Montana Employee Stock Purchase Plan (ESPN) is a program offered by companies to their employees in the state of Montana, allowing them to purchase company stocks at a discounted price. This plan serves as a valuable employee benefit, promoting a sense of ownership and involvement by providing employees with a mechanism to invest in their company's success. The Montana Employee Stock Purchase Plan operates by deducting a portion of an employee's paycheck, typically on an after-tax basis, to accumulate funds for purchasing company stocks. The accumulated funds are then used to buy stocks during predetermined offering periods or enrollment windows. The price at which employees can buy the stocks is usually at a discounted rate compared to the market price, providing an incentive for participation in the plan. The primary goal of the Montana Employee Stock Purchase Plan is to encourage long-term employee retention, loyalty, and engagement. By allowing employees to become co-owners of the company, the ESPN aligns their financial interests with those of the organization, fostering a sense of shared success. Furthermore, participating employees can gain financial benefits if the stocks' value increases over time, potentially accumulating wealth as the company grows. Montana's companies may offer different types of Employee Stock Purchase Plans, tailored to their specific needs and goals. Some common variations include: 1. Qualified ESPN: This type of plan meets strict regulatory requirements outlined by the Internal Revenue Service (IRS). It offers employees the opportunity to purchase company stocks at a discounted price without incurring additional tax liability at the time of purchase. 2. Non-Qualified ESPN: These plans do not meet the IRS's stringent guidelines for qualified status. While they still allow employees to purchase stocks at a discount, the difference from the market value is generally taxable as ordinary income. 3. Direct Stock Purchase Plan (DSP): Though not technically an ESPN, a DSP allows employees to buy company stocks directly from the company itself, bypassing brokers or traditional stock exchanges. Drops often provide discounted prices and may or may not offer payroll deductions. 4. Subscription Agreement Plan: In this type of plan, employees enter into an agreement to subscribe to a set number of company shares at predetermined terms and prices. 5. Reload ESPN: This plan allows employees to automatically replenish sold or transferred shares with newly purchased shares. It grants employees the ability to continuously participate in the plan without interruption. 6. Look back ESPN: With a look back provision, employees can purchase company stocks at a discount based on either the market price at the beginning or the end of the offering period, whichever is lower. This provision maximizes the potential discount for participating employees. Overall, Montana Employee Stock Purchase Plans are valuable tools that not only promote employee ownership and engagement but also provide an opportunity for employees to build wealth and participate in the financial success of their organization.

Montana Employee Stock Purchase Plan

Description

How to fill out Montana Employee Stock Purchase Plan?

Are you presently in a placement where you require papers for possibly business or specific reasons just about every time? There are plenty of legitimate document templates available online, but getting types you can rely on isn`t simple. US Legal Forms delivers a large number of kind templates, much like the Montana Employee Stock Purchase Plan, that are published to meet federal and state specifications.

When you are previously familiar with US Legal Forms site and also have your account, merely log in. After that, you are able to acquire the Montana Employee Stock Purchase Plan design.

If you do not offer an bank account and need to begin using US Legal Forms, adopt these measures:

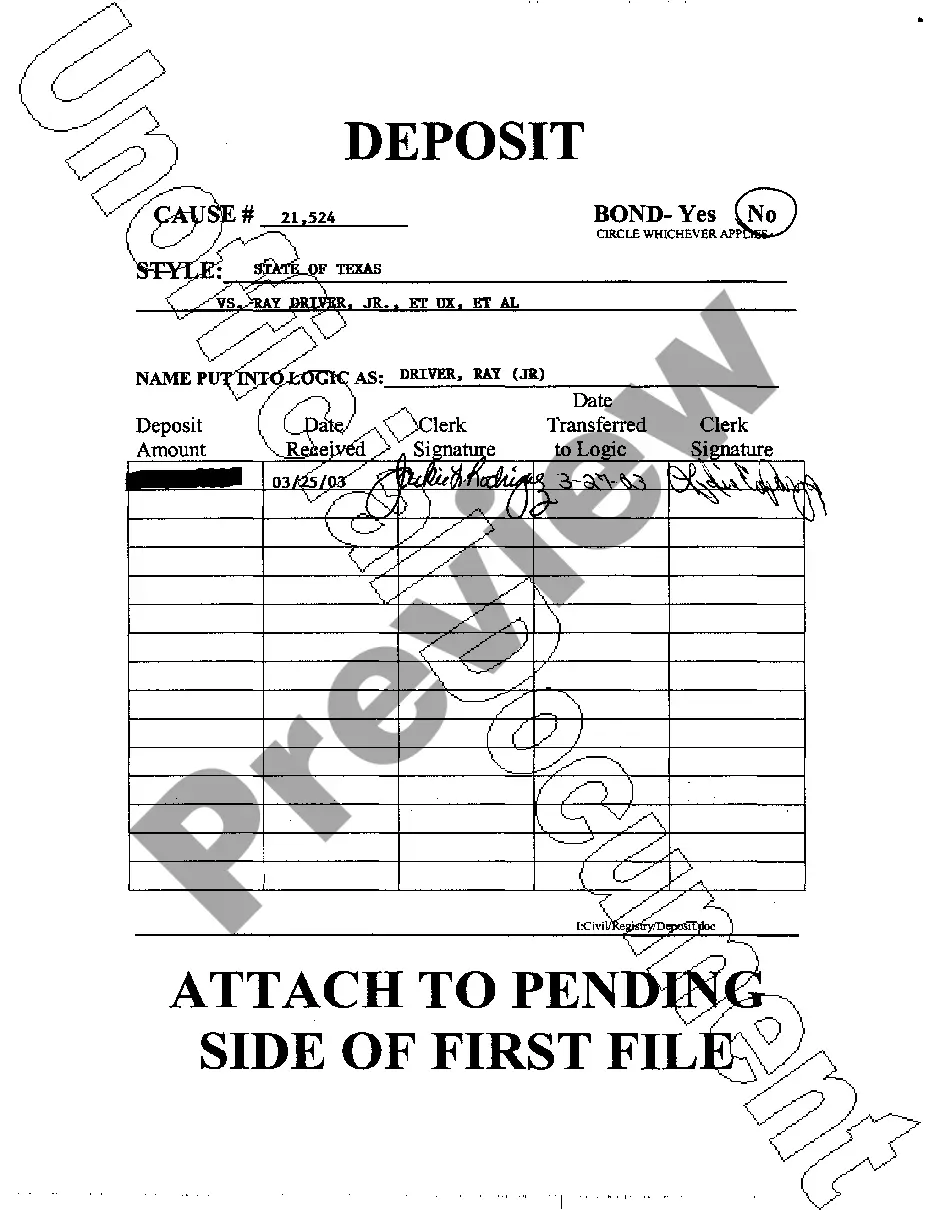

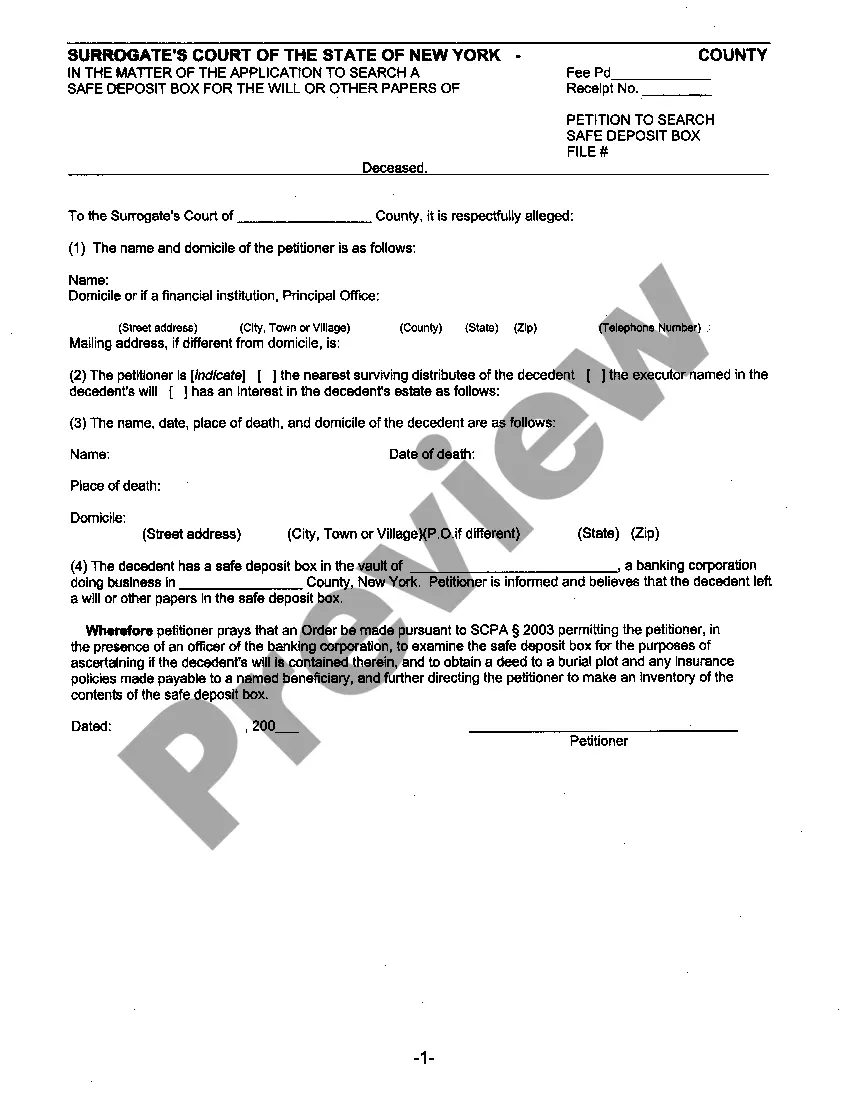

- Obtain the kind you will need and make sure it is for that correct metropolis/area.

- Utilize the Review key to check the form.

- Read the outline to actually have chosen the right kind.

- If the kind isn`t what you`re trying to find, make use of the Look for discipline to get the kind that meets your needs and specifications.

- Whenever you discover the correct kind, simply click Get now.

- Pick the prices plan you want, fill out the necessary details to produce your bank account, and buy the order using your PayPal or Visa or Mastercard.

- Choose a practical document structure and acquire your version.

Find all the document templates you possess purchased in the My Forms food list. You can obtain a more version of Montana Employee Stock Purchase Plan any time, if required. Just select the essential kind to acquire or printing the document design.

Use US Legal Forms, the most considerable assortment of legitimate forms, to conserve time and stay away from errors. The service delivers skillfully made legitimate document templates that can be used for a variety of reasons. Generate your account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

To qualify for a service retirement, you must meet the following age or service requirements: Age 60 with at least five years membership service; Attain age 65 while employed; regardless of years of membership service. 30 years of membership service at any age.

Member Contributions You contribute 7.9% of your compensation to your individual account. Your 7.9% contribution is calculated based on your gross compensation, before any pretax deductions. This means your contributions are made on a pre-tax basis and grow tax deferred until you withdraw the funds.

The Public Employee Retirement System (PERS) provides retirement, disability and death benefits to employees of the State of Montana, the Montana University System, local governments and school districts.

Both you and your employer will make regular contributions to your individual account. Effective July 1, 2023, total contributions to your individual account will be 16.63%.

There are basically two types of pensions: defined benefit plans and defined contribution plans. PERS is a defined benefit plan, which is a plan designed based on strength in numbers, automatic participation, and pooled risk so that members may receive a benefit for life at retirement.

Leave accelerator hours are added an employee's hours accumulated at the state, enabling some employees to meet the annual leave accrual threshold sooner. The chart below outlines annual leave accrual rates based on years of Montana public-sector service.

PERS is a defined benefit retirement system. The monthly benefit you receive upon retirement is based on your years of service and your highest average compensation. Benefits and contributions are set by law, and protected by the Montana Constitution and only the Legislature may change them.