The Montana Cash Receipts Control Log is a vital document used by businesses and organizations in Montana to track and monitor their cash inflows accurately and efficiently. It serves as a control mechanism to ensure that all cash received is appropriately accounted for and recorded. This log is crucial for maintaining proper financial records, reconciling transactions, and preventing any potential discrepancies or fraudulent activities. Keywords: Montana, cash receipts, control log, businesses, organizations, track, monitor, cash inflows, accurately, efficiently, control mechanism, accounted for, recorded, financial records, reconciling, transactions, discrepancies, fraudulent activities. Different Types of Montana Cash Receipts Control Log: 1. Standard Cash Receipts Control Log: This is the most commonly used type of log, designed for businesses of various industries and sizes. It includes fields to record important details such as date, time, transaction type, amount received, customer name or account number, payment method, and capturing any necessary remarks or notes. 2. Montana Government Agency Cash Receipts Control Log: Tailored specifically for government agencies in Montana, this log incorporates additional fields to capture information such as agency name, department, program or service received, relevant project or grant codes, and additional approvals or signatures required within the agency. 3. Montana Non-Profit Organization Cash Receipts Control Log: Non-profit organizations often have distinct requirements when it comes to tracking funds received, as they rely heavily on donations and grants. This specialized log may include fields to record donor information, granter details, purpose or use of funds, tax-exempt documentation, and any acknowledgement letters sent to donors. 4. Montana Retail Store Cash Receipts Control Log: Retail businesses in Montana may have unique needs related to tracking sales and processing cash transactions. This log could feature additional fields like employee ID or initials, item details or description, sales tax amount, discounts or promotions applied, and inventory tracking codes if necessary. 5. Montana Service Industry Cash Receipts Control Log: Designed for service-based businesses, such as restaurants, hotels, or repair shops, this log might include fields to note specific services rendered, table or room numbers, waiter or service staff names, gratuities or tips received, and any additional charges or fees applicable. In conclusion, the Montana Cash Receipts Control Log is an essential tool for businesses and organizations in Montana to efficiently track and manage their cash inflows. By utilizing this log, companies can maintain accurate financial records, prevent discrepancies, and ensure compliance with applicable regulations.

Montana Cash Receipts Control Log

Description

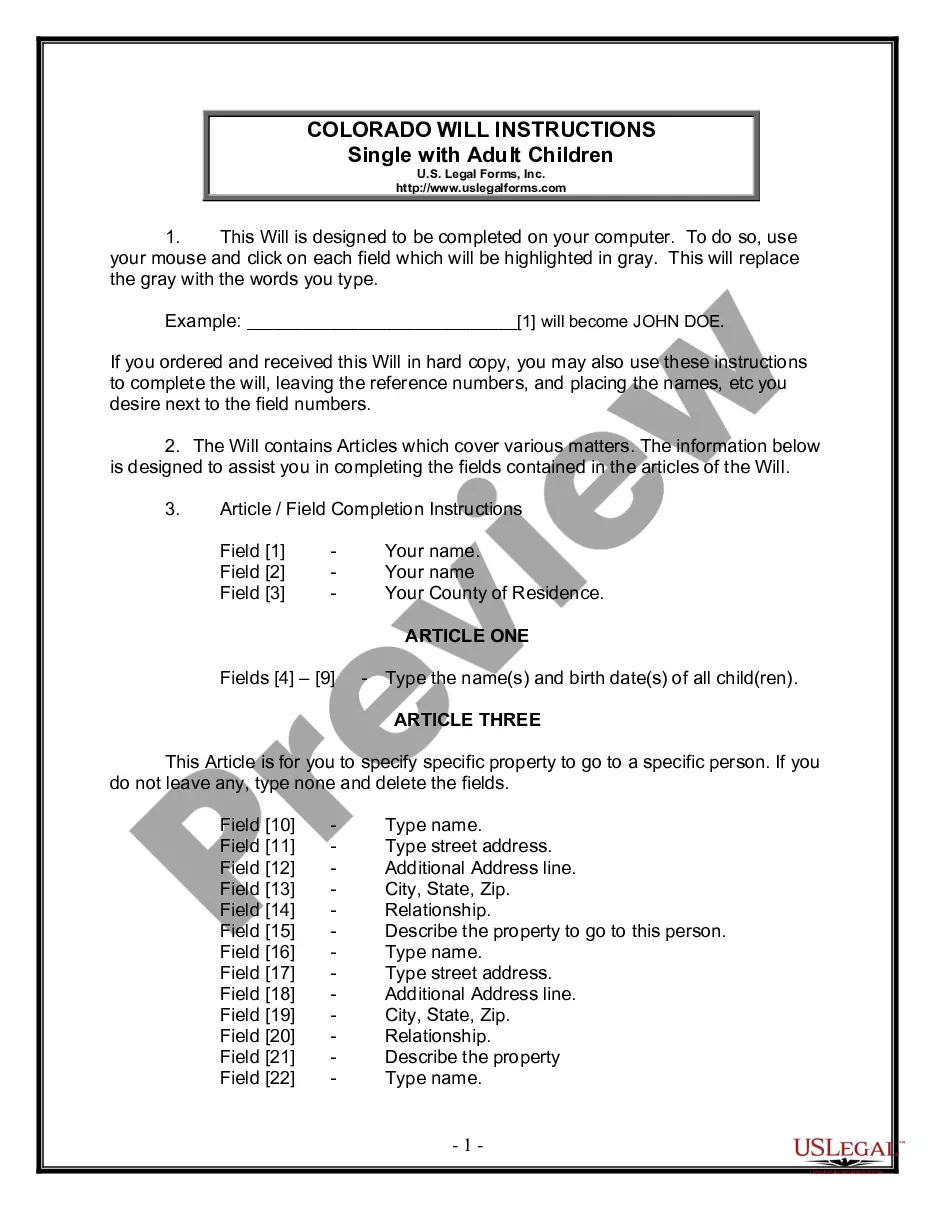

How to fill out Montana Cash Receipts Control Log?

US Legal Forms - one of the biggest libraries of authorized types in the USA - gives a variety of authorized record themes it is possible to acquire or print out. While using web site, you will get thousands of types for company and individual functions, categorized by groups, suggests, or key phrases.You can find the most up-to-date variations of types much like the Montana Cash Receipts Control Log within minutes.

If you already have a subscription, log in and acquire Montana Cash Receipts Control Log from the US Legal Forms library. The Down load button will show up on each kind you look at. You get access to all formerly delivered electronically types from the My Forms tab of the account.

If you would like use US Legal Forms the first time, allow me to share easy directions to get you started out:

- Make sure you have picked out the best kind for the city/county. Go through the Preview button to examine the form`s articles. Look at the kind information to ensure that you have chosen the correct kind.

- If the kind does not fit your demands, make use of the Search discipline near the top of the monitor to obtain the one which does.

- Should you be happy with the shape, affirm your selection by visiting the Acquire now button. Then, pick the pricing strategy you prefer and give your qualifications to sign up for the account.

- Process the financial transaction. Make use of charge card or PayPal account to perform the financial transaction.

- Find the formatting and acquire the shape on the device.

- Make modifications. Complete, modify and print out and signal the delivered electronically Montana Cash Receipts Control Log.

Each and every template you put into your bank account does not have an expiration day which is your own permanently. So, if you want to acquire or print out one more duplicate, just proceed to the My Forms portion and click around the kind you will need.

Gain access to the Montana Cash Receipts Control Log with US Legal Forms, probably the most extensive library of authorized record themes. Use thousands of skilled and condition-specific themes that meet up with your small business or individual requires and demands.

Form popularity

FAQ

Nebraska, Texas & Kansas accounted for roughly 41% of the cash receipts for cattle in the United States in 2019. Nebraska, Texas, Kansas, Iowa & Colorado accounted for roughly 53% of the cash receipts for cattle in the United States in 2019.

In 2020, the top 10 agriculture-producing States in terms of cash receipts were (in descending order): California, Iowa, Nebraska, Texas, Kansas, Minnesota, Illinois, Wisconsin, Indiana, and North Carolina. See these and related statistics in the USDA, Economic Research Service Farm Income and Wealth Statistics.

California ranks first in the U.S. for agricultural cash receipts followed by Iowa, Texas, Nebraska and Illinois. California ranks first in the United States for agricultural cash receipts followed by Iowa, Texas, Nebraska and Illinois.

Nebraska had the highest cash receipts for cattle in 2019 followed by Texas, Kansas, Iowa & Colorado. Nebraska was the only state in 2019 to have cash receipts for cattle over $10 billion. Nebraska, Texas & Kansas accounted for roughly 41% of the cash receipts for cattle in the United States in 2019.

California ranks first in the U.S. for agricultural cash receipts followed by Iowa, Texas, Nebraska and Illinois. California ranks first in the United States for agricultural cash receipts followed by Iowa, Texas, Nebraska and Illinois.

2, projects cash receipts from the sales of crops and livestock will decline by $12 billion, or 3%, from 2019 to $358 billion. If realized, U.S. farm cash receipts will be at the lowest level in more than a decade, and $18 billion below the 10-year average of $376 billion.

In 2020, the 10 largest sources of cash receipts from the sale of U.S.-produced farm commodities were (in descending order): cattle/calves, corn, soybeans, dairy products/milk, miscellaneous crops, broilers, hogs, wheat, chicken eggs, and hay.

A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. A cash receipt contains the following information: The date of the transaction.

Cattle and calves had the highest agricultural cash receipts in Kansas in 2019 followed by corn, soybeans, wheat & sorghum. Cattle and calves had the highest agricultural cash receipts in Kansas in 2019 followed by corn, soybeans, wheat & sorghum.

More info

Word View Office. Word Business Software Small Business Pricing OpenOffice Vision View Office. Word Business Software Small Business Pricing OpenOffice XPS View Office. Word Business Software Small Business Pricing OpenOffice Word View Office.