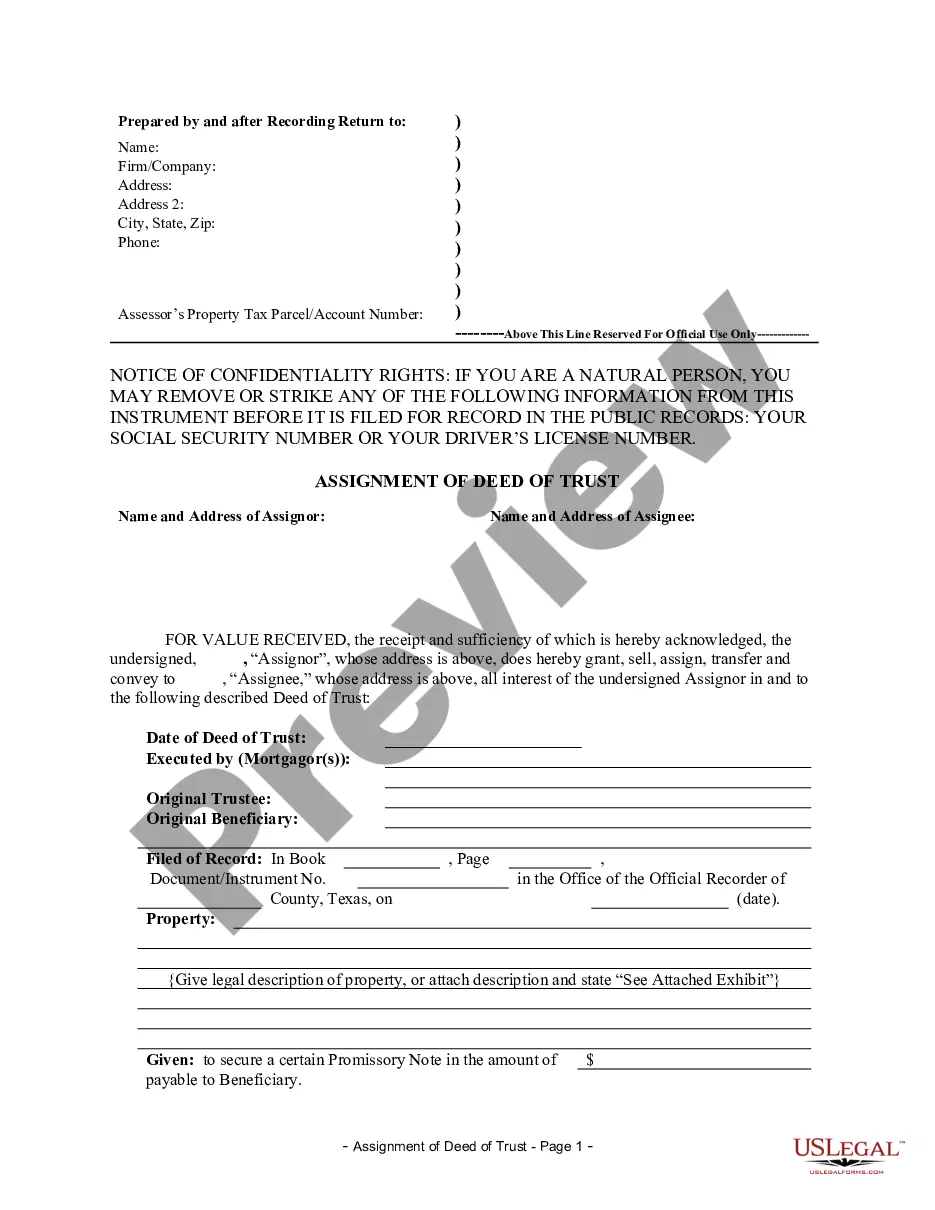

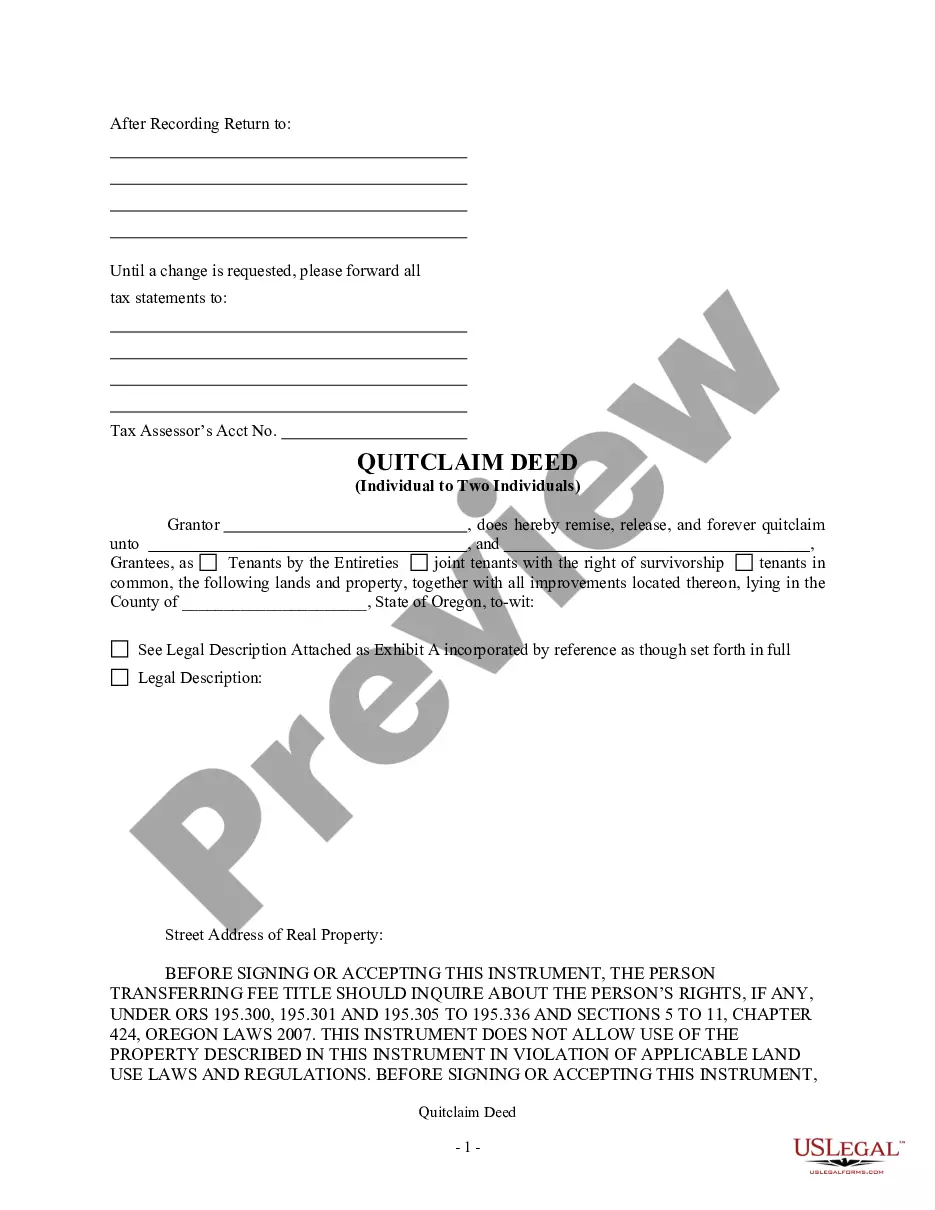

A Montana Loan Agreement for Business is a legally binding document that outlines the terms and conditions of a loan arrangement between a lender and a borrower in the state of Montana. This agreement is meant specifically for businesses seeking financial assistance. It ensures that both parties involved have a clear understanding of their obligations and responsibilities. The Montana Loan Agreement for Business typically includes essential details such as the loan amount, interest rate, repayment terms, collateral, and any penalties or fees associated with late payments or defaults. The agreement also outlines the rights and obligations of both the lender and borrower, establishing a framework for a fair and transparent loan process. There are a few different types of Montana Loan Agreement for Business that cater to various lending scenarios: 1. Secured Loan Agreement: This type of agreement requires the borrower to provide collateral, such as property or assets, to secure the loan. In the event of default, the lender can seize the collateral as a means of recovering the loan amount. 2. Unsecured Loan Agreement: Unlike a secured loan, an unsecured loan does not require collateral. This type of agreement is based solely on the borrower's creditworthiness and financial history, making it riskier for the lender. Consequently, unsecured loans often have higher interest rates. 3. Term Loan Agreement: A term loan refers to a loan that is repaid over a specific period, usually with fixed monthly payments. The loan agreement clearly defines the repayment schedule, including the principal amount and interest due. 4. Revolving Loan Agreement: Revolving loans are more flexible, allowing borrowers to access a predetermined amount of credit whenever needed. The borrower can borrow, repay, and borrow again within the agreed-upon limit, similar to a credit card. 5. Equipment Loan Agreement: Specifically designed for businesses in need of financing for purchasing equipment, this agreement outlines the terms and conditions related to the loan amount, repayment, and any relevant equipment guarantees. 6. Bridge Loan Agreement: Bridge loans provide short-term financing to businesses until they secure permanent funding or fulfill certain conditions. This agreement specifies the repayment terms once the bridge loan is repaid or converted into long-term financing. 7. Acquisition Loan Agreement: This type of loan is utilized when a business intends to acquire another company or asset. The agreement outlines the terms of the loan specifically related to the acquisition, including any requirements or conditions. In summary, a Montana Loan Agreement for Business is a comprehensive document that ensures a transparent and legally binding loan process between a lender and a borrower in Montana. It is crucial for both parties to review and understand the agreement before signing to avoid any potential conflicts or misunderstandings in the future.

Montana Loan Agreement for Business

Description

How to fill out Loan Agreement For Business?

Discovering the right legitimate document format can be quite a battle. Of course, there are a variety of themes accessible on the Internet, but how do you discover the legitimate type you need? Use the US Legal Forms web site. The services provides a large number of themes, for example the Montana Loan Agreement for Business, that you can use for organization and private requires. Every one of the kinds are checked out by professionals and meet up with federal and state requirements.

When you are currently registered, log in to the accounts and click the Down load button to find the Montana Loan Agreement for Business. Use your accounts to appear from the legitimate kinds you might have bought in the past. Check out the My Forms tab of the accounts and acquire yet another version of the document you need.

When you are a fresh consumer of US Legal Forms, listed below are simple recommendations that you should adhere to:

- Initially, be sure you have selected the correct type for your metropolis/region. You may look over the form making use of the Preview button and study the form outline to make certain this is the best for you.

- When the type fails to meet up with your requirements, take advantage of the Seach industry to discover the correct type.

- Once you are certain that the form would work, click on the Purchase now button to find the type.

- Select the costs plan you need and enter in the needed information and facts. Create your accounts and pay for the transaction using your PayPal accounts or charge card.

- Pick the submit structure and acquire the legitimate document format to the system.

- Comprehensive, edit and print and indicator the attained Montana Loan Agreement for Business.

US Legal Forms is definitely the largest catalogue of legitimate kinds that you can see different document themes. Use the company to acquire skillfully-produced documents that adhere to state requirements.

Form popularity

FAQ

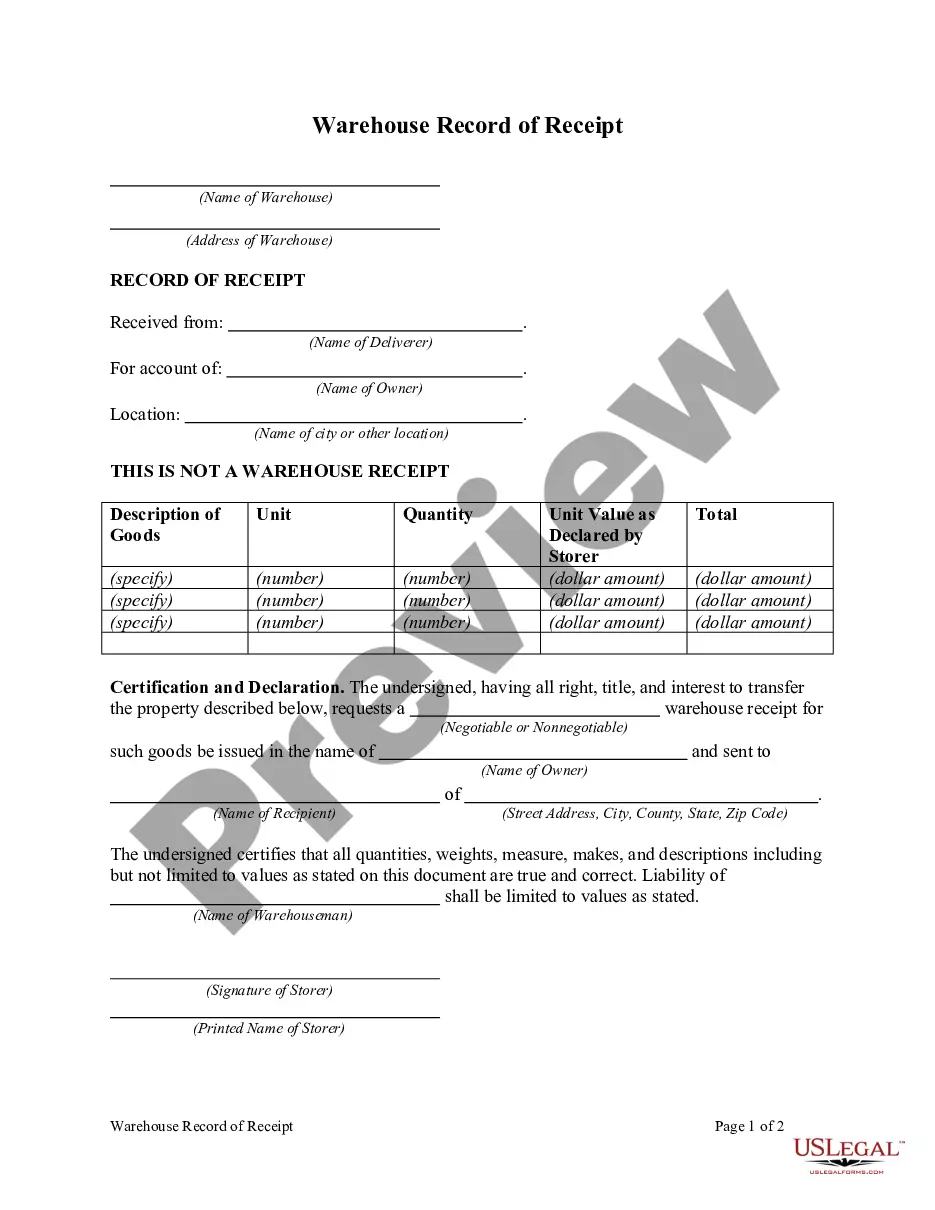

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

A business loan agreement is a legal document between you and your lender, whether that's a bank, credit union, online lender or even a family member. It serves both parties by clarifying everything about the loan, including its repayment schedule and any collateral that secures it.

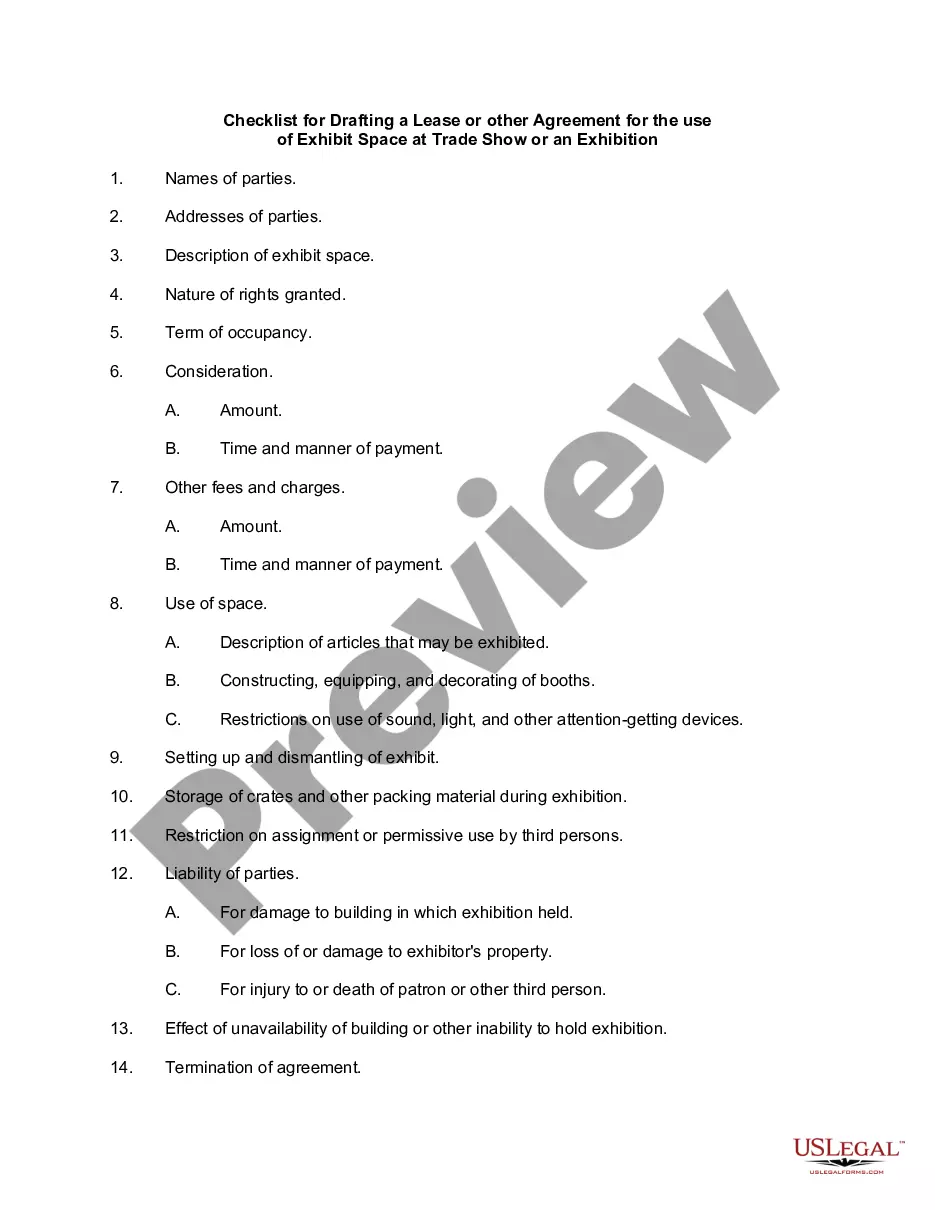

How to Write a Business Loan Agreement Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate. ... Step 7 ? Late Payment Fees. ... Step 8 ? Determine Prepayment Options.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.