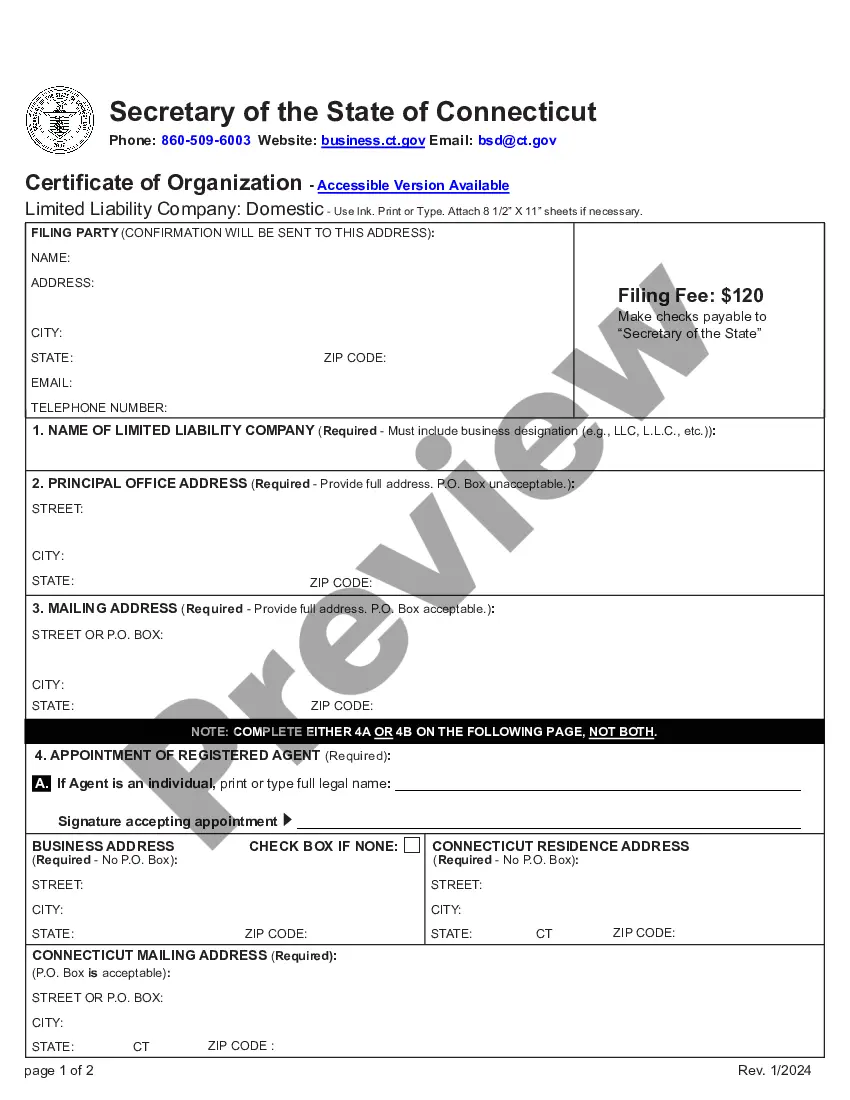

Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Montana Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association: In the state of Montana, members of a church operating as an unincorporated association have the option to incorporate as a nonprofit corporation. This process provides a legal framework and protection for the church, its members, and its operations. By incorporating, the church can gain certain advantages such as limited liability, tax-exempt status, and perpetual existence. The resolution to incorporate as a nonprofit corporation by members of a church operating as an unincorporated association is an important step towards formalizing the church's structure and ensuring its long-term sustainability. This resolution should be carefully crafted to meet the specific needs and goals of the church, while adhering to the legal requirements set forth in the Montana nonprofit corporation laws. Key elements to include in the Montana resolution to incorporate as a nonprofit corporation may involve the church's name, purpose, and specific activities it aims to undertake. The resolution should also designate individuals who will serve as the initial directors and officers of the corporation. These individuals will play crucial roles in the future governance and management of the church. Different types of resolutions to incorporate as a nonprofit corporation by members of a church operating as an unincorporated association can vary depending on the church's particular circumstances. Some churches may choose to incorporate solely for legal protection and liability purposes, while others may focus on obtaining tax-exempt status to maximize their ability to receive donations and grants. Additionally, churches may opt for different classes of nonprofit corporations to suit their unique needs. For example, a church may decide to incorporate as a religious corporation, which specifically caters to religious organizations and provides certain benefits under Montana law. Alternatively, the church may consider incorporating as a charitable corporation if its primary focus is providing services, assistance, or support to the community. Regardless of the type of resolution or classification chosen, there are various steps that must be followed to successfully incorporate a church as a nonprofit corporation in Montana. These may include drafting and filing articles of incorporation with the Secretary of State, creating and adopting bylaws that outline the internal governance of the corporation, and seeking necessary approvals from relevant government agencies. In conclusion, a Montana resolution to incorporate as a nonprofit corporation by members of a church operating as an unincorporated association is a significant decision to ensure the church's legal recognition and protection. By going through this process, the church can enjoy advantages such as limited liability and tax-exempt status, allowing it to fulfill its religious or charitable mission effectively. However, it is crucial for churches to understand the specific requirements and considerations involved in this process, and consult legal and accounting professionals for guidance.