Montana Key Employee Stock Option Award Agreement

Description

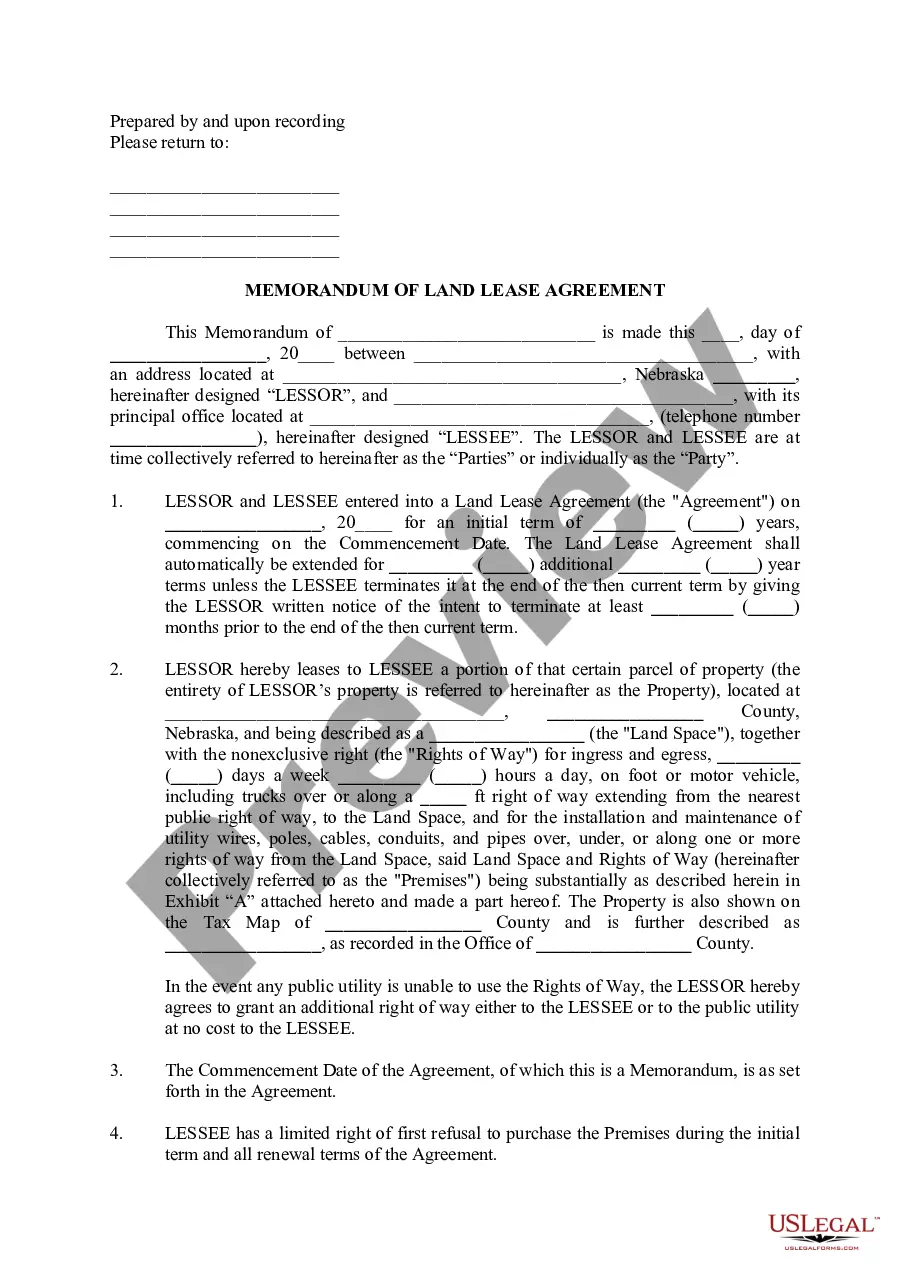

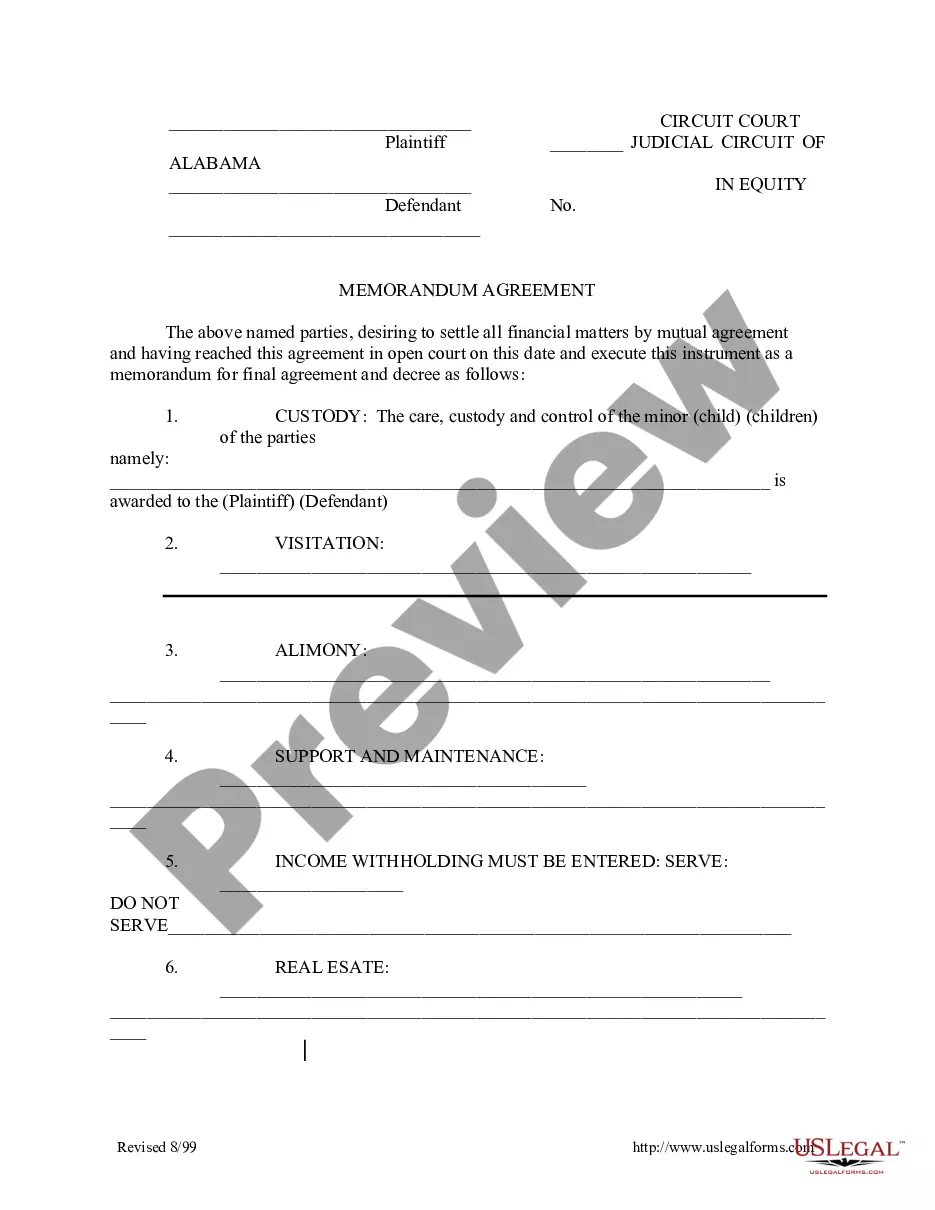

How to fill out Key Employee Stock Option Award Agreement?

Are you presently within a situation in which you need to have files for both company or person uses virtually every working day? There are tons of lawful file themes available on the net, but getting types you can rely isn`t easy. US Legal Forms delivers a large number of kind themes, much like the Montana Key Employee Stock Option Award Agreement, which can be written in order to meet federal and state needs.

In case you are previously familiar with US Legal Forms internet site and possess your account, merely log in. Next, you can acquire the Montana Key Employee Stock Option Award Agreement format.

Should you not come with an account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is to the right area/state.

- Make use of the Review switch to examine the form.

- See the information to ensure that you have selected the proper kind.

- In the event the kind isn`t what you`re seeking, make use of the Research industry to discover the kind that meets your needs and needs.

- When you obtain the right kind, click Acquire now.

- Opt for the prices program you want, complete the necessary info to make your account, and purchase the transaction utilizing your PayPal or bank card.

- Decide on a practical file format and acquire your copy.

Locate all the file themes you might have bought in the My Forms menus. You can obtain a additional copy of Montana Key Employee Stock Option Award Agreement any time, if needed. Just select the essential kind to acquire or produce the file format.

Use US Legal Forms, one of the most considerable assortment of lawful forms, in order to save some time and prevent blunders. The assistance delivers professionally produced lawful file themes that can be used for a variety of uses. Produce your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

If you quit, you could take the stock with you. *Note: If your contract includes a clawback, your company can take back your vested stock options when you leave the company. The agreement might require you to sell it back at the price you paid for it or at the FMV as of your termination.

At the time of your departure, you are generally allowed to exercise the vested portion of your stock option awards, and you will forfeit the unvested portion. If you are planning on leaving your job, you should review the details of your vesting schedule.

A stock option award is a type of compensation contract that companies use to incentivize employees. This contract is an agreement between the company and employee that gives them the right, but not the obligation, to purchase shares of company stock at a set price in the future (usually for pennies on the dollar).

The stock options plan is drafted by the company's board of directors and contains details of the grantee's rights. The options agreement will provide the key details of your option grant such as the vesting schedule, how the ESOs will vest, shares represented by the grant, and the strike price.

What Happens to My Stock Options After a Job Termination? While your plan should include an expiration date, generally, if you are terminated from the company, you must exercise your stock options before the stated expiration date.

At the time of your departure, you are generally allowed to exercise the vested portion of your stock option awards, and you will forfeit the unvested portion. If you are planning on leaving your job, you should review the details of your vesting schedule.

Once a company files for bankruptcy, they are no longer ?good for? the agreed-upon value, and the potential for Chapter 7 bankruptcy increases. Essentially, the company becomes illiquid. In this case, stock options are either suspended or lose all of their value. Thus, you'll be unable to sell off your shares.