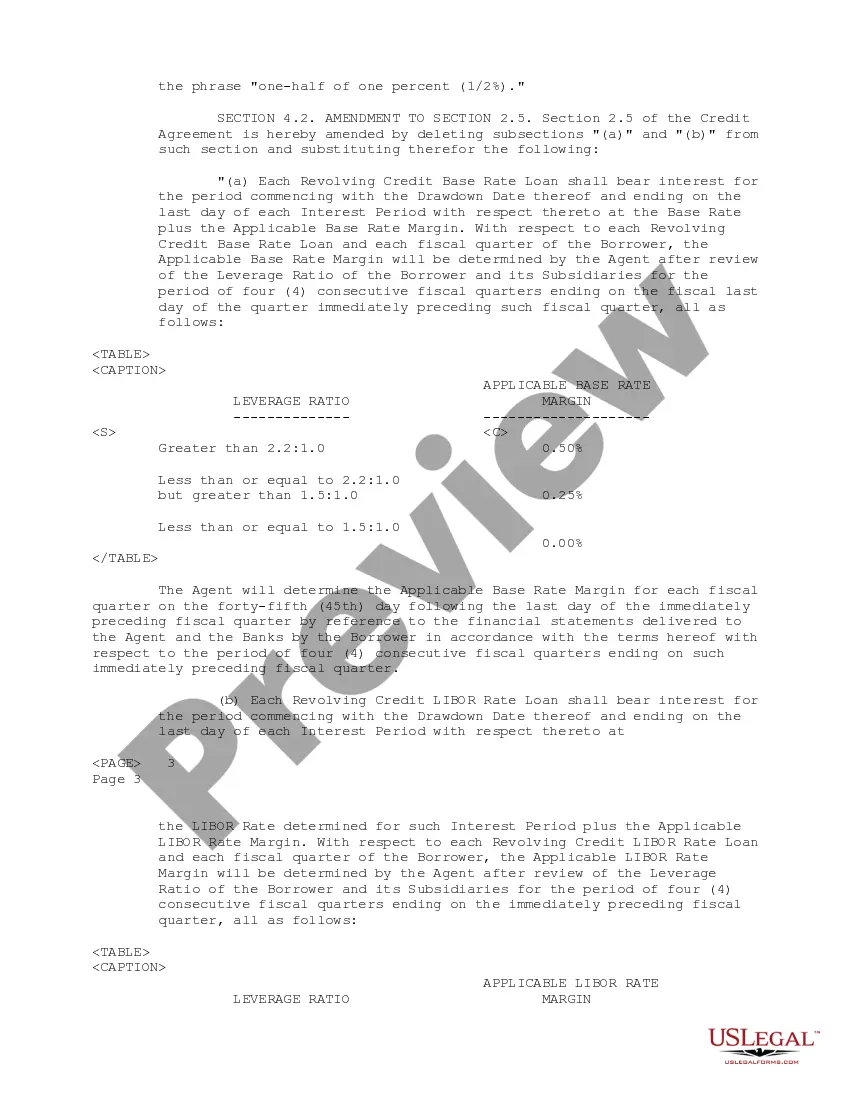

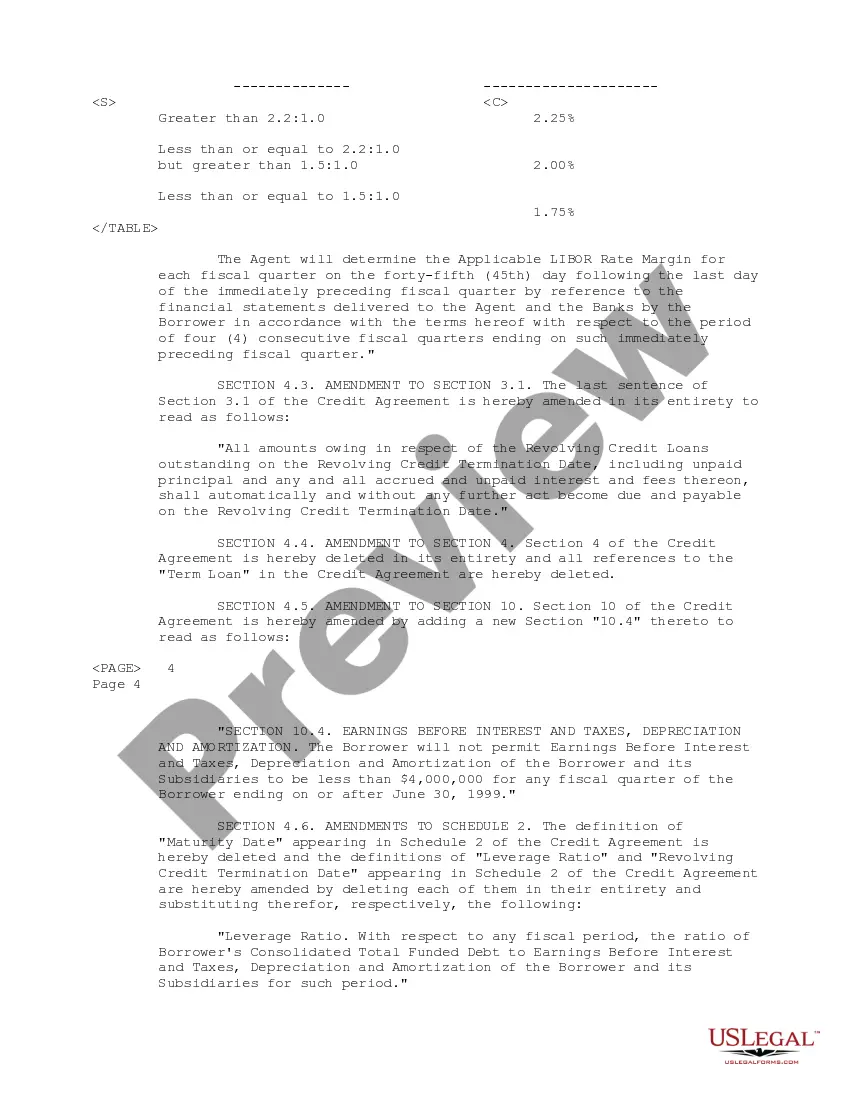

Title: Understanding the Montana Fourth Amendment to Amended Restated Credit Agreement: Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus Introduction: The Montana Fourth Amendment to the Amended Restated Credit Agreement is a legal document that outlines the terms and conditions of a credit agreement between Ray tel Medical Corp, Bank Boston, N.A., and Banquet Paribus. This agreement serves as a binding contract that governs the borrowing and lending relationship between the parties involved. In this article, we will delve into the essential aspects of the Montana Fourth Amendment and shed light on its significance. Keywords: Montana Fourth Amendment, Amended Restated Credit Agreement, Ray tel Medical Corp, Bank Boston N.A., Banquet Paribus, agreement types 1. Key Parties Involved: The Montana Fourth Amendment involves three main parties: a) Ray tel Medical Corp: The borrower party, seeking credit to fulfill its financial needs. b) Bank Boston, N.A.: A financial institution acting as a lender, providing credit facilities. c) Banquet Paribus: Another financial institution, often acting as a co-lender or agent in the credit agreement. 2. Overview of the Montana Fourth Amendment: The Montana Fourth Amendment represents a modification or update to the original credit agreement between the parties. It is an addendum that introduces new terms, provisions, or amendments to the existing agreement, tailored to meet the changing financial requirements or to address certain issues that have arisen during the course of the original credit agreement. 3. Purpose of Montana Fourth Amendment: The Montana Fourth Amendment serves several purposes, such as: a) Adjusting interest rates: The amendment may include changes in interest rates on borrowed funds based on market conditions or mutually agreed-upon metrics. b) Extending maturity dates: It allows for an extension of the repayment period, which can provide additional flexibility to the borrower. c) Amending borrowing limits: In cases where the borrower requires additional credit, the amendment may modify the borrowing limits available. d) Modifying repayment structures: The amendment can alter the repayment structure, including revised payment schedules or changes in payment methods. e) Addressing legal or regulatory requirements: The amendment can ensure compliance with evolving legal or regulatory obligations that may impact the credit agreement. 4. Types of Montana Fourth Amendment: The Montana Fourth Amendment can include various types, addressing specific aspects of the credit agreement. Some common examples may involve: a) Interest Rate Amendment: Focused on revising interest rates imposed on the principal amount borrowed. b) Term Extension Amendment: Pertains to prolonging the credit facility's maturity date. c) Borrowing Base Amendment: Adjusts the maximum loan amount based on agreed-upon criteria, such as accounts receivable or inventory levels. d) Fee Amendment: Involves modifying fees charged in relation to the credit facility, including commitment fees or administrative charges. Conclusion: The Montana Fourth Amendment to the Amended Restated Credit Agreement is a crucial legal document that allows parties to update and modify their existing credit agreement based on changing circumstances. By implementing specific amendments, the parties involved can ensure the credit terms remain current and tailored to their financial needs. Understanding the various aspects and modifications within the Montana Fourth Amendment helps all parties navigate the credit agreement smoothly.

Montana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Montana Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

Are you presently inside a situation that you will need files for possibly company or specific uses virtually every time? There are plenty of legal papers layouts available on the net, but discovering versions you can rely on isn`t simple. US Legal Forms provides a huge number of form layouts, just like the Montana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas, that happen to be published to satisfy federal and state specifications.

Should you be already knowledgeable about US Legal Forms website and possess a merchant account, just log in. Next, you are able to acquire the Montana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas format.

Should you not come with an accounts and need to begin to use US Legal Forms, adopt these measures:

- Get the form you will need and ensure it is to the correct city/state.

- Utilize the Review switch to examine the shape.

- See the explanation to actually have selected the appropriate form.

- When the form isn`t what you`re searching for, take advantage of the Research area to discover the form that fits your needs and specifications.

- When you obtain the correct form, click on Purchase now.

- Opt for the prices plan you would like, fill out the required information to make your bank account, and pay money for the transaction making use of your PayPal or credit card.

- Select a handy paper format and acquire your copy.

Find all the papers layouts you might have purchased in the My Forms food selection. You may get a extra copy of Montana Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas whenever, if possible. Just select the needed form to acquire or produce the papers format.

Use US Legal Forms, the most extensive selection of legal types, to conserve efforts and avoid mistakes. The support provides appropriately made legal papers layouts which you can use for a selection of uses. Produce a merchant account on US Legal Forms and begin making your life easier.