Montana Amended and Restated Agreement Admitting a New Partner to a Real Estate Investment Partnership

Description

How to fill out Amended And Restated Agreement Admitting A New Partner To A Real Estate Investment Partnership?

Locating the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how can you find the legal form you require? Use the US Legal Forms website. This service offers a wide array of templates, including the Montana Amended and Restated Agreement Admitting a New Partner to a Real Estate Investment Partnership, suitable for business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Montana Amended and Restated Agreement Admitting a New Partner to a Real Estate Investment Partnership. Utilize your account to browse the legal forms you have purchased in the past. Visit the My documents tab of your account to retrieve another copy of the document you need.

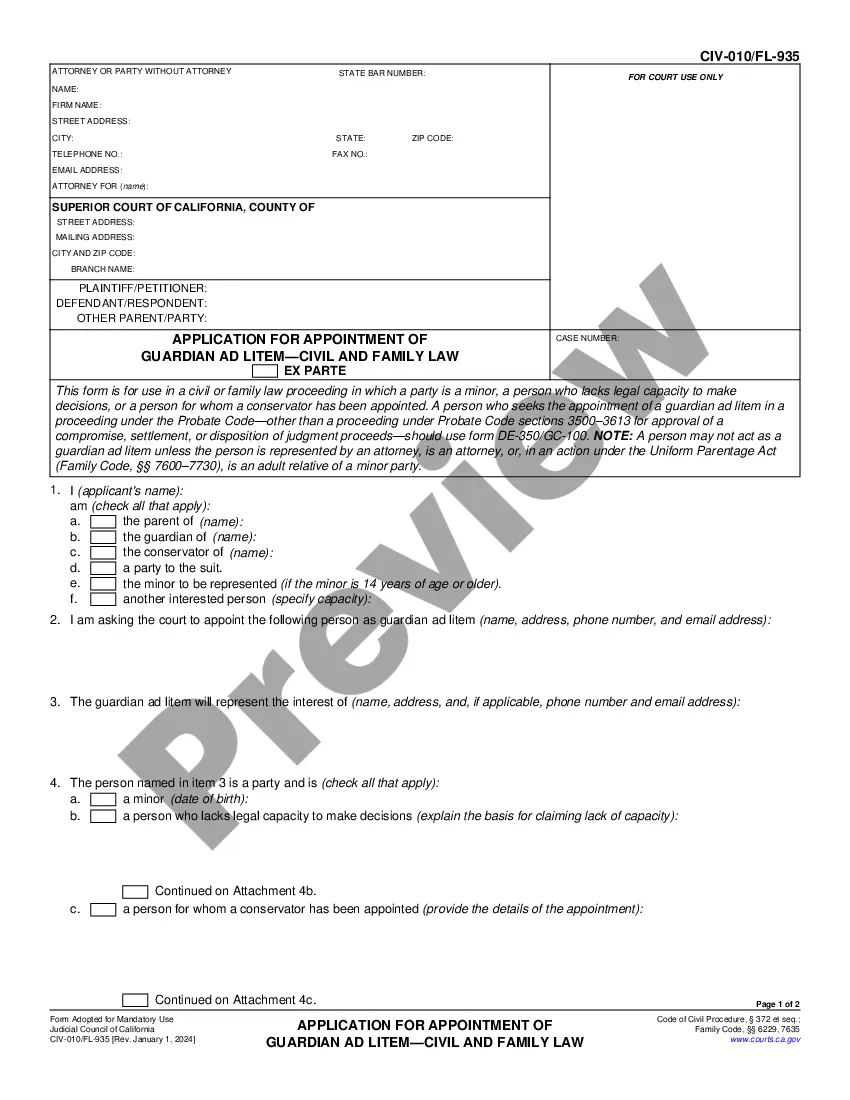

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality. You can review the form using the Review option and read the form description to confirm it is suitable for you. If the form does not meet your requirements, take advantage of the Search field to find the appropriate form.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Use this service to acquire professionally crafted documents that adhere to state requirements.

- Once you are confident the form is correct, click on the Purchase now button to obtain the form.

- Choose the pricing plan you desire and input the necessary information.

- Create your account and pay for the order using your PayPal account or Visa or Mastercard.

- Select the document format and download the legal document template to your device.

- Complete, edit, and print the received Montana Amended and Restated Agreement Admitting a New Partner to a Real Estate Investment Partnership.

Form popularity

FAQ

A restated agreement or restated means that the original contract is reproduced in full in one document.

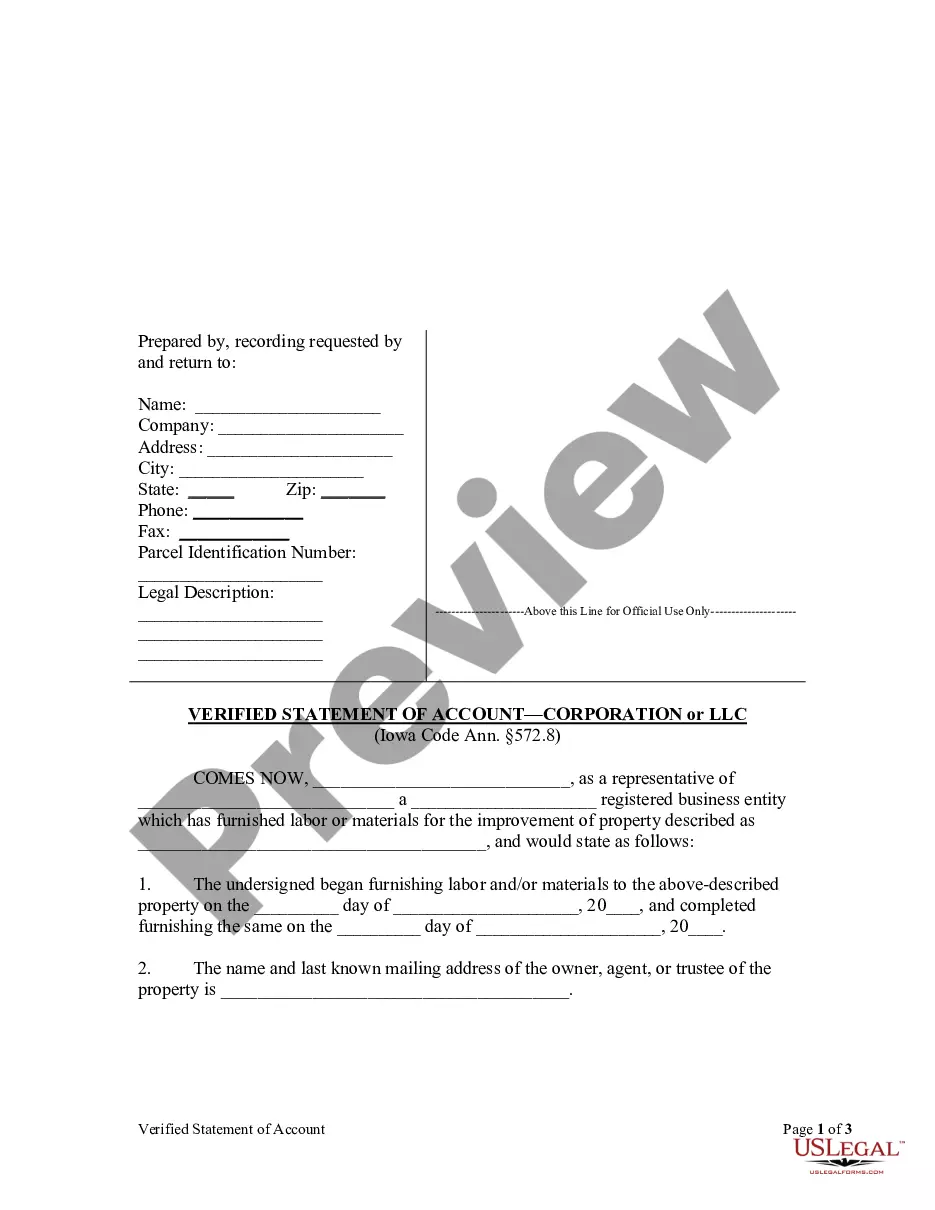

Drafting and FilingAn amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.

A substituted contract is an agreement between parties that were involved in a previous contract. The substituted contract replaces the original contract, completely taking its place and discharging the terms of the original agreement.

You can use a contract amendment letter to list the changes to the original document and have both parties sign. You can create a contract amendment created from a template or from a legal services provider. You can add amendment pagesdigital or printto the end of the original signed contract.

Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document.

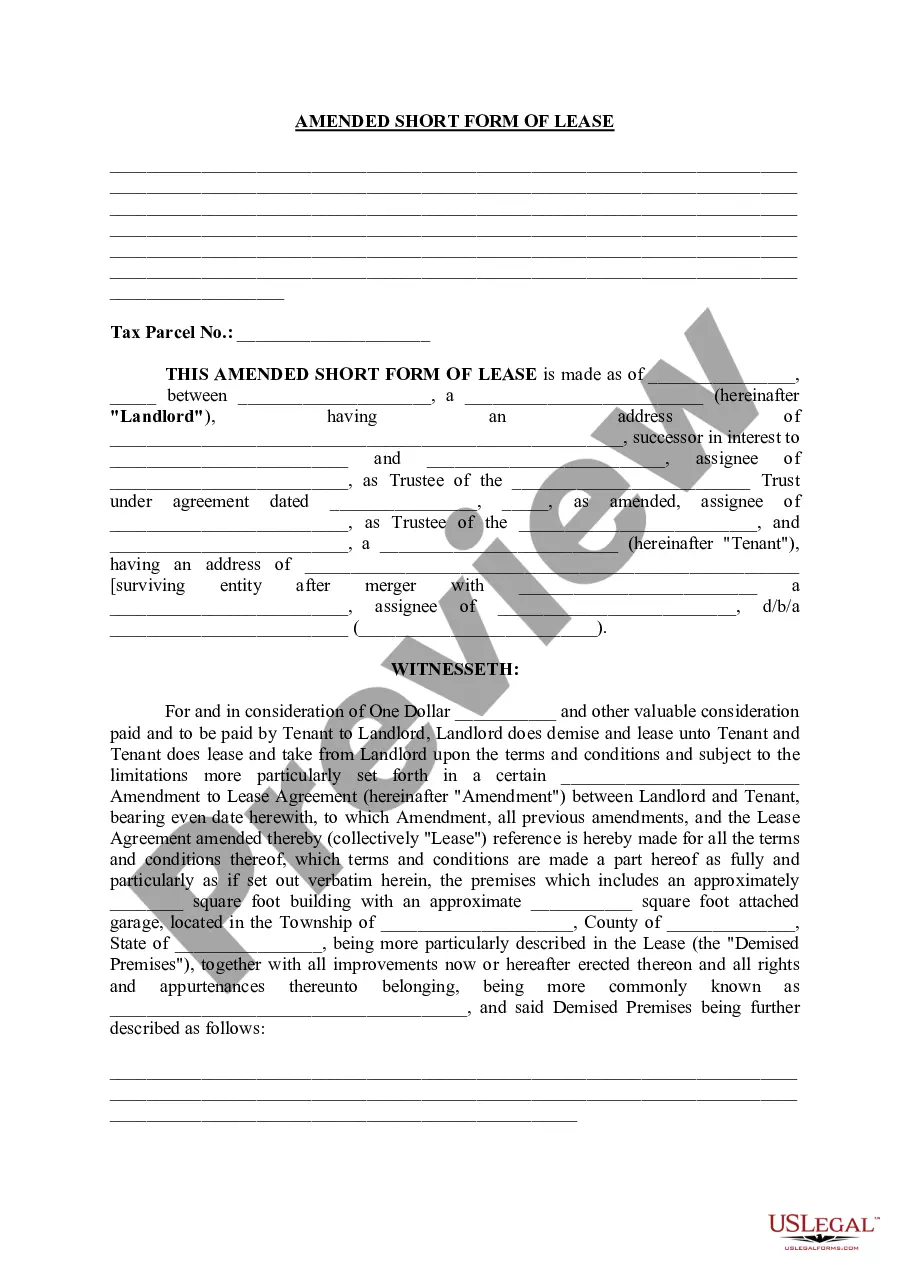

Amending and Restating a ContractWhen Amendments Become Unwieldy.Review All Existing Documents.Fully Merge All Existing Terms Into the New Contract.Add New Terms.Add an Integration Clause.Finalizing the A&R Agreement.

Restated Partnership Agreement has the meaning assigned to such term in the recitals. Restated Partnership Agreement means the amended and restated agreement of limited partnership of each Owner in effect immediately upon the Closing.

Restatement of the Original Facility Agreement This clause provides that with effect from the Restatement Date, the Original Facility Agreement shall be amended and restated in the form set out in Schedule 2. On the Restatement Date, the Restated Facility Agreement will replace the Original Facility Agreement.

A contract amendment allows the parties to make a mutually agreed-upon change to an existing contract. An amendment can add to an existing contract, delete from it, or change parts of it. The original contract remains in place, only with some terms altered by way of the amendment.

The term "amended and restated" is used in corporate law to refer to an agreement or other document that has been amended one or more times in the past and is presented in its entirety (restated) including all amendments to date.