Montana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

You can invest several hours on-line looking for the lawful document template that meets the federal and state specifications you want. US Legal Forms supplies a large number of lawful kinds that happen to be reviewed by pros. It is simple to acquire or print out the Montana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed from my services.

If you already have a US Legal Forms accounts, you may log in and then click the Obtain button. Following that, you may comprehensive, edit, print out, or sign the Montana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed. Each lawful document template you purchase is yours permanently. To get one more backup of any acquired form, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms site the first time, adhere to the basic instructions beneath:

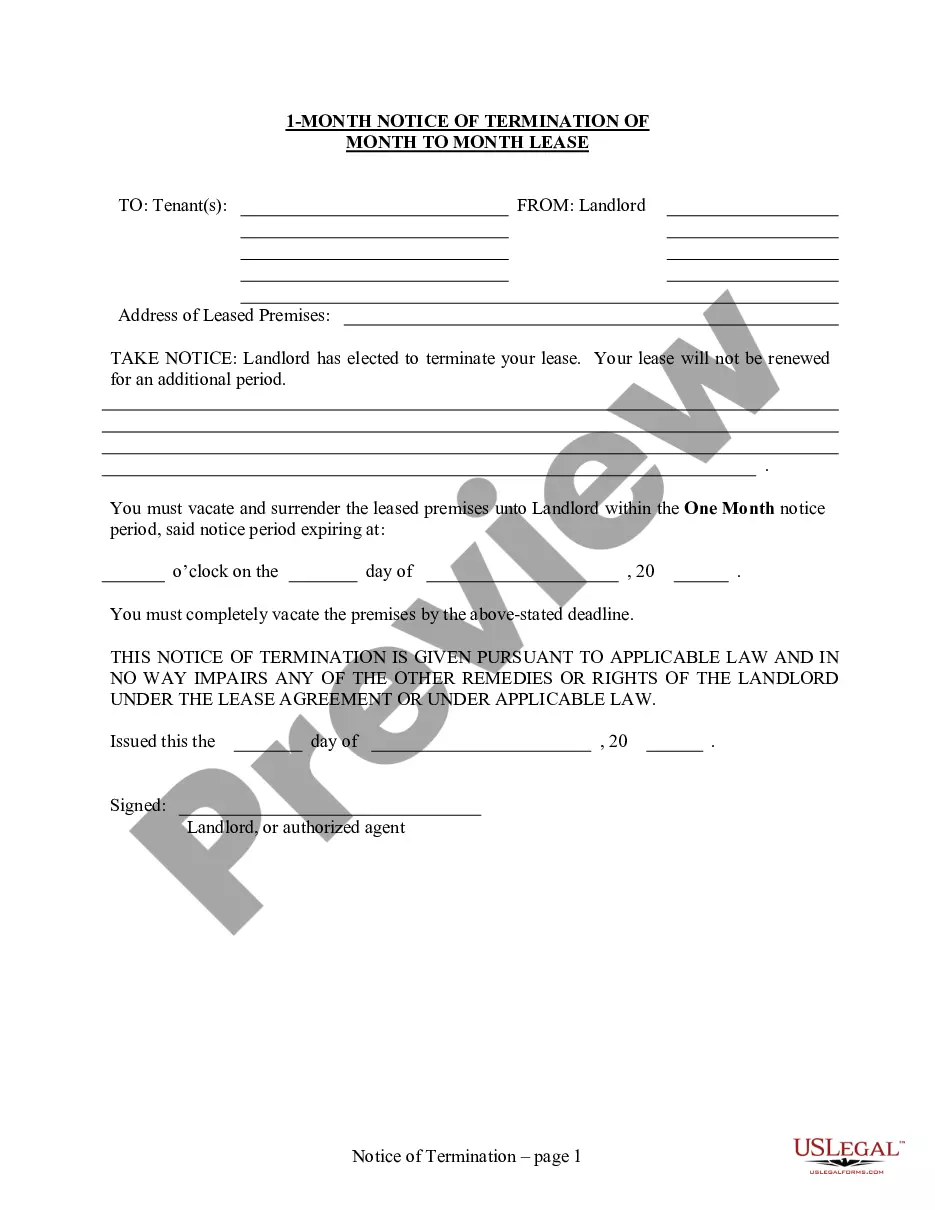

- Very first, be sure that you have selected the best document template for that county/city of your choosing. See the form description to ensure you have chosen the right form. If accessible, utilize the Review button to search with the document template at the same time.

- In order to discover one more model of the form, utilize the Look for area to obtain the template that meets your needs and specifications.

- Upon having discovered the template you would like, just click Buy now to proceed.

- Find the rates program you would like, enter your references, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal accounts to purchase the lawful form.

- Find the file format of the document and acquire it in your system.

- Make alterations in your document if necessary. You can comprehensive, edit and sign and print out Montana Employee Stock Ownership Plan of Franklin Savings Bank - Detailed.

Obtain and print out a large number of document templates using the US Legal Forms site, which provides the greatest assortment of lawful kinds. Use expert and status-particular templates to tackle your small business or person requirements.

Form popularity

FAQ

With an ESOP, the company is structured as a C or S corporation where the stock is held by an ESOP trust, which is administered by a trustee on employees' behalf.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

In a typical ESOP, a small number of executives typically select (or serve as) the trustee and compose the majority of the board of directors. The board oversees the management, which is responsible for choosing and overseeing employees.

How Do You Start an ESOP? To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for the ESOP to buy company shares, or both. The ESOP trust will own the stock and allocate shares to individual employee's accounts.