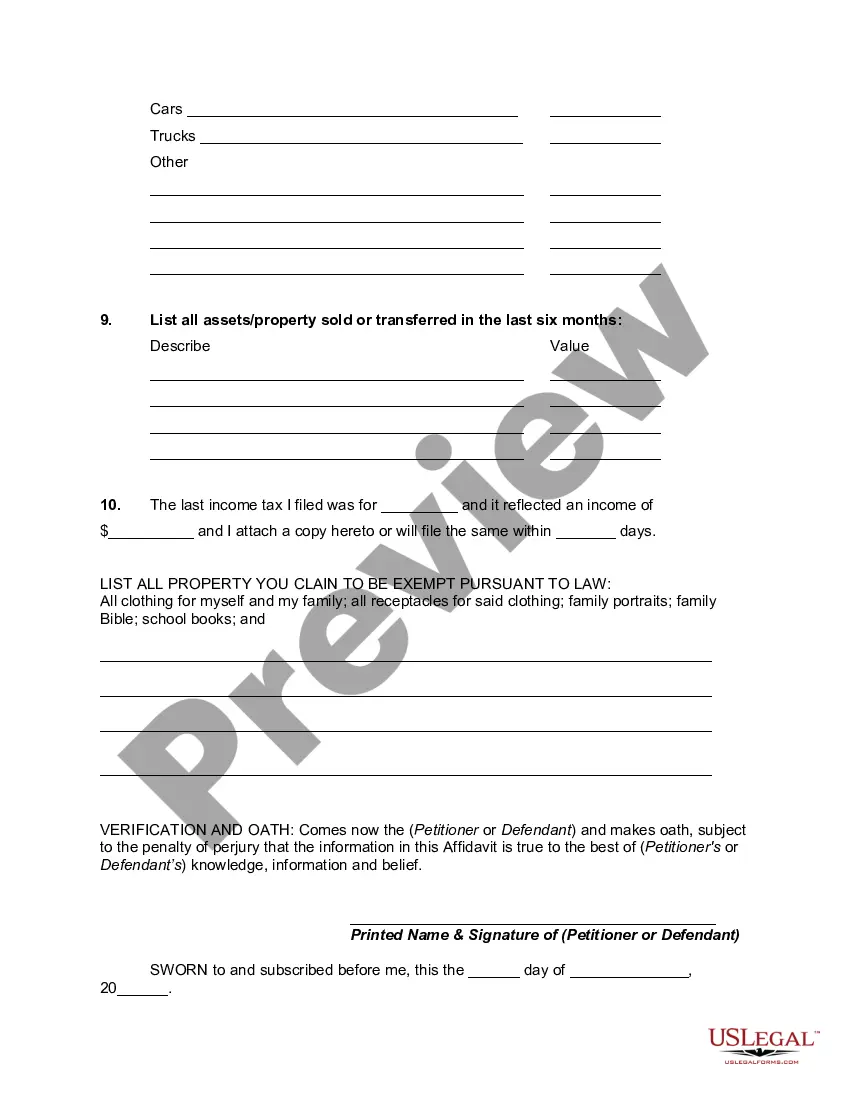

Montana Affidavit or Proof of Income and Property — Assets and Liabilities serves as a legal document that verifies an individual's financial standing through a detailed breakdown of their income, assets, and liabilities. This assessment is crucial in various situations such as applying for loans, renting a property, divorce proceedings, or determining eligibility for government assistance programs. The Montana Affidavit or Proof of Income and Property — Assets and Liabilities consists of several sections, where individuals are required to disclose essential financial information. These sections include income details, which encompass wages, salaries, bonuses, rental income, or any other sources of regular earnings. Additionally, individuals must provide documentation and proof such as pay stubs, tax returns, bank statements, or any other relevant financial records to substantiate their income claims. Assets form another critical component of the Montana Affidavit or Proof of Income and Property — Assets and Liabilities. This section aims to outline an individual's personal assets, including real estate properties, vehicles, investments, valuable possessions, and savings accounts. Each asset should be accompanied by a comprehensive description, market value, and any pending loans or debts associated with it. On the contrary, the liabilities section focuses on an individual's outstanding debts, loans, mortgages, credit card balances, or any financial obligations. Similar to the asset section, individuals must provide accurate information regarding the amount owed, creditor details, and terms of repayment. It is important to note that there are specific variations of the Montana Affidavit or Proof of Income and Property — Assets and Liabilities, depending on the purpose and jurisdiction. For instance, a Montana Affidavit for divorce proceedings might include additional sections related to spousal support or child custody matters, while a Montana Affidavit for a rental application might concentrate on the individual's ability to afford the monthly rent based on their income and financial stability. In summary, the Montana Affidavit or Proof of Income and Property — Assets and Liabilities is a comprehensive document that assesses an individual's financial standing, including income, assets, and liabilities. This document serves various purposes in legal, financial, and personal matters, ensuring transparency and verification of an individual's financial status.Montana Affidavit or Proof of Income and Property — Assets and Liabilities serves as a legal document that verifies an individual's financial standing through a detailed breakdown of their income, assets, and liabilities. This assessment is crucial in various situations such as applying for loans, renting a property, divorce proceedings, or determining eligibility for government assistance programs. The Montana Affidavit or Proof of Income and Property — Assets and Liabilities consists of several sections, where individuals are required to disclose essential financial information. These sections include income details, which encompass wages, salaries, bonuses, rental income, or any other sources of regular earnings. Additionally, individuals must provide documentation and proof such as pay stubs, tax returns, bank statements, or any other relevant financial records to substantiate their income claims. Assets form another critical component of the Montana Affidavit or Proof of Income and Property — Assets and Liabilities. This section aims to outline an individual's personal assets, including real estate properties, vehicles, investments, valuable possessions, and savings accounts. Each asset should be accompanied by a comprehensive description, market value, and any pending loans or debts associated with it. On the contrary, the liabilities section focuses on an individual's outstanding debts, loans, mortgages, credit card balances, or any financial obligations. Similar to the asset section, individuals must provide accurate information regarding the amount owed, creditor details, and terms of repayment. It is important to note that there are specific variations of the Montana Affidavit or Proof of Income and Property — Assets and Liabilities, depending on the purpose and jurisdiction. For instance, a Montana Affidavit for divorce proceedings might include additional sections related to spousal support or child custody matters, while a Montana Affidavit for a rental application might concentrate on the individual's ability to afford the monthly rent based on their income and financial stability. In summary, the Montana Affidavit or Proof of Income and Property — Assets and Liabilities is a comprehensive document that assesses an individual's financial standing, including income, assets, and liabilities. This document serves various purposes in legal, financial, and personal matters, ensuring transparency and verification of an individual's financial status.