The Montana Exchange Agreement refers to a legal contract established by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders for the purpose of facilitating a strategic business transaction or partnership. This agreement entails various terms and conditions that outline the rights, obligations, and responsibilities of the involved parties. The Montana Exchange Agreement can be associated with different types, depending on the specific nature of the collaboration between the aforementioned entities. Here are some possible variations: 1. Merger and Acquisition Agreement: This type of Montana Exchange Agreement may be formulated when Danielson Holding Corp. intends to acquire Mission American Insurance Co. or enter into a merger with this entity. The agreement would outline the terms of the transaction, including the purchase price, share allotment, transfer of assets, and liabilities, among other essential details. 2. Partnership Agreement: In cases where Danielson Holding Corp. and CCP Shareholders aim to establish a partnership, a specific type of Montana Exchange Agreement can be devised. This agreement would define the structure, responsibilities, and profit-sharing arrangements between the parties involved, ensuring a smooth collaboration and maximizing mutual benefits. 3. Subsidiary Agreement: If Danielson Holding Corp. seeks to create a subsidiary company with Mission American Insurance Co. or CCP Shareholders, a Montana Exchange Agreement can be tailored to this particular purpose. This agreement would outline the ownership percentages, governance framework, financial obligations, and operational guidelines for the subsidiary entity. 4. Joint Venture Agreement: Another possible variant of the Montana Exchange Agreement could be designed if Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders aim to form a joint venture. This agreement would delineate the roles, responsibilities, decision-making processes, and profit-sharing arrangements among the parties involved. These types of Montana Exchange Agreements can vary in terms of their specifics and legal implications, depending on the unique objectives and goals of the collaboration between Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders. It is essential for all parties involved to carefully draft and review the agreement to ensure a comprehensive and mutually beneficial relationship.

Montana Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

How to fill out Montana Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Are you currently in a situation in which you need to have documents for both organization or individual uses almost every day time? There are tons of legal file layouts available online, but locating types you can rely on isn`t easy. US Legal Forms offers a large number of type layouts, just like the Montana Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders, which can be published to satisfy state and federal needs.

Should you be presently knowledgeable about US Legal Forms internet site and have a free account, just log in. Afterward, you are able to download the Montana Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders format.

Should you not provide an account and need to begin using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for your right city/area.

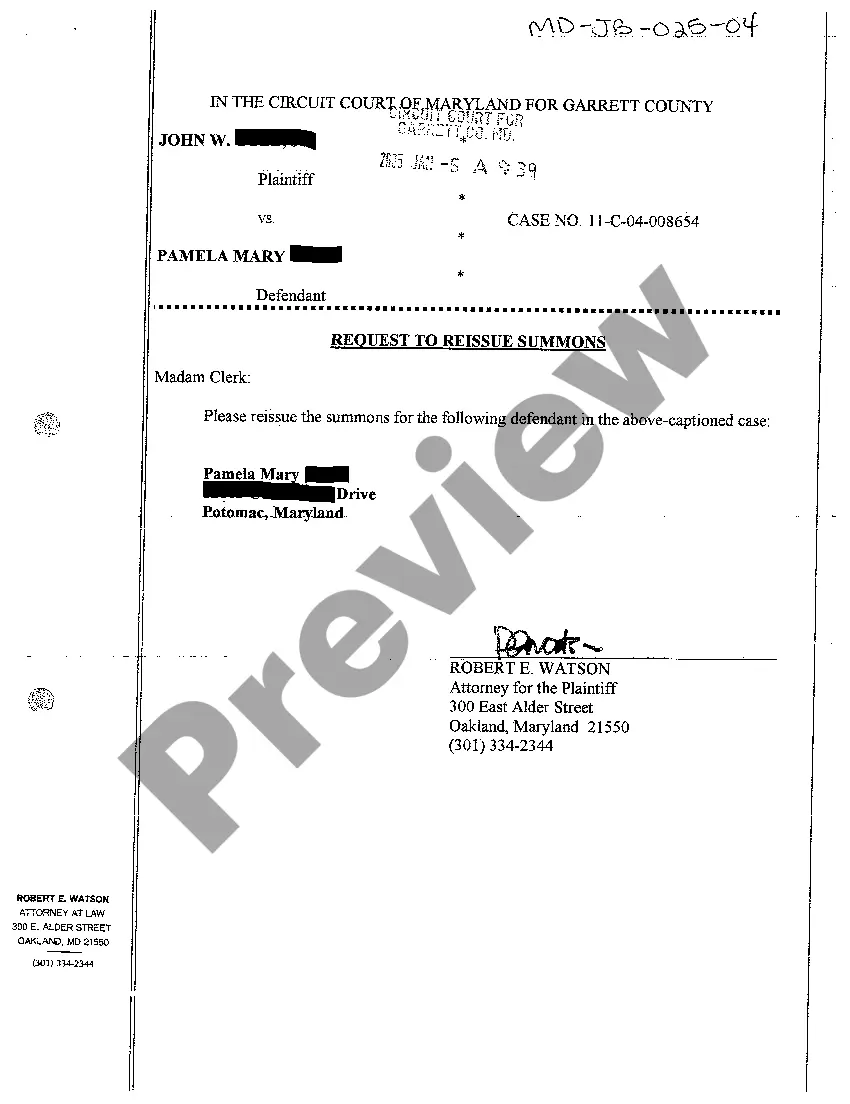

- Take advantage of the Review button to review the form.

- Look at the description to ensure that you have chosen the proper type.

- If the type isn`t what you are trying to find, take advantage of the Lookup field to discover the type that meets your requirements and needs.

- Whenever you obtain the right type, simply click Purchase now.

- Opt for the prices program you want, complete the specified information to produce your bank account, and pay for your order making use of your PayPal or bank card.

- Select a convenient file formatting and download your version.

Find all of the file layouts you possess purchased in the My Forms menu. You may get a more version of Montana Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders at any time, if possible. Just click the required type to download or print out the file format.

Use US Legal Forms, by far the most extensive variety of legal types, to save efforts and steer clear of mistakes. The services offers professionally created legal file layouts which you can use for a variety of uses. Make a free account on US Legal Forms and start producing your lifestyle easier.