Montana Plan of Reorganization is an agreement between Ingenuity Capital Trust and Firsthand Funds that outlines the restructuring and reorganization process of the companies involved. It aims to address financial challenges, improve operational efficiency, and protect the interests of all parties involved. This plan typically includes a detailed roadmap for the future of the companies, ensuring a smooth transition and successful reemergence after the restructuring process. Under the Montana Plan, Ingenuity Capital Trust and Firsthand Funds will collaborate closely to assess their current financial positions, identify areas of improvement, and develop strategic initiatives to achieve their reorganization objectives. This may involve analyzing the companies' assets, liabilities, and overall financial health, as well as evaluating market conditions and competition. The plan may outline specific actions such as debt restructuring, asset sales, cost-cutting measures, workforce adjustments, and changes in management or corporate structure. It aims to optimize resource allocation, enhance operational efficiency, and restore financial stability to Ingenuity Capital Trust and Firsthand Funds. Throughout the Montana Plan of Reorganization, key stakeholders, including shareholders, creditors, and employees, will be consulted and their interests will be considered. It is essential for the plan to provide a fair and transparent process that protects the rights of all parties involved and maximizes value. Different types of Montana Plans of Reorganization may vary depending on the specific circumstances and needs of Ingenuity Capital Trust and Firsthand Funds. These could include: 1. Financial Restructuring Plan: This type of plan focuses primarily on addressing the companies' debt obligations, negotiating with creditors, and reshaping their financial structure to reduce liabilities and improve liquidity. 2. Operational Restructuring Plan: In this case, the plan focuses on improving operational efficiency by streamlining processes, reorganizing departments, reallocating resources, and implementing cost-cutting measures to drive profitability. 3. Strategic Restructuring Plan: Here, the focus is on repositioning the companies' business strategies and operations to adapt to changing market conditions, new technologies, or emerging opportunities. This may involve diversification, investment in research and development, or exploring new markets or product lines. 4. Merger or Acquisition Plan: In situations where the Montana Plan of Reorganization involves the consolidation of Ingenuity Capital Trust and Firsthand Funds, this type of plan aims to outline the integration process, synergies, and growth objectives resulting from the merger or acquisition. By developing a comprehensive Montana Plan of Reorganization, Ingenuity Capital Trust and Firsthand Funds can navigate through periods of financial distress and emerge as stronger, more competitive entities in the market. It provides a roadmap for their recovery, effective resource allocation, and enhances their chances of long-term success.

Montana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

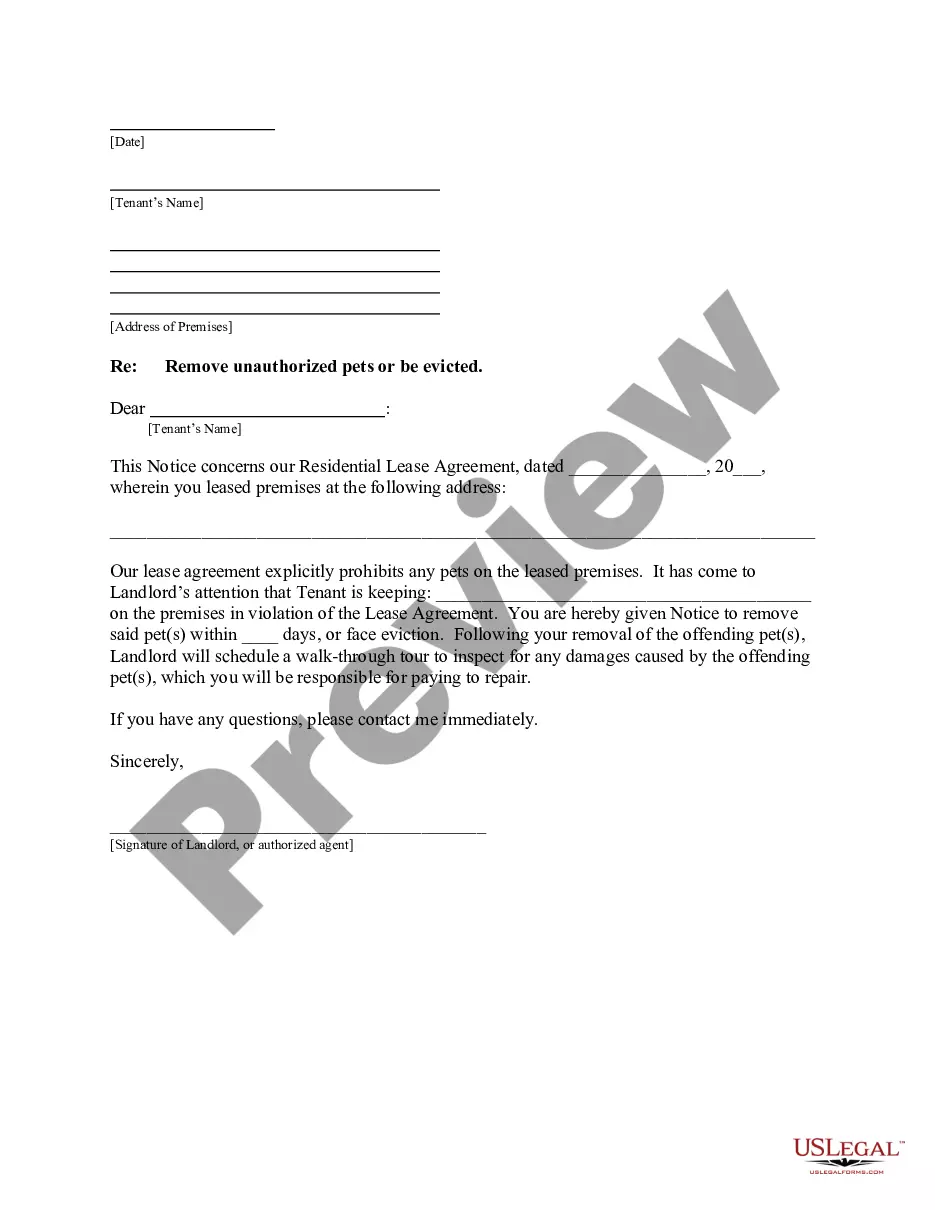

How to fill out Montana Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

If you need to complete, down load, or printing authorized papers themes, use US Legal Forms, the greatest assortment of authorized types, that can be found on-line. Make use of the site`s basic and hassle-free search to get the documents you need. Numerous themes for enterprise and personal purposes are sorted by classes and suggests, or search phrases. Use US Legal Forms to get the Montana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with a couple of mouse clicks.

If you are previously a US Legal Forms consumer, log in for your accounts and click the Acquire option to get the Montana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Also you can gain access to types you in the past delivered electronically within the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that correct city/nation.

- Step 2. Make use of the Review solution to look over the form`s content. Do not overlook to read the information.

- Step 3. If you are not happy using the kind, utilize the Search industry on top of the display screen to locate other variations of the authorized kind web template.

- Step 4. Once you have located the form you need, go through the Acquire now option. Select the prices strategy you favor and include your accreditations to register for the accounts.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal accounts to perform the deal.

- Step 6. Select the structure of the authorized kind and down load it on your own system.

- Step 7. Comprehensive, modify and printing or signal the Montana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Each authorized papers web template you get is the one you have permanently. You possess acces to each and every kind you delivered electronically inside your acccount. Click on the My Forms section and choose a kind to printing or down load once more.

Remain competitive and down load, and printing the Montana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms. There are millions of expert and express-specific types you may use for the enterprise or personal requires.