Montana Angel Investor Agreement

Description

How to fill out Angel Investor Agreement?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can find thousands of documents for business and personal purposes, categorized by type, state, or keywords. You can access the latest versions of documents such as the Montana Angel Investor Agreement in no time.

If you already have an account, Log In to download the Montana Angel Investor Agreement from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the payment.

Select the file format and download the document to your device. Make changes. Fill out, modify, and print or sign the downloaded Montana Angel Investor Agreement. Each template you add to your account does not expire and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the document you need. Access the Montana Angel Investor Agreement with US Legal Forms, the largest collection of legal document templates. Utilize thousands of expert and state-specific templates that meet your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct document for your region/area.

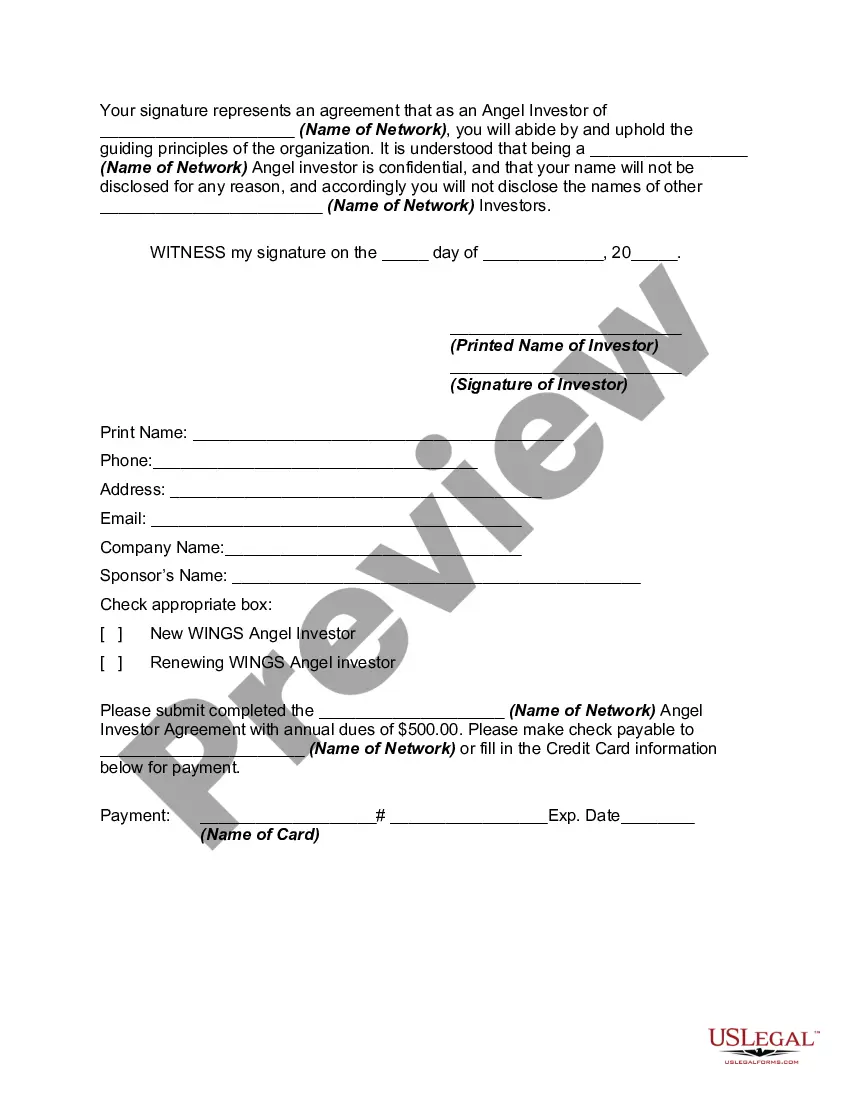

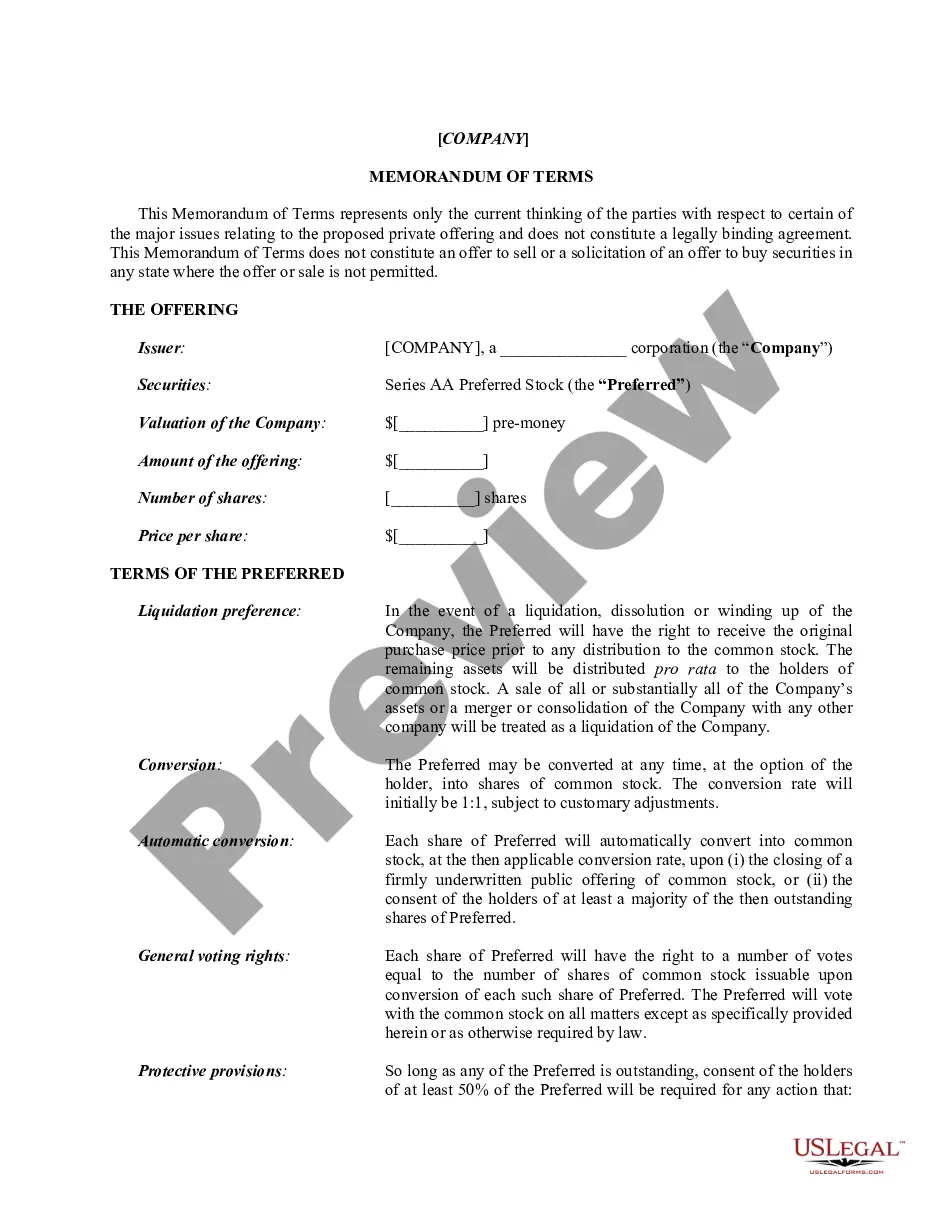

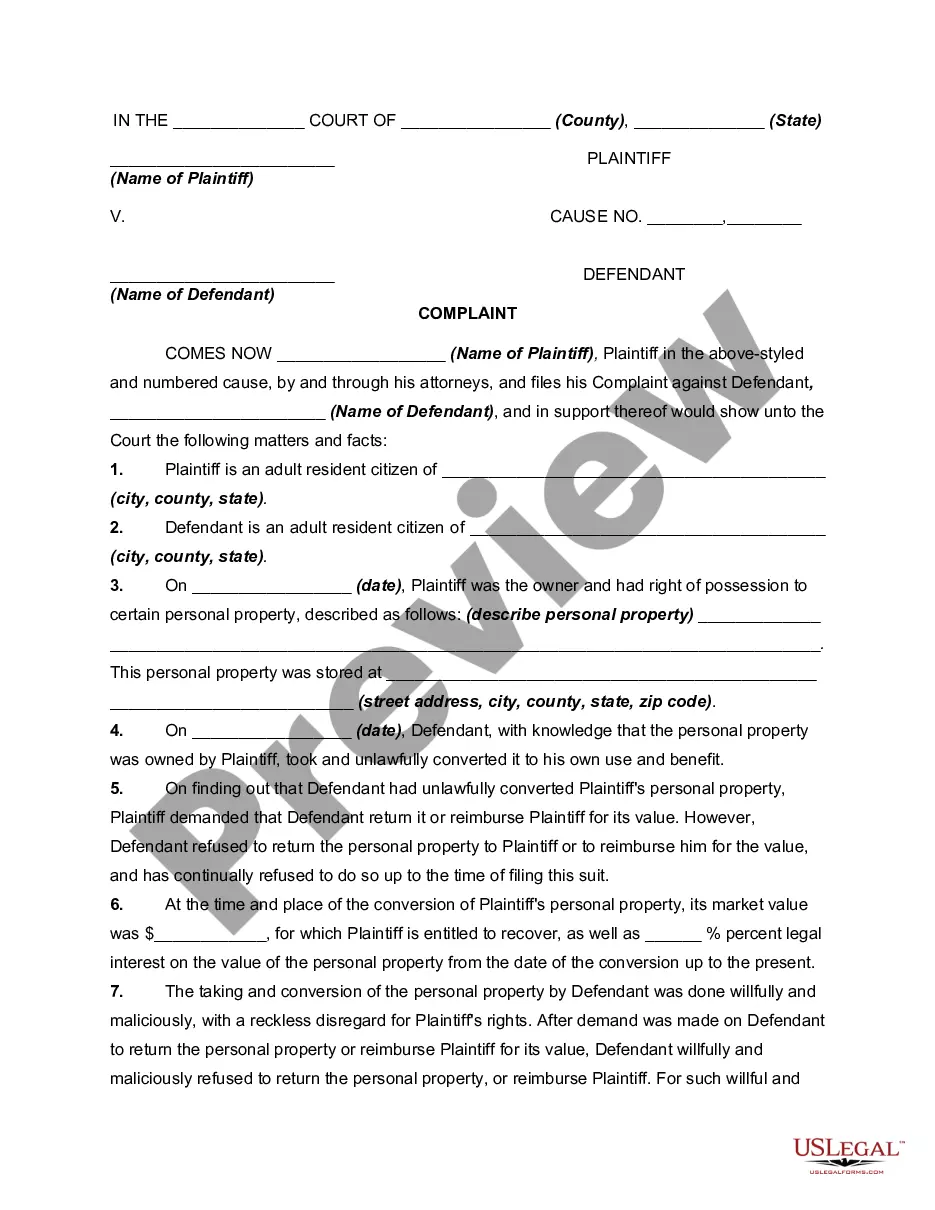

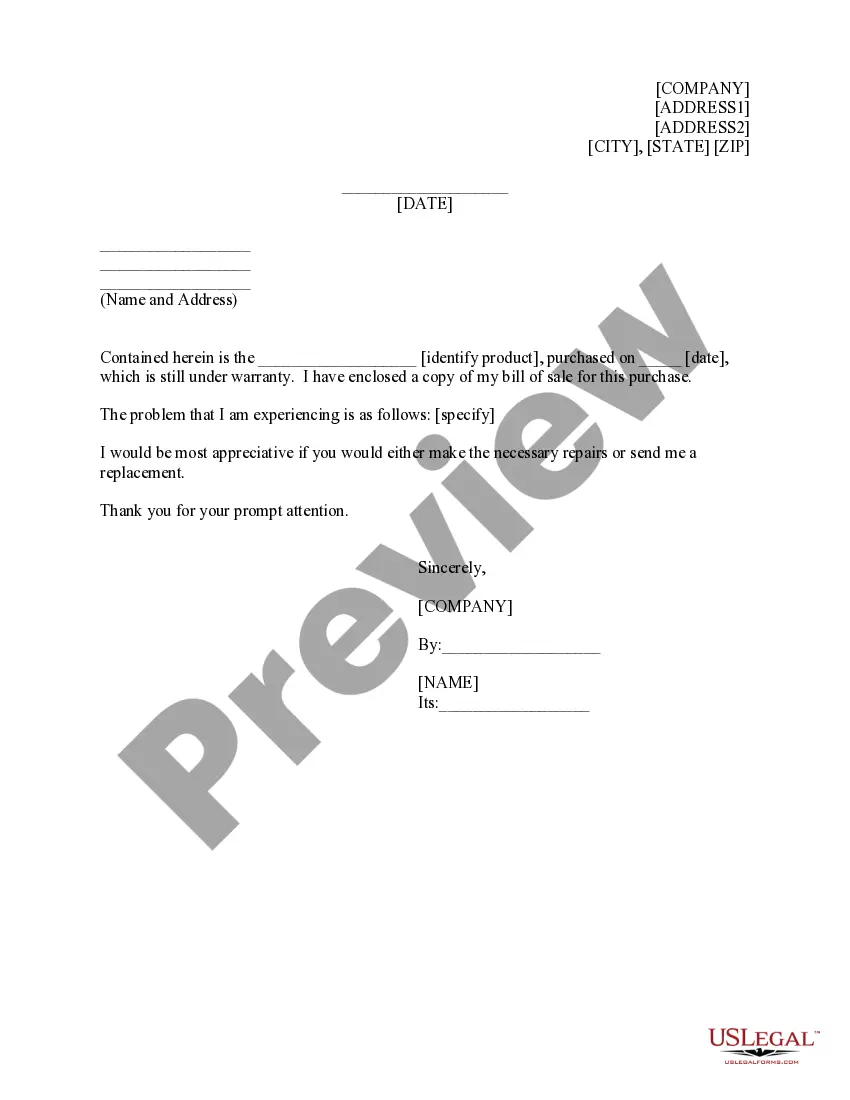

- Click the Preview option to review the form's content.

- Check the form outline to make sure you have picked the right document.

- If the document does not meet your needs, utilize the Search feature at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, select your preferred pricing plan and provide your credentials to register for the account.

Form popularity

FAQ

To pitch your idea to an angel investor, start with a concise overview of your business model, market needs, and how your product or service meets those needs. Keep your presentation engaging and data-driven, highlighting your unique value proposition. Ensure your Montana Angel Investor Agreement is polished and ready to demonstrate your professionalism when they express interest.

To effectively get in front of angel investors, use social media to highlight your venture and engage with potential backers. Additionally, partnering with business incubators can provide valuable introductions. A well-prepared Montana Angel Investor Agreement will support your discussions, signaling that you are serious about your business.

When approaching angel investors, start by crafting a compelling pitch that outlines your business idea and potential returns. Make sure to personalize your approach, showing that you understand their investment focus. Plus, offering a detailed Montana Angel Investor Agreement enhances your proposal's professionalism and credibility.

To qualify as an angel investor, you generally need to meet certain financial criteria, including having a net worth above a specific threshold. Additionally, familiarity with the startup landscape and a desire to invest in new ventures are crucial. If you're drafting a Montana Angel Investor Agreement, ensure that your qualifications are clearly defined to attract suitable investments.

To reach out to angel investors, begin by researching investor profiles that align with your business. Use tools like LinkedIn to connect, or join investor networks for better access. Once you establish contact, having a well-structured Montana Angel Investor Agreement ready can facilitate discussions and build trust.

Securing an angel investor can be challenging, but preparation makes a difference. Investors typically look for strong business ideas and capable entrepreneurs. Presenting a solid Montana Angel Investor Agreement can demonstrate your seriousness and commitment, increasing your chances of attracting interest.

To connect with angel investors, start by attending networking events, entrepreneurship meetups, and pitch competitions. Leverage online platforms designed for startups, where investors actively seek opportunities. Additionally, consider utilizing resources like the USLegalForms platform, which offers tailored agreements like the Montana Angel Investor Agreement to facilitate discussions.

Angel investors are categorized as high-net-worth individuals who provide capital for startups, often in exchange for equity. They are typically seen as a bridge between personal savings and venture capital funding. Understanding this category is vital when entering a Montana Angel Investor Agreement, as it helps define your expectations and approach in seeking investment. Researching potential investors can help you find the right fit for your business.

To write off worthless investments, you must declare them as losses on your tax return. This can be done using Form 4797 or Schedule D, which allows you to record capital losses. If you're dealing with a failed investment under a Montana Angel Investor Agreement, documenting the investment’s decline is essential for proper tax reporting. Always check with a tax advisor to navigate these forms accurately.

While angel investors can provide vital funding, there are notable drawbacks. These include potential loss of control, as investors may want a say in business decisions. Additionally, the process of negotiating a Montana Angel Investor Agreement can be complex, requiring time and legal knowledge. Understanding these challenges can help you prepare for a successful partnership.