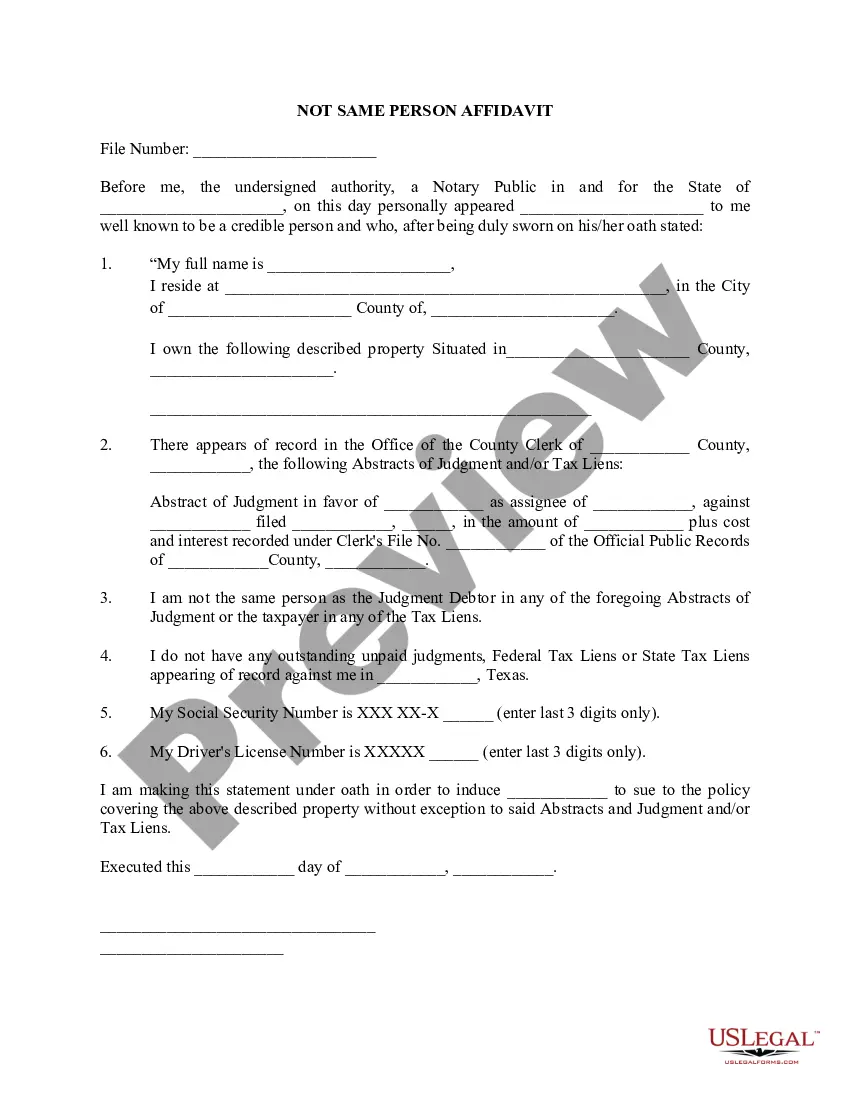

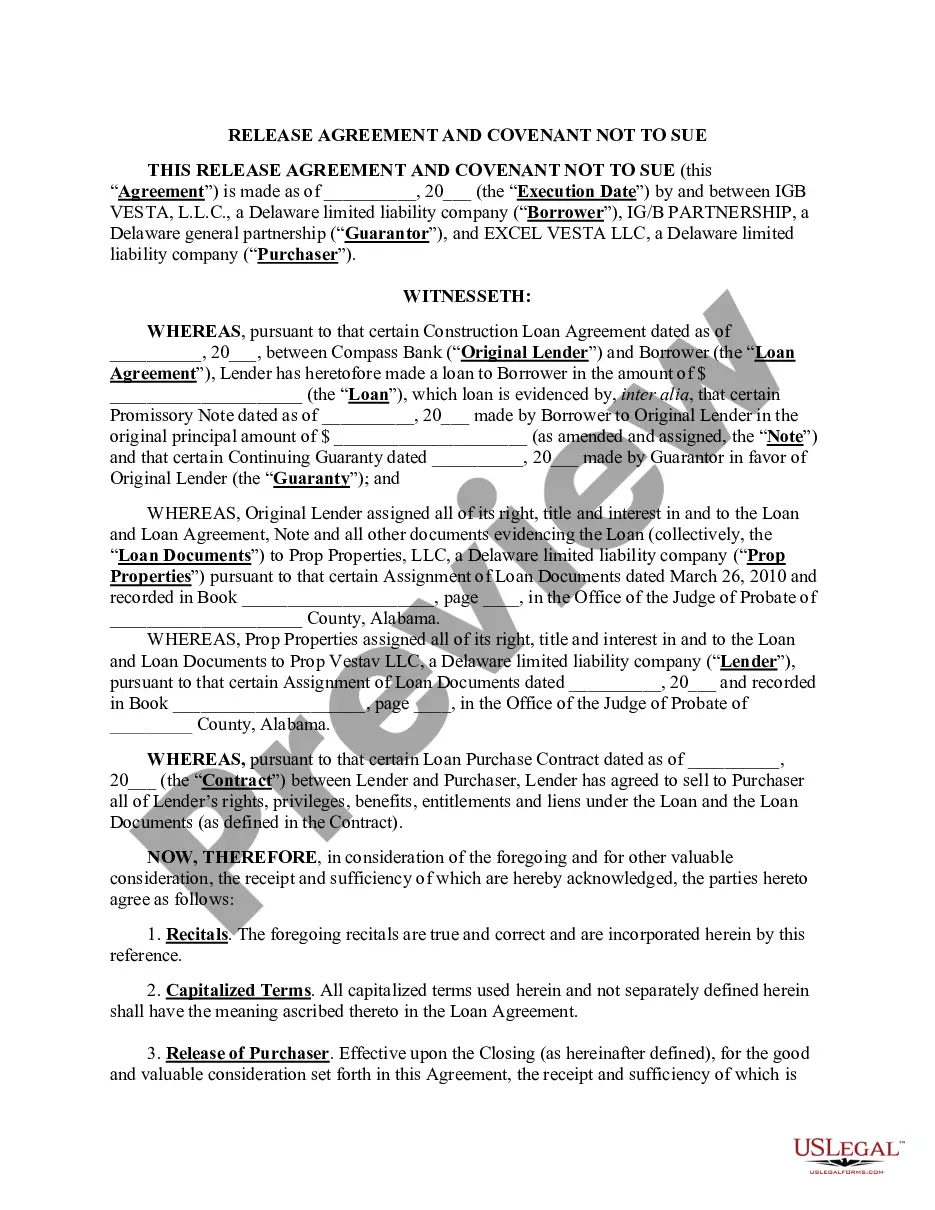

Subject: Request for Tax Receipt for Fundraiser Dinner Attendance — Your Contribution Matters, [Attendee's Name]! Dear [Attendee's Name], Warm greetings! I hope this letter finds you in good health and high spirits. On behalf of [Organization/Charity Name], I would like to extend my heartfelt gratitude for your participation and generous contribution to our recent fundraiser dinner in Montana. Your presence and support at the fundraiser dinner were invaluable in helping us achieve our mission and make a positive difference in the lives of those in need. We sincerely appreciate your commitment to philanthropy and dedication to uplifting our community. We understand that tax receipts are essential for tax-deductible donations, and we are more than happy to assist you with the necessary documentation. As a registered nonprofit organization, [Organization/Charity Name] has prepared a comprehensive Montana Sample Letter for Tax Receipt for Fundraiser Dinner, tailored specifically to meet your requirements. This template suggests the necessary language and includes all the essential details expected by the Internal Revenue Service (IRS). Our Montana Sample Letter for Tax Receipt includes the following information: 1. Your Personal Information: — Full Name: [Attendee's Full Name— - Mailing Address: [Attendee's Address] — City, State, ZIP: [Attendee's City, State, ZIP] — Phone Number: [Attendee's Phone Number] — Email Address: [Attendee's Email Address] 2. Donation Details: — Date of Donation: [Date of Fundraiser Dinner] — Description of Goods/Services Provided: [Description of Dinner or anything additional provided] — Total Amount paid or contributed: [Amount Contributed] 3. Acknowledgment and Thanks: — Expressing heartfelt thanks for the attendee's support and contribution to the fundraiser event. — Mentioning the attendee's role in making a difference and improving the lives of our community members. — Provide details on how their contribution will be utilized to achieve the organization's goals. By combining all the relevant information in our Montana Sample Letter for Tax Receipt, we aim to make the tax filing process easier for you. It is essential to note that tax deductions are subject to certain regulations, and this letter serves as proof of your attendance and donation. We kindly request you to consult with a tax professional or IRS guidelines to ensure compliance with the applicable tax regulations. Please find attached the Montana Sample Letter for Tax Receipt for Fundraiser Dinner. Should you require any modifications or additional information, kindly feel free to reach out to us at [Organization/Charity Contact Details], and we will be pleased to assist you further. Once again, thank you from the depths of our hearts for your unwavering support, commitment, and contribution towards our cause. Your involvement makes an irreplaceable impact on the lives of those in need. With sincere gratitude, [Your Name] [Your Title/Position] [Organization/Charity Name] [Contact Details, including phone number and email address] Types of Montana Sample Letter for Tax Receipt for Fundraiser Dinner: 1. Request for Tax Receipt for Individual Attendee: Used when an individual attendee requests a tax receipt for their contribution. 2. Request for Tax Receipt for Corporate Attendee: Used when a corporate attendee requests a tax receipt for their contribution or sponsorship. 3. Request for Modified Tax Receipt: Used when an attendee requires modifications or additional information in their tax receipt, such as an address change or clarification of details. 4. Retrospective Request for Tax Receipt: Used when an individual fails to request a tax receipt at the time of the fundraiser dinner but later wishes to obtain one for their tax filings. Note: These named variations serve as examples and can be customized further based on organizational needs and attendee requests.

Montana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

How to fill out Montana Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

US Legal Forms - one of several biggest libraries of lawful kinds in America - offers a wide range of lawful record web templates it is possible to down load or produce. Making use of the internet site, you may get a huge number of kinds for company and personal uses, sorted by types, states, or search phrases.You will discover the most recent versions of kinds such as the Montana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee in seconds.

If you currently have a membership, log in and down load Montana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee from your US Legal Forms collection. The Obtain button can look on each and every form you view. You have accessibility to all earlier delivered electronically kinds within the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed below are easy instructions to help you started:

- Ensure you have picked the right form for your personal city/area. Go through the Review button to review the form`s information. See the form outline to ensure that you have selected the proper form.

- In the event the form does not match your specifications, take advantage of the Look for field on top of the monitor to discover the one who does.

- When you are satisfied with the form, verify your choice by clicking the Acquire now button. Then, select the rates plan you prefer and give your qualifications to register for the bank account.

- Approach the purchase. Use your charge card or PayPal bank account to perform the purchase.

- Find the format and down load the form on the product.

- Make changes. Complete, modify and produce and indicator the delivered electronically Montana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee.

Every template you included in your account does not have an expiry particular date and is also the one you have forever. So, if you wish to down load or produce one more version, just visit the My Forms area and click around the form you require.

Get access to the Montana Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee with US Legal Forms, probably the most comprehensive collection of lawful record web templates. Use a huge number of specialist and condition-particular web templates that meet your organization or personal requirements and specifications.

Form popularity

FAQ

How to Write a Fundraising LetterAddress your recipient personally.Tell a story.Define the problem.Explain your mission and outline your goal.Explain how your donor can make an impact.Call the reader to action.

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

Here's what you should include in your own donation receipts:The donor's name.The organization's name, federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3)Date of the donation.The amount of money or a description (but not the value) of the item(s) donated.More items...

The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.

How to Write1 Access The Receipt Template On This Page.2 The Recipient's Information Must Be Presented.3 Record The Donor's Details.4 Provide A Report On The Donated Items.5 The Donor's Signature Is Required.

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

How to Write(1) Date.(2) Non-Profit Organization.(3) Mailing Address.(4) EIN.(5) Donor's Name.(6) Donor's Address.(7) Donated Amount.(8) Donation Description.More items...?