Montana Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property

Description

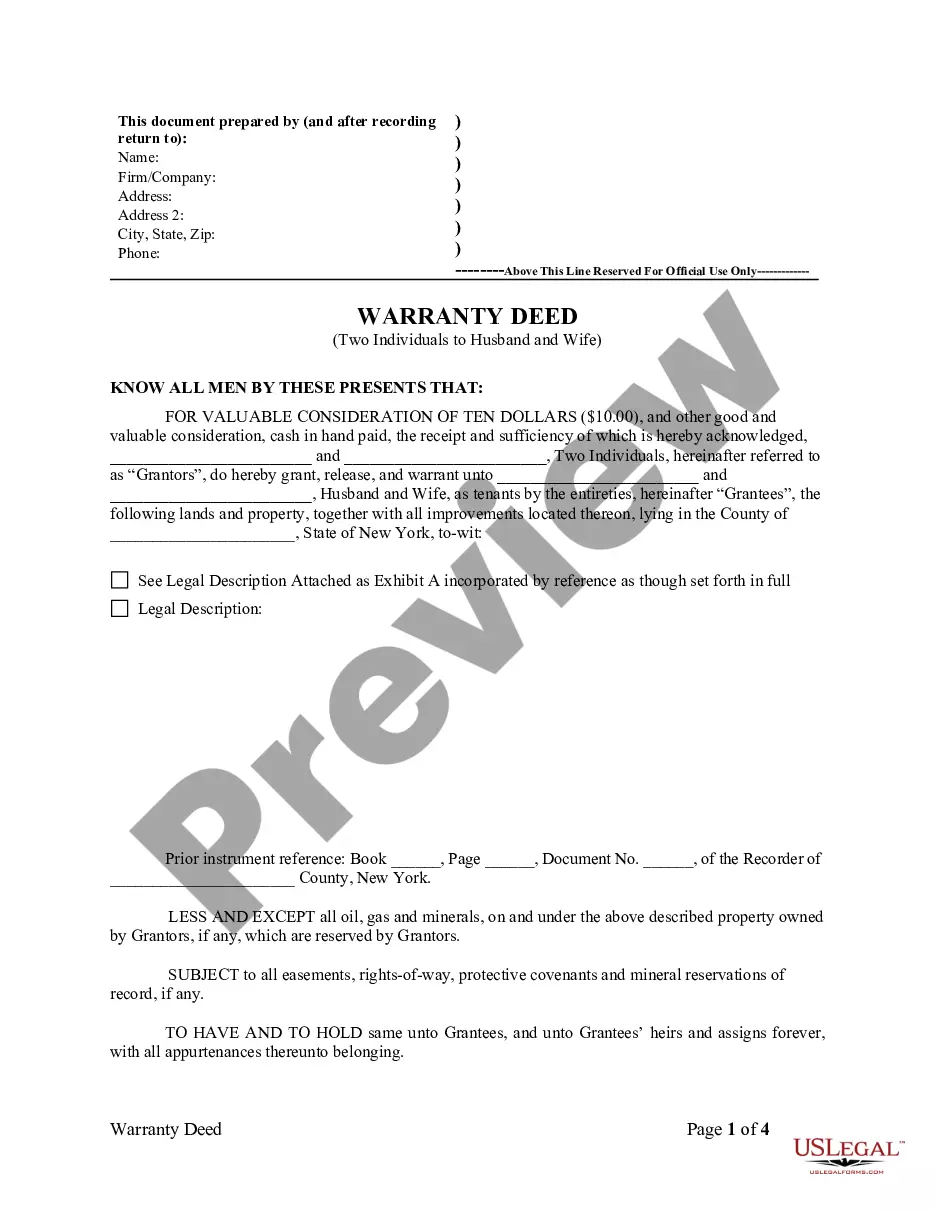

How to fill out Agreement For Sale Of Business By Sole Proprietorship Including Purchase Of Real Property?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the Montana Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property, which can be tailored to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Montana Agreement for Sale of Business by Sole Proprietorship including Purchase of Real Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A business purchase agreement should detail the names of the buyer and seller at the start of the agreement. It will also need to include the information of the business being sold, such as name, location, a description of the business and the type of business entity it is.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Buy and sell agreements are designed to help partners manage potentially difficult situations in ways that protect the business and their own personal and family interests. For example, the agreement can restrict owners from selling their interests to outside investors without approval from the remaining owners.

Potential buyers could be current partners / co-owners, members of staff or even competitors. It's therefore possible for a sole proprietor or sole-owner to enter into a buy and sell contract.

A sole proprietorship was designed to have only one owner. Therefore, when the owner dies or the business is sold, the structure automatically dissolves. A sole proprietorship cannot be transferred to another party. However, it may able to have its assets transferred to a new owner.

A Montana residential real estate purchase and sale agreement is a document used to present an offer for a piece of real estate and is executed by two (2) parties: a buyer and a seller.

Company purchase agreements are essential for transferring the ownership of a business upon a trigger event, such as death or disability. They generally contain the terms and conditions of the sale, including obligations, warranties, and liabilities.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.