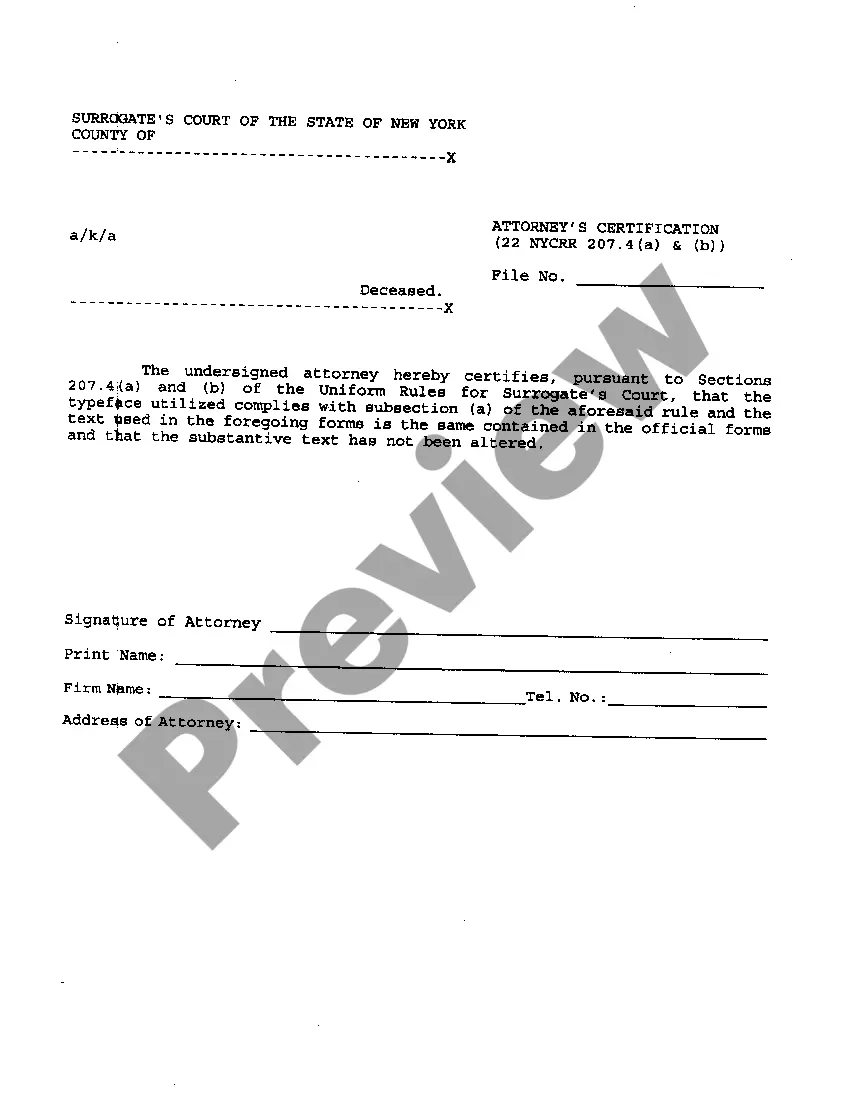

Montana Approval of option grant

Description

How to fill out Approval Of Option Grant?

US Legal Forms - one of several largest libraries of lawful forms in the USA - gives a wide array of lawful papers web templates you are able to acquire or produce. Utilizing the web site, you will get a huge number of forms for enterprise and individual purposes, categorized by categories, says, or key phrases.You can find the latest types of forms much like the Montana Approval of option grant within minutes.

If you already have a monthly subscription, log in and acquire Montana Approval of option grant from your US Legal Forms library. The Acquire switch can look on every develop you see. You have access to all formerly acquired forms inside the My Forms tab of your own account.

If you want to use US Legal Forms initially, listed here are easy directions to get you started off:

- Be sure you have chosen the right develop for the town/state. Select the Review switch to analyze the form`s articles. See the develop explanation to ensure that you have chosen the right develop.

- In case the develop does not fit your demands, use the Lookup discipline towards the top of the screen to get the one that does.

- When you are satisfied with the shape, affirm your selection by simply clicking the Acquire now switch. Then, select the rates strategy you want and give your qualifications to sign up for the account.

- Method the financial transaction. Use your Visa or Mastercard or PayPal account to finish the financial transaction.

- Choose the formatting and acquire the shape on the device.

- Make alterations. Fill up, edit and produce and indicator the acquired Montana Approval of option grant.

Each format you included with your money lacks an expiry particular date and it is your own property eternally. So, if you would like acquire or produce an additional duplicate, just visit the My Forms section and then click on the develop you will need.

Get access to the Montana Approval of option grant with US Legal Forms, one of the most extensive library of lawful papers web templates. Use a huge number of specialist and condition-particular web templates that meet up with your small business or individual requires and demands.

Form popularity

FAQ

Grants are an opportunity for non-profits, for-profit, and government agencies to obtain the funding they need to reach their goals and measurably impact the target sector they serve.

The U.S. Patent and Trademark Office (USPTO) is issuing electronic patent grants (eGrants) for all patents with an issue date on or after April 18, 2023. eGrants are available through Patent Center, the USPTO's electronic patent application filing and management system, which includes patent document viewing.

If you are awarded a grant, the next step is to use the money to improve your life. There are many different ways that you can do this, but some of the most common ways to use grant money include paying for education, starting a business, or making home improvements.

The FEMA eGrants system was developed to provide eligible Subapplicants and Applicants with the ability to manage their subapplication and application processes electronically. Specifically, eGrants is used to: Create pre-applications (when required) and submit them to Applicants.

A grant is ?free money? given to a recipient that meets certain criteria or uses the money to complete a specific task. A loan, however, is a sum of money that a recipient borrows from an individual or organization in exchange for future repayment plus interest.