Montana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

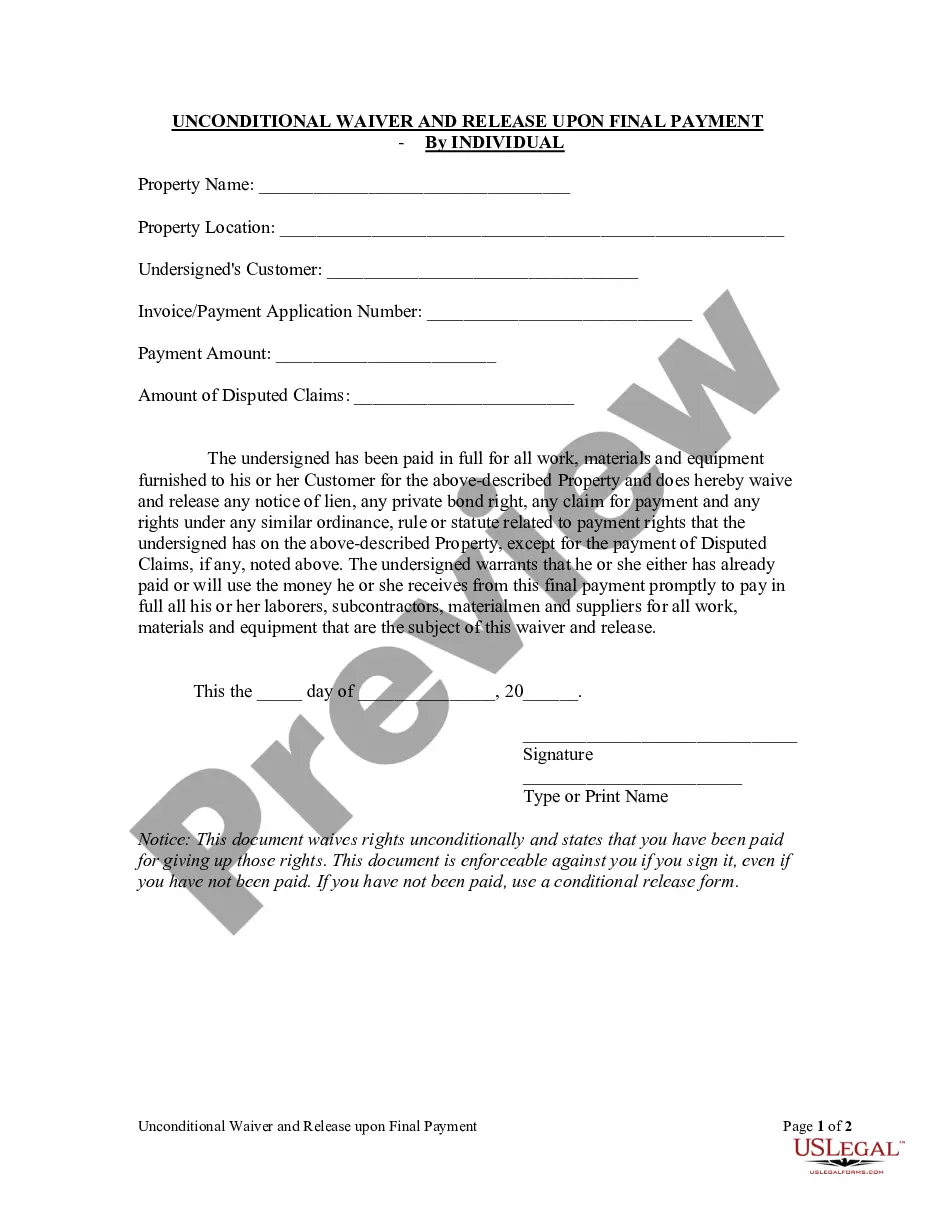

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

You are able to spend hrs on the web looking for the legal record template which fits the state and federal specifications you will need. US Legal Forms gives a large number of legal types which are analyzed by professionals. It is simple to download or print out the Montana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock from our support.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Obtain key. Next, it is possible to full, edit, print out, or indicator the Montana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Every single legal record template you get is your own for a long time. To acquire another version of the acquired kind, proceed to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms site the very first time, follow the easy recommendations listed below:

- Very first, make sure that you have chosen the right record template for that area/metropolis of your choosing. Browse the kind description to ensure you have picked the proper kind. If available, use the Preview key to check throughout the record template at the same time.

- If you want to find another model of your kind, use the Lookup field to discover the template that meets your requirements and specifications.

- After you have identified the template you want, click Buy now to continue.

- Choose the pricing plan you want, type your credentials, and register for a merchant account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal accounts to cover the legal kind.

- Choose the format of your record and download it to your gadget.

- Make modifications to your record if possible. You are able to full, edit and indicator and print out Montana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

Obtain and print out a large number of record templates utilizing the US Legal Forms website, which offers the greatest selection of legal types. Use specialist and condition-specific templates to handle your small business or person requirements.

Form popularity

FAQ

To amend your LLC in Montana, there is a $15 filing fee required. You may request one-hour expedited service for an additional $100, or one day processing for an additional $20.

To amend the Articles of Organization of your Montana LLC, you will have to submit a completed Articles of Amendment for Domestic Limited Liability Company to the Secretary of State. You can file the proper form by mail, fax, or in person. You also need to include the $15 filing fee.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To make amendments to your Montana Corporation, you submit the completed Articles of Amendment for Profit Corporation form to the Secretary of State by mail, fax or in person, along with the filing fee.

You can easily change your Montana LLC name. The first step is to file a form called the Articles of Amendment with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Montana. The filing fee for the Articles of Amendment in Montana is $15.