Montana Sample Letter for Foreclosed Home of Estate

Description

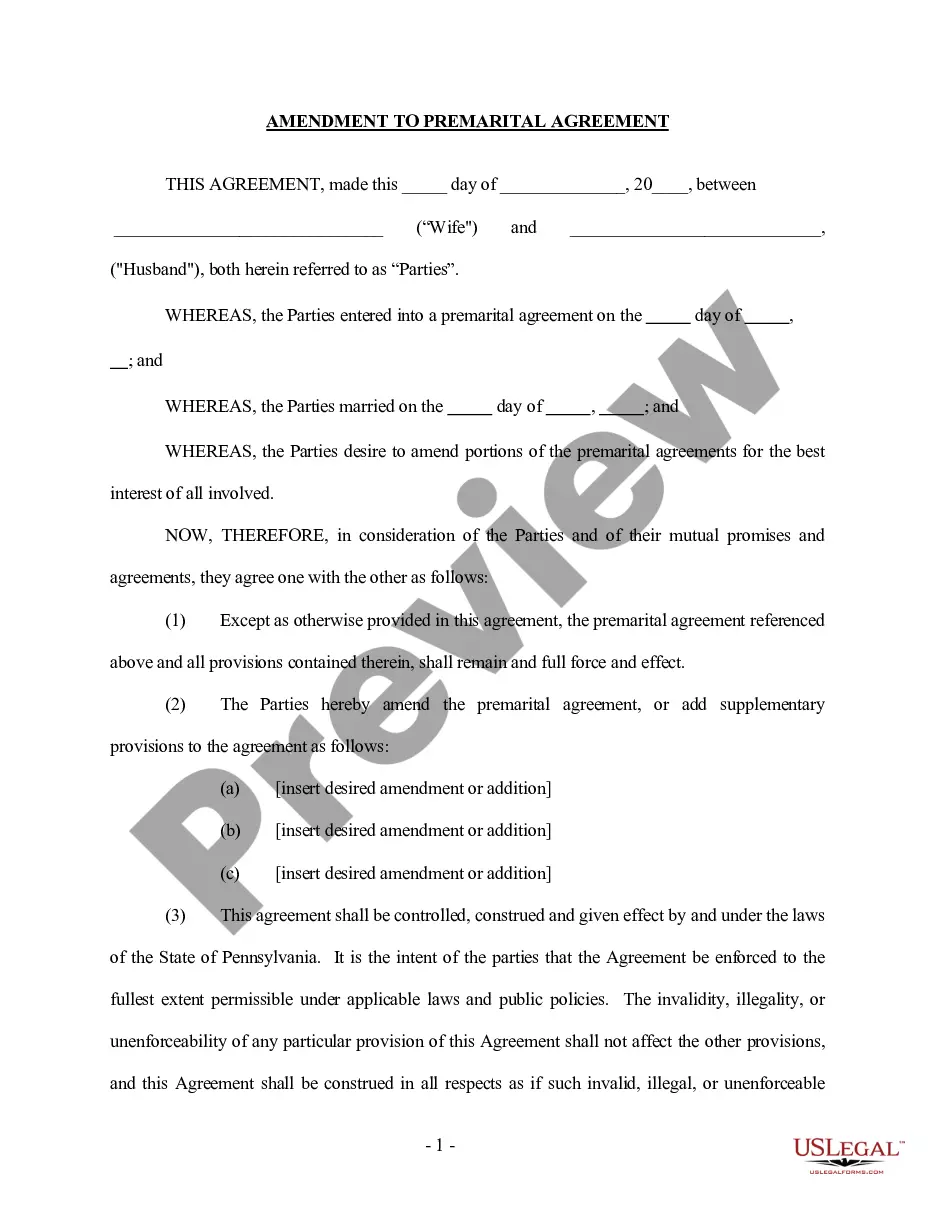

How to fill out Sample Letter For Foreclosed Home Of Estate?

If you wish to full, acquire, or produce lawful record web templates, use US Legal Forms, the most important collection of lawful forms, that can be found on-line. Use the site`s simple and easy hassle-free look for to get the files you need. Numerous web templates for enterprise and personal uses are sorted by groups and claims, or search phrases. Use US Legal Forms to get the Montana Sample Letter for Foreclosed Home of Estate with a handful of click throughs.

If you are currently a US Legal Forms consumer, log in for your account and click the Download option to have the Montana Sample Letter for Foreclosed Home of Estate. Also you can access forms you in the past downloaded in the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that proper town/country.

- Step 2. Use the Review method to look through the form`s content material. Do not forget about to read the explanation.

- Step 3. If you are not happy using the develop, make use of the Search field at the top of the display screen to get other models from the lawful develop template.

- Step 4. When you have discovered the shape you need, click the Buy now option. Choose the costs plan you favor and add your references to register for an account.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Find the structure from the lawful develop and acquire it on your product.

- Step 7. Full, edit and produce or signal the Montana Sample Letter for Foreclosed Home of Estate.

Every single lawful record template you buy is the one you have permanently. You possess acces to each and every develop you downloaded with your acccount. Click the My Forms area and decide on a develop to produce or acquire once again.

Be competitive and acquire, and produce the Montana Sample Letter for Foreclosed Home of Estate with US Legal Forms. There are millions of specialist and condition-particular forms you can utilize for your enterprise or personal demands.

Form popularity

FAQ

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

Usually by the third missed payment the lender will enter a notice of default. Also, the lender will charge you for costs to prepare the legal papers. So now you have legal fees, late fees, and your late payments to pay. Next, the mortgage lender will publish a notice of foreclosure, called a Notice of Trustee's Sale.

A few potential ways to stop a foreclosure and keep your home include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. Working out a loss mitigation option, like a loan modification, will also stop a foreclosure.

Eviction Rules After a foreclosure sale, federal law says that the new owner or the bank must give you a written 90 day notice to move out before starting a case to evict you in Court, even if you don't have a lease.

Whenever a property or home is bought by borrowing a loan from a bank or lender, the homeowner needs to repay the loan amount in the specified amount of time. In case, the homeowner fails to repay this amount, the home or property is considered to be in foreclosure.

The state of Montana allows 150 days before your home can be fully foreclosed on, but that means that you will be notified by the bank after one missed payment. You must make recompense with the bank or they will take your home, claim it and eventually sell it.

In Montana, there is no right of redemption after a non-judicial foreclosure sale. However, if your lender forecloses judicially, you have 1 year after the sale to redeem your property.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.