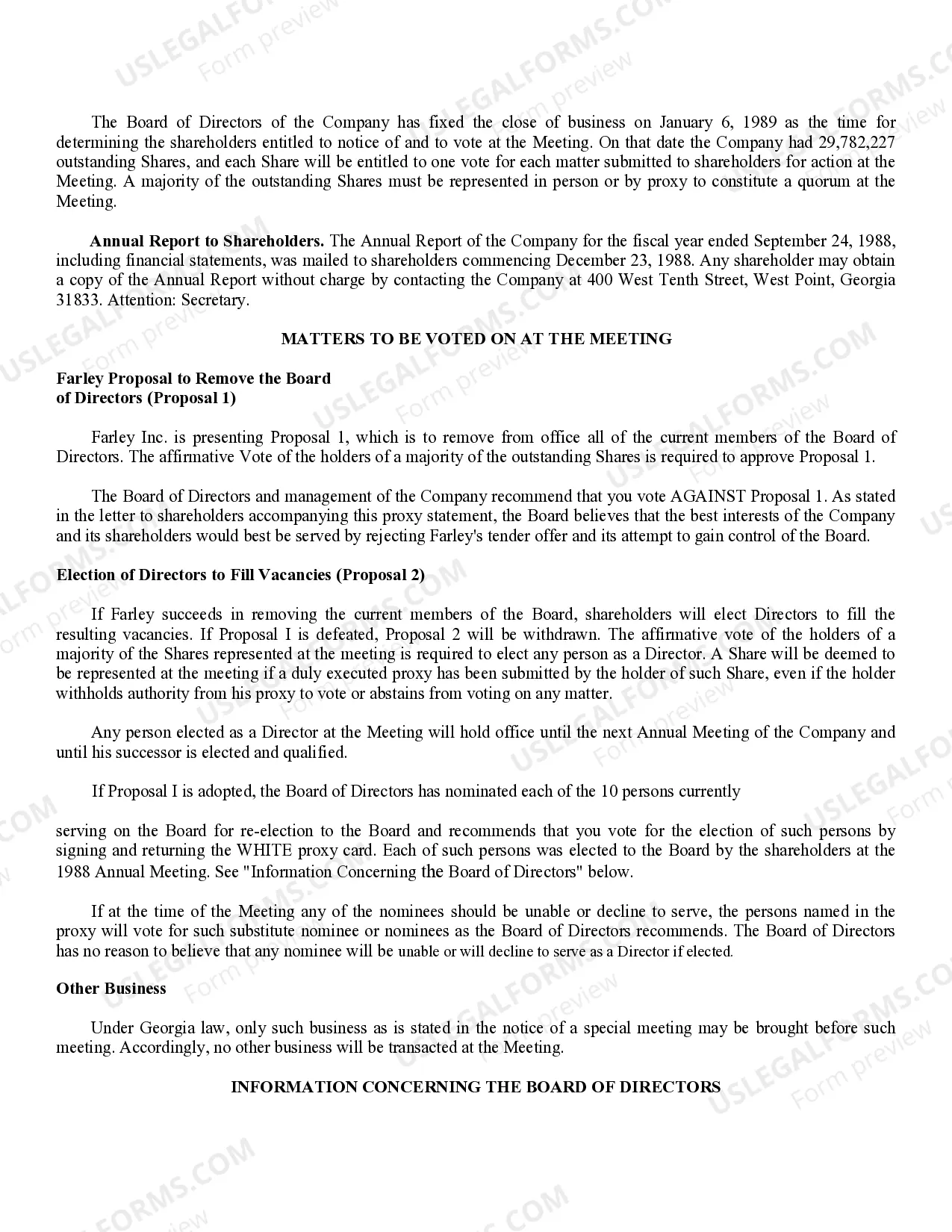

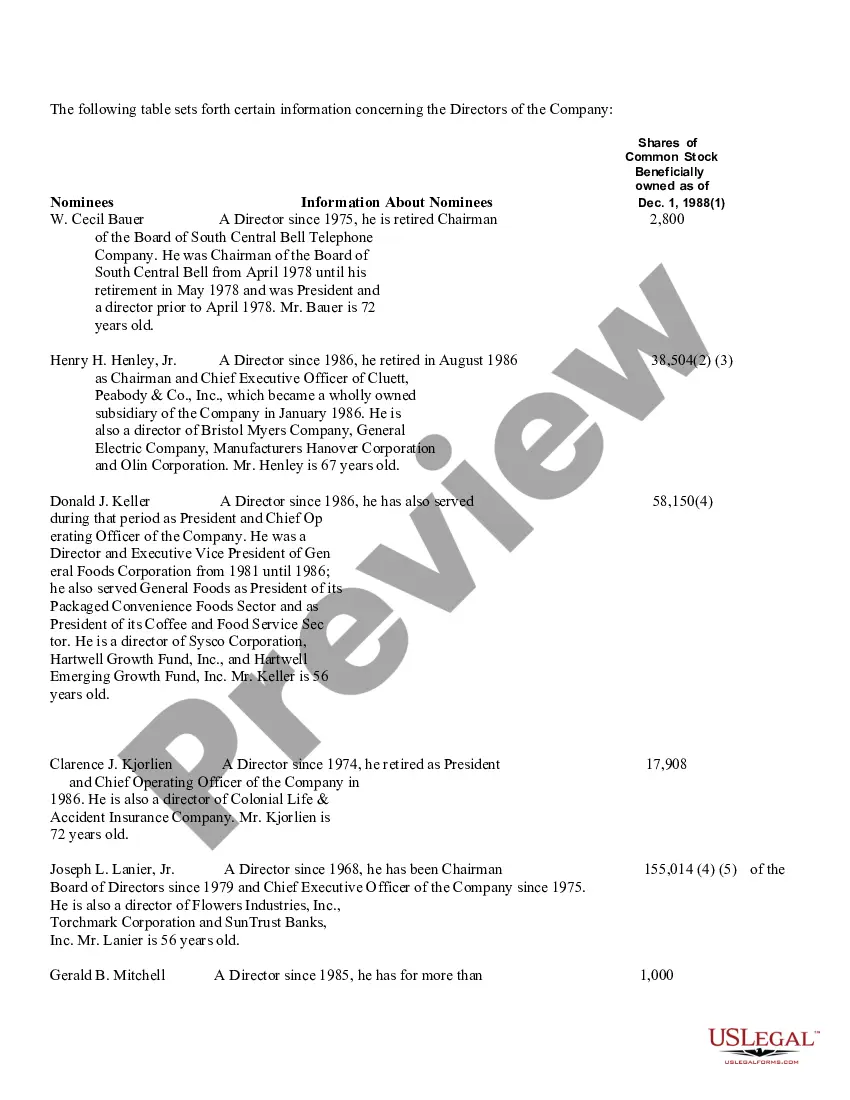

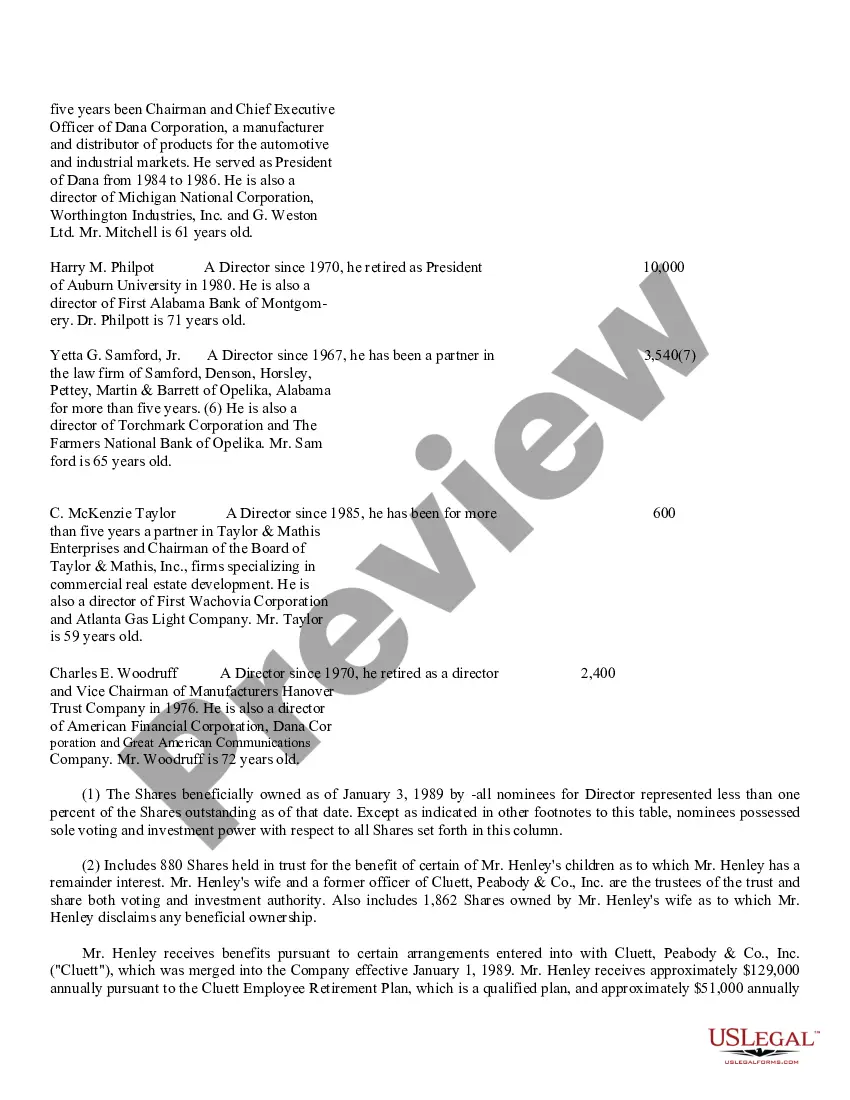

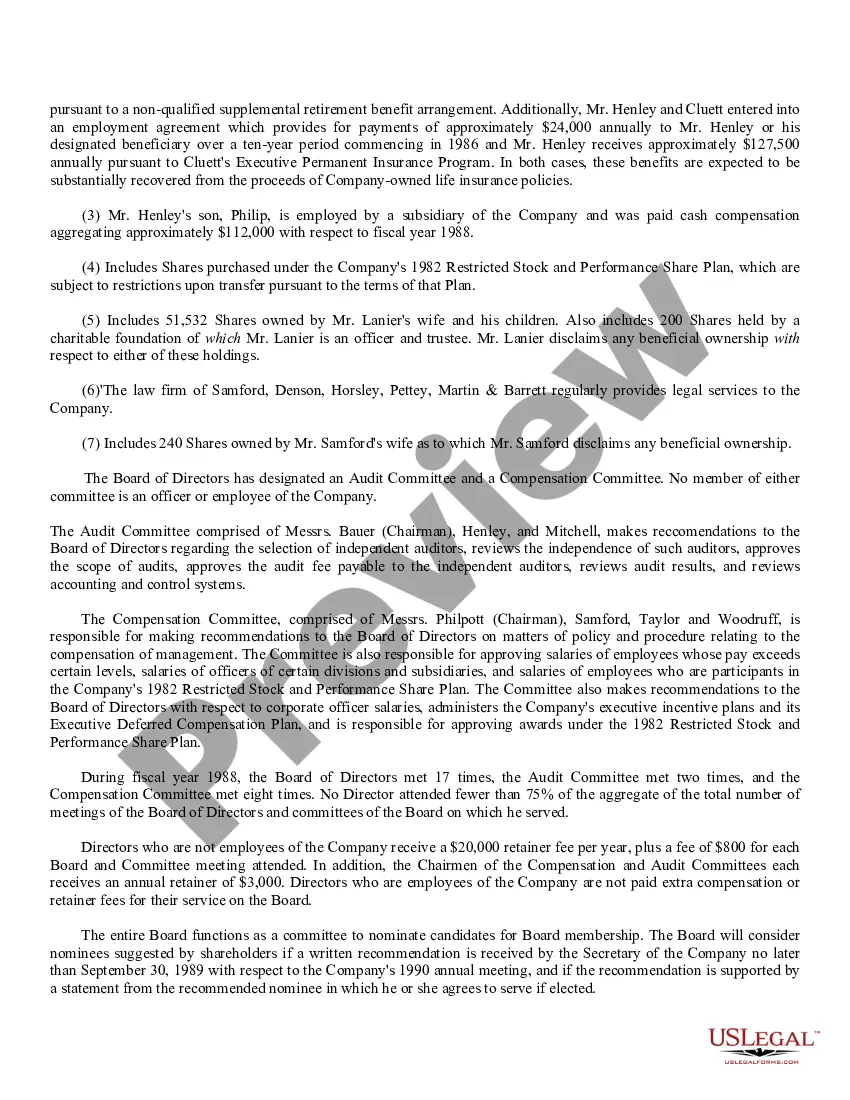

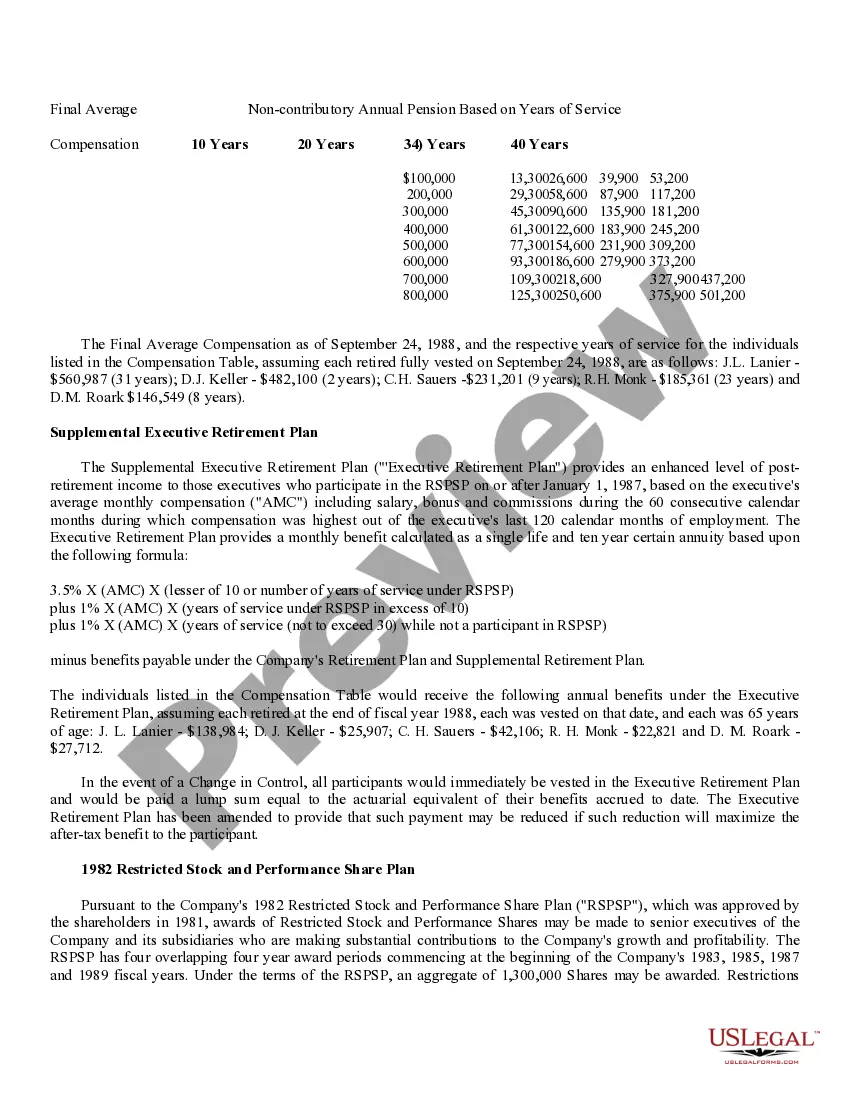

Montana Proxy Statement with Appendices of West Point-Pepperell, Inc. A Montana Proxy Statement with appendices of West Point-Pepperell, Inc. provides a comprehensive overview of the company's proxy voting process and related information. This statement is a crucial document for shareholders and investors, as it covers important details about corporate governance, ownership structure, and executive compensation. The Montana Proxy Statement consists of several sections, each providing valuable insights into the operations and decision-making processes within West Point-Pepperell, Inc. Some key sections and appendices commonly included in different types of Montana Proxy Statements are: 1. Proxy Voting Process: This section outlines the mechanisms and procedures through which shareholders can cast their votes. It explains the various methods available, such as voting in person, by mail, or online, and provides instructions on how to appoint a proxy to vote on their behalf. 2. Board Structure and Composition: In this section, the statement details the composition of the board of directors, including the names, backgrounds, and qualifications of individual board members. It may also provide insights into the board's committees and their functions, such as audit, compensation, and governance. 3. Executive Compensation: This section discloses the remuneration packages and benefits awarded to the company's top executives, including the CEO and other key management personnel. It typically includes detailed information about salaries, bonuses, stock options, and other forms of compensation. 4. Shareholder Proposals: This part outlines any proposals raised by shareholders and provides information on how these proposals will be considered during the annual general meeting. It explains the procedures for voting on these proposals, including any limitations or specific requirements. 5. Related Party Transactions: This section highlights any significant transactions or relationships between the company and its directors, executives, or other related parties. The statement discloses the nature and extent of these transactions, ensuring transparency and preventing potential conflicts of interest. Different types of Montana Proxy Statements with appendices of West Point-Pepperell, Inc. may include variations in the level of detail or specific sections covered. However, the core purpose remains the same — to provide shareholders with relevant information to make informed decisions during the proxy voting process. In conclusion, a Montana Proxy Statement with appendices of West Point-Pepperell, Inc. serves as a vital communication tool between the company and its shareholders. It aims to empower shareholders by offering access to crucial information related to corporate governance, executive compensation, and the voting process. By studying this document, investors can gain valuable insights into the company's operations, enabling them to make well-informed decisions that align with their own interests.

Montana Proxy Statement with Appendices of West Point-Pepperell, Inc. A Montana Proxy Statement with appendices of West Point-Pepperell, Inc. provides a comprehensive overview of the company's proxy voting process and related information. This statement is a crucial document for shareholders and investors, as it covers important details about corporate governance, ownership structure, and executive compensation. The Montana Proxy Statement consists of several sections, each providing valuable insights into the operations and decision-making processes within West Point-Pepperell, Inc. Some key sections and appendices commonly included in different types of Montana Proxy Statements are: 1. Proxy Voting Process: This section outlines the mechanisms and procedures through which shareholders can cast their votes. It explains the various methods available, such as voting in person, by mail, or online, and provides instructions on how to appoint a proxy to vote on their behalf. 2. Board Structure and Composition: In this section, the statement details the composition of the board of directors, including the names, backgrounds, and qualifications of individual board members. It may also provide insights into the board's committees and their functions, such as audit, compensation, and governance. 3. Executive Compensation: This section discloses the remuneration packages and benefits awarded to the company's top executives, including the CEO and other key management personnel. It typically includes detailed information about salaries, bonuses, stock options, and other forms of compensation. 4. Shareholder Proposals: This part outlines any proposals raised by shareholders and provides information on how these proposals will be considered during the annual general meeting. It explains the procedures for voting on these proposals, including any limitations or specific requirements. 5. Related Party Transactions: This section highlights any significant transactions or relationships between the company and its directors, executives, or other related parties. The statement discloses the nature and extent of these transactions, ensuring transparency and preventing potential conflicts of interest. Different types of Montana Proxy Statements with appendices of West Point-Pepperell, Inc. may include variations in the level of detail or specific sections covered. However, the core purpose remains the same — to provide shareholders with relevant information to make informed decisions during the proxy voting process. In conclusion, a Montana Proxy Statement with appendices of West Point-Pepperell, Inc. serves as a vital communication tool between the company and its shareholders. It aims to empower shareholders by offering access to crucial information related to corporate governance, executive compensation, and the voting process. By studying this document, investors can gain valuable insights into the company's operations, enabling them to make well-informed decisions that align with their own interests.