Montana Employment Form

Description

How to fill out Employment Form?

Locating the appropriate legal document format can be a challenge.

It goes without saying that there is an abundance of templates accessible online, but how can you identify the specific legal document you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/county. You can view the form using the Preview button and read the form description to verify it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident the form is correct, click the Buy now button to obtain the document. Choose the pricing option you desire and fill in the necessary information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal paperwork to your device. Fill in, modify, print, and sign the obtained Montana Employment Form. US Legal Forms is the largest repository of legal templates where you can explore various document formats. Take advantage of the service to download properly crafted documents that adhere to state regulations.

- The service offers a wide variety of templates, including the Montana Employment Form, suitable for both business and personal needs.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to get the Montana Employment Form.

- Use your account to browse the legal templates you have purchased in the past.

- Visit the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

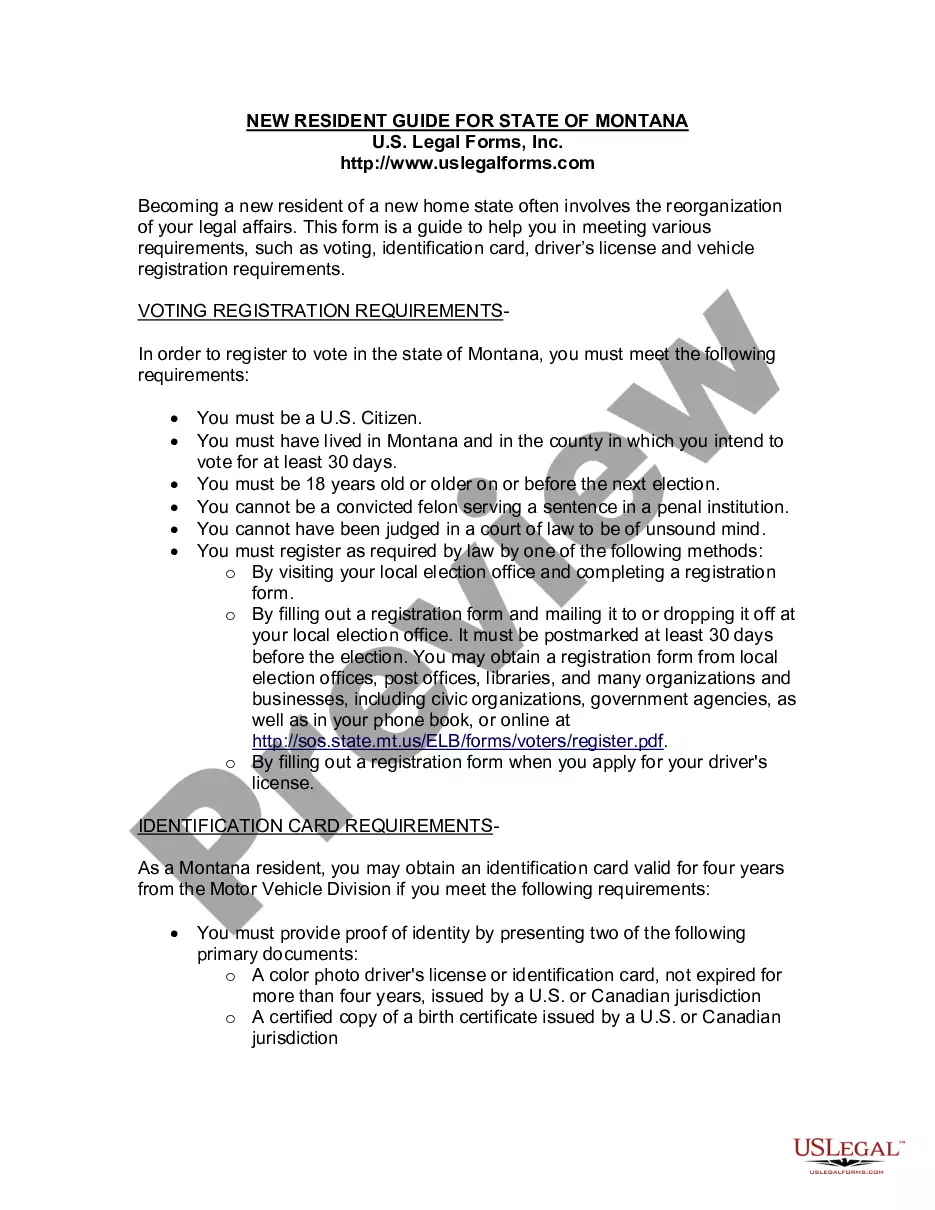

Montana does not recognize the federal exempt status available on the federal Form W-4. Therefore, exemption from withholding for federal purposes does not exempt you from Montana income tax withholding.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

August 2, 2021 by Montana Department of Revenue. A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.

Step-by-Step Guide to Running Payroll in MontanaStep 1: Set up your business as an employer.Step 2: Register with the Montana Department of Revenue.Step 3: Set up your payroll process.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.More items...?

Montana Payroll Laws, Taxes & Regulations. Naturally, you need to begin by following federal law for income taxes, Social Security and Medicare (FICA), and federal unemployment insurance (FUTA). You'll pay FICA taxes of 6.2% (Social Security) and 1.45% (Medicare).

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Payment OptionsMake payments online using the TransAction Portal. You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

Wage withholding is the money held back by an employer to pay an employee's income tax. This is the employee's money, held in trust by the employer until paid to the state. Employers can find more information in the Montana Withholding Tax Table and Guide.