Montana Guaranty with Pledged Collateral is a type of financial arrangement in which a borrower provides collateral to secure a loan guaranteed by the state of Montana. This guarantee ensures that the lender will be repaid even if the borrower defaults on the loan. The primary purpose of implementing a Montana Guaranty with Pledged Collateral is to mitigate risk for lenders and encourage them to provide loans to small businesses and agricultural producers who may not meet the traditional lending criteria. By offering loan guarantees, the state of Montana aims to stimulate economic growth, job creation, and support the development of local businesses and agriculture. Under this program, the borrower must provide collateral to secure the loan. Collateral can include real estate, equipment, inventory, accounts receivable, or other assets approved by the lending institution. This collateral acts as a guarantee for the lender in case of default. It's important to note that the Montana Guaranty with Pledged Collateral program has different variations tailored to specific needs: 1. Small Business Guaranty with Pledged Collateral: This variation is designed to assist small businesses in accessing capital for expansion, working capital needs, or equipment purchases. By pledging collateral, small businesses can mitigate the risk for lenders, making it easier to secure funding. 2. Agricultural Guaranty with Pledged Collateral: The agricultural sector can benefit from this specific variation. It supports farmers, ranchers, and agricultural enterprises by allowing them to pledge collateral in exchange for loan guarantees. This enables them to finance land acquisitions, livestock purchases, machinery upgrades, or other necessary investments in their operations. 3. Environmental Guaranty with Pledged Collateral: This variation focuses on funding projects with an environmental impact. It provides guarantees to lenders when borrowers pledge collateral related to environmentally conscious initiatives, such as renewable energy projects, sustainable infrastructure development, or conservation efforts. Both borrowers and lenders can benefit from the Montana Guaranty with Pledged Collateral program. Borrowers gain access to affordable financing, often with more favorable terms, while lenders feel more secure knowing that their loans are backed by the state's guarantee. In conclusion, the Montana Guaranty with Pledged Collateral program is a beneficial financial tool, offering different variations tailored to small businesses, agricultural enterprises, and environmental initiatives. It facilitates access to capital for borrowers, stimulates economic growth, and helps to create a thriving business environment in the state of Montana.

Montana Guaranty with Pledged Collateral

Description

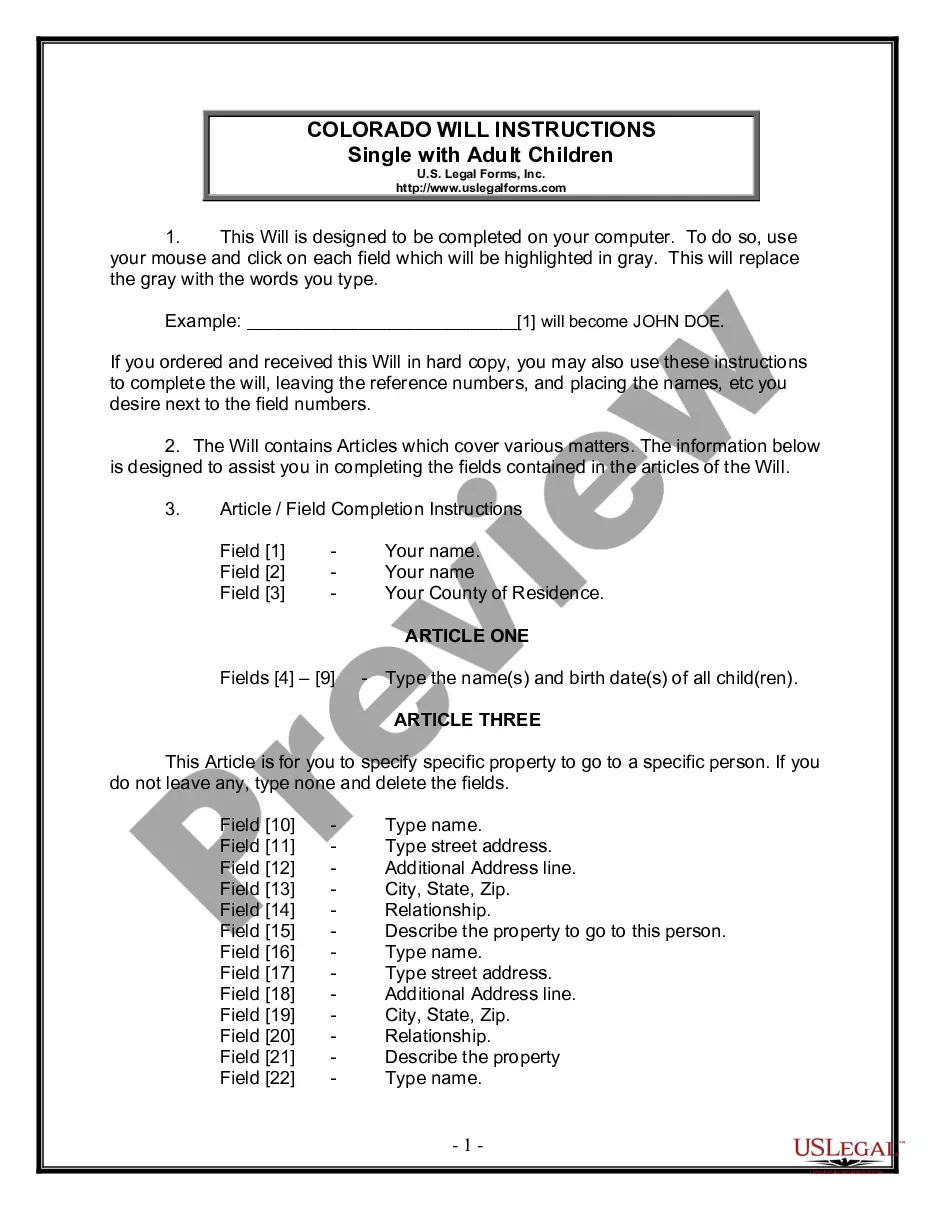

How to fill out Montana Guaranty With Pledged Collateral?

US Legal Forms - one of many biggest libraries of lawful varieties in the USA - offers a variety of lawful record templates you are able to obtain or produce. While using site, you may get 1000s of varieties for organization and personal uses, sorted by classes, claims, or keywords.You will find the latest types of varieties such as the Montana Guaranty with Pledged Collateral in seconds.

If you have a subscription, log in and obtain Montana Guaranty with Pledged Collateral from the US Legal Forms collection. The Obtain option can look on each and every develop you see. You get access to all formerly downloaded varieties inside the My Forms tab of your own account.

If you wish to use US Legal Forms initially, listed below are straightforward directions to get you started:

- Ensure you have chosen the best develop for your personal town/county. Click the Preview option to analyze the form`s content. See the develop explanation to actually have selected the right develop.

- If the develop does not suit your needs, make use of the Research industry near the top of the display screen to find the one which does.

- When you are pleased with the shape, confirm your selection by visiting the Get now option. Then, select the rates program you favor and give your qualifications to register to have an account.

- Procedure the purchase. Make use of your Visa or Mastercard or PayPal account to perform the purchase.

- Pick the file format and obtain the shape on your own gadget.

- Make adjustments. Fill out, modify and produce and sign the downloaded Montana Guaranty with Pledged Collateral.

Every single design you put into your account does not have an expiry particular date and is yours eternally. So, if you would like obtain or produce one more version, just go to the My Forms section and click on the develop you will need.

Get access to the Montana Guaranty with Pledged Collateral with US Legal Forms, probably the most substantial collection of lawful record templates. Use 1000s of specialist and condition-particular templates that satisfy your company or personal needs and needs.