Montana Consumer Equity Sheet

Instant download

Description

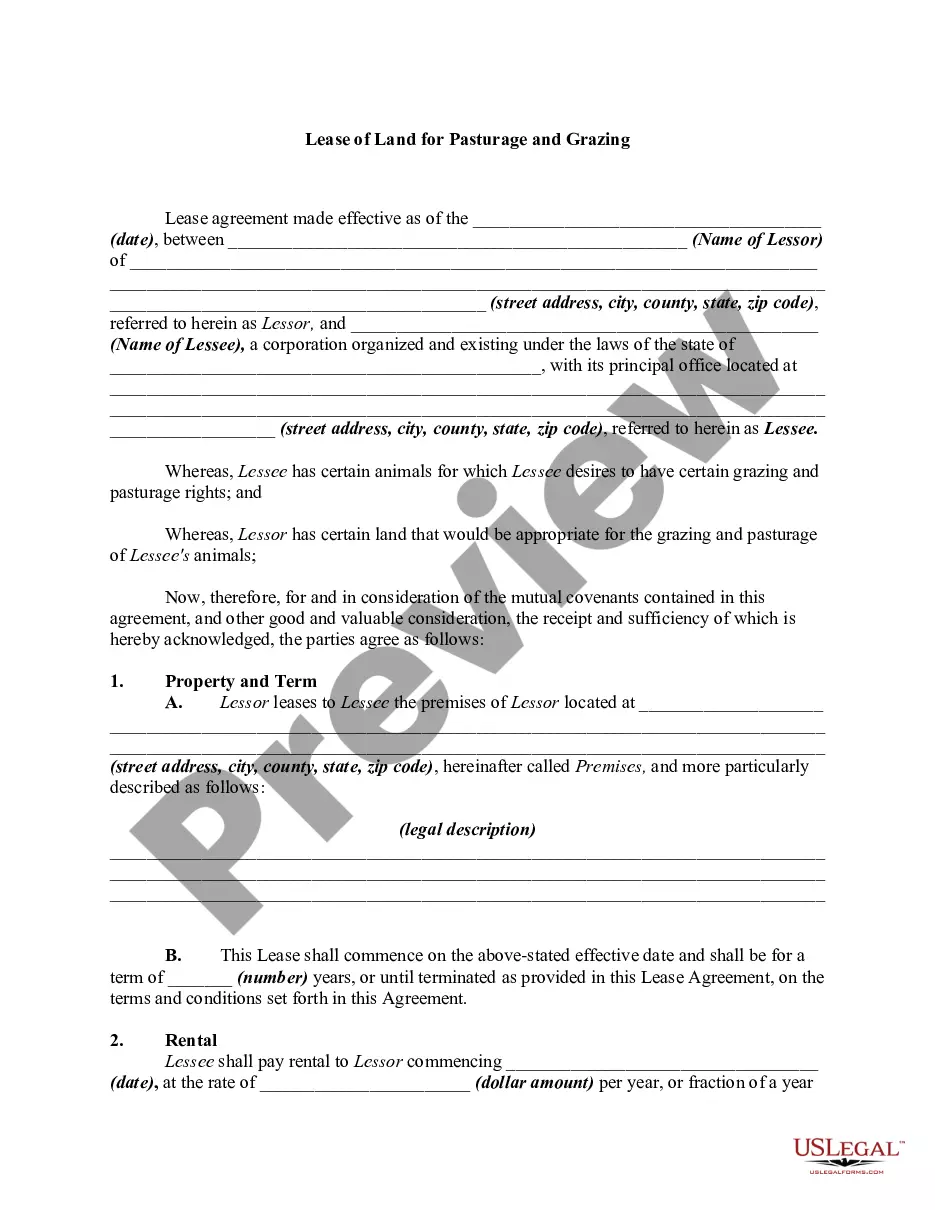

Forfeiture is the lessor's ability to end a lease in the event that the lessee breaches a term of the lease or where another specified event takes place. There must be a valid forfeiture clause in the lease. This clause will specify when the lessor can forfeit the lease. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Consumer Equity Sheet?

It is feasible to spend multiple hours online looking for the legal documentation template that meets the federal and state requirements you will necessitate.

US Legal Forms provides thousands of legal documents that are assessed by experts.

You can obtain or create the Montana Consumer Equity Sheet through our service.

To obtain an additional version of your form, use the Search field to find the template that suits your needs and requirements.

- If you hold a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, create, or sign the Montana Consumer Equity Sheet.

- Every legal document template you acquire becomes yours indefinitely.

- To obtain another copy of any acquired form, go to the My documents tab and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, confirm that you have selected the correct document template for your county/town.

- Review the form description to ensure you have chosen the right template.