A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

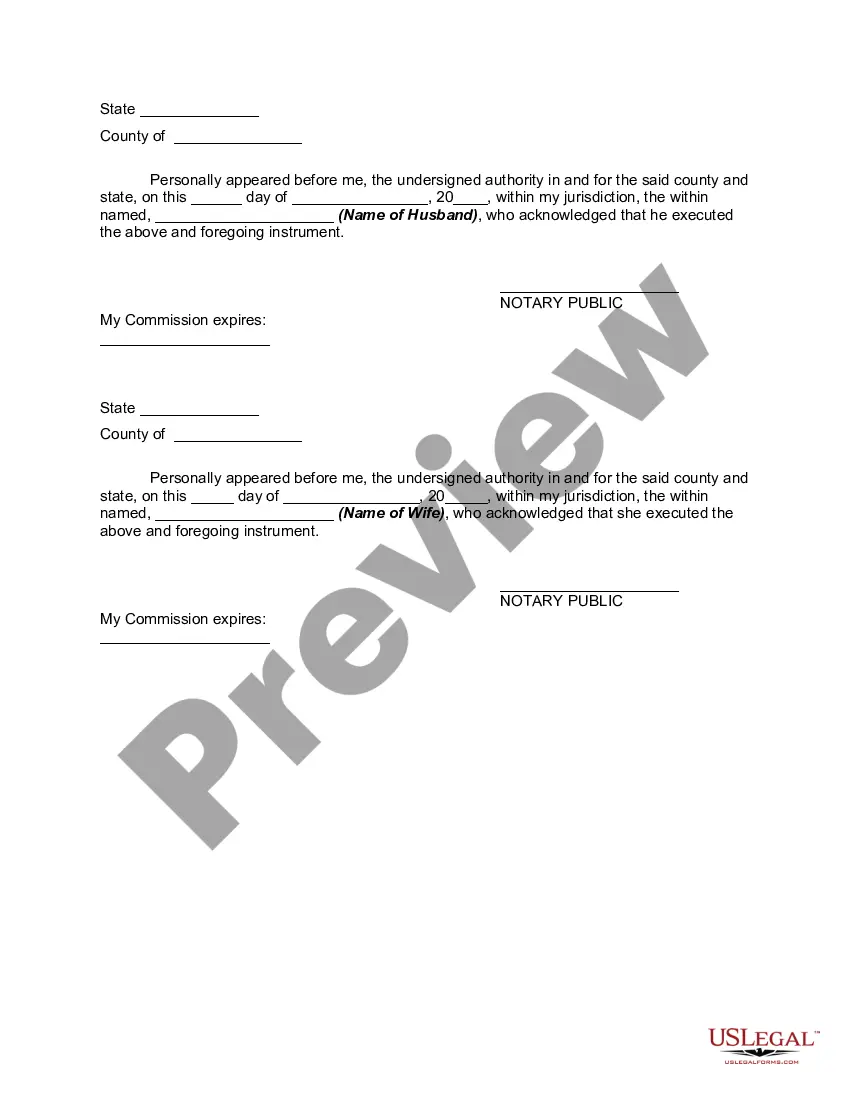

Montana Transmutation, also known as Postnuptial Agreement, refers to a legally binding agreement in the state of Montana that allows couples to convert their community property into separate property. This type of agreement is often entered into after marriage to modify the classification of property, ensuring asset reclassification according to the wishes of both parties involved. Here we will explore the details of Montana Transmutation and delve into its different types: 1. Montana Transmutation Agreement: Montana Transmutation Agreement is the primary type of agreement that allows spouses in Montana to redefine the classification of their property. It involves the voluntary agreement between both partners to convert certain assets from community property, which is jointly owned, into separate property, which is individually owned. This agreement is typically executed in writing and must be signed by both spouses to be legally enforceable. 2. Real Estate Transmutation Agreement: Under Montana law, couples can utilize a Real Estate Transmutation Agreement to convert the classification of real property, such as houses, land, or rental properties. This agreement enables spouses to transpose their shared ownership of a particular property into sole ownership, ensuring separate property rights for one spouse, if agreed upon mutually. 3. Business Transmutation Agreement: A Business Transmutation Agreement is employed when a married couple wishes to convert a jointly run business from community property to separate property. This type of agreement allows one partner to assume sole ownership and control of the business, thereby severing the financial entanglement in case of a divorce or separation. 4. Investment Transmutation Agreement: For couples seeking to convert jointly-owned investments, financial accounts, or stocks into separate property, the Investment Transmutation Agreement is utilized. This agreement outlines the assets subject to transmutation, specifies the new ownership arrangement, and safeguards the separate property rights of the contracting spouse. 5. Personal Property Transmutation Agreement: Montana Transmutation also extends to personal property, such as vehicles, jewelry, artwork, or other valuable possessions. The Personal Property Transmutation Agreement allows spouses to reclassify these assets, granting exclusive ownership to one spouse and potentially protecting them from being divided as community property during divorce proceedings. It is important to note that any transmutation agreement should comply with Montana's legal requirements for enforceability, including appropriate disclosures, fair and voluntary execution, and clear intent expressed by both parties involved. Seeking legal advice from a qualified attorney experienced in family law is highly recommended ensuring compliance and to protect each spouse's interests throughout the process.