Montana Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

You can spend several hours online attempting to find the legitimate record template that suits the state and federal needs you will need. US Legal Forms provides 1000s of legitimate types which are analyzed by experts. You can actually acquire or print the Montana Split-Dollar Life Insurance from my service.

If you have a US Legal Forms account, you can log in and click the Acquire option. After that, you can full, change, print, or sign the Montana Split-Dollar Life Insurance. Every legitimate record template you acquire is your own property eternally. To have one more backup for any obtained form, proceed to the My Forms tab and click the related option.

If you work with the US Legal Forms web site for the first time, adhere to the simple instructions beneath:

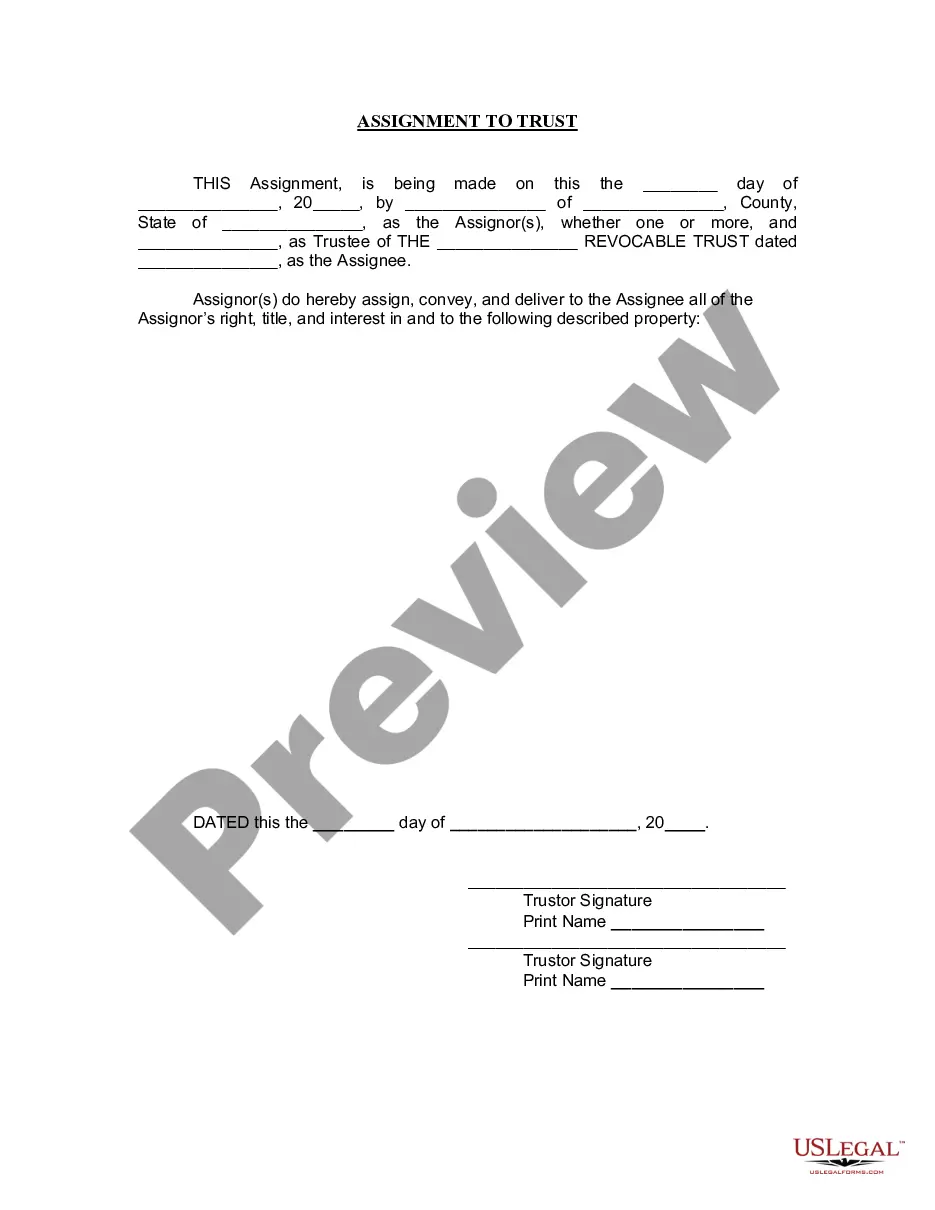

- Initial, make certain you have selected the proper record template to the region/metropolis of your choice. See the form explanation to ensure you have picked out the proper form. If accessible, make use of the Review option to check through the record template too.

- If you wish to discover one more variation from the form, make use of the Look for discipline to get the template that suits you and needs.

- When you have located the template you need, click on Get now to continue.

- Pick the prices strategy you need, type your references, and sign up for a free account on US Legal Forms.

- Total the transaction. You can utilize your bank card or PayPal account to cover the legitimate form.

- Pick the structure from the record and acquire it to your system.

- Make changes to your record if required. You can full, change and sign and print Montana Split-Dollar Life Insurance.

Acquire and print 1000s of record web templates utilizing the US Legal Forms web site, which provides the greatest variety of legitimate types. Use skilled and status-certain web templates to handle your company or individual needs.

Form popularity

FAQ

With a classic split-dollar plan, the employer pays some of the premium (the part that is equal to cash value), while the employee pays the rest. If the employees dies, or the plan is terminated, the surrender cash value is paid to the company, and the death benefits are paid out to beneficiaries.

The best way is to contact the policy's issuer (the life insurance company). Their records are key: even if you see your name listed on an old policy document, the deceased may have changed their beneficiaries (or the allocation of benefits among those beneficiaries) after that document was printed.

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a life insurance policy. Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

Employers are responsible for making split-dollar life insurance premiums, regardless of the plan's type. However, it is important to note that under loan arrangements, employees must repay the premiums via collateral assignments made to their employer.

?Economic benefit? refers to how the IRS treats this type of split-dollar insurance agreement. It means your employer is giving you some benefit but not a loan. That means you'll be taxed on the value of the life insurance provided, and that value is determined by the IRS or the insurance company.