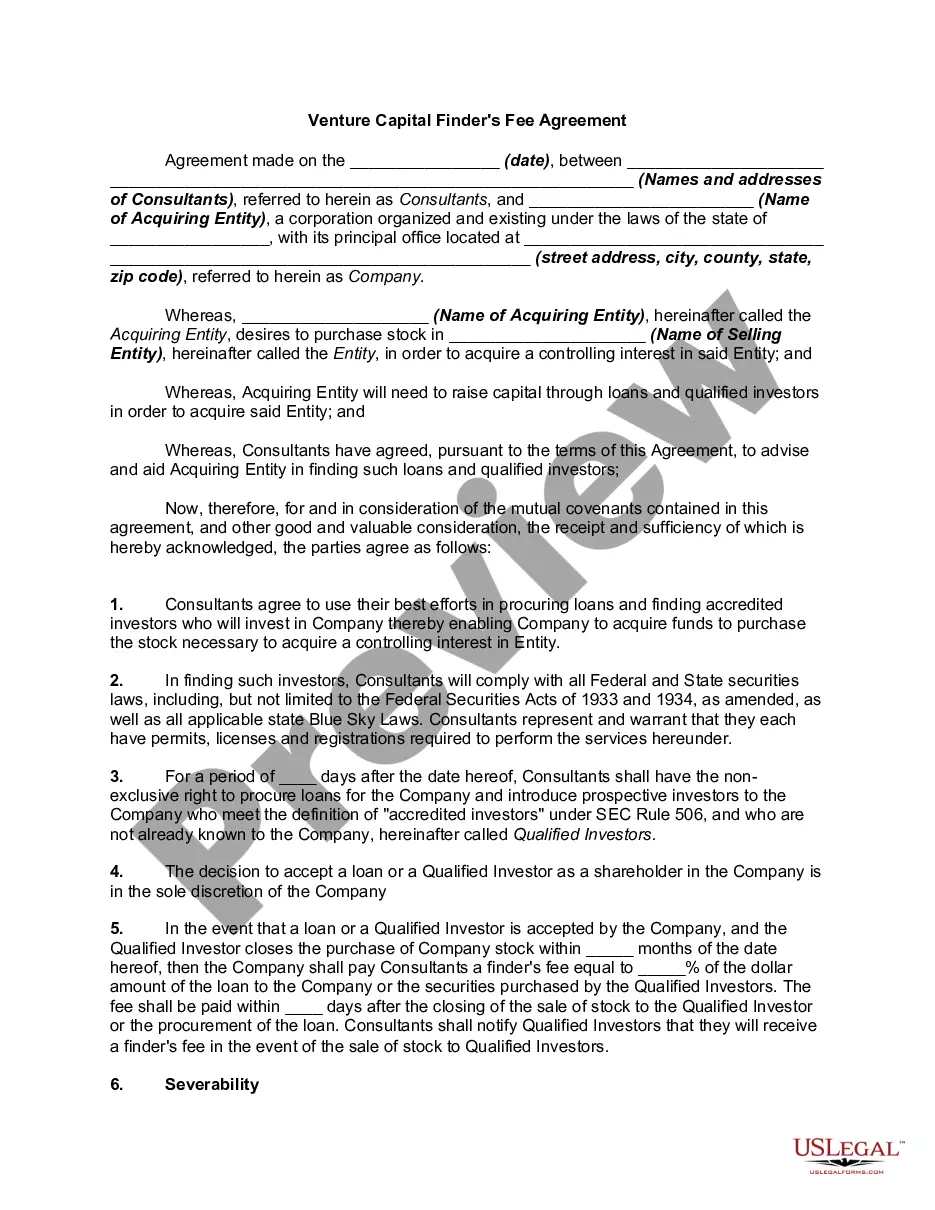

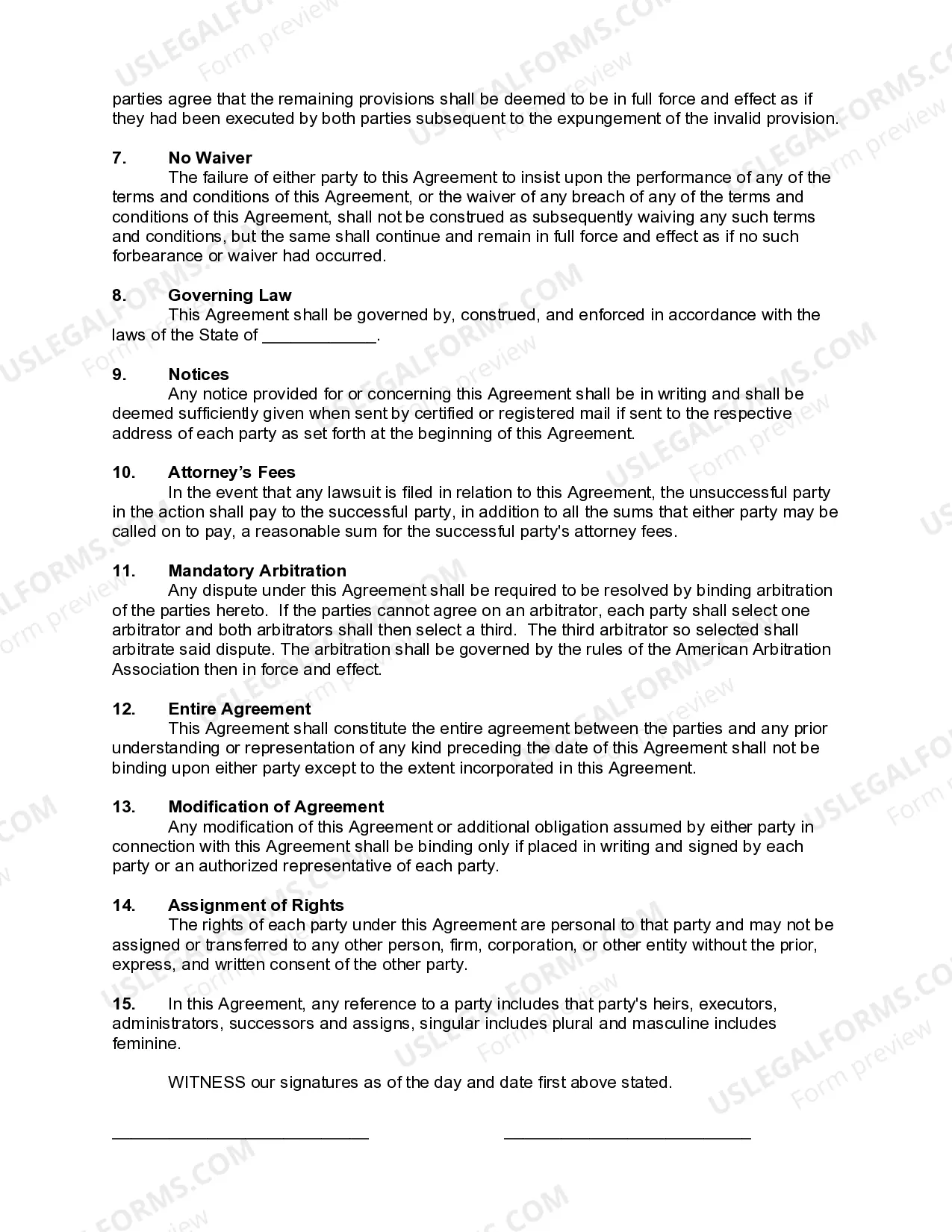

Montana Venture Capital Finder's Fee Agreement, also known as a VC Finder's Fee Agreement, is a legal document entered into between a venture capital firm and an individual or entity, known as the finder or intermediary, for facilitating the introduction and acquisition of investment opportunities. This agreement outlines the terms and conditions surrounding the finder's compensation for successfully connecting the venture capital firm with potential investment prospects. In Montana, and across other jurisdictions, the VC Finder's Fee Agreement serves as a binding contract that governs the relationship between the finder and the firm. It defines various essential elements, such as the scope of the finder's services, the type of investments sought by the venture capital firm, and the compensation structure for the finder's services upon a successful investment placement. The agreement typically includes relevant information such as: 1. Parties involved: The agreement identifies the venture capital firm and the finder, providing their legal names, contact details, and official designations. 2. Scope of Services: It specifies the services to be provided by the finder, which may include sourcing, analyzing, and conducting due diligence on potential investment opportunities according to the venture capital firm's investment criteria. 3. Exclusivity and Non-Compete: Some agreements may enforce exclusivity, meaning that the finder cannot represent similar investment opportunities to other venture capital firms, ensuring the undivided attention and dedication of the finder to the firm. 4. Fee Structure: The agreement outlines the compensation mechanism for the finder's services. It can be a fixed percentage of the investment amount, a fixed monetary amount, or a combination of both. The agreement may also include provisions for milestone-based payments, such as partial fees upon reaching specific investment stages. 5. Conditions for Payment: The agreement specifies the conditions under which the finder is eligible for payment, generally finding and successfully introducing an investment opportunity that meets the firm's investment criteria and subsequently closes the investment round. The payment schedule and method, such as wire transfer or check, are often outlined as well. It is important to note that while the general structure and purpose of a VC Finder's Fee Agreement remain consistent, specific variations can exist. These variations could include agreements tailored to specific industries, such as technology, healthcare, or real estate, or agreements designed for different stages of investment, such as seed funding, early-stage, or later-stage investments. Ultimately, the exact terms and distinctions of Montana's VC Finder's Fee Agreement may differ depending on the requirements and preferences of the involved parties.

Montana Venture Capital Finder's Fee Agreement

Description

How to fill out Montana Venture Capital Finder's Fee Agreement?

If you wish to comprehensive, download, or print legitimate file themes, use US Legal Forms, the biggest collection of legitimate kinds, which can be found on-line. Make use of the site`s basic and handy search to find the files you require. Different themes for organization and individual uses are sorted by types and claims, or keywords. Use US Legal Forms to find the Montana Venture Capital Finder's Fee Agreement within a few clicks.

When you are currently a US Legal Forms client, log in for your account and then click the Acquire button to find the Montana Venture Capital Finder's Fee Agreement. You can also entry kinds you formerly acquired inside the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for that right area/country.

- Step 2. Utilize the Preview choice to look over the form`s content material. Never overlook to read the information.

- Step 3. When you are unhappy with all the kind, take advantage of the Research industry at the top of the monitor to find other versions from the legitimate kind format.

- Step 4. When you have found the shape you require, click on the Acquire now button. Opt for the rates plan you favor and put your credentials to sign up on an account.

- Step 5. Process the purchase. You can utilize your charge card or PayPal account to accomplish the purchase.

- Step 6. Find the structure from the legitimate kind and download it on the product.

- Step 7. Complete, modify and print or indicator the Montana Venture Capital Finder's Fee Agreement.

Every single legitimate file format you buy is your own forever. You might have acces to each kind you acquired within your acccount. Click the My Forms section and pick a kind to print or download yet again.

Contend and download, and print the Montana Venture Capital Finder's Fee Agreement with US Legal Forms. There are millions of professional and state-particular kinds you can use for the organization or individual requirements.