Title: Montana Exemption Statement — Texas: A Comprehensive Overview Introduction: Montana Exemption Statement — Texas refers to a legal document that provides exemption from certain taxes or obligations within the state of Texas. This statement is crucial for individuals or entities seeking exemptions under specific circumstances. In this article, we will delve into the details of Montana Exemption Statement — Texas, discussing its purpose, varying types, and notable features. Key Keywords: Montana Exemption Statement, Texas, exemptions, legal document, taxes, obligations, individuals, entities 1. Purpose of Montana Exemption Statement — Texas: The primary purpose of the Montana Exemption Statement — Texas is to provide individuals and entities with relief from specific taxes or obligations as mandated by Texas laws. It aims to legally exempt qualified individuals or organizations from certain financial liabilities, thereby encouraging economic growth and facilitating specific activities. 2. Types of Montana Exemption Statement — Texas: a) Sales and Use Tax Exemption: This specific type of exemption statement allows businesses and qualifying entities to avoid the payment of sales and use taxes on certain items or transactions. It helps foster business expansion and development by reducing financial burdens. b) Property Tax Exemption: Montana Exemption Statement — Texas also covers property tax exemptions for certain organizations, such as religious, charitable, and nonprofit institutions. These exemptions aim to support the contributions of these organizations to the community without placing a heavy tax burden on them. c) Energy and Environment Exemptions: Montana Exemption Statement — Texas may also provide exemptions related to the energy sector, such as renewable energy initiatives, energy-efficient construction, or environmental conservation projects. These exemptions incentivize environmental responsibility and sustainable practices. d) Agriculture and Farming Exemptions: Montana Exemption Statement — Texas offers exemptions for agricultural purposes, including machinery, equipment, and feed used in farming operations. Such exemptions support the agriculture industry, vital for the state's economy, by reducing operational costs. 3. Notable Features of Montana Exemption Statement — Texas: a) Eligibility Criteria: Each type of Montana Exemption Statement — Texas has specific eligibility requirements, such as the classification of the entity applying for exemption, the nature of the activity, or meeting certain financial thresholds. Understanding these criteria is vital to ensure proper application. b) Application Process: The process of obtaining a Montana Exemption Statement — Texas involves completing and submitting the appropriate forms to the relevant state authorities. Timely submission and accuracy play a crucial role in the success of the application. c) Expiration and Renewal: Some exemptions may have expiration dates, requiring periodic renewal to remain valid. Understanding the expiration and renewal process can help avoid lapses and interruptions in the exemption status. Conclusion: Montana Exemption Statement — Texas is a legal document that provides various exemptions from taxes and obligations within the state. Its different types cater to specific sectors and activities, aiming to support economic growth, encourage environmental responsibility, and aid social causes. Understanding the intricacies of Montana Exemption Statement — Texas is pivotal for individuals and entities seeking relief from financial liabilities while complying with state regulations.

Montana Exemption Statement

Description

How to fill out Montana Exemption Statement?

Discovering the right legitimate file design can be quite a battle. Naturally, there are tons of templates available on the Internet, but how do you find the legitimate type you will need? Take advantage of the US Legal Forms internet site. The services delivers a huge number of templates, such as the Montana Exemption Statement - Texas, which can be used for organization and personal requires. Each of the types are examined by pros and meet up with state and federal specifications.

Should you be previously registered, log in in your bank account and click on the Obtain button to find the Montana Exemption Statement - Texas. Make use of your bank account to look from the legitimate types you may have purchased earlier. Visit the My Forms tab of your respective bank account and obtain yet another backup in the file you will need.

Should you be a whole new user of US Legal Forms, listed below are simple guidelines so that you can comply with:

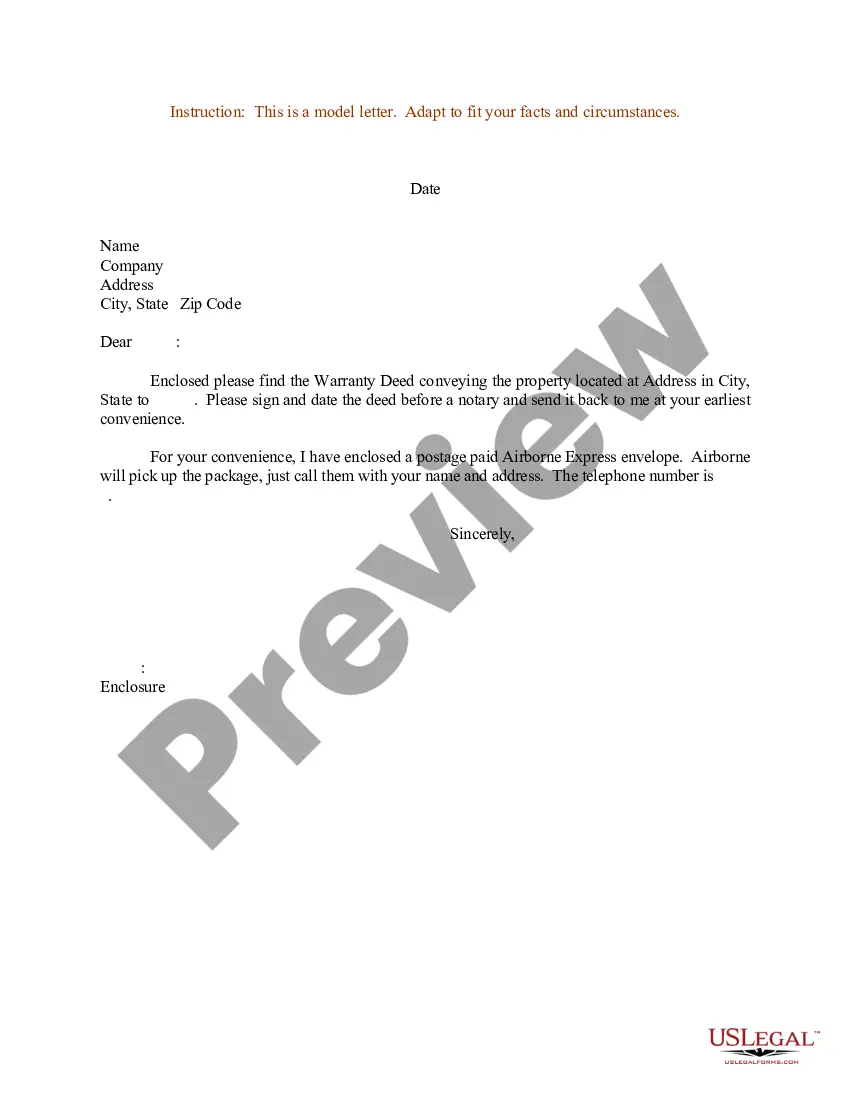

- First, make sure you have selected the correct type to your area/area. You are able to examine the form making use of the Review button and look at the form outline to ensure this is basically the right one for you.

- If the type is not going to meet up with your preferences, make use of the Seach discipline to obtain the correct type.

- When you are certain the form would work, click on the Buy now button to find the type.

- Choose the pricing prepare you need and type in the essential information. Create your bank account and pay money for the order making use of your PayPal bank account or charge card.

- Pick the document format and acquire the legitimate file design in your product.

- Complete, edit and print out and indicator the obtained Montana Exemption Statement - Texas.

US Legal Forms is the most significant collection of legitimate types in which you can see different file templates. Take advantage of the service to acquire skillfully-produced papers that comply with condition specifications.