Montana Guaranty of Payment of Dividends on Stocks

Description

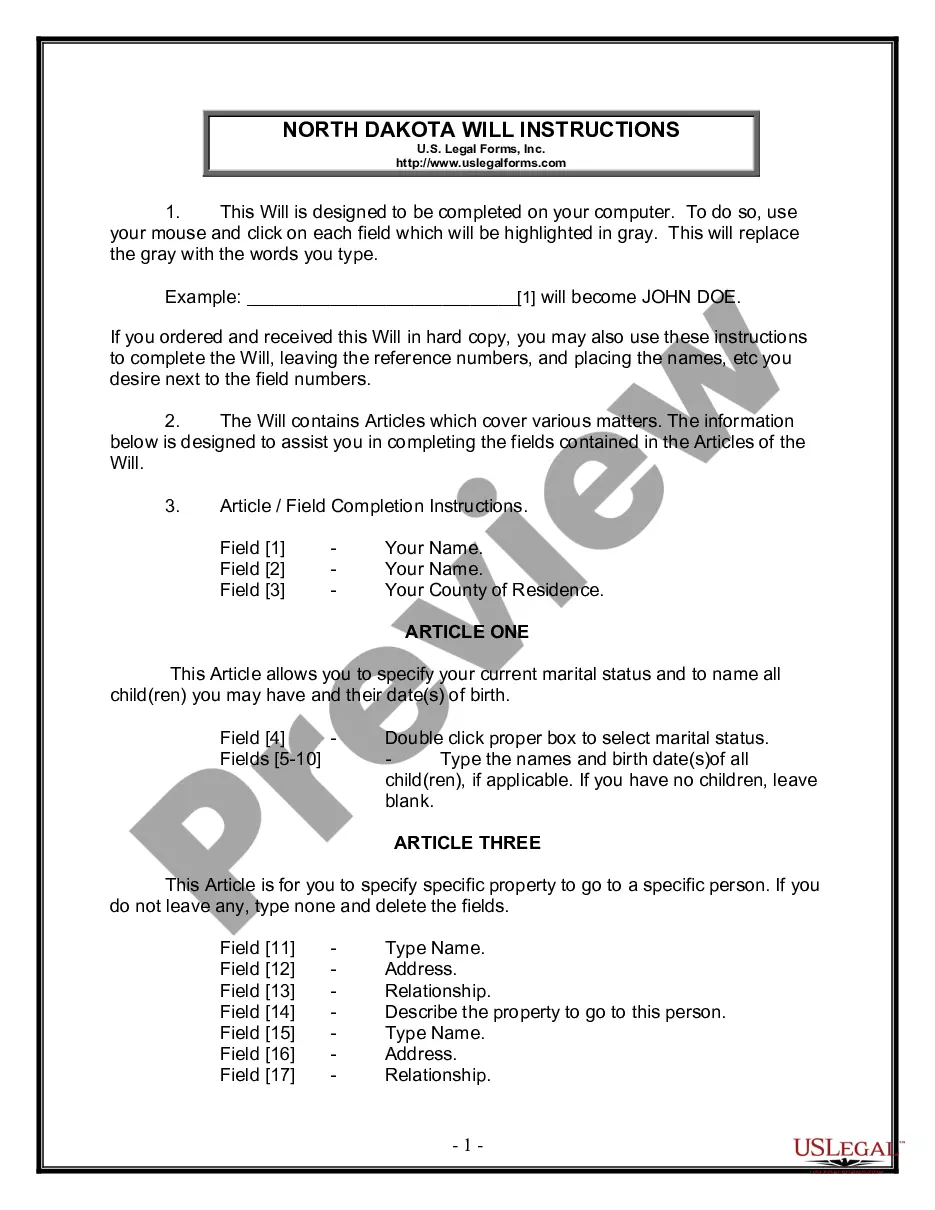

How to fill out Guaranty Of Payment Of Dividends On Stocks?

You are able to invest time on-line looking for the legal record design that fits the federal and state needs you need. US Legal Forms gives a huge number of legal kinds that are evaluated by specialists. You can actually download or print the Montana Guaranty of Payment of Dividends on Stocks from our support.

If you currently have a US Legal Forms accounts, you are able to log in and click the Download button. Next, you are able to total, change, print, or signal the Montana Guaranty of Payment of Dividends on Stocks. Every single legal record design you buy is yours eternally. To have one more version of the obtained develop, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms internet site the first time, keep to the basic instructions below:

- First, ensure that you have chosen the right record design to the region/town of your choosing. Look at the develop description to ensure you have picked out the correct develop. If available, utilize the Review button to check with the record design too.

- In order to locate one more variation in the develop, utilize the Search field to find the design that meets your requirements and needs.

- Once you have discovered the design you need, simply click Acquire now to continue.

- Select the costs strategy you need, type your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal accounts to purchase the legal develop.

- Select the file format in the record and download it to the gadget.

- Make adjustments to the record if needed. You are able to total, change and signal and print Montana Guaranty of Payment of Dividends on Stocks.

Download and print a huge number of record layouts while using US Legal Forms web site, that provides the largest assortment of legal kinds. Use specialist and express-certain layouts to tackle your small business or personal requires.

Form popularity

FAQ

Key Takeaways. Guaranteed stock is a rarely used form of preferred stock, where a party other than the original company guarantees dividends will be paid. Guaranteed stock issues, like guaranteed bonds, have most often used by railroads and public utilities.

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a shareholders' equity account) and an increase (credit) to Dividends Payable (a liability account):

For example, if a fund of investments pays a dividend of 50 cents quarterly and also pays an extra dividend of 12 cents per share because of a nonrecurring event from which the company benefited, the dividend rate is $2.12 per year (50 cents x 4 quarters + 12 cents = $2.12).

As an example, a company that is trading at $60 per share declares a $2 dividend on the announcement date. As the news becomes public, the share price may increase by $2 and hit $62. If the stock trades at $63 one business day before the ex-dividend date.

Cash dividends These are the most common type of dividends, paid out in cash. A company pays out a certain portion of its profits as dividends to shareholders. For example, An IT firm, XYZ, has made Rs 500 crores in profit for the year 2020.

A stock dividend is a payment to shareholders that consists of additional shares rather than cash. The distributions are paid in fractions per existing share. For example, if a company issues a stock dividend of 5%, it will pay 0.05 shares for every share owned by a shareholder.

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

A dividend is a company's payment, based on profit, to the people who own stock in the company. Dividend payments are based on the class of the stock, the stock price and the number of shares an investor has in a company. Dividends are frequently paid in cash to investors but may come in other forms of compensation.