Montana Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Proxy Statement - University National Bank And Trust Co.?

Are you currently inside a place that you need papers for both business or specific functions just about every day time? There are plenty of legitimate document themes available on the net, but finding ones you can rely on is not effortless. US Legal Forms offers a huge number of develop themes, just like the Montana Proxy Statement - University National Bank and Trust Co., that happen to be published to fulfill federal and state needs.

When you are presently acquainted with US Legal Forms website and get a merchant account, merely log in. After that, you can acquire the Montana Proxy Statement - University National Bank and Trust Co. format.

If you do not offer an account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is to the proper metropolis/county.

- Utilize the Review button to examine the shape.

- Read the outline to actually have selected the appropriate develop.

- In the event the develop is not what you are trying to find, take advantage of the Lookup industry to discover the develop that meets your requirements and needs.

- Once you obtain the proper develop, click on Buy now.

- Select the prices prepare you want, fill out the required info to produce your account, and buy your order utilizing your PayPal or credit card.

- Decide on a handy data file structure and acquire your backup.

Get every one of the document themes you have purchased in the My Forms food list. You can get a additional backup of Montana Proxy Statement - University National Bank and Trust Co. at any time, if required. Just select the necessary develop to acquire or produce the document format.

Use US Legal Forms, probably the most extensive selection of legitimate forms, in order to save time and avoid mistakes. The assistance offers expertly produced legitimate document themes that you can use for a selection of functions. Produce a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

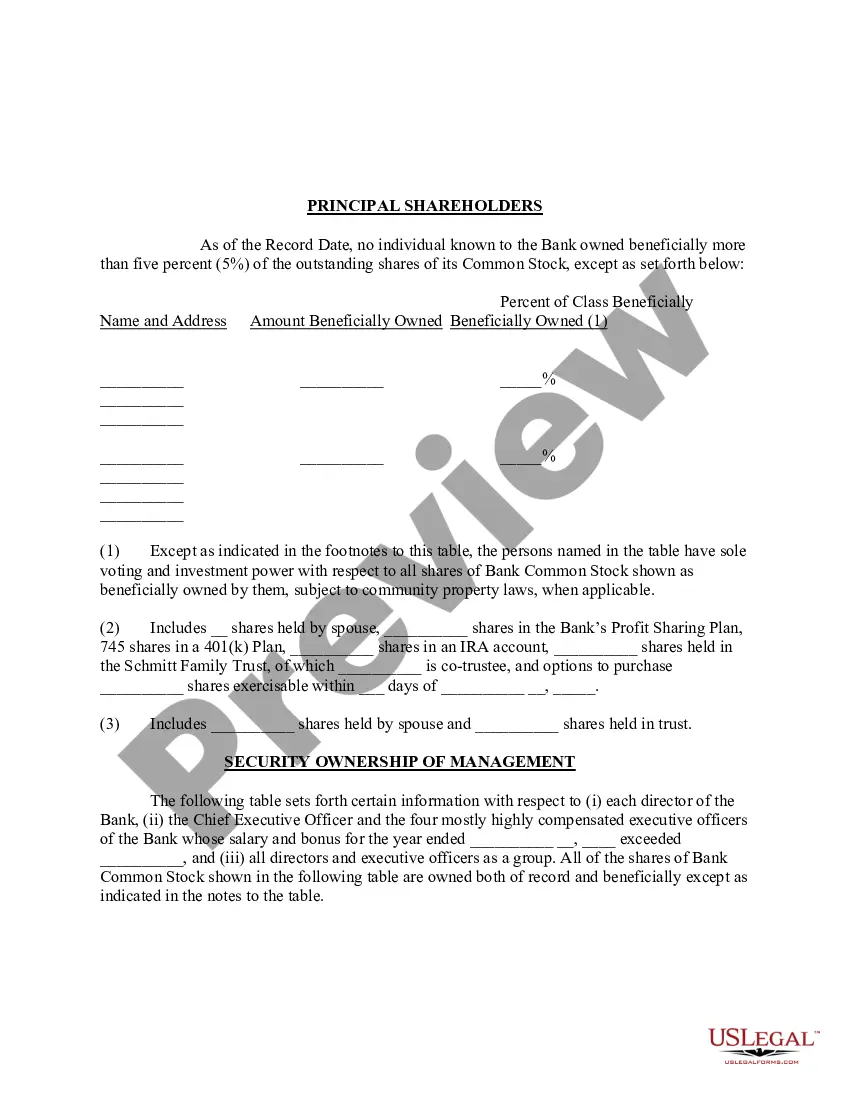

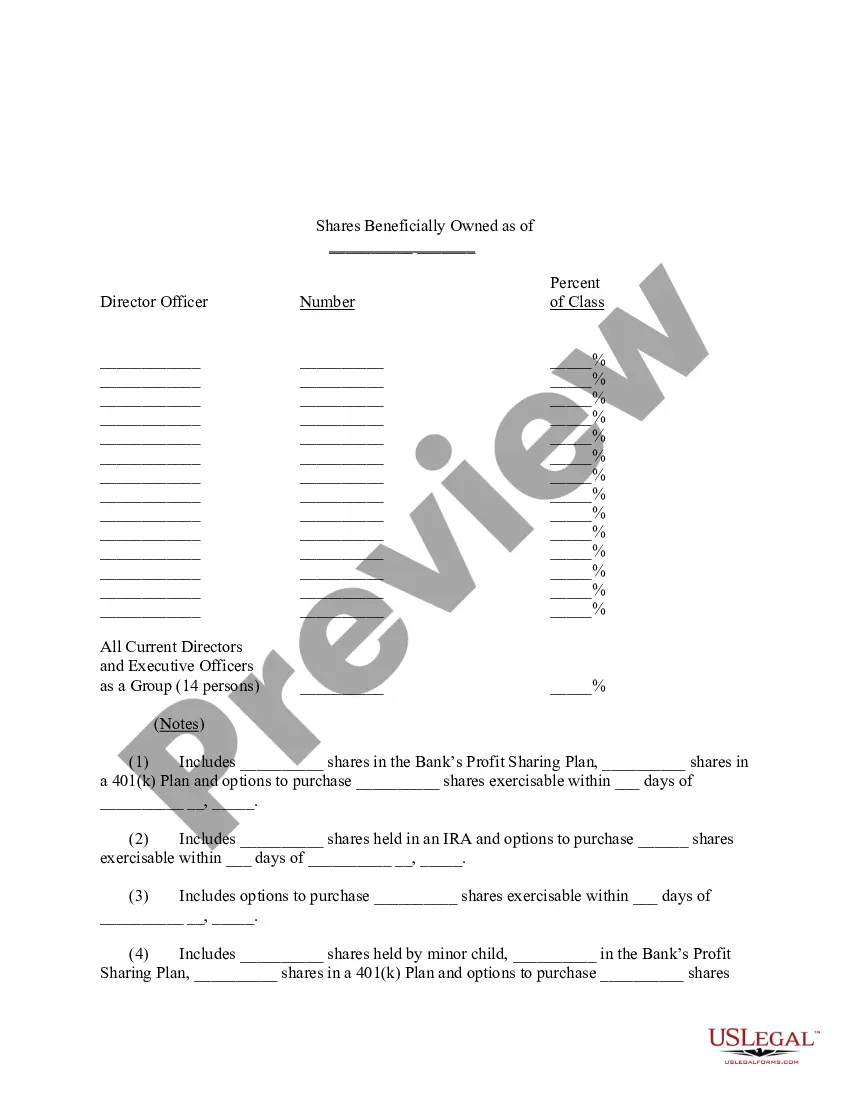

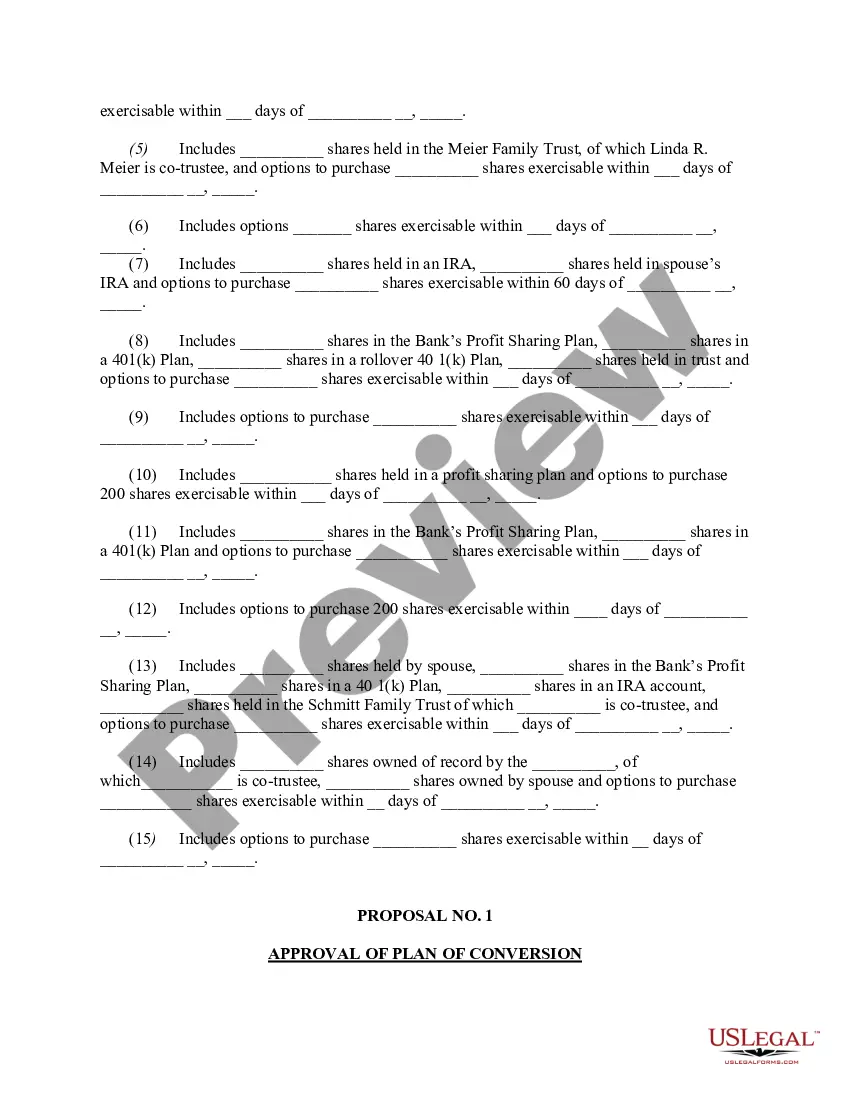

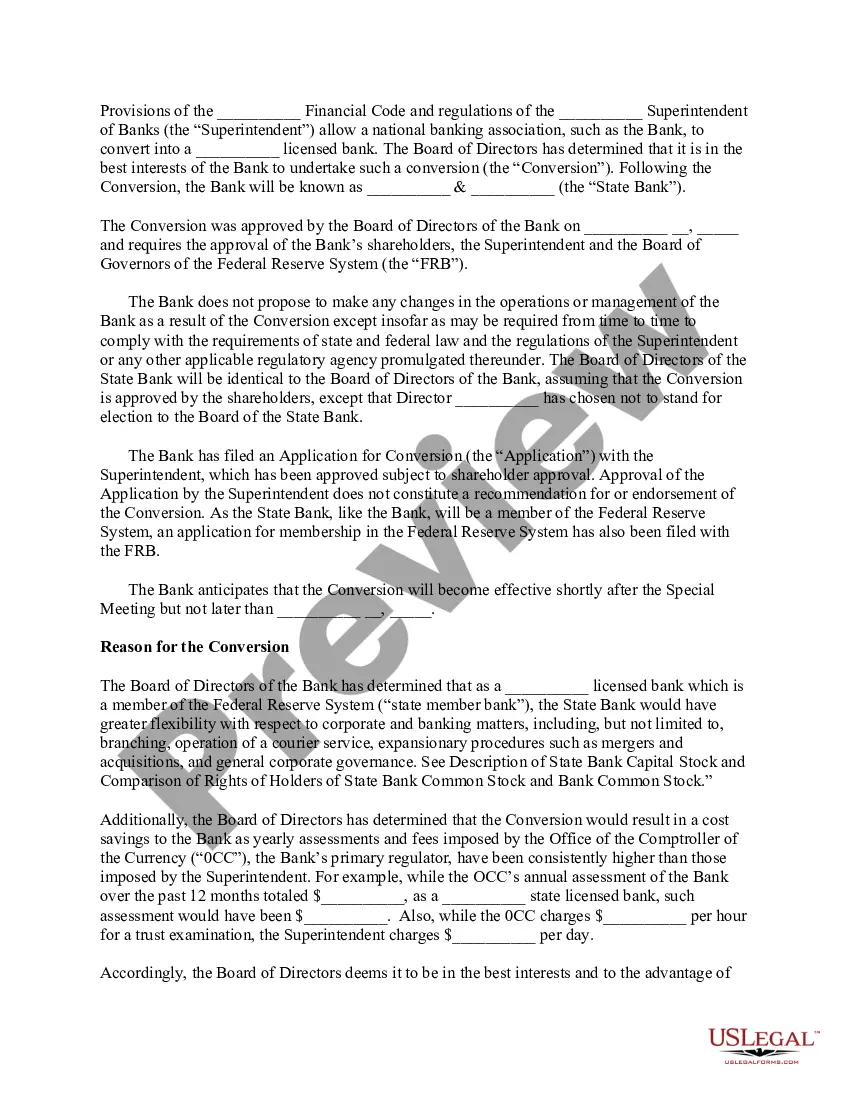

Proxy statements: The proxy statement is created and distributed by the corporation and includes everything a shareholder would need to make an informed decision. Proxy statements are typically sent online and recorded in the SEC database.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Rule 14a-4(f)61 forbids any person conducting a proxy solicitation to deliver a form of proxy, often referred to as a "proxy card," to a security holder unless it is accompanied or preceded by a proxy statement.

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.