The Montana General Form of Factoring Agreement — Assignment of Accounts Receivable is a legal document that outlines the terms and conditions of a factoring arrangement between a business and a factoring company. Factoring is a financial transaction where a business sells its accounts receivable to a third-party company (the factor) at a discounted rate. This agreement allows the factor to collect payment from the debtor and provides the business with immediate cash flow. Keywords: Montana, Factoring Agreement, Assignment of Accounts Receivable, legal document, factoring arrangement, business, factoring company, financial transaction, accounts receivable, third-party, factor, discounted rate, payment, debtor, cash flow. There may be different types of Montana General Form of Factoring Agreement — Assignment of Accounts Receivable based on the specific terms and conditions agreed upon by the parties involved in the agreement. Some potential variations or subtypes could include: 1. Recourse Factoring: In this type of factoring agreement, the business retains the risk of non-payment by the debtor. If the debtor fails to pay, the business is responsible for repurchasing the accounts receivable from the factor. 2. Non-Recourse Factoring: In contrast to recourse factoring, this type of agreement transfers the risk of non-payment to the factor. If the debtor defaults, the factor cannot seek repayment from the business. This type of factoring generally involves higher fees due to the increased risk assumed by the factor. 3. Maturity Factoring: This variant of factoring agreement involves the factor providing funding against accounts receivable that have a future payment date. The agreement allows the business to obtain immediate cash flow while waiting for the debtor to make the payment. 4. Spot Factoring: Also known as single invoice factoring, this type of agreement enables businesses to factor individual invoices selectively, rather than committing to factor all their accounts receivable. It provides flexibility and allows the business to tailor their cash flow needs according to their specific requirements. 5. Credit Factoring: This form of agreement includes credit insurance provided by the factor. The factor assumes the risk of non-payment due to customer bankruptcy or insolvency, protecting the business from potential losses. 6. Invoice Discounting: Although not strictly a form of factoring, this financial arrangement closely resembles it. In invoice discounting, the business retains control of its accounts receivable and secures a loan against them from a financing institution. The loan amount is typically a percentage of the accounts receivable value. 7. Domestic Factoring: In this type of agreement, the factor and the business are based in the same country, typically Montana. It simplifies the collection process and minimizes cross-border complexities. 8. International Factoring: This variant of factoring involves the factor and the business located in different countries. It accounts for the additional challenges posed by different legal systems, languages, currencies, and regulations. When entering a Montana General Form of Factoring Agreement — Assignment of Accounts Receivable, it is necessary to carefully review and tailor the agreement to meet the specific needs and circumstances of the parties involved. Legal advice, particularly pertaining to Montana state regulations, is highly recommended ensuring compliance and protect the rights of all parties involved.

Montana General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

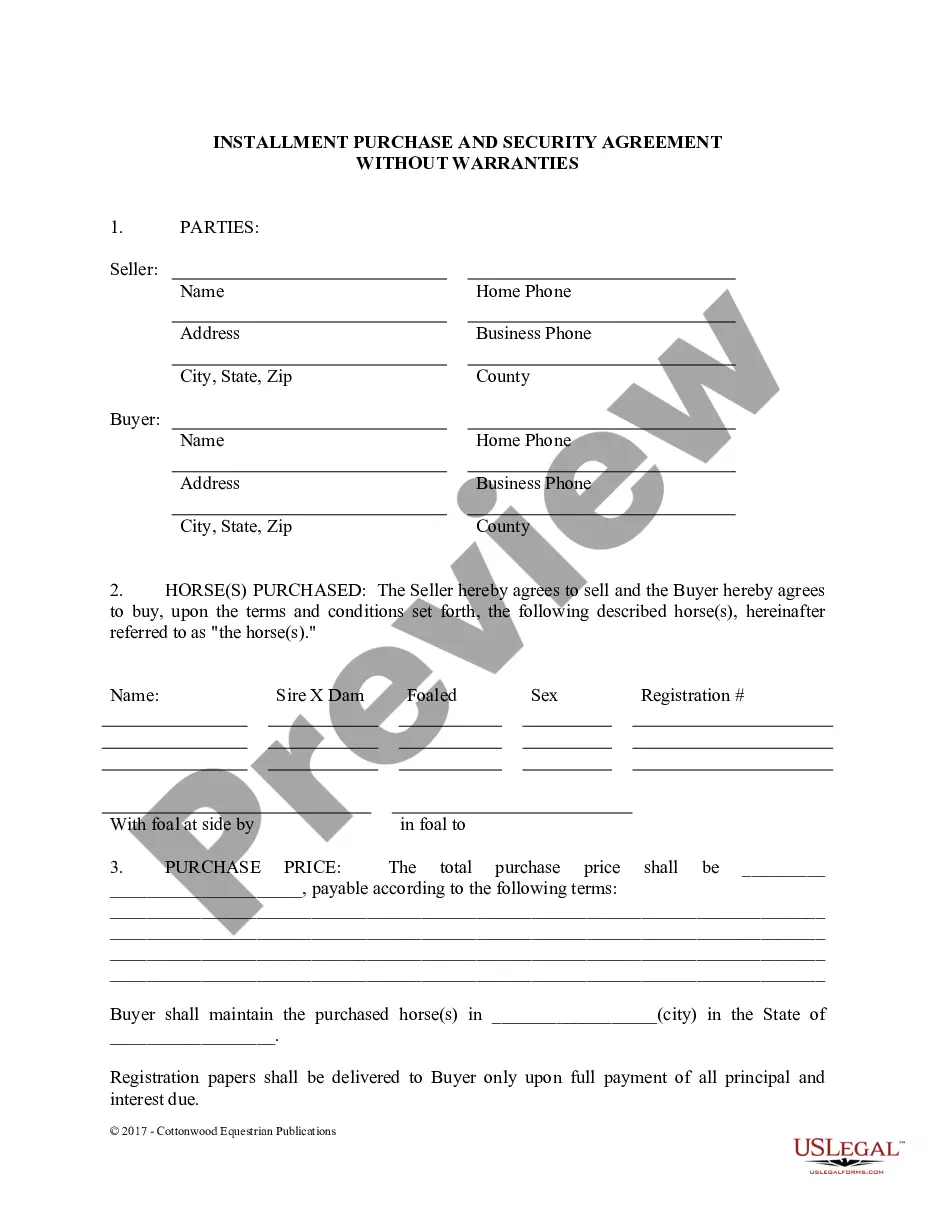

How to fill out Montana General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Have you been inside a position the place you will need papers for either company or individual uses virtually every time? There are a variety of lawful document layouts accessible on the Internet, but finding versions you can rely isn`t simple. US Legal Forms gives a large number of kind layouts, such as the Montana General Form of Factoring Agreement - Assignment of Accounts Receivable, which are published to fulfill state and federal demands.

When you are currently knowledgeable about US Legal Forms site and also have an account, just log in. Following that, you may download the Montana General Form of Factoring Agreement - Assignment of Accounts Receivable template.

If you do not come with an profile and wish to start using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for your appropriate metropolis/region.

- Take advantage of the Preview key to examine the form.

- Look at the outline to ensure that you have selected the right kind.

- When the kind isn`t what you`re searching for, take advantage of the Look for industry to find the kind that meets your requirements and demands.

- If you get the appropriate kind, just click Buy now.

- Select the prices prepare you desire, complete the required info to create your bank account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy file file format and download your copy.

Locate each of the document layouts you may have purchased in the My Forms food list. You can get a extra copy of Montana General Form of Factoring Agreement - Assignment of Accounts Receivable anytime, if needed. Just click the essential kind to download or printing the document template.

Use US Legal Forms, probably the most substantial collection of lawful kinds, to save time and stay away from mistakes. The services gives expertly produced lawful document layouts which can be used for a range of uses. Create an account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

(3) Any assignment of receivables which constitute security for repayment of any loan advanced by any Bank or other creditor and if the assignor has given notice of such encumbrance to the assignee, then on accepting assignment of such receivable, the assignee shall pay the consideration for such assignment to the Bank

For example, if you sell $100,000 worth of accounts receivables and get a 90 percent advance, you will receive $90,000. The accounts receivable factoring company holds the remaining 10-percent or $10,000 as security until the payment of the invoice or invoices have been received.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Factoring can be done either on a notification basis, where the seller's customers remit directly to the factor, or on a non-notification basis, where the seller handles the collections and remits to the factor.

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

Factoring allows companies to immediately build up their cash balance and pay any outstanding obligations. Therefore, factoring helps companies free up capital. that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor.

Step by step factoring process in QuickbooksCreate an account for factored invoices. In your Chart of Account, create a liabilities account just for factored invoices.Create an account for factoring fees.Create an invoice.Record a deposit.Record the fee.Record the received payment.Apply payment to loan.