Montana Uniform Residential Loan Application

Description

How to fill out Uniform Residential Loan Application?

US Legal Forms - one of many biggest libraries of legal types in the United States - gives an array of legal document layouts you may acquire or print. Utilizing the internet site, you will get thousands of types for organization and person reasons, categorized by groups, states, or search phrases.You will find the most up-to-date versions of types just like the Montana Uniform Residential Loan Application in seconds.

If you have a registration, log in and acquire Montana Uniform Residential Loan Application from the US Legal Forms catalogue. The Obtain key can look on every develop you see. You have access to all previously downloaded types from the My Forms tab of your accounts.

If you wish to use US Legal Forms the first time, listed here are basic guidelines to obtain started off:

- Be sure to have selected the right develop for your town/region. Click the Preview key to review the form`s content. See the develop description to actually have selected the appropriate develop.

- If the develop doesn`t satisfy your demands, take advantage of the Look for field at the top of the screen to find the the one that does.

- If you are pleased with the form, validate your choice by clicking the Purchase now key. Then, pick the rates strategy you favor and provide your qualifications to sign up to have an accounts.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Find the structure and acquire the form on your system.

- Make modifications. Fill out, change and print and sign the downloaded Montana Uniform Residential Loan Application.

Each and every template you included in your money does not have an expiry date and it is your own eternally. So, if you want to acquire or print another copy, just proceed to the My Forms portion and then click around the develop you will need.

Gain access to the Montana Uniform Residential Loan Application with US Legal Forms, probably the most considerable catalogue of legal document layouts. Use thousands of skilled and express-specific layouts that meet your organization or person requires and demands.

Form popularity

FAQ

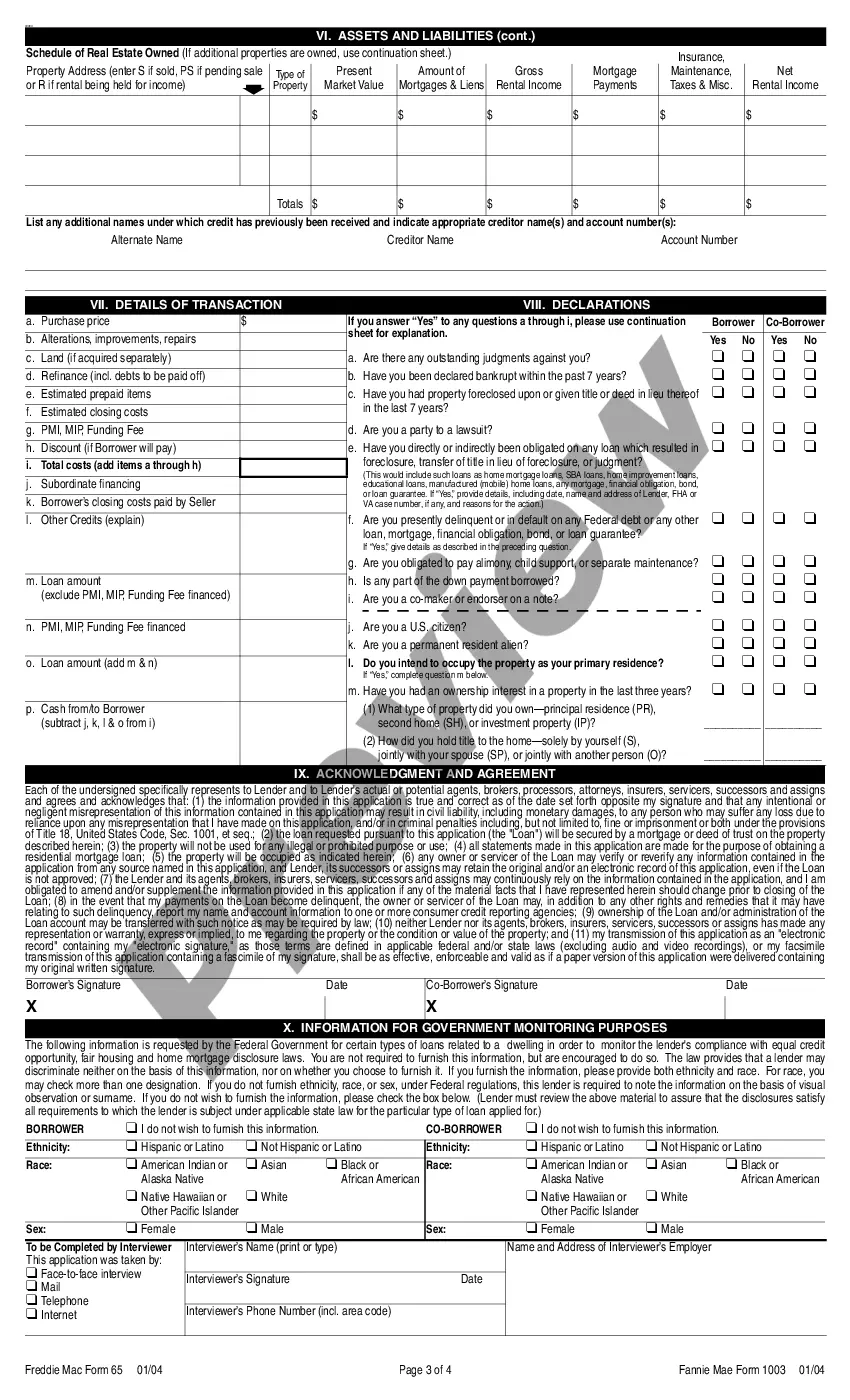

The Uniform Underwriting and Transmittal Summary Form 1008 summarizes key data from the loan application package. Lenders use this information in reaching the underwriting decision. Form 1008 (or a similar document) must be retained in the mortgage file for manually underwritten mortgage loans.

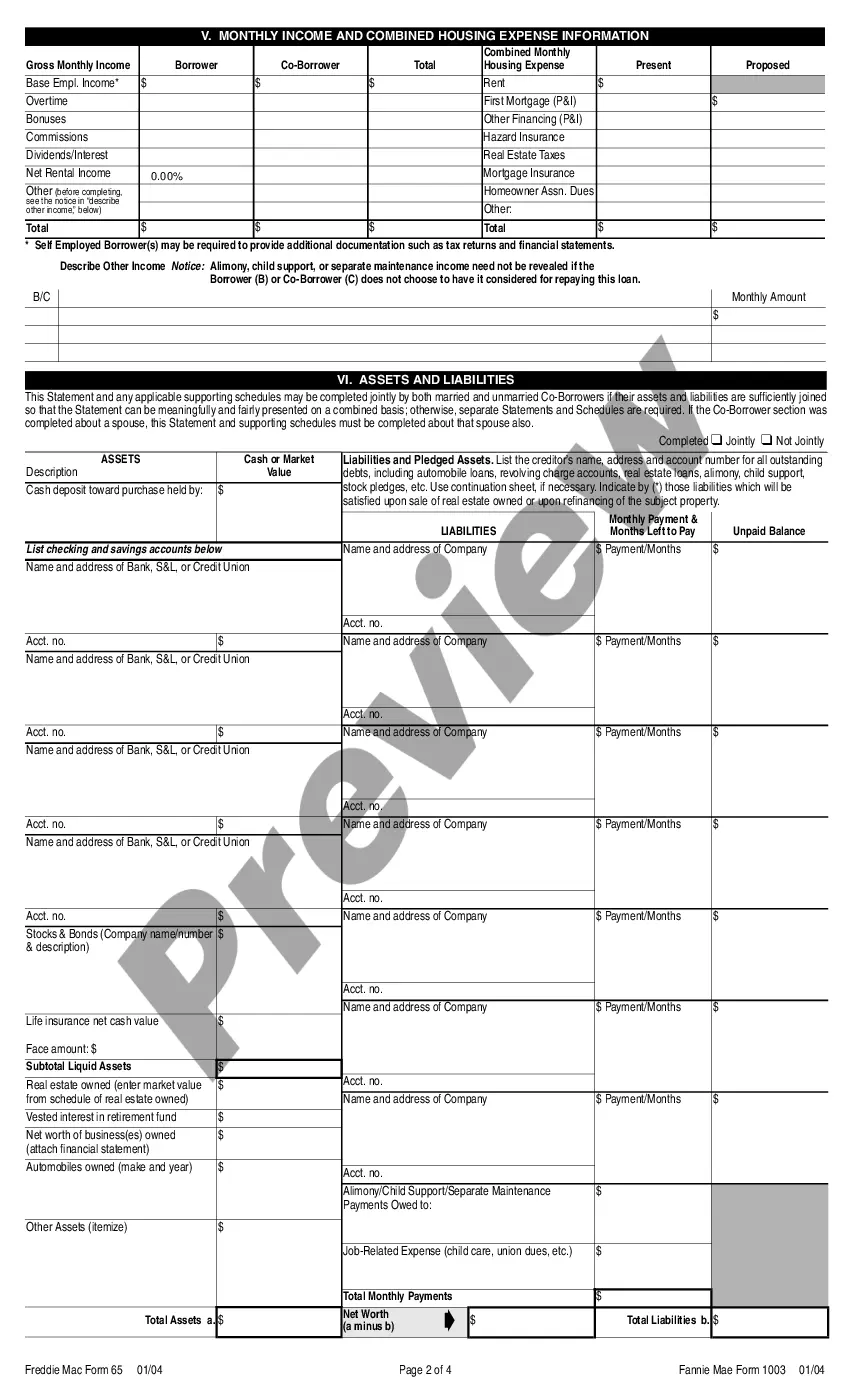

What is the Uniform Residential Loan Application? The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories.

The SCIF (Fannie Mae/Freddie Mac Form 1103) is an industry-recognized form used during the mortgage application process that allows borrowers to voluntarily identify language preferences and provide information on housing counseling and homeownership education they may have received.

Uniform Residential Loan Application (Form 1003) | Fannie Mae.

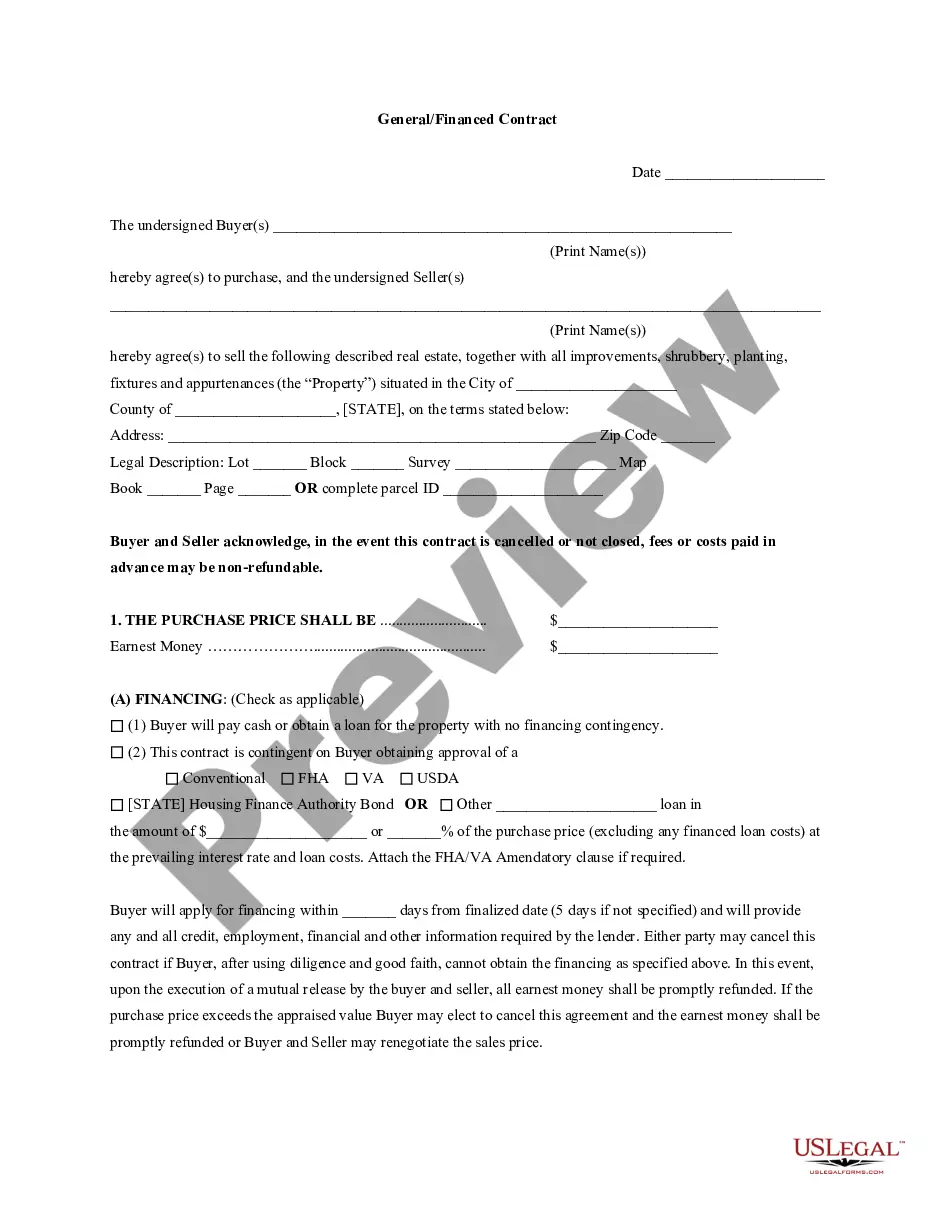

A loan application must be documented on the Uniform Residential Loan Application (Form 1003). A complete, signed, and dated version of the final Form 1003 must always be included in the loan file. The final Form 1003 must reflect the income, assets, debts, and final loan terms used in the underwriting process.

Filling out a 1003 form is the first step you'll take to getting preapproved for a mortgage. Officially known as the uniform residential loan application ? URLA for short ? the 1003 application gives your lender the information required to determine whether you qualify for the loan you're applying for.

In addition to your legal name, Social Security number and date of birth, you'll need two years' worth of address information. Your finances. Lenders need info about your income, assets and monthly debt payments. They'll also need information about anything you're legally required to pay, like alimony or child support.