Montana Independent Contractor Agreement with Church: A Comprehensive Overview Keywords: Montana, Independent Contractor Agreement, Church, types, detailed description Introduction: Montana Independent Contractor Agreement with Church refers to a legally binding document that establishes the professional relationship between an individual or entity acting as an independent contractor and a church or religious organization based in Montana. This agreement ensures that both parties understand their rights, responsibilities, and obligations throughout the duration of their working relationship. It offers clarity on various crucial aspects such as compensation, terms of engagement, intellectual property protection, confidentiality, dispute resolution, and termination procedures. There may be different types of Independent Contractor Agreements tailored to specific roles within a church; let's explore some common ones: 1. Pastoral Services Agreement: This type of agreement is designed for pastors or clergy members engaging in various religious duties within the church. It outlines the scope of their responsibilities, including sermon delivery, counseling, leading worship services, performing marriages, conducting funerals, and managing congregational matters. 2. Music Ministry Agreement: The Music Ministry Agreement caters to musicians, worship leaders, or choir directors hired by the church. It defines the terms and conditions regarding their performance duties, rehearsal requirements, copyrights, use of equipment, and potential compensation for special events or concerts. 3. Facility Maintenance Agreement: In cases where an independent contractor is hired by the church to manage facility maintenance, repair, or cleaning tasks, the Facility Maintenance Agreement becomes essential. This contract outlines specific responsibilities, working hours, equipment usage, and protocols for reporting maintenance or safety issues. 4. Administrative Support Agreement: This agreement covers individuals or entities providing administrative support to the church, such as bookkeepers, secretaries, or virtual assistants. It clarifies the tasks, working hours, payment terms, and confidentiality requirements associated with managing church records, financials, correspondence, scheduling, and other administrative duties. Key Elements of a Montana Independent Contractor Agreement with Church: A well-crafted Independent Contractor Agreement typically encompasses the following crucial elements: 1. Introduction: The agreement identifies both the church and the independent contractor, outlining their legal names, addresses, and relevant contact information. 2. Scope of Work: This section delineates the specific services to be provided by the contractor, including the expected quality of work, deadlines, and any project milestones. 3. Payment: Details regarding compensation, invoicing procedures, payment schedules, and any additional expenses or reimbursements are outlined in this section. 4. Intellectual Property: If the contractor creates any original work or intellectual property during the engagement, this section will define who retains ownership and any usage rights granted to the church. 5. Confidentiality: To protect sensitive information, this section establishes the obligations of both parties to maintain confidentiality and restrict the disclosure of proprietary or confidential materials. 6. Term and Termination: The agreement specifies the duration of the engagement and the conditions under which either party can terminate the contract, such as breach of agreement or mutual agreement for early termination. 7. Dispute Resolution: To handle potential disputes, this section outlines the preferred methods of dispute resolution, such as mediation or arbitration, before resorting to the courts. Conclusion: In summary, a Montana Independent Contractor Agreement with Church is a vital legal instrument that safeguards the interests of both independent contractors and churches in Montana. By explicitly defining expectations, responsibilities, and rights, these agreements promote harmonious and professional relationships within the religious community. The types of agreements vary based on the specific roles, encompassing pastoral services, music ministry, facility maintenance, and administrative support. Understanding these agreements and their key elements is vital for ensuring a smooth working relationship between independent contractors and churches.

Montana Independent Contractor Agreement with Church

Description

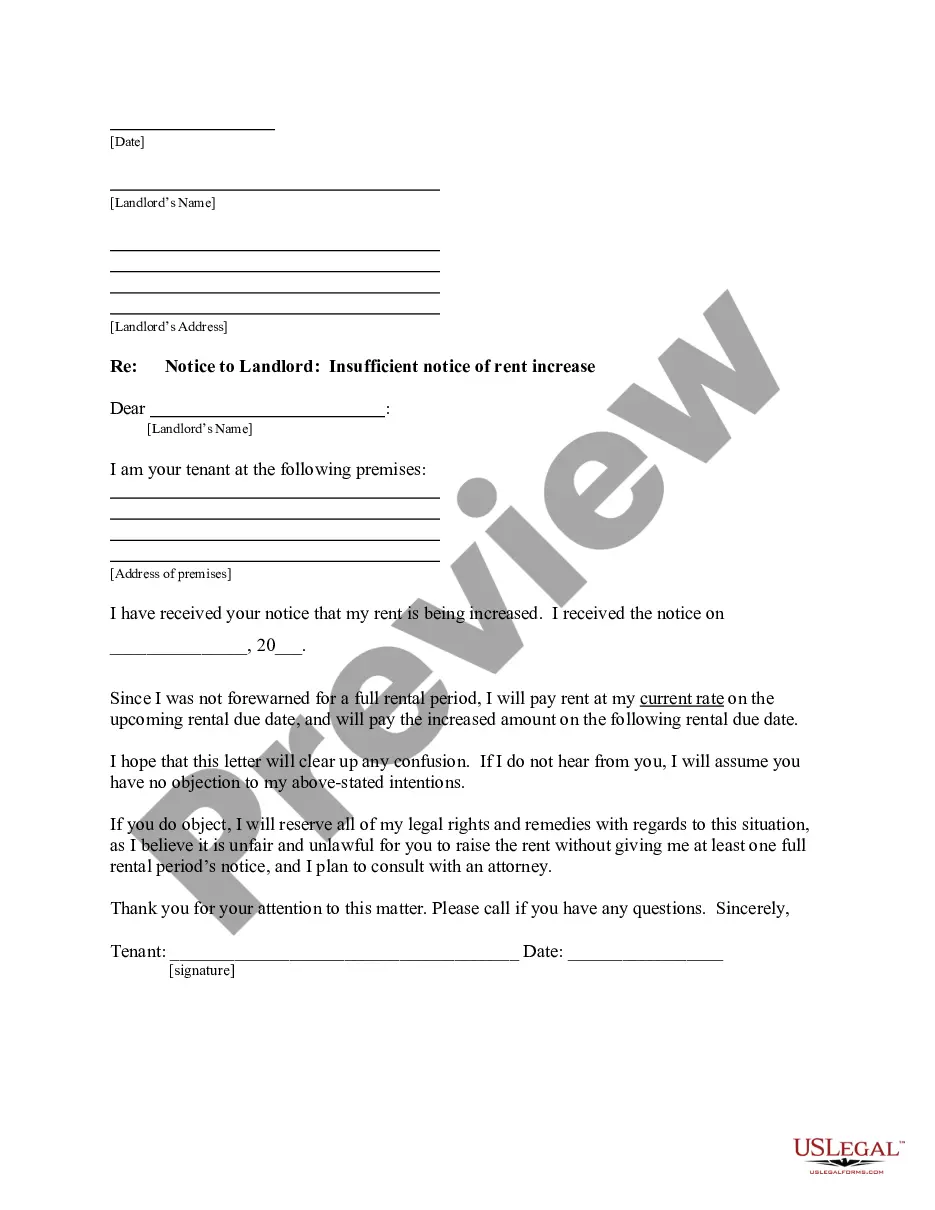

How to fill out Montana Independent Contractor Agreement With Church?

If you wish to comprehensive, down load, or print authorized document web templates, use US Legal Forms, the most important collection of authorized kinds, that can be found on the web. Make use of the site`s easy and hassle-free research to find the documents you require. Numerous web templates for company and specific functions are categorized by classes and claims, or key phrases. Use US Legal Forms to find the Montana Independent Contractor Agreement with Church with a handful of clicks.

When you are previously a US Legal Forms customer, log in to your accounts and click on the Acquire switch to have the Montana Independent Contractor Agreement with Church. You can even access kinds you formerly downloaded within the My Forms tab of your accounts.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that correct area/land.

- Step 2. Take advantage of the Preview option to examine the form`s information. Do not overlook to see the information.

- Step 3. When you are not satisfied with the develop, utilize the Lookup industry near the top of the display to get other models in the authorized develop format.

- Step 4. When you have located the shape you require, click on the Get now switch. Opt for the prices program you like and add your qualifications to sign up on an accounts.

- Step 5. Process the purchase. You can use your bank card or PayPal accounts to perform the purchase.

- Step 6. Select the file format in the authorized develop and down load it on the system.

- Step 7. Full, change and print or signal the Montana Independent Contractor Agreement with Church.

Every authorized document format you acquire is your own permanently. You might have acces to every develop you downloaded with your acccount. Click the My Forms area and select a develop to print or down load once more.

Remain competitive and down load, and print the Montana Independent Contractor Agreement with Church with US Legal Forms. There are many specialist and express-particular kinds you may use to your company or specific demands.

Form popularity

FAQ

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

The fee for a contractor registration application is $70, and the independent contractor registration fee is $125. Neither of these registrations requires work experience or a written exam.

General contractors, including handymen, are not required to hold a license to work in Montana. However, if you have employees, you will be required to register with the Department of Labor and Industry, Contractor Registration Unit. To register, you must show proof of workers' compensation insurance.

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.