Montana Restructuring Agreement

Description

How to fill out Restructuring Agreement?

Have you been within a situation where you need to have documents for both company or personal purposes nearly every day? There are a variety of legal record templates accessible on the Internet, but finding types you can trust isn`t effortless. US Legal Forms provides a large number of form templates, like the Montana Restructuring Agreement, which can be created in order to meet federal and state requirements.

In case you are already knowledgeable about US Legal Forms website and also have your account, simply log in. After that, you are able to download the Montana Restructuring Agreement format.

Unless you offer an account and need to start using US Legal Forms, follow these steps:

- Obtain the form you need and ensure it is for the right city/state.

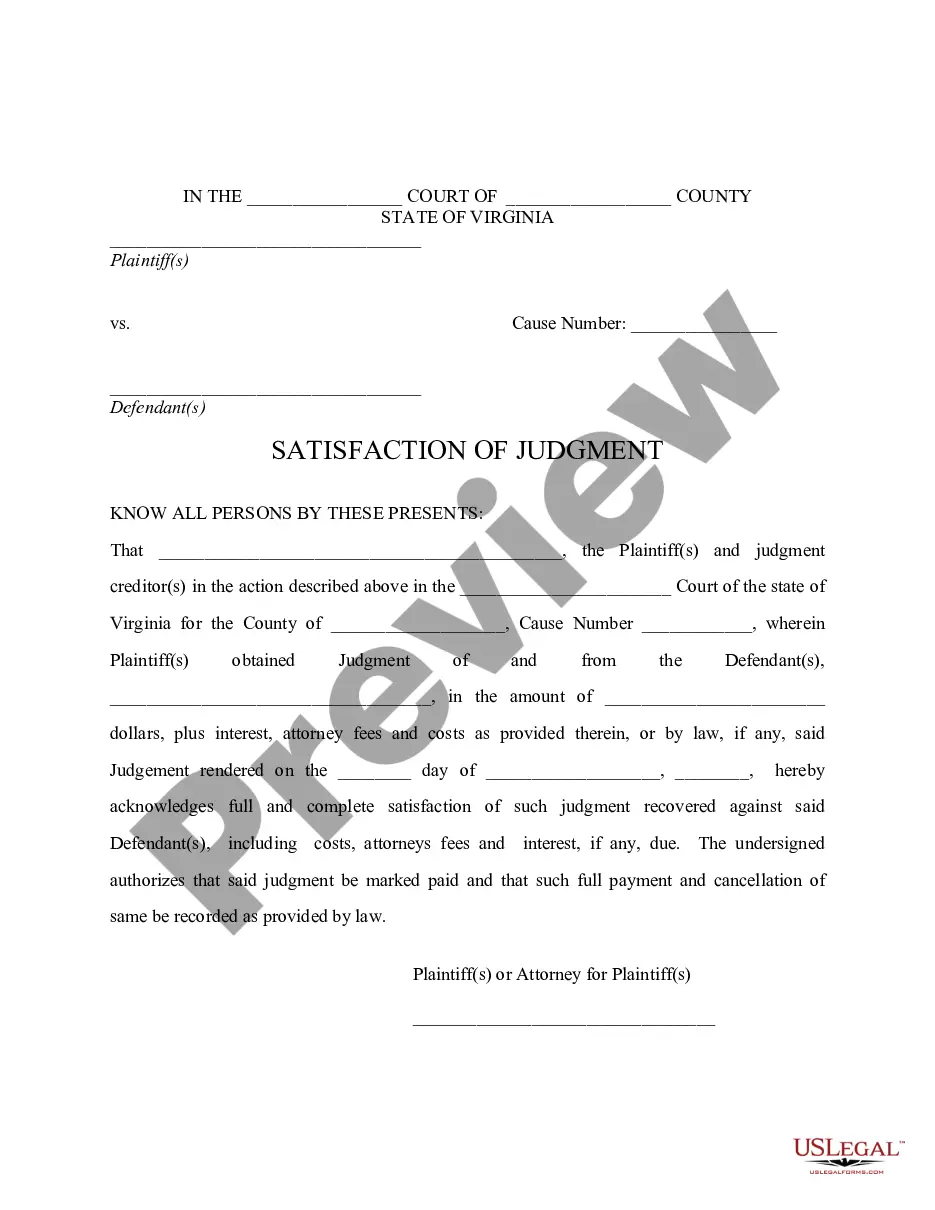

- Make use of the Preview button to examine the form.

- Browse the information to actually have selected the right form.

- If the form isn`t what you`re looking for, utilize the Research area to get the form that fits your needs and requirements.

- Whenever you get the right form, click Purchase now.

- Opt for the costs prepare you desire, submit the specified info to produce your money, and buy an order with your PayPal or credit card.

- Choose a handy document file format and download your duplicate.

Get all the record templates you have bought in the My Forms menu. You can get a extra duplicate of Montana Restructuring Agreement anytime, if necessary. Just click on the required form to download or print the record format.

Use US Legal Forms, by far the most considerable assortment of legal forms, to save time and steer clear of errors. The service provides professionally created legal record templates which can be used for a range of purposes. Make your account on US Legal Forms and begin generating your way of life easier.