Montana Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding trustworthy ones isn’t straightforward.

US Legal Forms provides a vast selection of form templates, such as the Montana Employee Payroll Records Checklist, designed to comply with state and federal regulations.

Once you find the appropriate form, click on Buy now.

Select the subscription plan you prefer, fill in the necessary details to create your account, and purchase the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can acquire an additional copy of the Montana Employee Payroll Records Checklist anytime, if necessary. Just click on the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and prevent errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Montana Employee Payroll Records Checklist template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

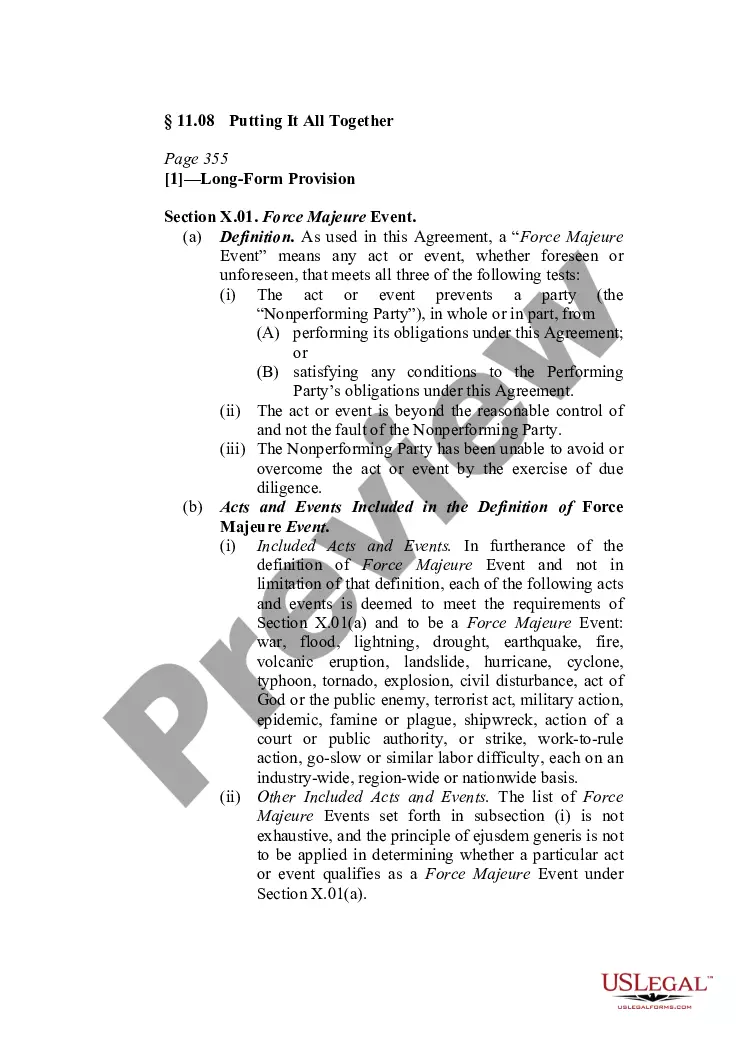

- Utilize the Review option to examine the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn’t what you seek, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Creating your own payroll system involves several key steps, such as choosing the right software, understanding tax requirements, and setting a schedule for payments. You can use the Montana Employee Payroll Records Checklist to identify the necessary data and forms needed for your new system. A well-designed payroll system ensures timely payments and reduces errors. Remember, this can save your business time and improve employee satisfaction.

To manage payroll effectively, you need essential documents like employee time sheets, W-4 forms, and any state-specific tax forms. The Montana Employee Payroll Records Checklist can help you ensure every necessary document is collected and organized. Maintaining accurate records is crucial for compliance and smooth processing. This checklist simplifies your payroll process, making it easy to keep track of what you need.

To register as a Montana state withholding employer, you need to complete the required forms provided by the Montana Department of Revenue. This process typically includes submitting your Employer Identification Number and information about your business. Ensure that you refer to a Montana Employee Payroll Records Checklist to keep all documentation in order during the registration.

The best tool to create a checklist depends on your specific needs and preferences. Many people find digital tools like spreadsheets or dedicated checklist applications effective for organizing tasks. However, for those focusing on payroll processes, a Montana Employee Payroll Records Checklist template from uslegalforms can provide a solid foundation for your payroll management.

To create a payroll checklist, begin by identifying all the tasks involved in payroll processing, such as calculating employee hours and tax withholdings. Organize these tasks in a logical sequence to streamline the process. Referencing a Montana Employee Payroll Records Checklist can help you cover all necessary areas and ensure nothing is overlooked.

To create a checklist for employees, start by determining the key tasks or requirements you want to track. Include essential items like training requirements, equipment assignments, and compliance documents. It is helpful to refer to a Montana Employee Payroll Records Checklist to ensure you do not miss any important steps throughout the onboarding process.

To hire an employee in Montana, you should first obtain an Employer Identification Number (EIN) from the IRS. Then, ensure you comply with state-specific hiring regulations, such as verifying eligibility to work. Additionally, provide a Montana Employee Payroll Records Checklist to secure all required documents during onboarding, such as tax forms and employment agreements.

Creating a payroll checklist involves outlining all the necessary tasks to complete payroll processing. First, list essential items like employee hours, wage rates, and deductions. Next, incorporate compliance with Montana labor laws to ensure all records are accurate. Utilize a Montana Employee Payroll Records Checklist to guide you in managing each step.

Yes, Montana does have a state payroll tax that employers must withhold from employee wages. This tax contributes to statewide funding for various programs and services. To ensure compliance, it is essential to understand the implications outlined in the Montana Employee Payroll Records Checklist. This checklist will help you stay informed about payroll obligations and maintain accurate records.

You cannot easily look up someone's salary online in Montana due to privacy laws. While some public employee salaries may be accessible, most private sector information remains confidential. For more detailed insights on salary and payroll records, you can refer to the Montana Employee Payroll Records Checklist. This checklist can guide you on how to request relevant information appropriately.