Montana Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

Locating the appropriate legal document template can be quite challenging.

Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Montana Authorization of Consumer Report, that are suitable for both business and personal needs.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to locate the Montana Authorization of Consumer Report.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your area/state. You can preview the form using the Preview button and review the form description to ensure it’s the right one for you.

Form popularity

FAQ

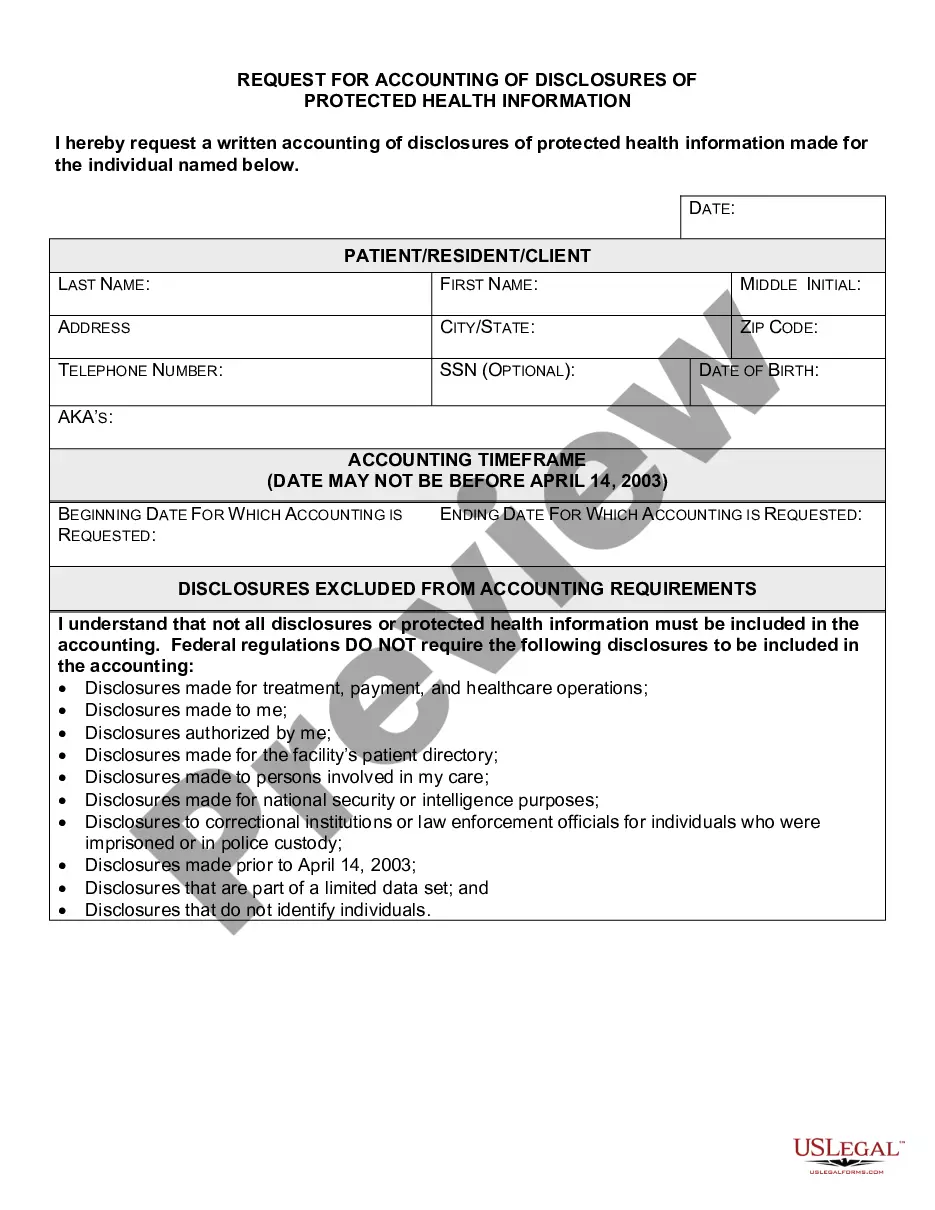

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

The FCRA defines a consumer report as any written or oral communication that meets all of the following conditions: 220e It is prepared by a CRA. 220e It bears on a consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

A statement indicating that the account "meets FCRA requirements" may be added if a consumer disputes information on their credit report, but the credit bureau determines that the information is accurate. Additionally, it can be concluded that all information is accurate and under federal regulations.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

Consumer reports typically include an individual's credit history and payment patterns, demographic and identifying information, and public records information, such as arrests, judgments, and bankruptcies.

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.

Disclosures to consumers. (a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.