Montana Industrial Revenue Development Bond Workform

Description

How to fill out Industrial Revenue Development Bond Workform?

US Legal Forms - one of the largest libraries of legitimate kinds in the States - provides an array of legitimate file templates you are able to down load or produce. Making use of the internet site, you can get 1000s of kinds for enterprise and specific uses, sorted by types, states, or key phrases.You can get the most recent versions of kinds such as the Montana Industrial Revenue Development Bond Workform within minutes.

If you have a monthly subscription, log in and down load Montana Industrial Revenue Development Bond Workform from your US Legal Forms catalogue. The Acquire key will show up on each and every kind you view. You gain access to all previously saved kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, listed here are basic directions to obtain started:

- Be sure you have selected the proper kind for the area/region. Click the Preview key to analyze the form`s articles. Read the kind information to actually have selected the proper kind.

- In case the kind does not suit your specifications, utilize the Research discipline on top of the display screen to find the one which does.

- If you are content with the shape, confirm your selection by simply clicking the Get now key. Then, choose the rates program you like and give your credentials to register to have an bank account.

- Approach the transaction. Utilize your charge card or PayPal bank account to accomplish the transaction.

- Select the formatting and down load the shape on your own product.

- Make adjustments. Complete, modify and produce and signal the saved Montana Industrial Revenue Development Bond Workform.

Each and every web template you put into your bank account lacks an expiry date and it is your own for a long time. So, if you want to down load or produce an additional version, just visit the My Forms section and click in the kind you will need.

Gain access to the Montana Industrial Revenue Development Bond Workform with US Legal Forms, by far the most comprehensive catalogue of legitimate file templates. Use 1000s of expert and state-distinct templates that meet up with your business or specific requirements and specifications.

Form popularity

FAQ

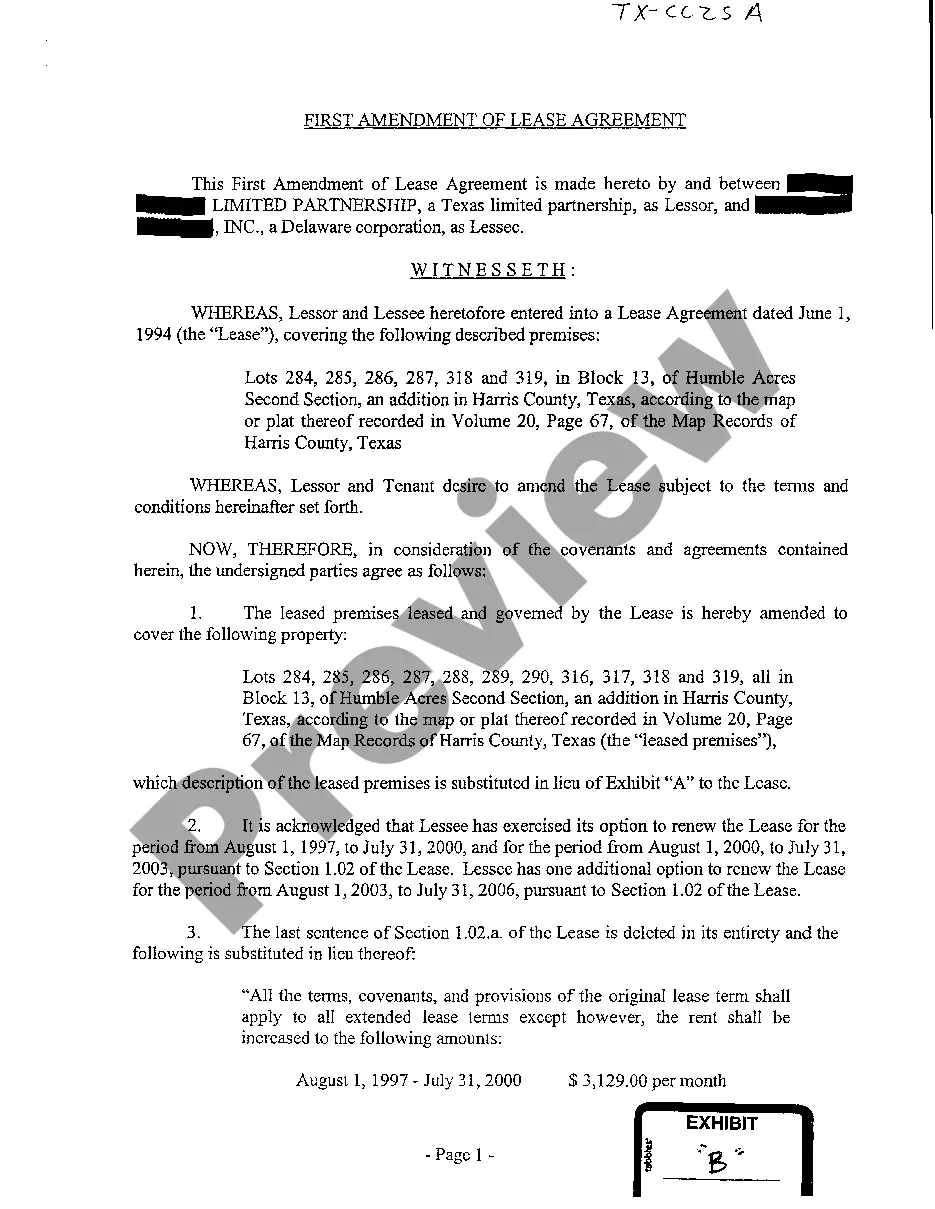

Revenue bonds issued by a municipality and secured by a lease agreement with a corporation. The purpose for the offering is to build a facility for a private company.

Industrial Development Bonds (IDB's) are tax-exempt securities issued up to $10 million by a government agency to provide money for the acquisition, construction, rehabilitation and equipping of manufacturing and processing facilities for private companies. Industrial Development Bonds California Infrastructure and Economic Development Bank (.gov) ? bonds ? industrial-developm... California Infrastructure and Economic Development Bank (.gov) ? bonds ? industrial-developm...

General obligation bonds are issued by states, cities or counties and not secured by any assets. Instead, general obligation are backed by the ?full faith and credit? of the issuer, which has the power to tax residents to pay bondholders.

Who guarantees an Industrial Development Bond? Industrial Development Bonds are issued by municipal authorities, with the revenue source being the lease payments made by a corporate lessee.

Industrial Development Bonds are issued by municipal authorities, with the revenue source being the lease payments made by a corporate lessee. Furthermore, the corporate lessee unconditionally guarantees the bonds - so they take on the credit rating of the corporate guarantor. DEBT- Municipal Flashcards - Quizlet quizlet.com ? debt-municipal-flash-cards quizlet.com ? debt-municipal-flash-cards

A) Industrial revenue bonds. The industrial revenue bonds would have the highest risk because debt service is the responsibility of the corporation leasing the facility rather than the issuing municipality.