Montana Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Are you currently at the location where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of form templates, including the Montana Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, designed to comply with federal and state regulations.

Choose a convenient document format and download your copy.

Explore all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Montana Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company anytime, if needed. Just access the required form to download or print the document template. Use US Legal Forms, which has one of the most extensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Montana Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/county.

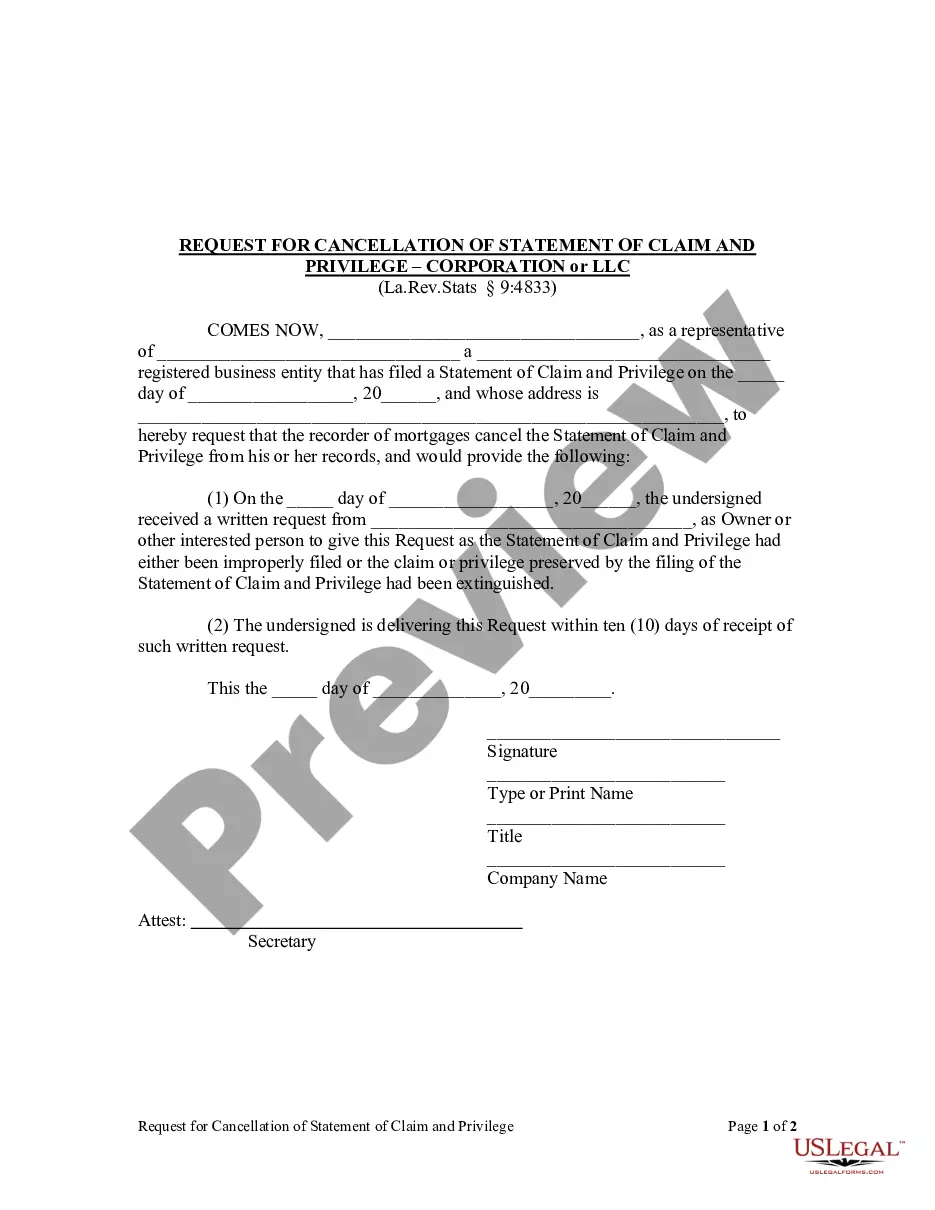

- Utilize the Review button to examine the form.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you locate the correct form, click Get now.

- Select the pricing plan you prefer, complete the required information to create your account, and complete the order using your PayPal or credit card.

Form popularity

FAQ

An operating agreement is a foundational document that outlines the management structure and rules of an LLC, while a resolution is a specific decision made at a meeting. The operating agreement provides a broader framework, whereas resolutions, such as the Montana Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, address particular issues as they arise. Both are important for governance but serve different purposes.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Montana does not require you to have an operating agreement when you form an LLC; however, even as the sole owner of the company, it's in your best interest to file an operating agreement when you create your LLC.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

A corporate resolution is generally required to document actions taken by the corporation, but when it comes to LLCs, resolutions are not mandated. Because of this, there is no specific or required way to draft an LLC resolution.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

The articles of organization is an operating agreement stating the procedure for voting on an LLC's resolutions. Usually, a majority vote is required for passing a resolution. However, it is permissible to have other voting percentages.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...