The Montana Pledge of Personal Property as Collateral Security is a legal document that allows an individual or business to use personal property as collateral for a loan. This pledging process helps secure the lender's interest in the event of default or non-payment by the borrower. The personal property being pledged can range from tangible assets, such as vehicles, inventory, equipment, or even intangible assets like intellectual property rights, accounts receivable, or securities. In Montana, there are different types of pledges of personal property as collateral security that can be utilized depending on the specific circumstances. Some common types include: 1. Chattel Mortgage: This type of pledge involves the transfer of ownership of personal property to the lender until the debt is fully repaid. Upon repayment, the ownership of the property is transferred back to the borrower. 2. Security Agreement: This type of pledge grants a security interest in the personal property to the lender, without transferring ownership. The borrower retains possession and use of the property but agrees that it can be seized by the lender in case of default. 3. UCC Financing Statement: This type of pledge involves filing a Uniform Commercial Code (UCC) financing statement with the Montana Secretary of State's office. This form serves as public notice of the lender's interest in the pledged personal property, protecting the lender's rights. Montana's law requires that certain specific information be included in the pledge agreement. This typically includes a detailed description of the pledged property, the amount of the loan, repayment terms, interest rates, and any conditions or restrictions imposed. The Montana Pledge of Personal Property as Collateral Security provides protection for both the borrower and the lender. By pledging personal property, the borrower can access loans that would otherwise be difficult to obtain, while lenders have assurance that their investment is secured. It is important for both parties to carefully review and understand the terms of the pledge agreement before entering into such agreements to ensure legal compliance and protection of their respective interests.

Montana Pledge of Personal Property as Collateral Security

Description

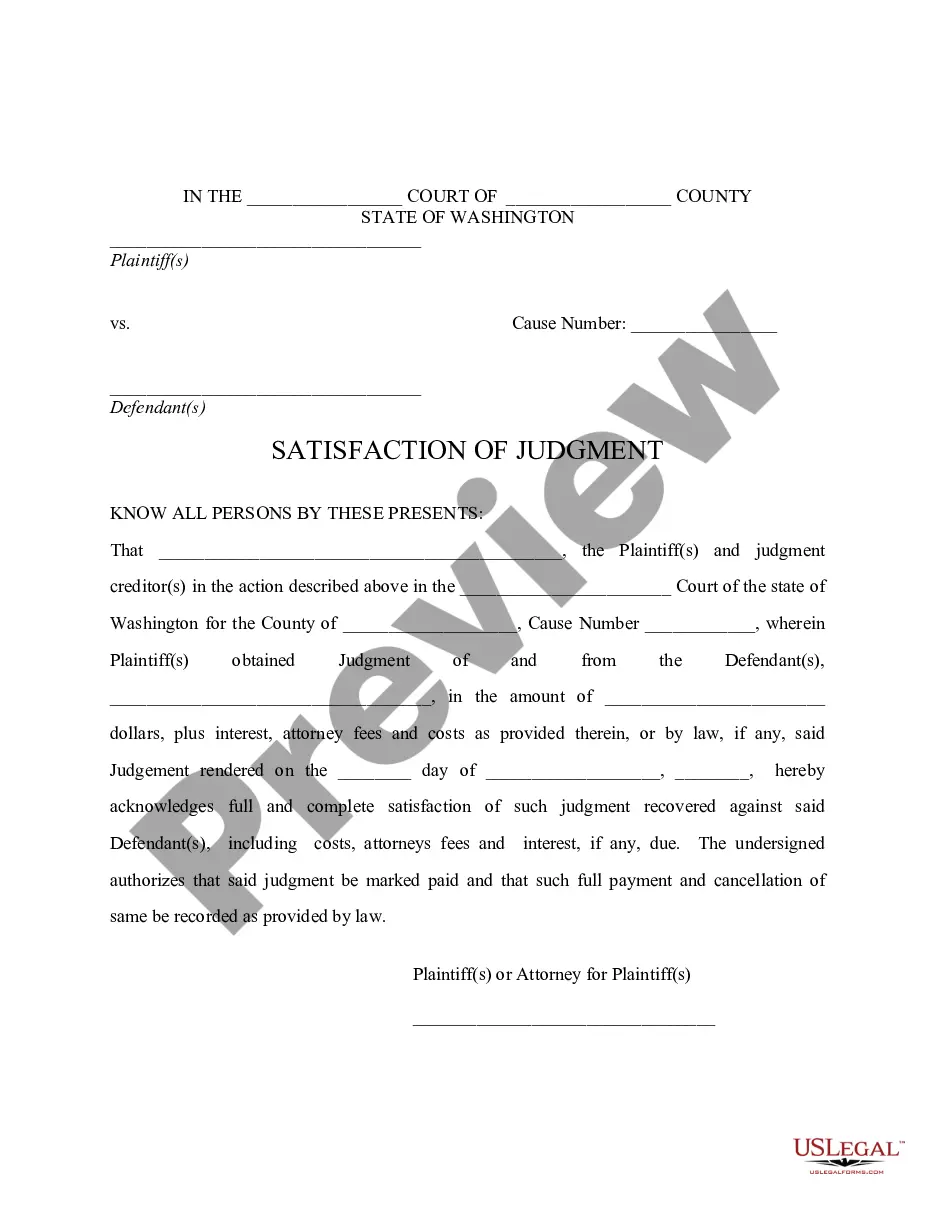

How to fill out Montana Pledge Of Personal Property As Collateral Security?

If you wish to complete, acquire, or print authorized record web templates, use US Legal Forms, the largest selection of authorized types, that can be found on the Internet. Take advantage of the site`s easy and convenient research to find the files you will need. A variety of web templates for business and specific reasons are sorted by groups and says, or key phrases. Use US Legal Forms to find the Montana Pledge of Personal Property as Collateral Security with a few clicks.

In case you are previously a US Legal Forms buyer, log in for your account and click the Down load button to get the Montana Pledge of Personal Property as Collateral Security. You may also access types you previously acquired in the My Forms tab of your account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form to the proper area/land.

- Step 2. Take advantage of the Review choice to look over the form`s content. Don`t neglect to read through the explanation.

- Step 3. In case you are unhappy together with the develop, utilize the Research field on top of the display to find other models of your authorized develop design.

- Step 4. After you have discovered the form you will need, select the Acquire now button. Opt for the costs plan you favor and include your credentials to register for the account.

- Step 5. Procedure the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Find the file format of your authorized develop and acquire it on your system.

- Step 7. Comprehensive, change and print or indicator the Montana Pledge of Personal Property as Collateral Security.

Each authorized record design you get is your own property for a long time. You might have acces to every develop you acquired in your acccount. Select the My Forms section and select a develop to print or acquire yet again.

Be competitive and acquire, and print the Montana Pledge of Personal Property as Collateral Security with US Legal Forms. There are millions of professional and status-specific types you can utilize for your business or specific requires.