A Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legally binding contract between an employer and an employee in the state of Montana. This agreement outlines the terms and conditions for the employee's retirement benefits which are funded through a life insurance policy. Keywords: Montana, employment agreement, nonqualified retirement plan, life insurance, retirement benefits. There are various types of Montana Employment Agreements with Nonqualified Retirement Plan Funded with Life Insurance, including: 1. Defined Benefit Plan: Under this type of agreement, the retirement benefits are determined based on a pre-determined formula that considers factors such as the employee's salary and years of service. The life insurance policy is used to fund the plan and provide the necessary funds upon retirement. 2. Cash Balance Plan: In this agreement, the employer contributes a specific amount or percentage of the employee's salary to a cash balance account. The accumulated funds, along with the cash value of the life insurance policy, are used to provide retirement benefits. 3. Executive Bonus Plan: This agreement is commonly used for key executives or high-level employees. The employer pays premiums for a life insurance policy on behalf of the employee, creating a cash value component that can be utilized for retirement purposes. 4. Split Dollar Plan: This type of agreement involves sharing the costs and benefits of a life insurance policy between the employer and the employee. The cash value of the policy can be used for retirement benefits, and the death benefit is split between the employer and the employee's designated beneficiaries. 5. Supplemental Executive Retirement Plan (SERP): SERPs are often provided to top-level executives as additional retirement benefits. The employer funds the plan, which includes a life insurance policy component, to ensure that executives receive substantial retirement benefits beyond what is offered through traditional retirement plans. Regardless of the specific type of Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, it is crucial for both the employer and the employee to clearly understand and agree upon the terms, including the funding mechanism, vesting schedules, retirement benefit calculations, and any applicable tax implications. Note: While this is a general description of a Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, it is essential to consult legal professionals and financial advisors to tailor the agreement to specific circumstances and comply with relevant state and federal laws.

Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

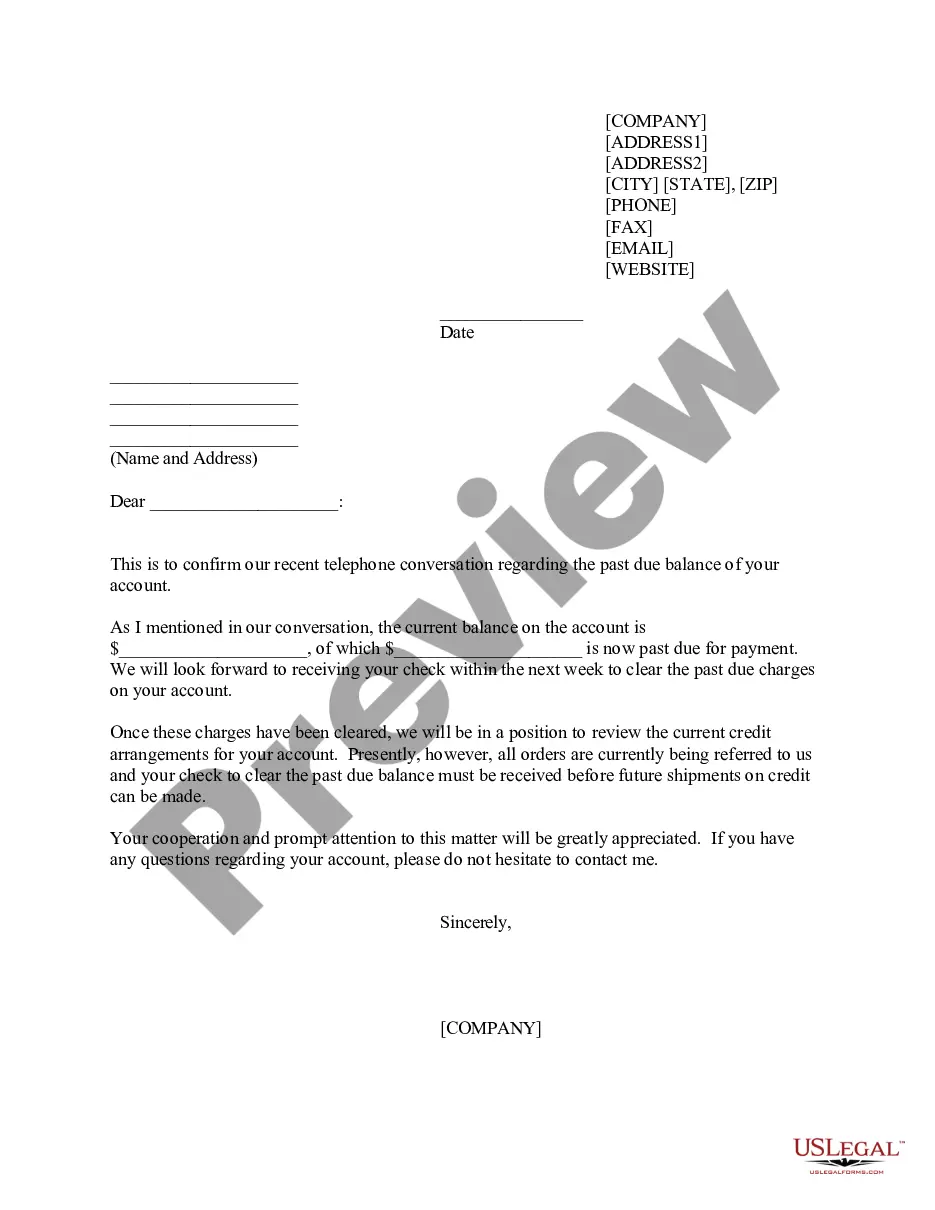

How to fill out Montana Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

US Legal Forms - one of several most significant libraries of legal kinds in America - offers a wide range of legal document layouts you may obtain or printing. Making use of the site, you will get thousands of kinds for enterprise and person purposes, sorted by types, suggests, or keywords.You will discover the newest models of kinds such as the Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance in seconds.

If you already have a monthly subscription, log in and obtain Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance through the US Legal Forms library. The Acquire button will appear on every type you look at. You have accessibility to all previously downloaded kinds within the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, listed here are simple recommendations to help you get started:

- Be sure you have picked the right type for your city/state. Click on the Review button to review the form`s articles. Browse the type information to actually have selected the appropriate type.

- When the type does not fit your requirements, take advantage of the Lookup field on top of the display to get the the one that does.

- In case you are happy with the form, validate your option by clicking the Get now button. Then, pick the prices prepare you want and provide your credentials to sign up on an accounts.

- Method the financial transaction. Make use of bank card or PayPal accounts to accomplish the financial transaction.

- Find the structure and obtain the form on your gadget.

- Make modifications. Fill out, modify and printing and indication the downloaded Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Each web template you put into your bank account lacks an expiration day which is the one you have forever. So, in order to obtain or printing one more copy, just visit the My Forms portion and then click around the type you want.

Gain access to the Montana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance with US Legal Forms, one of the most substantial library of legal document layouts. Use thousands of specialist and condition-certain layouts that satisfy your small business or person requires and requirements.

Form popularity

FAQ

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

Life insurance generally provides the most cost-effective method of informally funding a deferred compensation plan, as long as the executive participant is insurable.

An unfunded deferred compensation plan, representing the employers unsecured promise to pay the employee a future benefit, does not result in current taxable income to the employee. Income is not recognized for tax purposes until the funds are available for immediate distribution.

Unlike a 401(k), your deferred compensation account is not yours; it is the property of your employer and is subject to potential loss. If the company goes bankrupt or is unable to pay its bills, you may lose the compensation you deferred.

The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans.

Deferred compensation plans come in two types qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

A nonqualified deferred compensation (NQDC) plan is an arrangement between an employer and employee that defers the receipt of currently earned compensation. A NQDC plan doesn't need to comply with the discrimination and administrative rules that govern qualified plans, such as Section 401 of the Internal Revenue Code.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.