Montana Proposal to adopt and approve management stock purchase plan

Description

How to fill out Proposal To Adopt And Approve Management Stock Purchase Plan?

If you need to complete, obtain, or printing lawful document web templates, use US Legal Forms, the biggest collection of lawful types, which can be found on the web. Make use of the site`s easy and hassle-free search to discover the papers you want. A variety of web templates for business and individual functions are sorted by categories and says, or keywords and phrases. Use US Legal Forms to discover the Montana Proposal to adopt and approve management stock purchase plan with a handful of click throughs.

Should you be currently a US Legal Forms client, log in to the accounts and click the Obtain key to have the Montana Proposal to adopt and approve management stock purchase plan. You may also accessibility types you previously acquired from the My Forms tab of your own accounts.

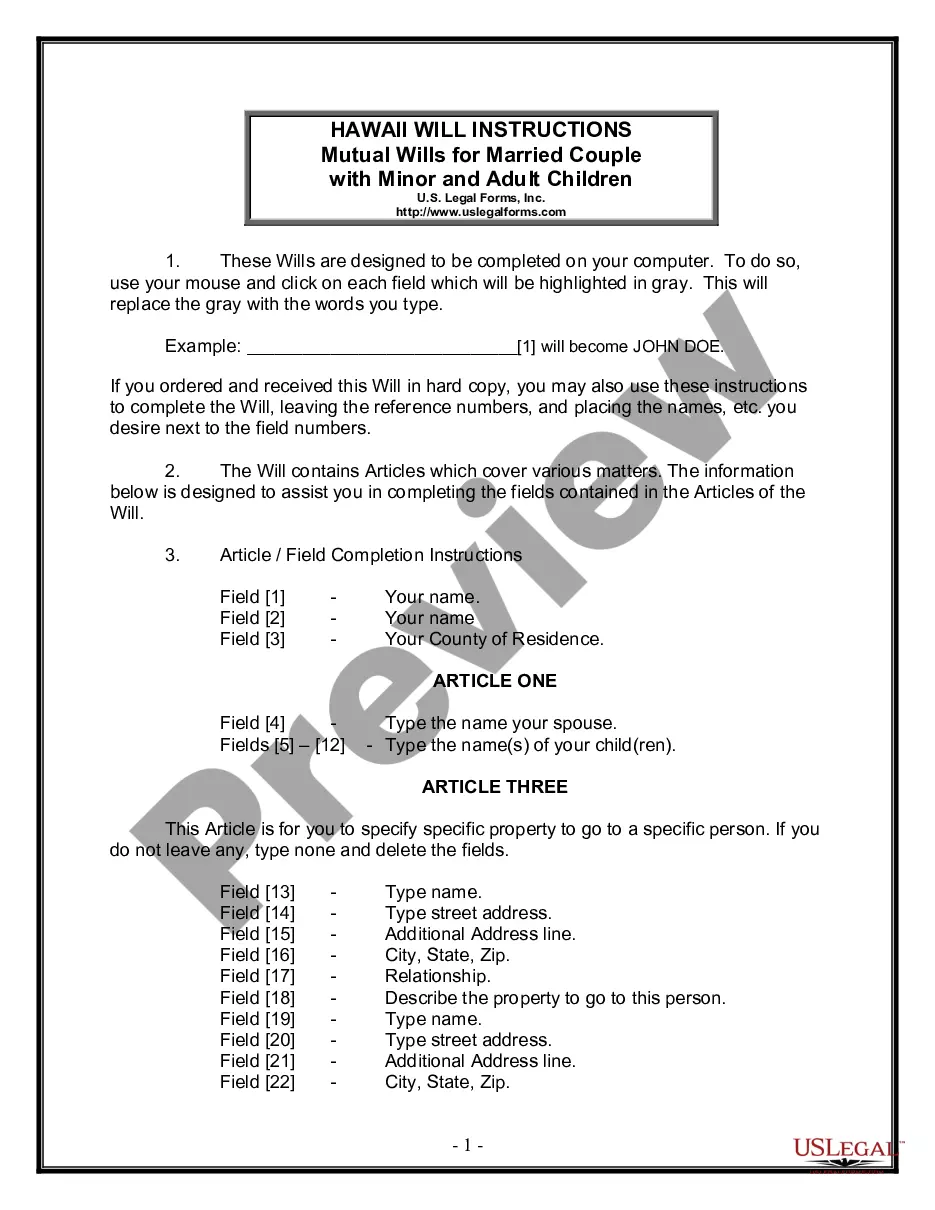

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for the correct metropolis/land.

- Step 2. Use the Preview solution to check out the form`s articles. Don`t forget about to see the description.

- Step 3. Should you be unsatisfied with all the develop, utilize the Search area towards the top of the display screen to find other models from the lawful develop format.

- Step 4. Once you have found the form you want, go through the Get now key. Pick the prices prepare you choose and add your references to register to have an accounts.

- Step 5. Approach the transaction. You should use your charge card or PayPal accounts to complete the transaction.

- Step 6. Find the formatting from the lawful develop and obtain it in your gadget.

- Step 7. Total, change and printing or sign the Montana Proposal to adopt and approve management stock purchase plan.

Every lawful document format you acquire is your own property for a long time. You have acces to every develop you acquired inside your acccount. Click on the My Forms segment and select a develop to printing or obtain once again.

Compete and obtain, and printing the Montana Proposal to adopt and approve management stock purchase plan with US Legal Forms. There are thousands of skilled and condition-particular types you can utilize for the business or individual needs.