Montana Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

US Legal Forms - one of the greatest libraries of lawful varieties in the States - provides a variety of lawful record layouts it is possible to acquire or produce. Utilizing the website, you may get a large number of varieties for business and person reasons, categorized by types, claims, or search phrases.You will find the most recent types of varieties much like the Montana Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank in seconds.

If you have a membership, log in and acquire Montana Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank through the US Legal Forms local library. The Acquire key will show up on each and every kind you see. You have accessibility to all earlier downloaded varieties inside the My Forms tab of your bank account.

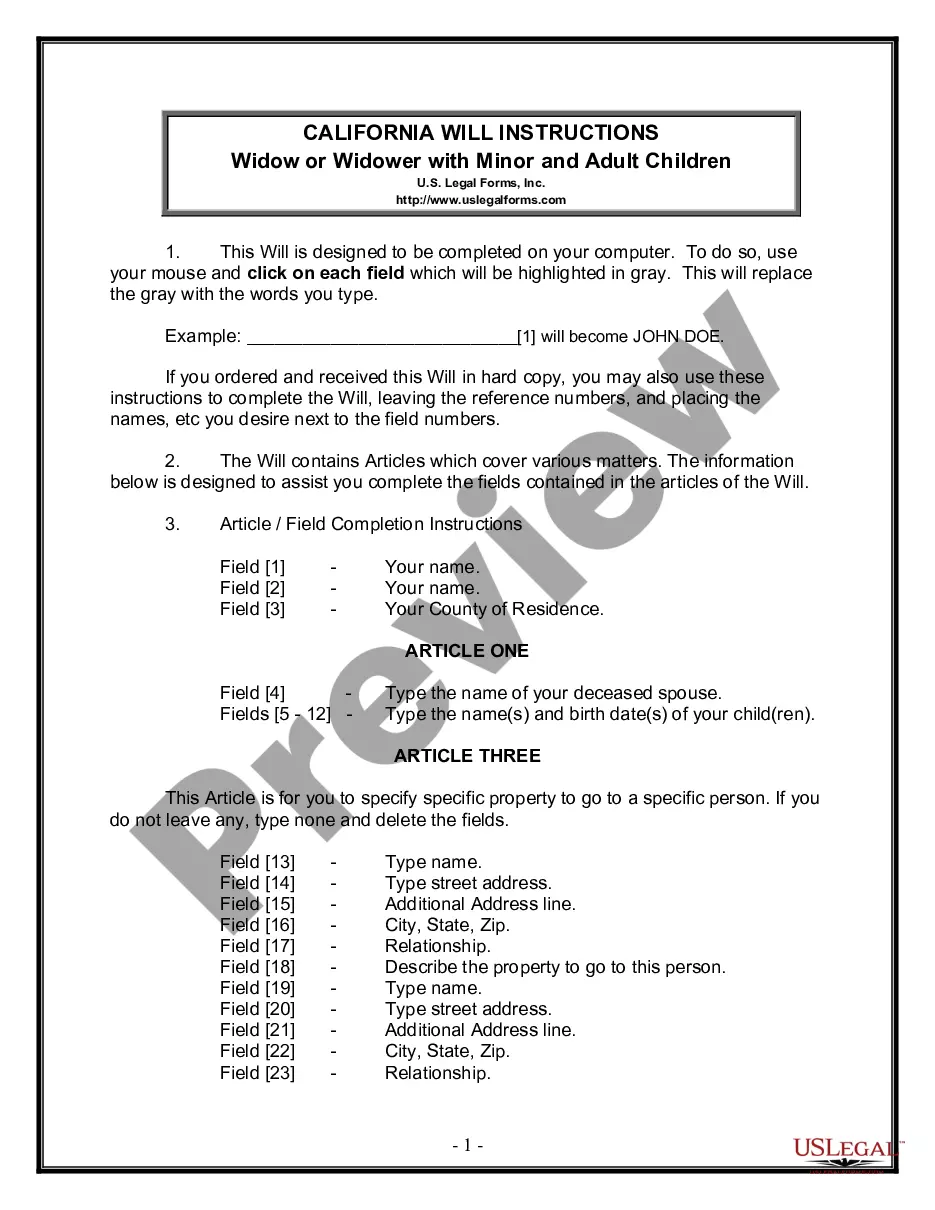

If you want to use US Legal Forms the first time, here are basic directions to help you get started out:

- Make sure you have chosen the correct kind for your personal metropolis/area. Click on the Review key to examine the form`s content. Browse the kind outline to actually have selected the proper kind.

- In the event the kind does not suit your demands, take advantage of the Look for industry towards the top of the display screen to find the one that does.

- In case you are satisfied with the form, verify your choice by clicking the Acquire now key. Then, select the pricing strategy you like and provide your qualifications to register for the bank account.

- Process the purchase. Make use of your bank card or PayPal bank account to finish the purchase.

- Choose the structure and acquire the form on the device.

- Make changes. Load, change and produce and signal the downloaded Montana Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank.

Every template you included in your money lacks an expiration particular date and is also yours eternally. So, in order to acquire or produce another backup, just go to the My Forms segment and then click on the kind you want.

Gain access to the Montana Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank with US Legal Forms, by far the most considerable local library of lawful record layouts. Use a large number of skilled and express-specific layouts that fulfill your small business or person requires and demands.