Montana Accredited Investor Representation Letters are legal documents that provide proof of an individual or entity's status as an accredited investor in the state of Montana. Accredited investors are individuals or entities who meet certain criteria, such as having a minimum net worth or income, and are deemed to have sufficient financial sophistication and ability to bear investment risks. The Montana Accredited Investor Representation Letter serves as a written representation to comply with securities laws and regulations, specifically in relation to private offerings or certain investment opportunities that are restricted to accredited investors. This letter is typically required by issuers, broker-dealers, or investment advisors to ensure compliance with Montana securities laws and provide assurance that the investor qualifies as an accredited investor. The contents of the Montana Accredited Investor Representation Letter may vary depending on the specific circumstances and requirements of the issuer or advisor. However, some common elements that may be included are: 1. Identification Information: The letter usually starts with the identification details of the investor, including their name, address, and contact information. 2. Accredited Investor Criteria: The letter will outline the specific criteria the investor meets to qualify as an accredited investor, such as minimum income or net worth requirements. 3. Investment Experience and Knowledge: The letter may require the investor to disclose their investment experience, including any relevant professional or financial background, demonstrating their understanding of the risks associated with private investments. 4. Risk Acknowledgment: Accredited investors often need to acknowledge and understand the potential risks involved in private investments, including liquidity, lack of marketability, and the potential for loss of investment. 5. Affirmation of No Violation of Securities Laws: The investor may need to confirm that they have not been subject to any securities' law violations or actions by regulatory authorities. 6. Signature and Date: The letter is typically concluded with the investor's signature and the date of signing. In Montana, there might not be different types of Accredited Investor Representation Letters, as the purpose and requirements are usually standard across the state. However, the specific content may vary slightly depending on the issuer or advisor and the nature of the investment opportunity being offered.

Montana Accredited Investor Representation Letter

Description

How to fill out Accredited Investor Representation Letter?

Choosing the best legitimate document format might be a have difficulties. Needless to say, there are a lot of themes available on the Internet, but how can you get the legitimate develop you will need? Use the US Legal Forms site. The service gives 1000s of themes, such as the Montana Accredited Investor Representation Letter, which can be used for company and private requires. All the varieties are examined by specialists and satisfy state and federal demands.

In case you are currently signed up, log in for your account and click on the Acquire switch to obtain the Montana Accredited Investor Representation Letter. Utilize your account to appear throughout the legitimate varieties you have ordered earlier. Go to the My Forms tab of your own account and obtain one more copy of your document you will need.

In case you are a whole new end user of US Legal Forms, listed here are straightforward instructions for you to comply with:

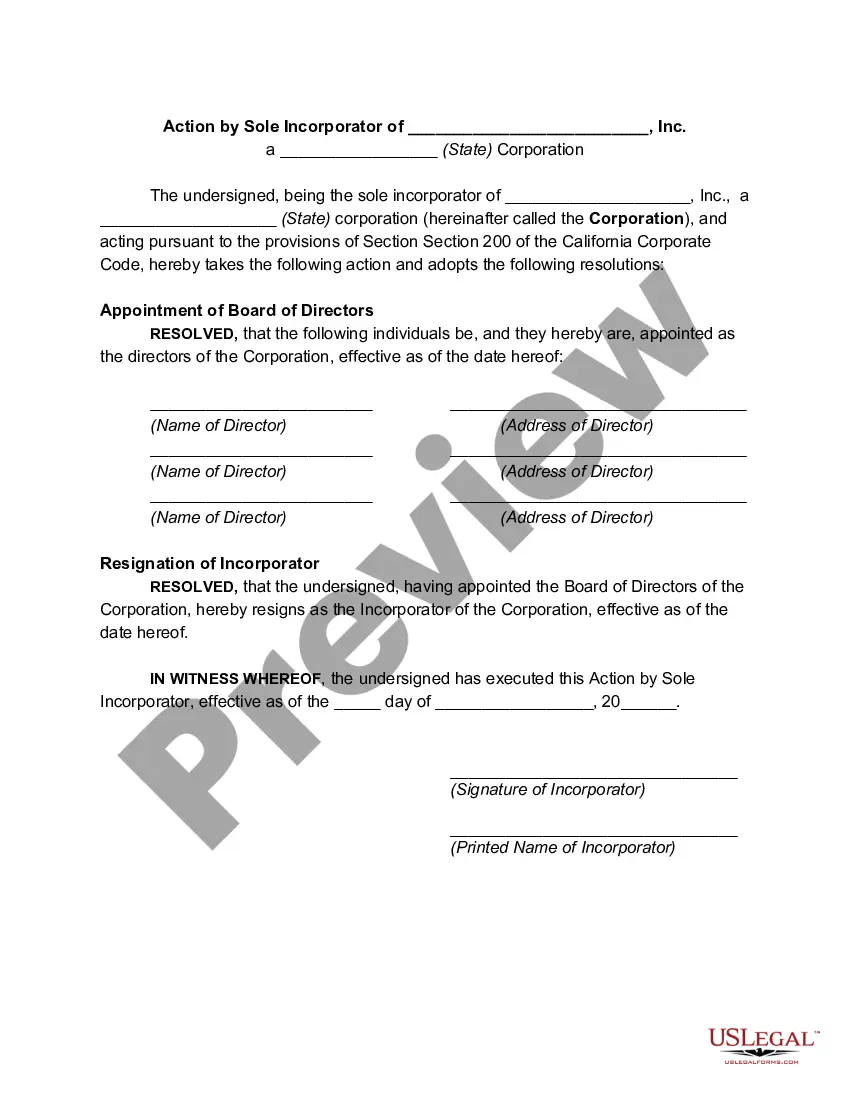

- Initially, ensure you have selected the appropriate develop for your city/county. You are able to look over the shape making use of the Review switch and study the shape description to ensure it will be the best for you.

- In case the develop will not satisfy your expectations, utilize the Seach industry to obtain the correct develop.

- When you are certain the shape is proper, go through the Purchase now switch to obtain the develop.

- Opt for the rates program you desire and type in the required information. Make your account and purchase the order utilizing your PayPal account or bank card.

- Opt for the submit structure and obtain the legitimate document format for your gadget.

- Complete, revise and printing and indicator the obtained Montana Accredited Investor Representation Letter.

US Legal Forms may be the biggest local library of legitimate varieties for which you can see numerous document themes. Use the service to obtain professionally-produced documents that comply with state demands.

Form popularity

FAQ

Syndication offering documents may require the investor to indemnify the Syndicator if they lie about their qualifications and it causes liability for the Syndicator later (ours do), so there could be repercussions against investors in those cases.

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

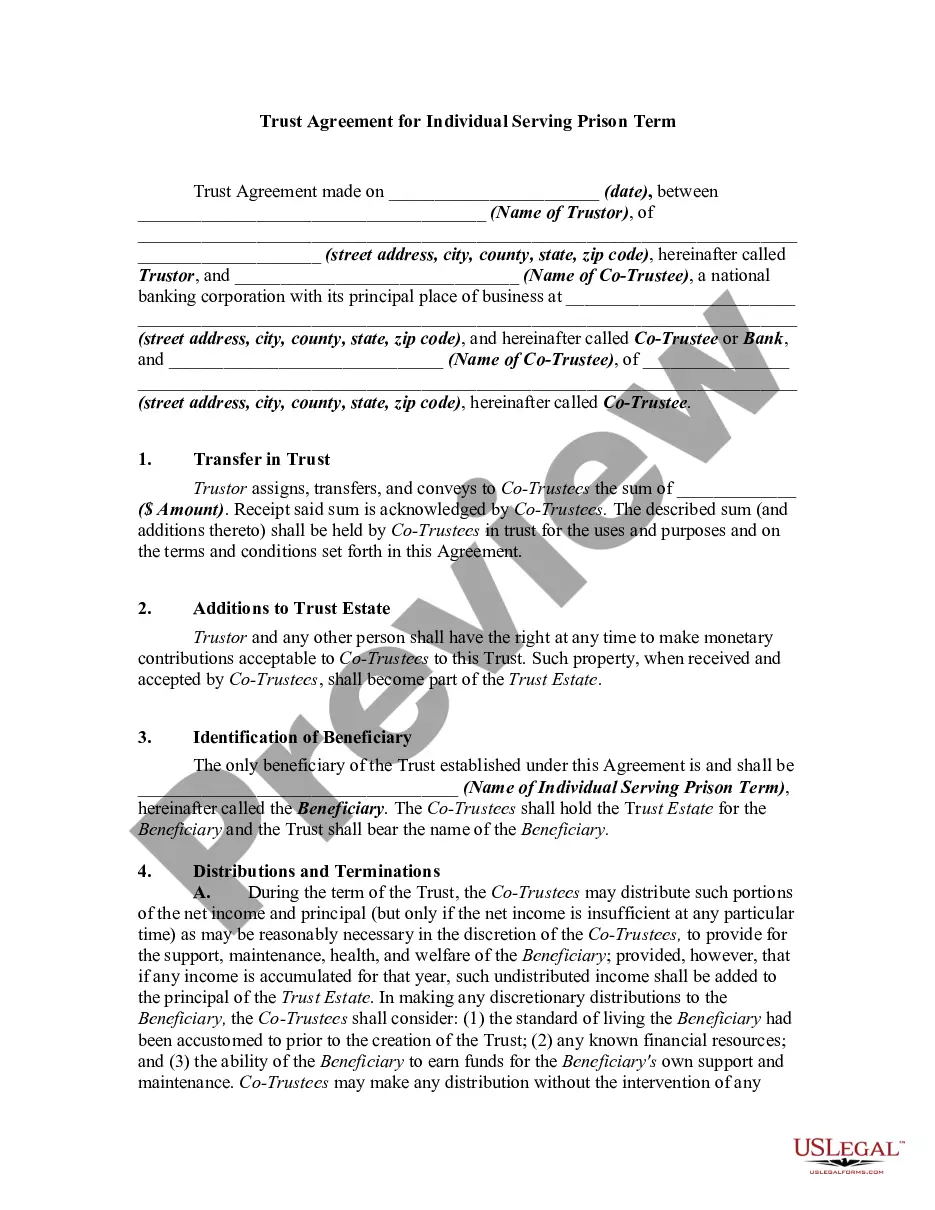

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.