Montana Profit Sharing Plan

Description

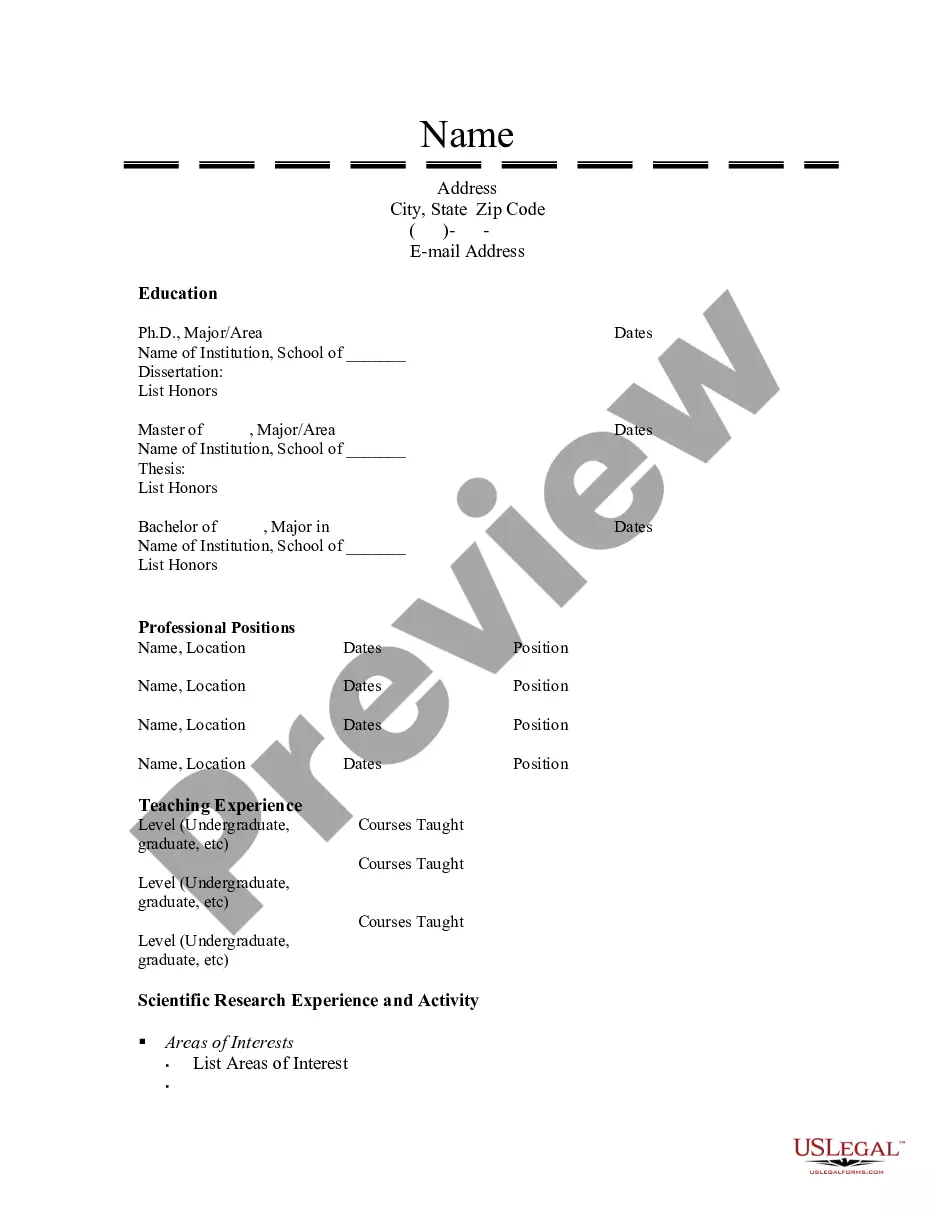

How to fill out Profit Sharing Plan?

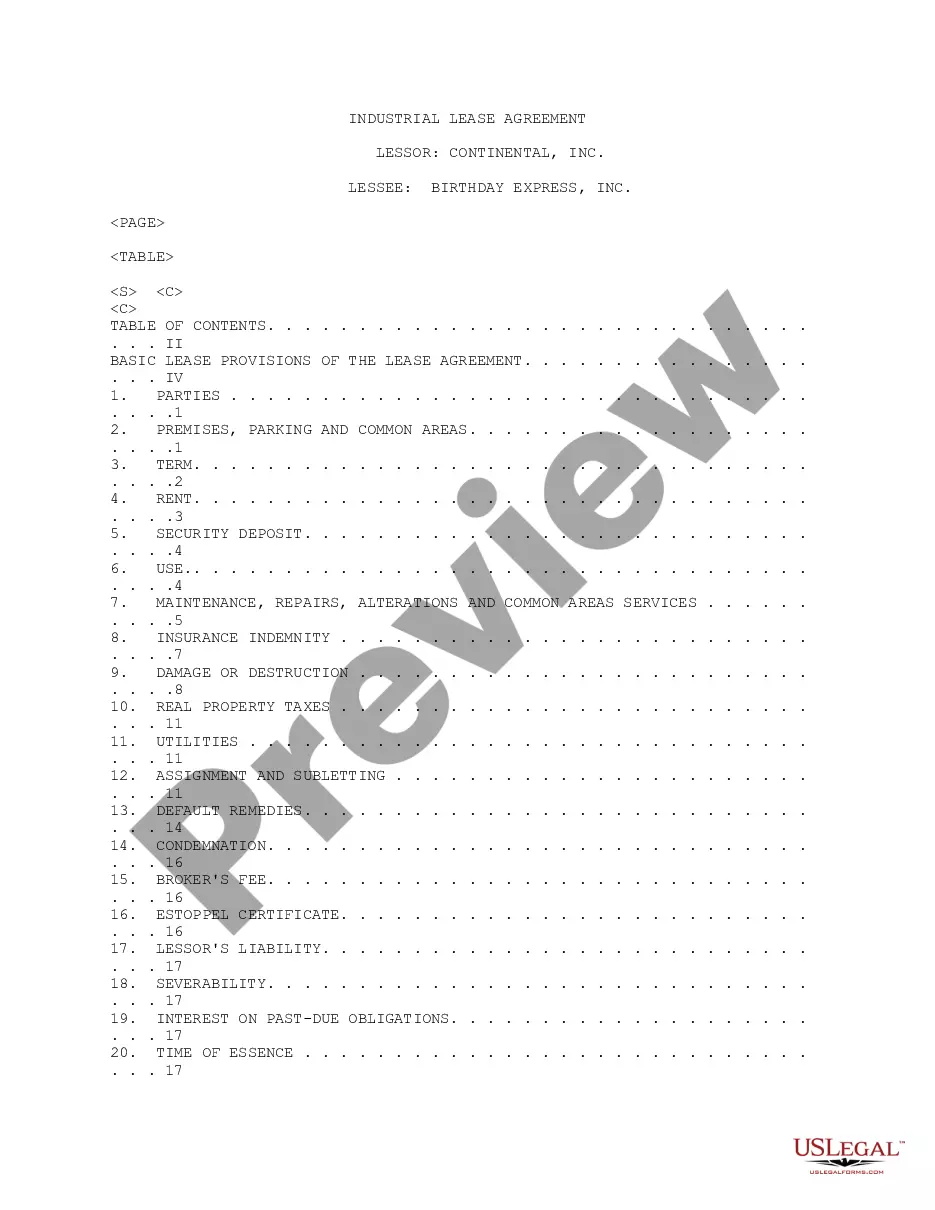

US Legal Forms - among the largest libraries of lawful varieties in America - delivers an array of lawful record layouts you may down load or produce. Utilizing the site, you will get 1000s of varieties for organization and personal functions, categorized by groups, says, or key phrases.You can get the newest variations of varieties much like the Montana Profit Sharing Plan within minutes.

If you have a registration, log in and down load Montana Profit Sharing Plan through the US Legal Forms collection. The Down load switch will appear on each type you view. You gain access to all previously delivered electronically varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, here are easy instructions to help you get began:

- Be sure to have selected the right type for your personal area/area. Click the Preview switch to examine the form`s content material. See the type information to actually have selected the correct type.

- In the event the type does not suit your demands, make use of the Look for industry at the top of the screen to get the one that does.

- If you are content with the shape, validate your option by clicking the Get now switch. Then, opt for the prices plan you want and offer your accreditations to register for the profile.

- Procedure the financial transaction. Use your charge card or PayPal profile to accomplish the financial transaction.

- Select the structure and down load the shape on your gadget.

- Make modifications. Fill out, modify and produce and indication the delivered electronically Montana Profit Sharing Plan.

Every single web template you added to your account does not have an expiration date which is yours eternally. So, if you wish to down load or produce yet another backup, just proceed to the My Forms portion and click on about the type you want.

Gain access to the Montana Profit Sharing Plan with US Legal Forms, one of the most substantial collection of lawful record layouts. Use 1000s of expert and condition-certain layouts that satisfy your company or personal requirements and demands.

Form popularity

FAQ

Learn the Facts About Refunding Once we process your application, you can typically expect to receive your refund within 30 to 45 days.

Montana is classed as a moderately tax-friendly state for retirees. Provided you are savvy with your spending, you can have a great retirement in this state. However, the state taxes most forms of retirement income and a portion of Social Security income if it exceeds a specific income level.

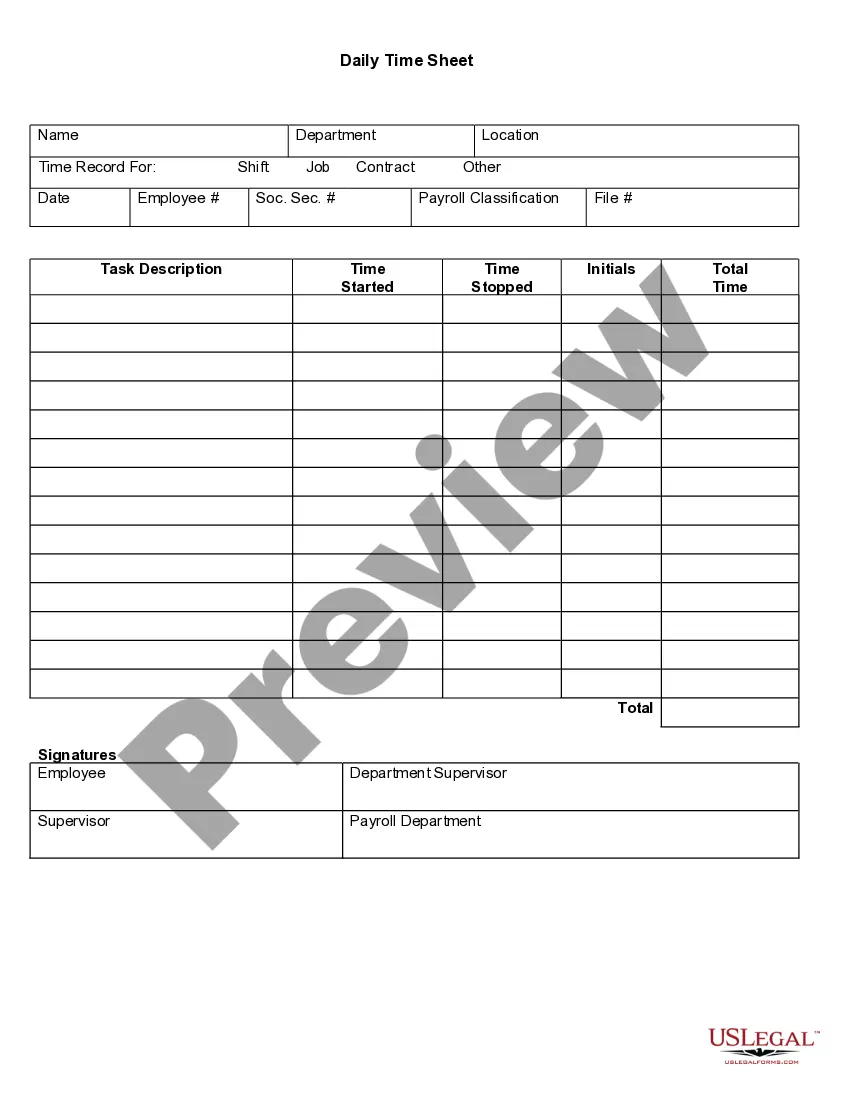

Both you and your employer will make regular contributions to your individual account. Effective July 1, 2023, total contributions to your individual account will be 16.63%.

To qualify for a service retirement, you must meet the following age or service requirements: Age 60 with at least five years membership service; Attain age 65 while employed; regardless of years of membership service. 30 years of membership service at any age.

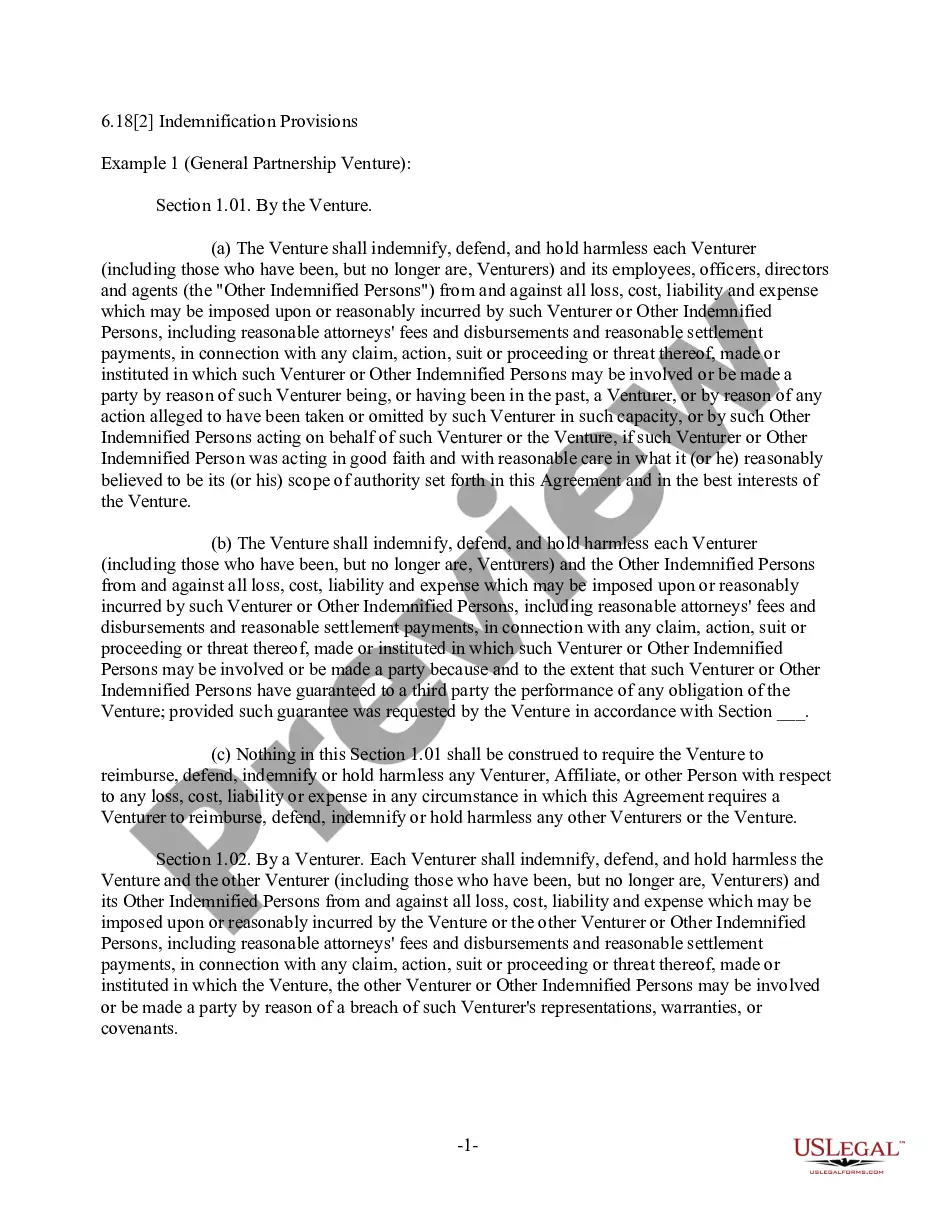

PERS is a defined benefit retirement system. The monthly benefit you receive upon retirement is based on your years of service and your highest average compensation. Benefits and contributions are set by law, and protected by the Montana Constitution and only the Legislature may change them.

Member Contributions You contribute 7.9% of your compensation to your individual account. Your 7.9% contribution is calculated based on your gross compensation, before any pretax deductions. This means your contributions are made on a pre-tax basis and grow tax deferred until you withdraw the funds.

If you have additional questions, please contact MPERA call 1-877-275-7372 or 406-444-3154.