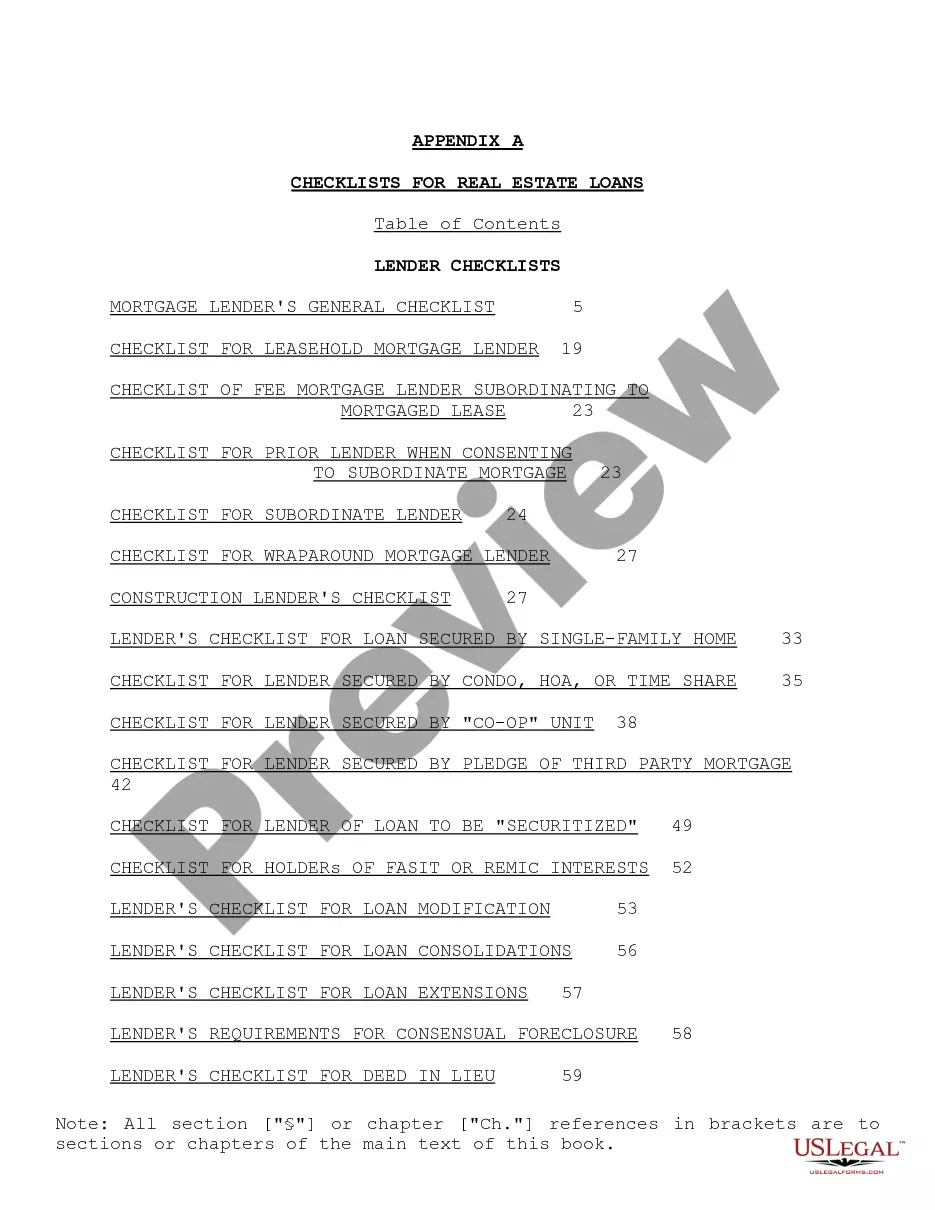

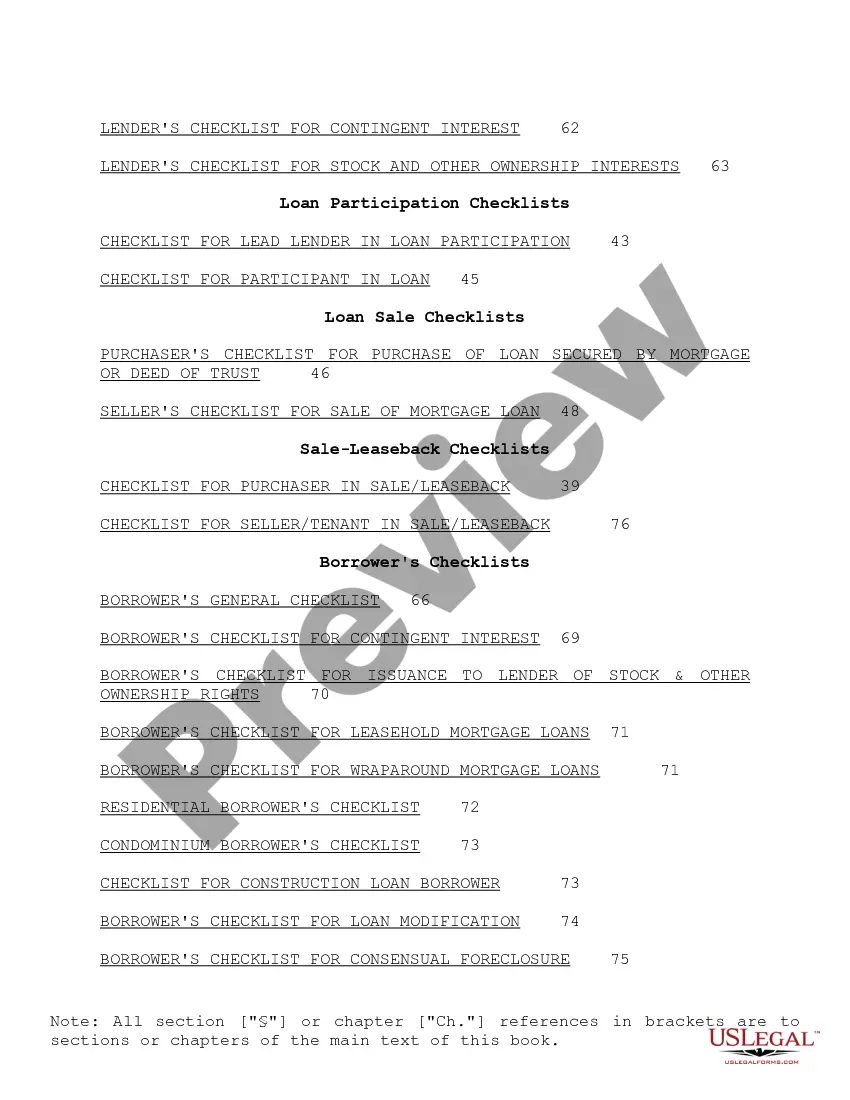

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

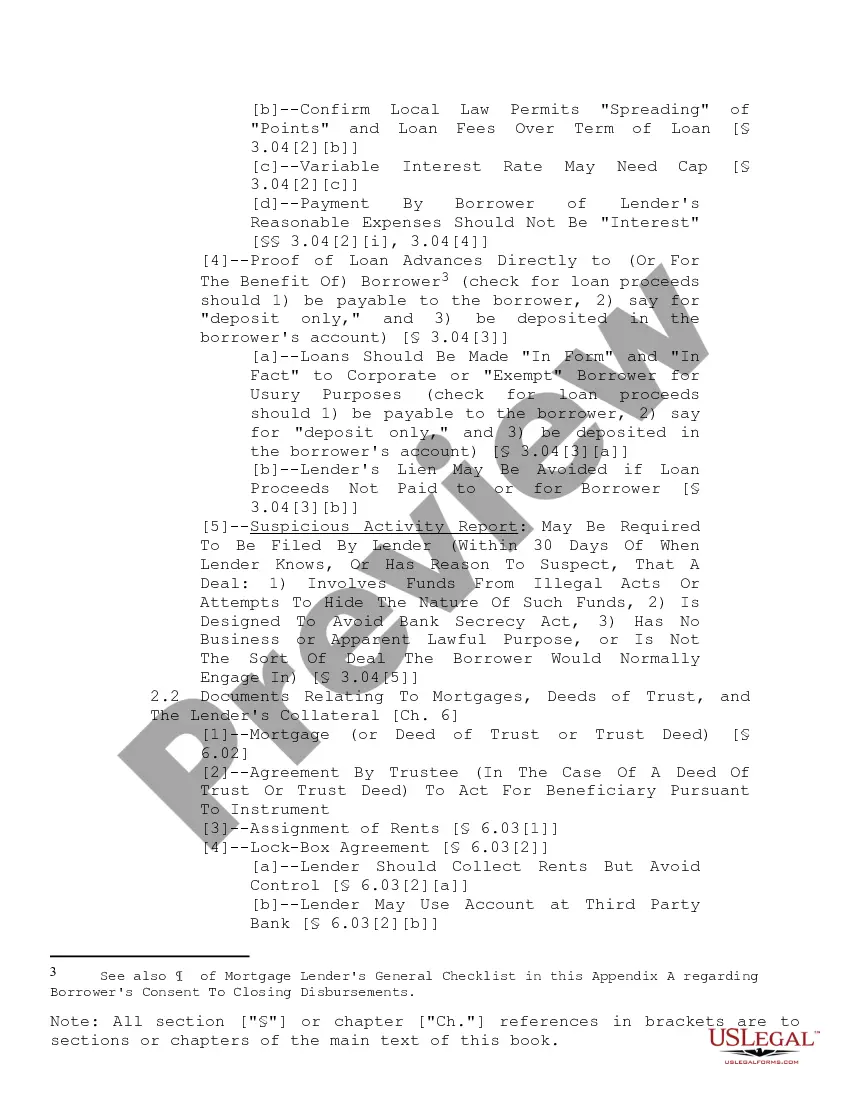

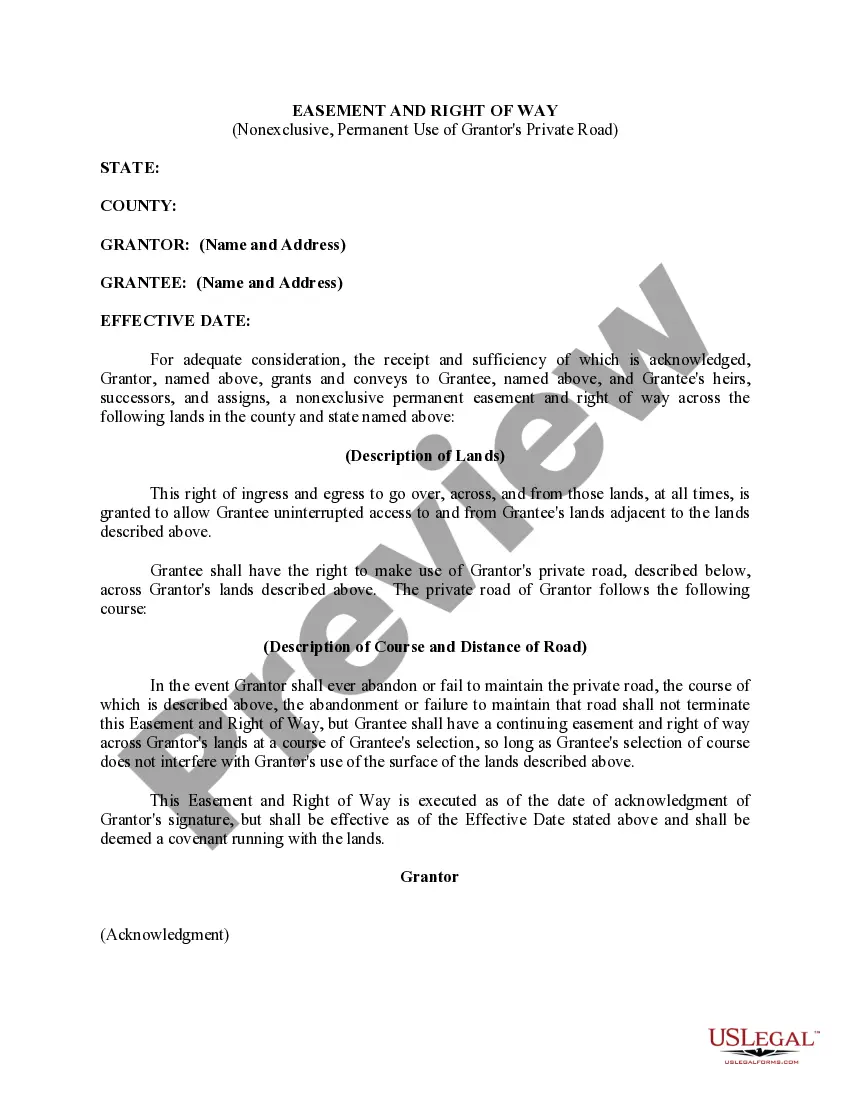

Montana Checklist for Real Estate Loans: A Comprehensive Guide for Borrowers When it comes to buying or refinancing a property in Montana, it is essential to be well-prepared and organized, especially when dealing with real estate loans. To streamline the loan application process and ensure a smooth transaction, borrowers need to familiarize themselves with the Montana Checklist for Real Estate Loans. This checklist serves as a comprehensive guide to help borrowers navigate the application process while meeting all the necessary requirements. Applying for a real estate loan can be overwhelming, but having a clear understanding of the Montana Checklist can alleviate stress and increase the chances of a successful loan application. Here is a breakdown of the key elements that are typically included in a Montana Checklist for Real Estate Loans: 1. Financial Documentation: Borrowers must gather essential financial documents, which typically include tax returns for the past two years, pay stubs highlighting current income, W-2 forms, and bank statements. Providing this documentation allows lenders to assess the borrower's financial standing and capacity to repay the loan. 2. Credit History: Lenders will review the borrower's credit history, so obtaining a credit report is crucial. Montana Checklist for Real Estate Loans emphasizes the importance of reviewing the credit report for any errors or discrepancies. Additionally, borrowers can take steps to improve their credit score if needed, such as paying off existing debts and resolving any outstanding issues. 3. Loan Application Form: Completing a detailed loan application form is an integral part of the Montana Checklist. This form requires the borrower to provide personal information, the desired loan amount, and details about the property being purchased or refinanced. Attention to detail is essential to ensure accuracy and avoid delays in loan processing. 4. Property Appraisal: A professional property appraisal is an essential step in the loan application process. This evaluation determines the current market value of the property, indicating whether it meets the lender's guidelines for loan approval. Thus, borrowers should include arranging for a property appraisal in their checklist. 5. Title Insurance and Property Insurance: Montana Checklist for Real Estate Loans emphasizes the importance of obtaining title insurance, which protects both the borrower and lender from any potential issues related to the property's title. Additionally, borrowers must secure property insurance to safeguard against damages or losses. 6. Down Payment and Closing Funds: Borrowers must ensure they have the necessary down payment funds available and verify the source of those funds. Including a detailed breakdown of the down payment in the checklist helps borrowers stay organized. Moreover, borrowers need to consider and plan for the closing costs, which include attorney fees, appraisal fees, and other miscellaneous expenses. Different Types of Montana Checklists for Real Estate Loans: Depending on the type of loan being pursued, there may be specific checklists that borrowers need to consider. Some common types of real estate loans include: 1. Conventional Loans: These loans are not insured or guaranteed by a government agency like FHA or VA loans. The checklist for conventional loans typically aligns with the standard Montana Checklist for Real Estate Loans. 2. FHA Loans: These loans are backed by the Federal Housing Administration. FHA loan checklists may have additional requirements, such as the need for borrower-paid mortgage insurance. 3. VA Loans: Reserved for military service members, veterans, and their families, VA loans have their own specific checklist. It includes verifying eligibility for VA benefits, obtaining a Certificate of Eligibility, and providing proof of military service. By adhering to the Montana Checklist for Real Estate Loans and any applicable additional checklists, borrowers can ensure they are fully prepared when applying for a loan in Montana. Taking the time to gather all necessary documents and meet the outlined requirements will help facilitate a successful loan application and a smoother real estate transaction.Montana Checklist for Real Estate Loans: A Comprehensive Guide for Borrowers When it comes to buying or refinancing a property in Montana, it is essential to be well-prepared and organized, especially when dealing with real estate loans. To streamline the loan application process and ensure a smooth transaction, borrowers need to familiarize themselves with the Montana Checklist for Real Estate Loans. This checklist serves as a comprehensive guide to help borrowers navigate the application process while meeting all the necessary requirements. Applying for a real estate loan can be overwhelming, but having a clear understanding of the Montana Checklist can alleviate stress and increase the chances of a successful loan application. Here is a breakdown of the key elements that are typically included in a Montana Checklist for Real Estate Loans: 1. Financial Documentation: Borrowers must gather essential financial documents, which typically include tax returns for the past two years, pay stubs highlighting current income, W-2 forms, and bank statements. Providing this documentation allows lenders to assess the borrower's financial standing and capacity to repay the loan. 2. Credit History: Lenders will review the borrower's credit history, so obtaining a credit report is crucial. Montana Checklist for Real Estate Loans emphasizes the importance of reviewing the credit report for any errors or discrepancies. Additionally, borrowers can take steps to improve their credit score if needed, such as paying off existing debts and resolving any outstanding issues. 3. Loan Application Form: Completing a detailed loan application form is an integral part of the Montana Checklist. This form requires the borrower to provide personal information, the desired loan amount, and details about the property being purchased or refinanced. Attention to detail is essential to ensure accuracy and avoid delays in loan processing. 4. Property Appraisal: A professional property appraisal is an essential step in the loan application process. This evaluation determines the current market value of the property, indicating whether it meets the lender's guidelines for loan approval. Thus, borrowers should include arranging for a property appraisal in their checklist. 5. Title Insurance and Property Insurance: Montana Checklist for Real Estate Loans emphasizes the importance of obtaining title insurance, which protects both the borrower and lender from any potential issues related to the property's title. Additionally, borrowers must secure property insurance to safeguard against damages or losses. 6. Down Payment and Closing Funds: Borrowers must ensure they have the necessary down payment funds available and verify the source of those funds. Including a detailed breakdown of the down payment in the checklist helps borrowers stay organized. Moreover, borrowers need to consider and plan for the closing costs, which include attorney fees, appraisal fees, and other miscellaneous expenses. Different Types of Montana Checklists for Real Estate Loans: Depending on the type of loan being pursued, there may be specific checklists that borrowers need to consider. Some common types of real estate loans include: 1. Conventional Loans: These loans are not insured or guaranteed by a government agency like FHA or VA loans. The checklist for conventional loans typically aligns with the standard Montana Checklist for Real Estate Loans. 2. FHA Loans: These loans are backed by the Federal Housing Administration. FHA loan checklists may have additional requirements, such as the need for borrower-paid mortgage insurance. 3. VA Loans: Reserved for military service members, veterans, and their families, VA loans have their own specific checklist. It includes verifying eligibility for VA benefits, obtaining a Certificate of Eligibility, and providing proof of military service. By adhering to the Montana Checklist for Real Estate Loans and any applicable additional checklists, borrowers can ensure they are fully prepared when applying for a loan in Montana. Taking the time to gather all necessary documents and meet the outlined requirements will help facilitate a successful loan application and a smoother real estate transaction.