Montana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

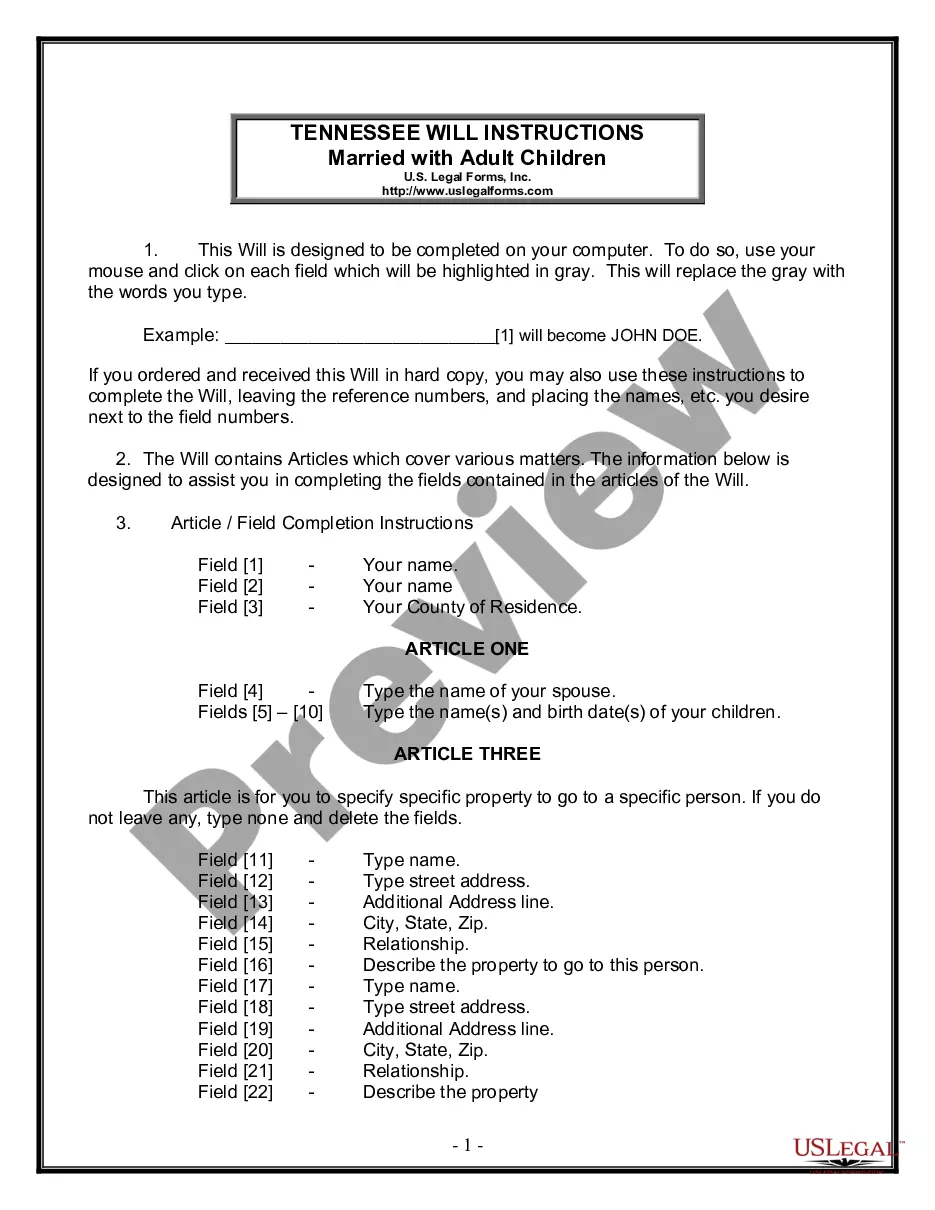

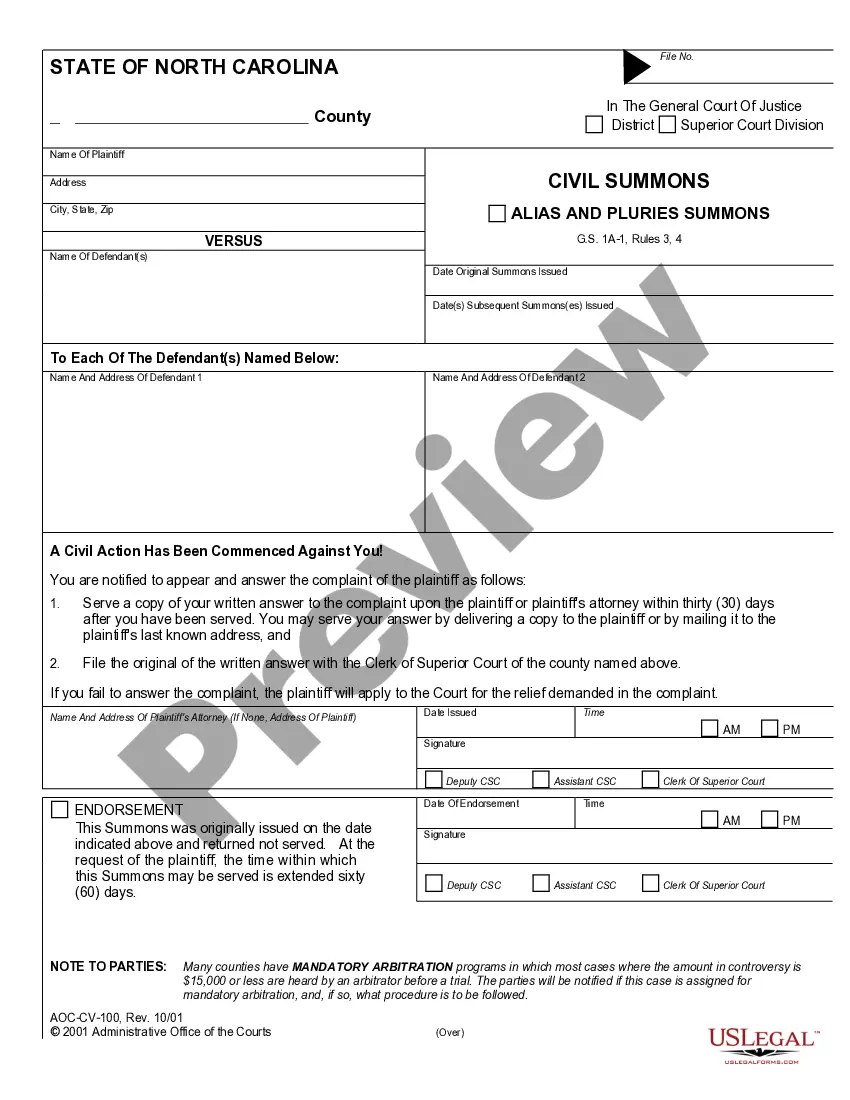

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

You can allocate time online attempting to locate the legitimate document template that meets the federal and state requirements you need.

US Legal Forms offers numerous legal documents that have been reviewed by experts.

You can easily download or create the Montana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate through my services.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, edit, produce, or sign the Montana Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your desired state/city.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

In construction lending, a Carry Guaranty is a standard and typical requirement whereby a Guarantor will guaranty the payment by Borrower of all costs incurred in connection with the operation, maintenance and management of the Property (or some subset of the same) for the term of the Loan (or, if the Property is

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A lease guarantee is a contract signed by the tenant, landlord and the third party. It stipulates the financial obligations of all the parties involved and safeguards them from future risks.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

Guaranty Obligation means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of such Person for any Indebtedness, lease, dividend or other obligation (the primary obligation) of another Person (the primary obligor), if the purpose or intent of such Person in incurring such

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.