Montana Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Montana Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

US Legal Forms - one of several greatest libraries of legitimate types in America - offers a variety of legitimate papers web templates you are able to acquire or printing. While using web site, you can get a large number of types for organization and person purposes, sorted by groups, says, or keywords and phrases.You can find the most recent versions of types like the Montana Notice of Violation of Fair Debt Act - Improper Contact at Work in seconds.

If you have a membership, log in and acquire Montana Notice of Violation of Fair Debt Act - Improper Contact at Work from the US Legal Forms library. The Acquire key will show up on each and every kind you perspective. You gain access to all earlier downloaded types within the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, allow me to share simple instructions to get you started:

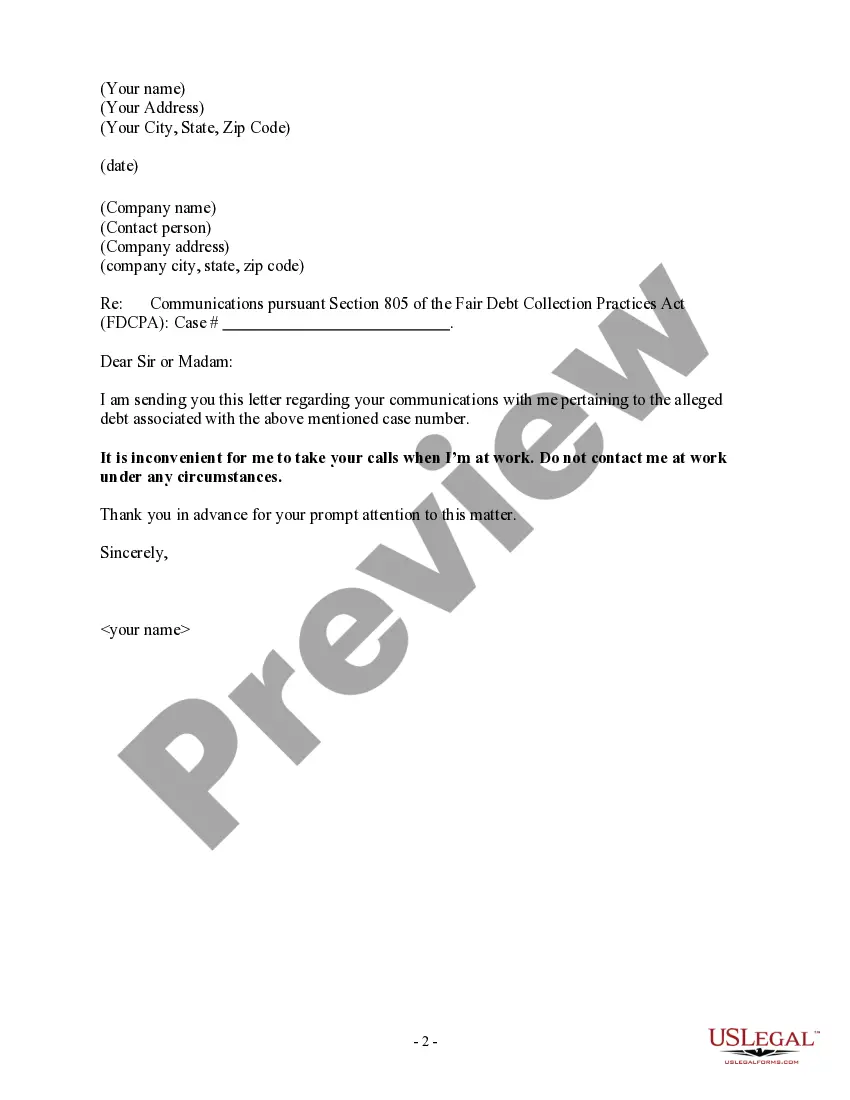

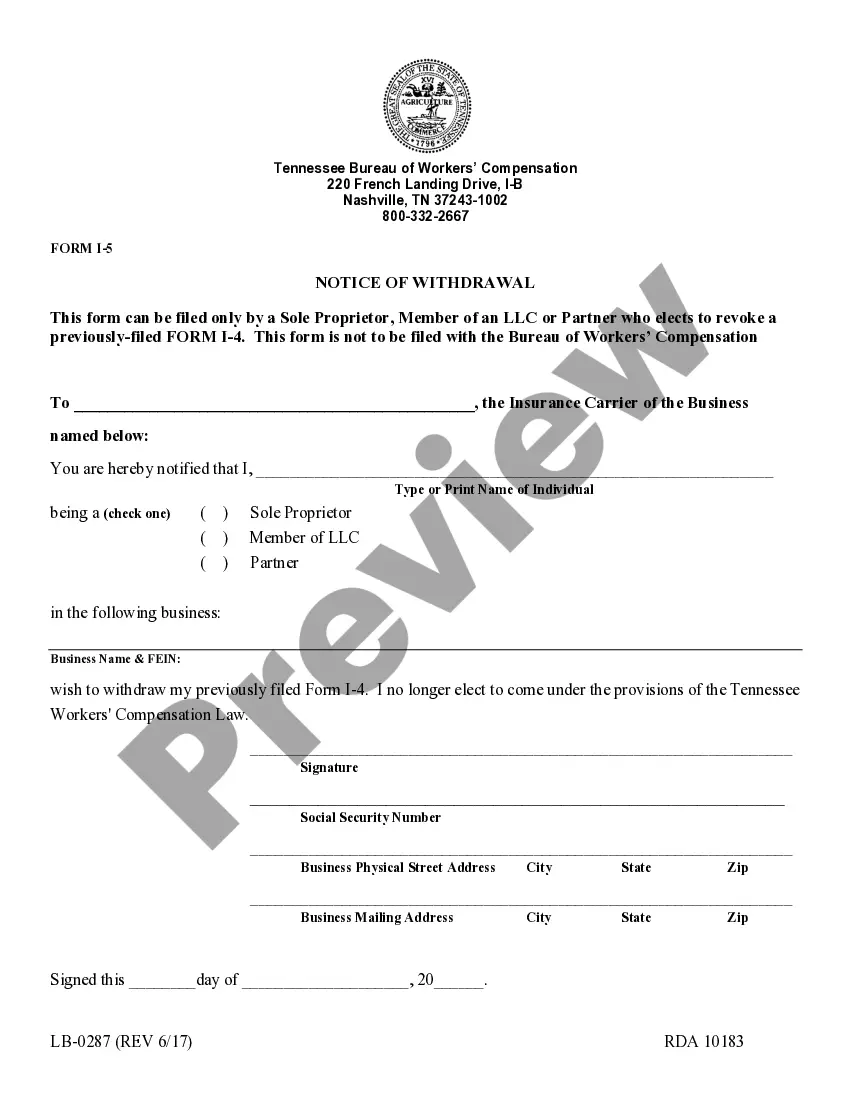

- Be sure to have selected the best kind for your personal city/region. Click on the Review key to examine the form`s content. Browse the kind explanation to actually have selected the proper kind.

- If the kind doesn`t satisfy your needs, use the Research discipline towards the top of the screen to get the one which does.

- Should you be pleased with the shape, affirm your selection by clicking the Get now key. Then, choose the costs program you want and offer your references to sign up for the accounts.

- Procedure the transaction. Use your credit card or PayPal accounts to perform the transaction.

- Find the file format and acquire the shape on your own system.

- Make modifications. Fill out, modify and printing and signal the downloaded Montana Notice of Violation of Fair Debt Act - Improper Contact at Work.

Each web template you included with your money does not have an expiration particular date and it is your own eternally. So, if you want to acquire or printing one more backup, just visit the My Forms segment and then click about the kind you need.

Obtain access to the Montana Notice of Violation of Fair Debt Act - Improper Contact at Work with US Legal Forms, one of the most considerable library of legitimate papers web templates. Use a large number of expert and status-specific web templates that meet up with your company or person requires and needs.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

It's not necessarily illegal for a debt collector to call you at work, but the FDCPA prohibits debt collection calls to your job if the debt collector "has reason to know" that your employer forbids those calls.

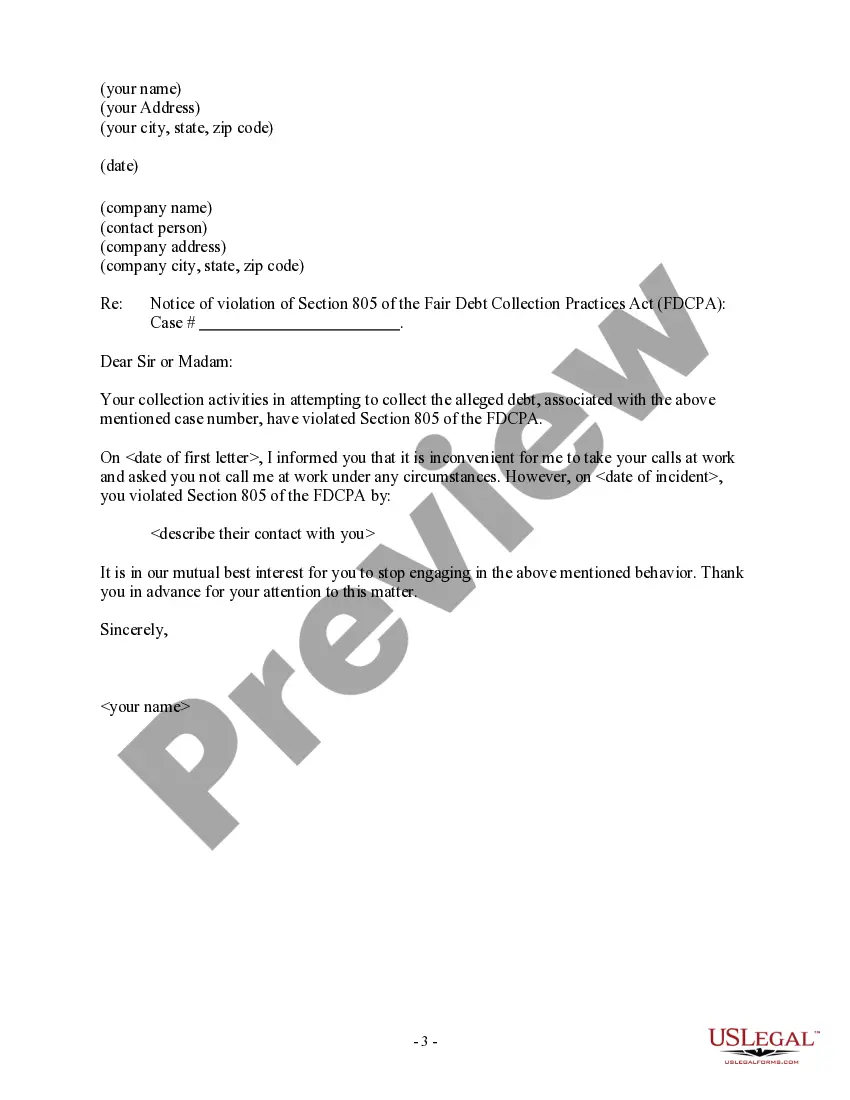

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You can stop debt collectors from calling you at work fairly easily. Simply tell the debt collector that your employer doesn't want them calling your job or that you're not allowed to receive personal calls at work.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

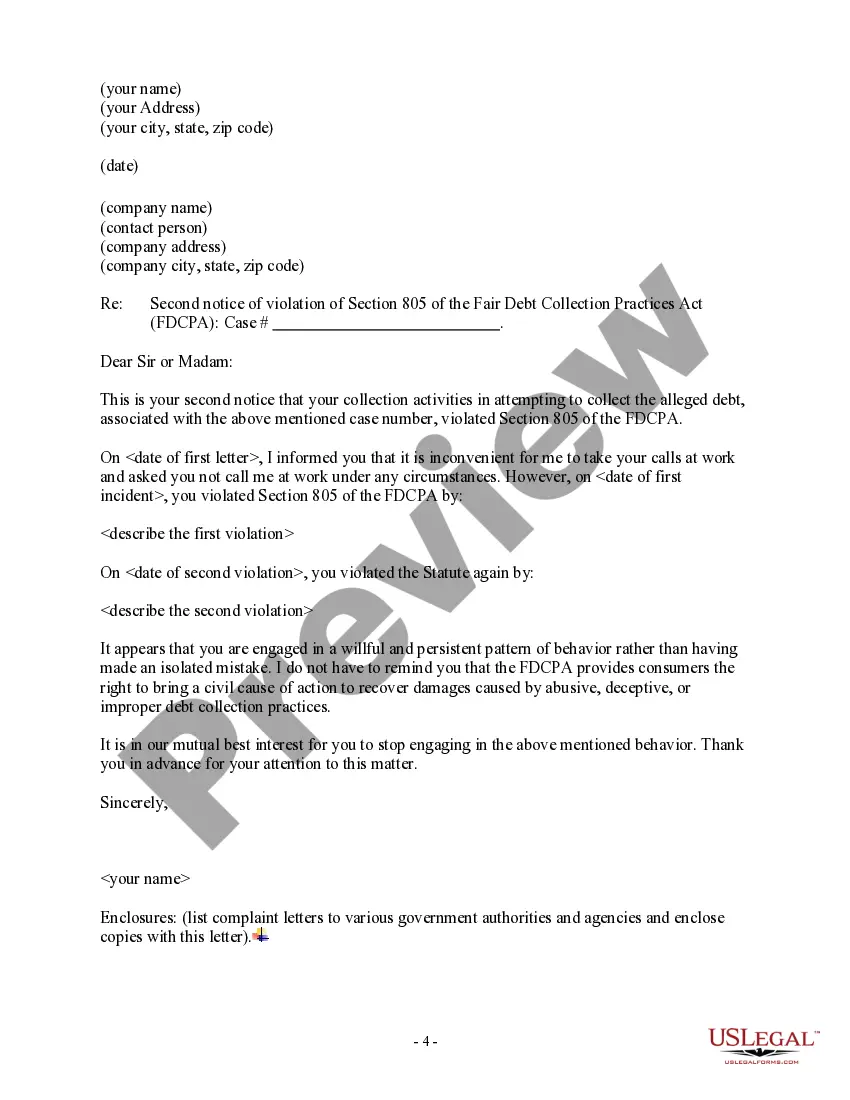

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.