Title: Exploring the Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion Introduction: In Montana, the General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion serves as an essential legal tool for individuals seeking to establish trusts for minors while also taking advantage of the annual gift tax exclusion. This detailed description will shed light on the intricacies of this trust agreement, exploring its purpose, advantages, and potential variations. Purpose of the Trust Agreement: The Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion facilitates the creation of a trust specifically designed for the benefit of a minor individual. This legal document outlines the terms and conditions governing the trust, ensuring that the minor receives the intended financial benefits under the annual gift tax exclusion. Annual Gift Tax Exclusion: The inclusion of the annual gift tax exclusion in this trust agreement is a crucial aspect. It allows the trust settler to gift a certain amount of money or assets per year to the trust for the benefit of the minor, without incurring any gift tax liability. The current annual exclusion amount in Montana is $15,000 per recipient (2021), although it is subject to change based on federal and state regulations. Key Elements of the Montana General Form of Trust Agreement: 1. Trust Settler: This section identifies the individual establishing the trust, often a parent or guardian, and delineates their responsibilities and rights. 2. Trustee: Specifies the person or entity entrusted with managing the trust assets and making distributions according to the trust's terms. 3. Minor Beneficiary: The agreement includes provisions specifying the rights, entitlements, and conditions for the minor beneficiary's access to the trust funds/assets. 4. Trust Terms and Conditions: This portion outlines the rules and guidelines governing the trust's operations, including any limitations or restrictions on the use of the trust assets for the minor. 5. Duration of the Trust: The agreement may provide details regarding the trust's lifespan, potentially extending beyond the minor's attainment of legal adulthood. Types of Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion: 1. Revocable Trust: Allows the trust settler to modify or terminate the trust at any time, providing flexibility in managing the trust assets. 2. Irrevocable Trust: Once established, this type of trust cannot be modified or revoked without the consent of all beneficiaries involved, providing more certainty and long-term asset protection. Conclusion: The Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is a versatile legal document that enables individuals to create trusts for minors while taking advantage of the annual gift tax exclusion. By adhering to specific guidelines and including applicable details, this trust agreement offers peace of mind, ensuring proper distribution of assets while minimizing gift tax implications. Understanding the nuances and available variations of this trust agreement will empower individuals to make informed decisions regarding their estate planning and the financial well-being of their minor beneficiaries.

Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

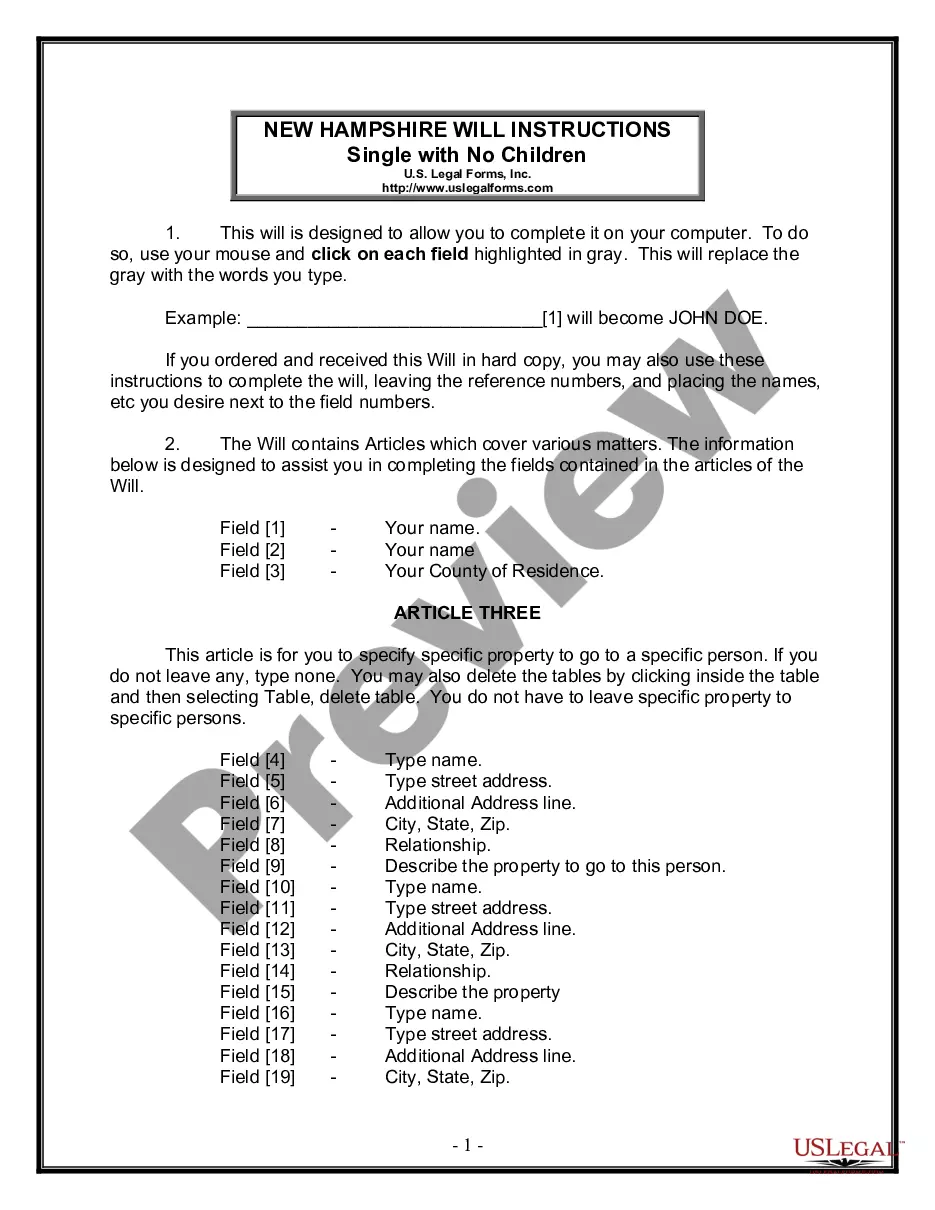

How to fill out Montana General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

US Legal Forms - one of several greatest libraries of legitimate kinds in the States - gives a wide array of legitimate papers web templates you may down load or produce. Using the web site, you can get thousands of kinds for organization and person purposes, categorized by categories, states, or key phrases.You can get the most up-to-date models of kinds just like the Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in seconds.

If you already have a membership, log in and down load Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in the US Legal Forms local library. The Download switch will appear on each and every kind you view. You have accessibility to all earlier saved kinds inside the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, here are basic instructions to help you get began:

- Be sure you have selected the proper kind to your city/county. Select the Preview switch to review the form`s information. Browse the kind explanation to ensure that you have chosen the proper kind.

- In the event the kind does not suit your specifications, take advantage of the Search industry near the top of the display to find the one who does.

- Should you be content with the shape, validate your decision by clicking on the Acquire now switch. Then, choose the pricing program you prefer and supply your qualifications to register to have an accounts.

- Procedure the transaction. Utilize your charge card or PayPal accounts to accomplish the transaction.

- Find the file format and down load the shape in your device.

- Make modifications. Fill up, change and produce and sign the saved Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

Each and every format you put into your account lacks an expiry date which is the one you have for a long time. So, if you wish to down load or produce another duplicate, just check out the My Forms area and click on in the kind you need.

Gain access to the Montana General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion with US Legal Forms, the most extensive local library of legitimate papers web templates. Use thousands of professional and condition-specific web templates that fulfill your small business or person demands and specifications.

Form popularity

FAQ

The Tax Court held that the withdrawal rights provided in a trust declaration were not illusory and that therefore a married couple's gifts to the trust were gifts of present interests in property that qualified for the annual exclusion.

The annual exclusion amount permits donors to give without facing a gift tax.

Section 2503(b) is also known as a Qualifying Minor's Trust or Mandatory Income Trust. This is an irrevocable trust which requires distribution of income on an annual basis. Most often, distributed funds are placed into a custodial bank account until the child reaches legal age.

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

Any gifts you make to a single person over $15,000 count toward your combined estate and gift tax exclusion. This is the amount you are allowed to leave in your estate or give as gifts during your life, tax-free.

A beneficiary can neither make a gift to a trust held for his/her benefit nor to a trust of which he/she is Trustee. WHAT ARE THE BENEFITS OF RECEIVING GIFTS THROUGH A TRUST? These are the most important reasons: The trust property will be protected from the claims of creditors of the beneficiary.

The key difference between a 2503(c) trust and a 2503(b) trust is the distribution requirement. Parents who are concerned about providing a child or other beneficiary with access to trust funds at age 21 might be better off with a 2503(b), since there is no requirement for access at age 21.

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).

A Section 2503(c) trust allows all the principal and income to be used for the child until he reaches the age of 21, unlike the 2503(b) trust that extends beyond age 21 and requires income to be paid to the child annually. The trustee can pay the child's college expenses from the 2503(c) trust.