Montana Employee Evaluation Form for Nonprofit

Description

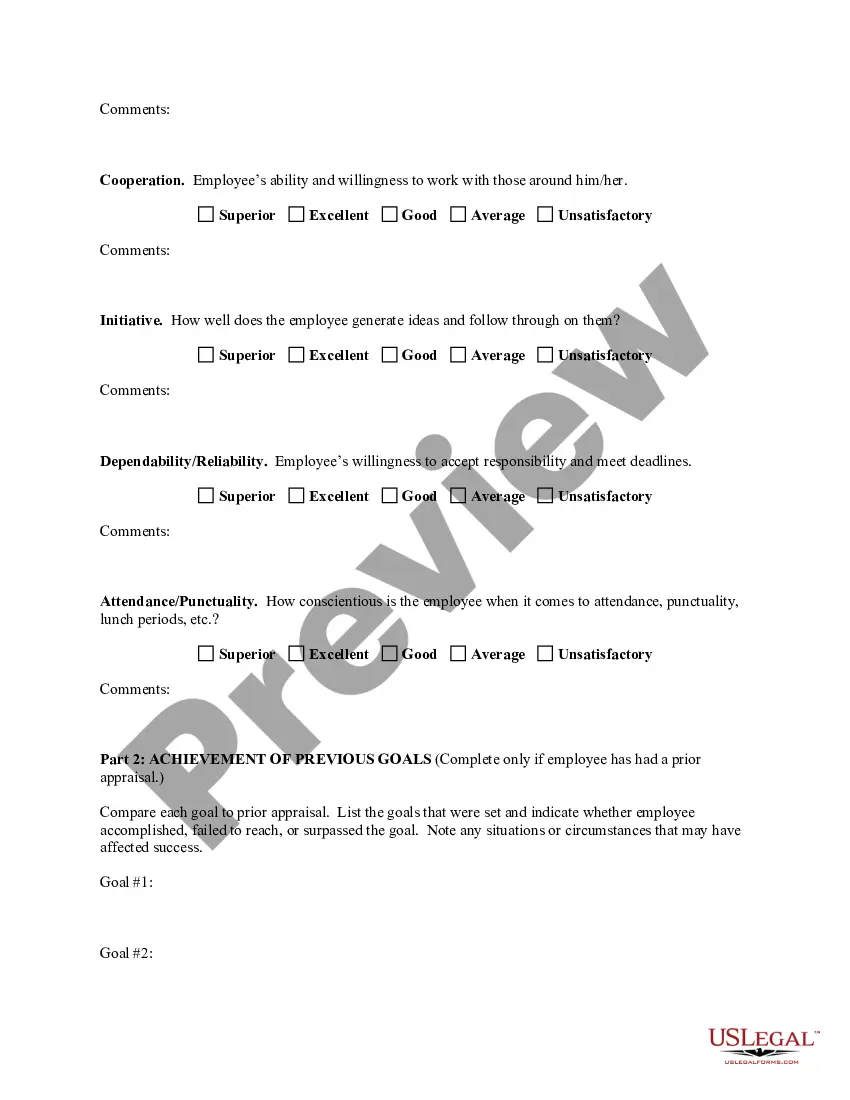

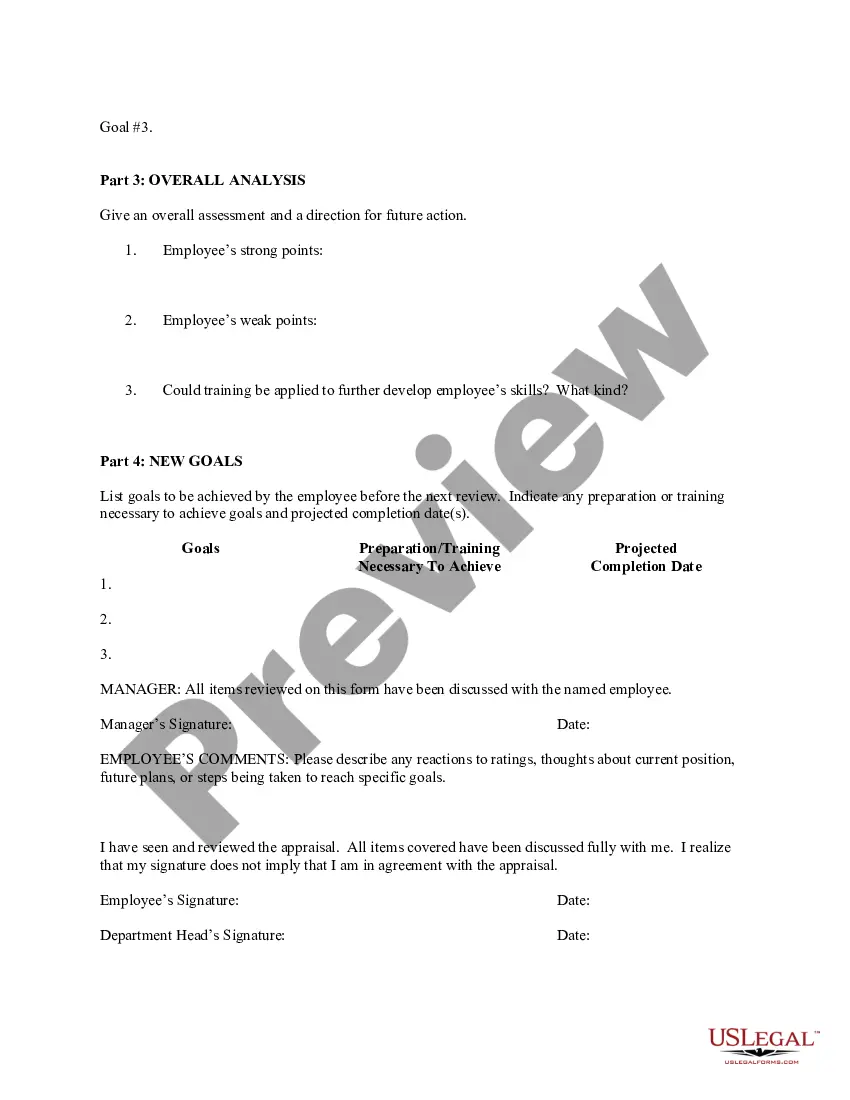

How to fill out Montana Employee Evaluation Form For Nonprofit?

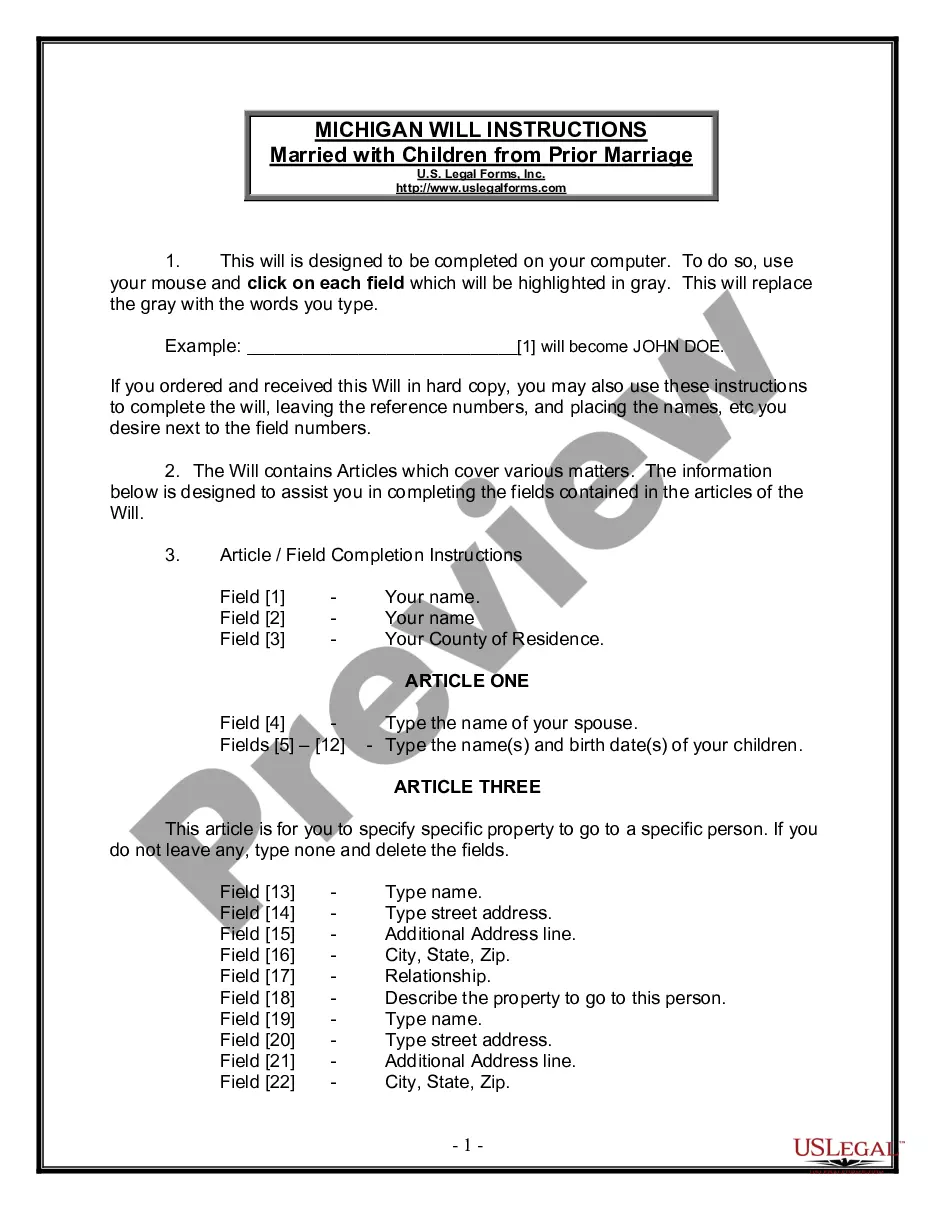

If you wish to comprehensive, download, or produce authorized record themes, use US Legal Forms, the largest variety of authorized varieties, that can be found on-line. Make use of the site`s basic and convenient lookup to get the papers you require. Numerous themes for enterprise and personal functions are categorized by groups and suggests, or keywords. Use US Legal Forms to get the Montana Employee Evaluation Form for Nonprofit in a few click throughs.

If you are presently a US Legal Forms client, log in in your account and click on the Down load switch to get the Montana Employee Evaluation Form for Nonprofit. You can also gain access to varieties you previously saved in the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form to the proper metropolis/nation.

- Step 2. Utilize the Review option to examine the form`s content material. Never overlook to read through the outline.

- Step 3. If you are not satisfied with the develop, utilize the Search field on top of the screen to locate other variations of your authorized develop web template.

- Step 4. After you have identified the form you require, click the Acquire now switch. Pick the rates plan you prefer and add your credentials to register for the account.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal account to finish the financial transaction.

- Step 6. Pick the format of your authorized develop and download it in your device.

- Step 7. Complete, edit and produce or indication the Montana Employee Evaluation Form for Nonprofit.

Every authorized record web template you purchase is the one you have eternally. You have acces to every develop you saved inside your acccount. Click the My Forms segment and choose a develop to produce or download again.

Contend and download, and produce the Montana Employee Evaluation Form for Nonprofit with US Legal Forms. There are thousands of specialist and condition-distinct varieties you may use for your enterprise or personal demands.

Form popularity

FAQ

Most nonprofit groups track their performance by metrics such as dollars raised, membership growth, number of visitors, people served, and overhead costs. These metrics are certainly important, but they don't measure the real success of an organization in achieving its mission.

The three main documents: the articles of incorporation, the bylaws, and the organizational meeting minutes; the nonprofit's directors' names and addresses (or the members' names and addresses if your nonprofit is a membership organization); and.

To start a nonprofit corporation in Montana, you must file nonprofit articles of incorporation with the Montana Secretary of State online at Montana.gov. The articles of incorporation cost $20 to file.

Being 501(c)(3) means that a particular nonprofit organization has been approved by the Internal Revenue Service as a tax-exempt, charitable organization.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

So2026. how much does it cost to start a nonprofit? The answer is it's complicated. Generally, you need an investment of $500 at a bare minimum, but costs can be as high as $1,000 or more.

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Section 501(c)(3) is one of the tax law provisions granting exemption from the federal income tax to nonprofit organizations that exist for religious, charitable, scientific, literary, or educational purposes, among others. See the IRS's website for more information on the designation of charitable organizations.