Montana Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

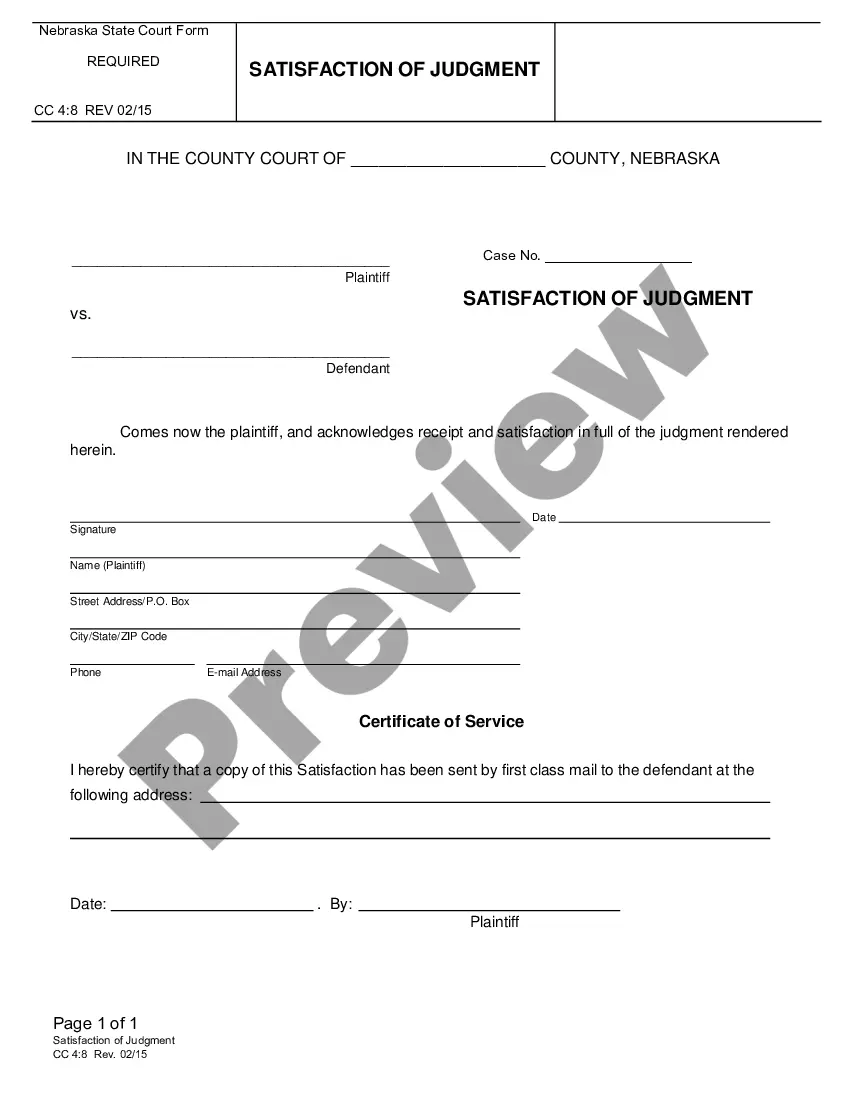

How to fill out Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

US Legal Forms - one of the most significant libraries of lawful varieties in America - provides a wide array of lawful record web templates you are able to down load or print out. While using web site, you will get a large number of varieties for company and specific reasons, sorted by categories, suggests, or keywords and phrases.You will discover the newest variations of varieties like the Montana Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. in seconds.

If you already possess a membership, log in and down load Montana Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. through the US Legal Forms catalogue. The Down load switch can look on each and every type you see. You have access to all formerly downloaded varieties inside the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, listed here are simple recommendations to help you get started off:

- Ensure you have picked out the right type to your town/area. Click on the Preview switch to review the form`s content. Browse the type outline to ensure that you have selected the right type.

- In case the type does not match your specifications, take advantage of the Research discipline at the top of the screen to obtain the the one that does.

- In case you are pleased with the form, verify your decision by simply clicking the Get now switch. Then, select the rates prepare you favor and offer your references to register on an profile.

- Procedure the deal. Make use of charge card or PayPal profile to perform the deal.

- Select the formatting and down load the form on your own product.

- Make adjustments. Complete, change and print out and signal the downloaded Montana Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co..

Each design you put into your money lacks an expiration particular date which is your own property eternally. So, in order to down load or print out one more version, just visit the My Forms portion and click on the type you need.

Get access to the Montana Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. with US Legal Forms, the most substantial catalogue of lawful record web templates. Use a large number of specialist and status-specific web templates that satisfy your small business or specific needs and specifications.

Form popularity

FAQ

In a merger, two separate legal entities come together to form a new joint legal entity. In an acquisition, one company (the acquirer) buys another company (the target) and takes control of its assets and operations.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

Public company mergers require filing a variety of public disclosure documents. In the United States, the companies make public filings of these materials with the Securities and Exchange Commission (SEC).

Every M&A transaction involves at least one purchaser, or buyer, the party that will be making the acquisition. This is the person (i.e., individual or company) that signs the purchase agreement, pays the purchase price and which, after closing, directly or indirectly, owns or controls the target company or its assets.

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

?parties? means Parent, Merger Sub and the Company.

A public seller will file the merger proxy with the SEC usually several weeks after a deal announcement. You'll first see something called a PREM14A, followed by a DEFM14A several days later. The first is the preliminary proxy, the second is the definitive proxy (or final proxy).

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).