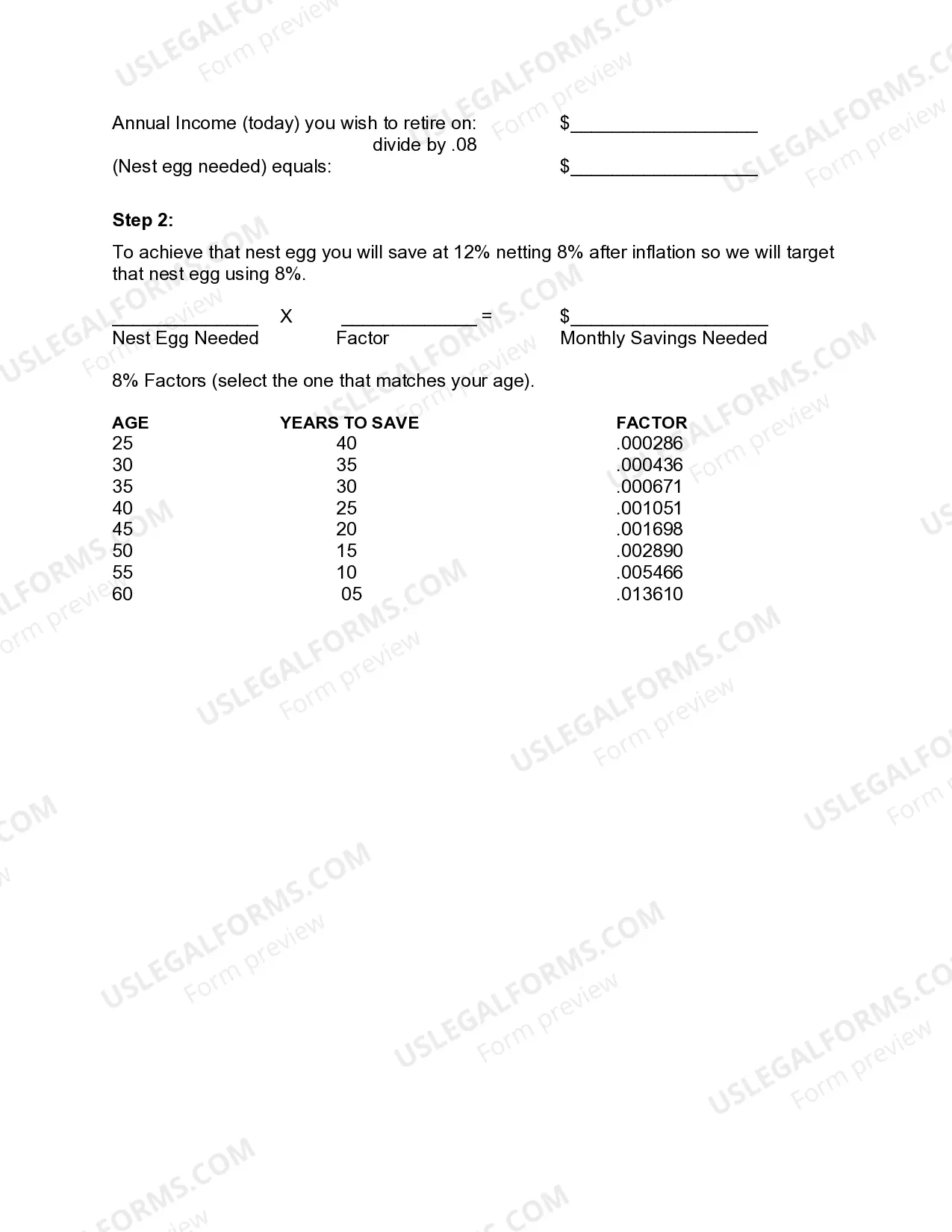

Montana Monthly Retirement Planning is a comprehensive financial service aimed at helping individuals and couples in Montana efficiently plan for their retirement years. This service incorporates a range of strategies and tools to ensure individuals can live comfortably and securely during their retirement, taking into account their unique financial situation and goals. Montana Monthly Retirement Planning provides personalized advice and guidance tailored to the specific needs of each client. By conducting a thorough analysis of their current financial situation and future retirement aspirations, experienced financial advisors create customized retirement plans designed to maximize savings, minimize tax liabilities, and generate income streams. Some key features and benefits that Montana Monthly Retirement Planning offers include: 1. Retirement Income Strategies: Advisors assist clients in developing tailored strategies to effectively manage their income during retirement, ensuring they have a steady cash flow to cover living expenses, healthcare costs, and enjoy their desired lifestyle. 2. Investment Planning: Through careful analysis of risk tolerance and retirement goals, advisors recommend appropriate investment vehicles to help grow the retirement nest egg, while considering factors like diversification, asset allocation, and long-term growth potential. 3. Social Security Optimization: Montana Monthly Retirement Planning helps clients understand various strategies to maximize Social Security benefits, such as timing the start of benefits or using spousal benefits, to ensure they receive the highest possible income stream in retirement. 4. Tax Planning: Advisors work closely with clients to develop tax-efficient strategies, taking advantage of available retirement accounts, tax deductions, and credits, helping individuals minimize tax burden and potentially increase their retirement savings. 5. Estate Planning: Montana Monthly Retirement Planning extends beyond retirement itself and helps clients protect their assets and estates. Advisors collaborate with estate planning attorneys to develop comprehensive plans that include wills, trusts, and advanced directives. Different types of Montana Monthly Retirement Planning may include: 1. Traditional IRA Planning: Focused on maximizing contributions to traditional Individual Retirement Accounts (IRAs) and exploring tax advantages associated with this type of retirement account. 2. Roth IRA Planning: Designed specifically for individuals interested in utilizing Roth IRAs, advisors provide guidance on contribution limits, tax-free withdrawals, and conversion strategies. 3. 401(k) Planning: Tailored to individuals with 401(k) retirement accounts, this type of planning focuses on aligning investment choices, employer matching contributions, and proper asset allocation. 4. Pension Planning: Aimed at individuals with pensions or defined benefit plans, advisors help clients understand their pension options, compare lump-sum vs. annuity payments, and strategize to optimize retirement income. Overall, Montana Monthly Retirement Planning offers comprehensive financial solutions to help Montanans plan for a secure and fulfilling retirement. Skilled financial advisors employ a range of strategies and tools to customize retirement plans that align with individual circumstances, goals, and aspirations, empowering individuals to achieve financial independence and peace of mind in retirement.

Montana Monthly Retirement Planning

Description

How to fill out Montana Monthly Retirement Planning?

Discovering the right legal document web template can be quite a battle. Of course, there are a lot of layouts available on the net, but how would you discover the legal type you want? Make use of the US Legal Forms site. The assistance delivers thousands of layouts, such as the Montana Monthly Retirement Planning, that can be used for enterprise and private requires. Every one of the kinds are checked out by experts and satisfy federal and state demands.

If you are presently registered, log in for your bank account and then click the Acquire option to have the Montana Monthly Retirement Planning. Make use of your bank account to search through the legal kinds you might have acquired in the past. Visit the My Forms tab of your bank account and have an additional duplicate of the document you want.

If you are a new user of US Legal Forms, allow me to share basic directions that you can adhere to:

- Initially, ensure you have chosen the correct type for your town/area. You may look through the shape while using Review option and browse the shape information to make sure it will be the best for you.

- In case the type fails to satisfy your expectations, utilize the Seach discipline to find the right type.

- When you are sure that the shape is acceptable, click on the Buy now option to have the type.

- Pick the pricing strategy you want and enter in the necessary information and facts. Design your bank account and pay for the order utilizing your PayPal bank account or credit card.

- Opt for the file structure and obtain the legal document web template for your device.

- Comprehensive, revise and print and indicator the obtained Montana Monthly Retirement Planning.

US Legal Forms is the largest local library of legal kinds that you will find various document layouts. Make use of the company to obtain expertly-made papers that adhere to express demands.