Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Montana Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Montana Letter Denying That Alleged Debtor Owes Any Part Of Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes Such A Debt?

Discovering the right authorized papers design can be a struggle. Of course, there are a lot of layouts accessible on the Internet, but how can you get the authorized type you require? Utilize the US Legal Forms internet site. The assistance offers a huge number of layouts, like the Montana Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, which you can use for organization and private requires. All of the varieties are checked out by professionals and meet up with federal and state specifications.

Should you be currently signed up, log in to the account and click the Acquire key to have the Montana Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt. Use your account to appear from the authorized varieties you may have bought previously. Check out the My Forms tab of the account and acquire one more version of your papers you require.

Should you be a brand new end user of US Legal Forms, listed below are basic guidelines for you to comply with:

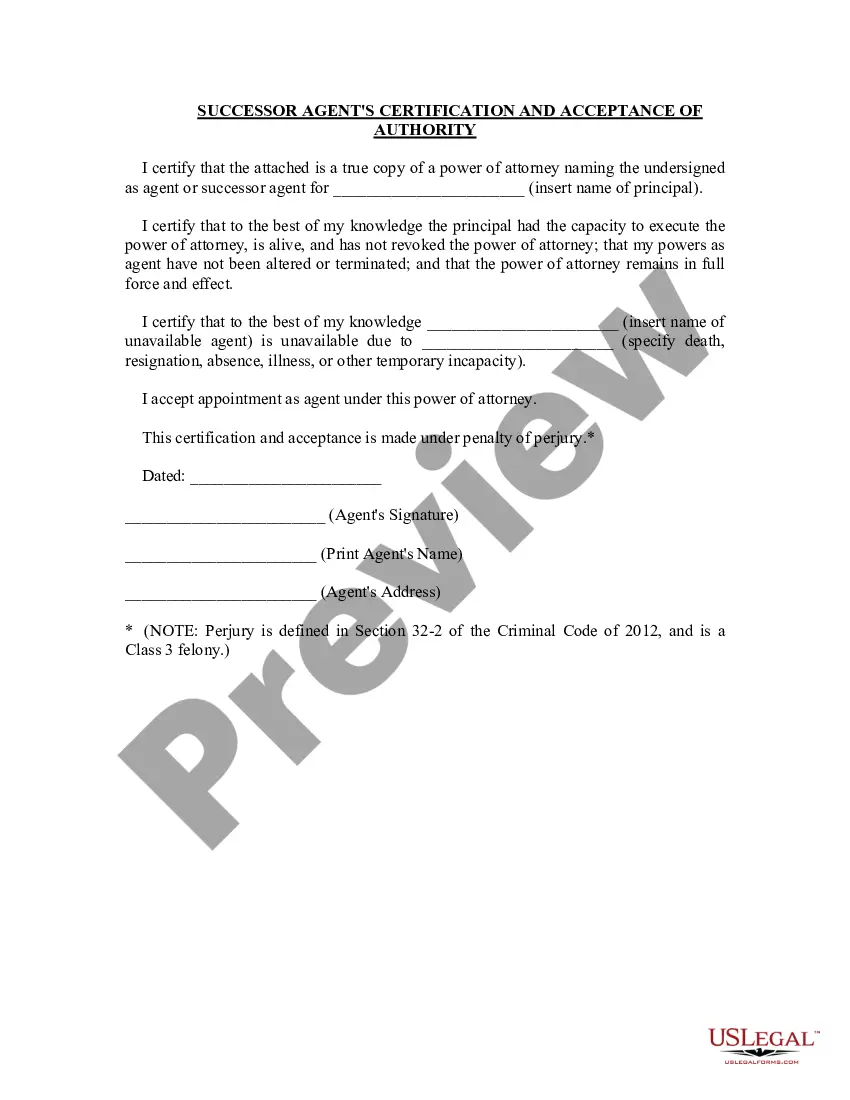

- Initial, ensure you have chosen the appropriate type to your metropolis/region. It is possible to examine the form while using Preview key and read the form explanation to make sure it is the right one for you.

- If the type will not meet up with your requirements, utilize the Seach industry to find the proper type.

- When you are certain that the form is suitable, click on the Get now key to have the type.

- Pick the pricing strategy you desire and enter in the essential information and facts. Design your account and purchase the transaction with your PayPal account or Visa or Mastercard.

- Opt for the submit structure and down load the authorized papers design to the product.

- Total, edit and print and sign the obtained Montana Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt.

US Legal Forms will be the largest collection of authorized varieties that you will find a variety of papers layouts. Utilize the service to down load appropriately-made documents that comply with state specifications.

Form popularity

FAQ

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Address the letter to the collection agency that reported the debt to the credit bureau. State that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

Format the letter thusly: Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Verbal contracts, accounts, or promises have a statute of limitation of 5 years. As for verbal obligations or liabilities that are not contracts, these have a statute of limitation of 3 years. For judgments of decrees in any U.S. court, creditors have 10 years to pursue Montana residents to collect debt.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.